Get the free Ct-12s

Get, Create, Make and Sign ct-12s

Editing ct-12s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-12s

How to fill out ct-12s

Who needs ct-12s?

CT-12S Form: A Comprehensive How-to Guide

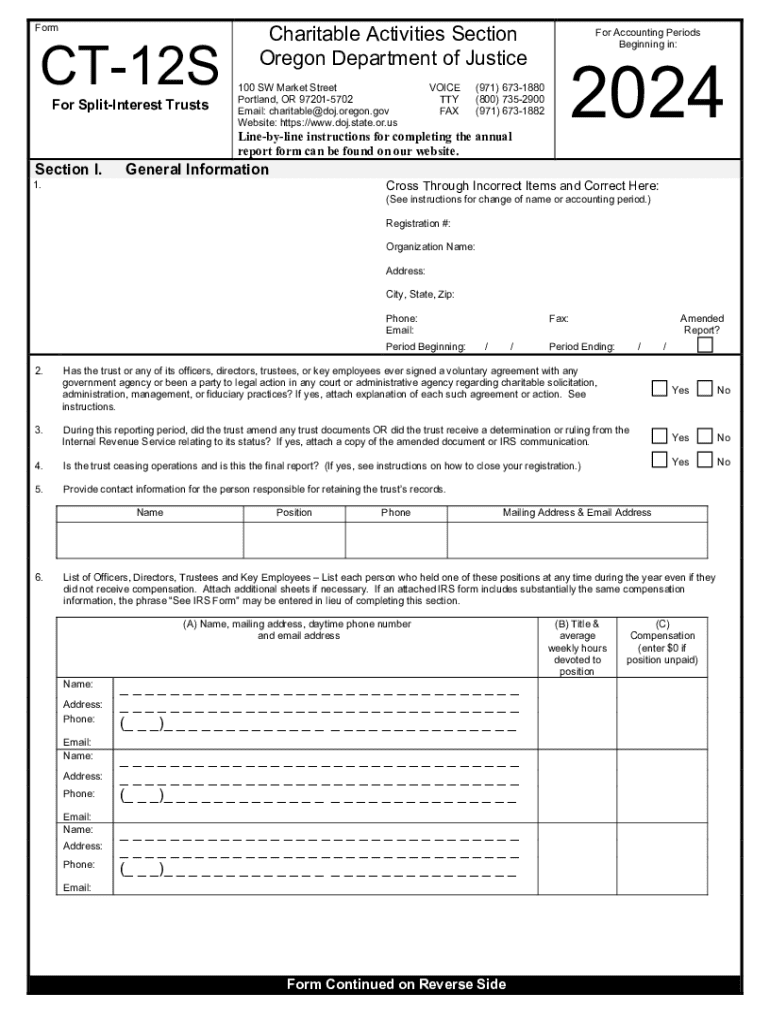

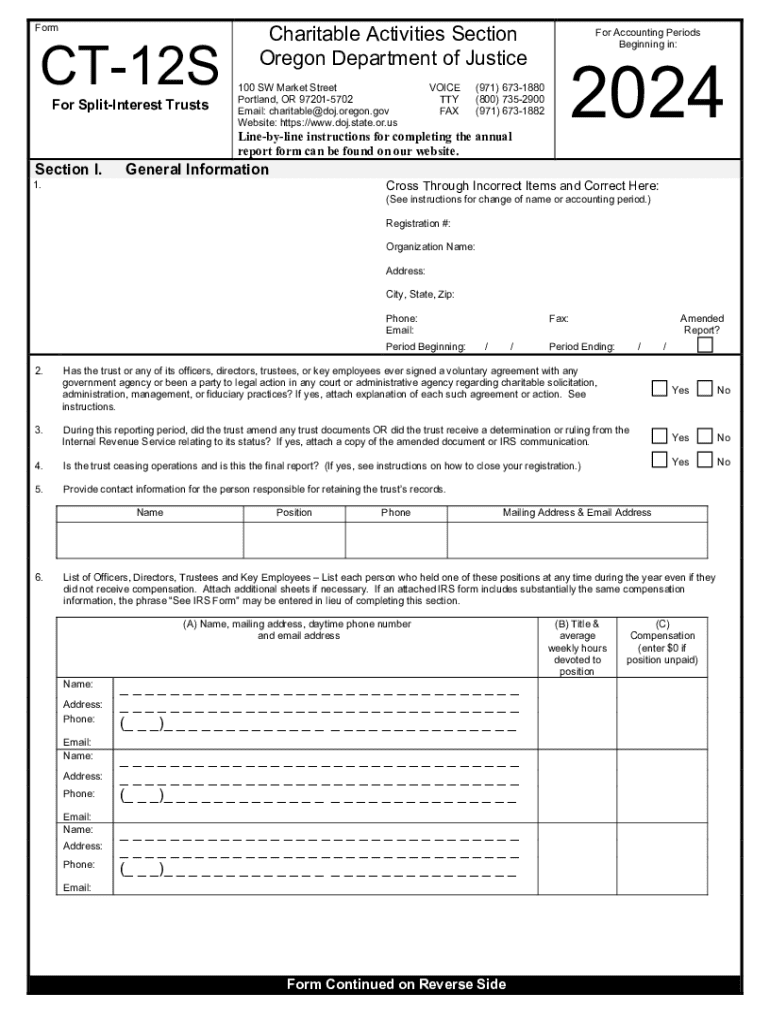

Understanding the CT-12S Form

The CT-12S Form is a critical document utilized primarily for specific tax reporting purposes that can significantly impact individual's or team's financial obligations. Its main purpose is to provide detailed information necessary for proper tax assessment by relevant authorities. Understanding this form is essential not only for compliance but also for ensuring that all deductions and credits applicable to your situation are accurately reported.

