Get the free Non-lodgment Advice

Get, Create, Make and Sign non-lodgment advice

How to edit non-lodgment advice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-lodgment advice

How to fill out non-lodgment advice

Who needs non-lodgment advice?

Comprehensive Guide to the Non-Lodgment Advice Form

Understanding non-lodgment advice

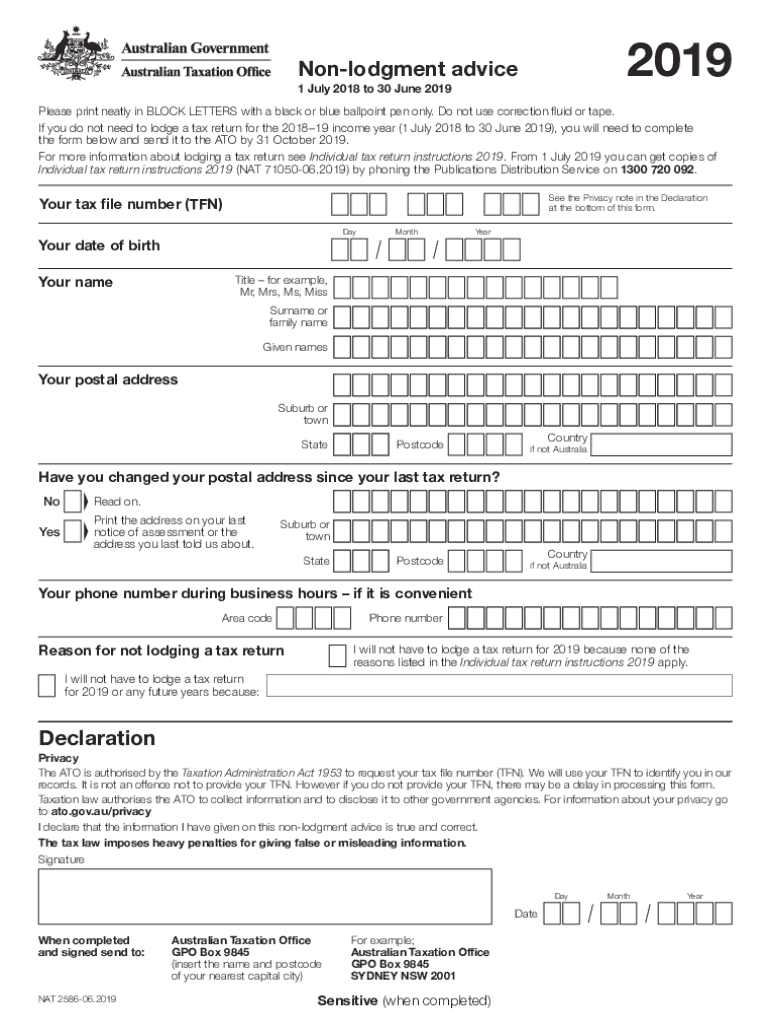

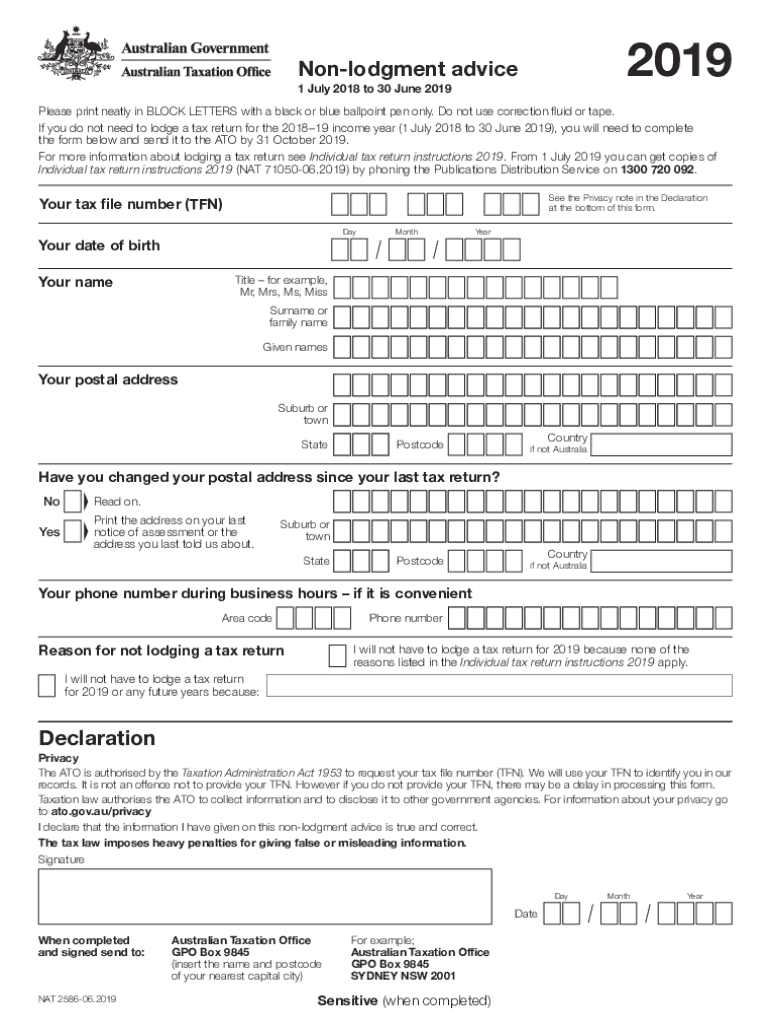

The non-lodgment advice form is a critical document for taxpayers who do not need to lodge a tax return with the Australian Taxation Office (ATO). Essentially, it serves as an official declaration that the individual does not have any income that requires tax reporting for a particular financial year.

This form is necessary when individuals meet specific criteria indicating they are exempt from lodging due to low income or other factors. Understanding when this advice is required can save individuals potential penalties for failing to comply with the ATO's regulations.

Overview of the non-lodgment advice form

The non-lodgment advice form plays a pivotal role in tax compliance. By utilizing this form, taxpayers communicate their exemption to the ATO without raising any questions regarding their financial status. The importance of this form extends beyond mere compliance; it helps individuals maintain their financial records and ensures the ATO has accurate information about their taxable status.

Key information required to complete the form typically includes personal details such as your Tax File Number (TFN) and basic income information if applicable. Accurately filling out the form also permits the ATO to maintain proper records, significantly aiding in reducing unnecessary follow-ups or compliance issues.

Preparing to complete the non-lodgment advice form

Before diving into the completion of the non-lodgment advice form, it’s crucial to determine your eligibility. This ensures that you are indeed in a position to claim exemption from lodging a tax return. Generally, individuals with very minimal income or who fall under specific categories as defined by the ATO are eligible.

Common situations include students, pensioners, or individuals on structured income support. Gathering necessary information in advance can streamline the process significantly. Key documents and details include:

Step-by-step guide to filling out the non-lodgment advice form

Filling out the non-lodgment advice form may seem daunting at first, but breaking it down into manageable steps simplifies the process. To start, access the form through the ATO’s website or utilize platforms like pdfFiller for easy editing and management.

Once you have the form, fill it out methodically. Below, you'll find a section-by-section breakdown of what to include:

Remember to carefully review each section. Common pitfalls include inputting incorrect personal details or misjudging your income status.

Editing and customizing your non-