For individuals and teams managing their taxes, the CT-12S Form ensures that they are transparent about their financial activities. Filing this form appropriately can potentially lead to tax refunds or minimizing potential penalties. Therefore, grasping its significance is crucial to successful financial management.

Who needs to file the CT-12S Form?

Not everyone is required to file the CT-12S Form, and knowing the criteria for eligibility is vital. Generally, individuals or teams that have specific financial activities subject to taxation, such as certain types of income, deductions, or tax credits, are mandated to complete and file this document.

Common scenarios where the CT-12S Form is applicable include situations where one has freelance income, investment earnings, or claims for business-related expenses. Additionally, non-profit organizations or teams managing grants and funds must understand whether their financial activities necessitate this form.

Key features of the CT-12S Form

The CT-12S Form comprises various essential components that structure the data collection necessary for thorough reporting. Key sections include identification information, financial activity descriptions, and necessary calculations, making it crucial to understand them before commencing the completion of the form.

Moreover, supporting documentation is often required to demonstrate the validity of the information provided. This could include receipts, financial statements, or prior tax returns. Adhering to the specified timeline for filing is also important, with deadlines typically varying based on the tax year and the nature of the filer's income.

Step-by-step guide to completing the CT-12S Form

Completing the CT-12S Form effectively requires gathering various pieces of information to ensure accuracy. Begin by collecting necessary personal data such as your full name, social security number, and contact information. Additionally, financial data, including income details and potential deductions, should be collated for a comprehensive application.

Each section of the form has specific fields and requirements. For example, when filling out income-related details, ensure that all sources of income are documented correctly. One common mistake to avoid is omitting essential details or miscalculating numbers—double-checking your entries can help avert these errors.

Editing and customizing the CT-12S Form

Utilizing pdfFiller’s tools effectively can significantly enhance your experience with the CT-12S Form. Accessing editing features allows for adjustments to the existing document without the hassle of printing and rewriting. This cloud-based platform offers flexibility in modifying your CT-12S Form from any location with internet access.

Additionally, annotating your CT-12S Form, such as adding electronic signatures, can streamline the review and approval process. Engaging multiple collaborators on the document can also simplify coordination, allowing inputs from different individuals on the same form.

Submitting your CT-12S Form

Submitting the CT-12S Form can be accomplished through multiple avenues, depending on your preferences. The most efficient and popular method is online submission through pdfFiller, which allows for instant filing and confirmation. Alternatively, you might opt to mail your submission or deliver it in person, though these methods typically involve longer confirmation times.

After submission, a confirmation notice is usually generated, indicating the successful processing of your form. Knowing how to track your submission status can alleviate any concerns regarding processing delays, a feature conveniently provided through pdfFiller.

Managing your CT-12S Form documents

Organizing your completed CT-12S Form and associated documents is critical for effective document management. Implementing a system for storing these forms, perhaps categorized by submission year or type of form, enhances retrieval efficiency for future reference or audits.

Take advantage of pdfFiller's document storage features, which allow you to access and retrieve forms effortlessly. Archive and backup options are also available within the platform, providing peace of mind regarding document longevity and security.

FAQs about the CT-12S Form

Many users might encounter common questions and concerns regarding the CT-12S Form. Addressing these frequently asked questions can alleviate stress and confusion surrounding the filing process. For example, users often inquire about the eligibility criteria for filing or whether extensions can be obtained in certain scenarios.

In the case of troubleshooting issues, having a clear direction for support can streamline the resolution process. Whether it involves technical difficulties with pdfFiller or challenges in understanding the form requirements, knowing where to seek help is vital.

Additional tips for a seamless filing experience

To further improve your experience with the CT-12S Form, consider maximizing the benefits offered by pdfFiller. Unique features offered by this platform, such as real-time collaboration and cloud-based accessibility, provide a user-friendly environment for managing and editing forms effectively.

Maintaining compliance and ensuring accuracy while filling out forms is crucial. Resources available through pdfFiller can help double-check your information, providing confidence that your submissions are error-free and meet the expected standards.

Case studies: Successful use of the CT-12S Form

Examining real-life applications of the CT-12S Form can provide valuable insights into its effective usage. For instance, many freelancers encountered challenges when first navigating tax obligations related to their income streams. Those who successfully leveraged the CT-12S Form often reported an easier reconciliation with tax authorities.

Key lessons learned include the importance of thorough documentation and understanding eligibility criteria, which can all significantly affect outcomes. Observing patterns from others can help individua, teams, and organizations enhance their compliance strategy.

Next steps after filing the CT-12S Form

Once you have filed the CT-12S Form, it's important to monitor compliance and preparedness for any subsequent requirements. This may involve tracking the outcomes of your submission, preparing for future revisions, or other related forms required based on your particular financial circumstances.

Staying informed about any changes in tax laws or regulations that might affect your situation is equally vital. Consistently reviewing your filings ensures you remain proactive and avoid potential pitfalls in future reporting periods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ct-12s from Google Drive?

How do I edit ct-12s on an iOS device?

How do I complete ct-12s on an iOS device?

What is ct-12s?

Who is required to file ct-12s?

How to fill out ct-12s?

What is the purpose of ct-12s?

What information must be reported on ct-12s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.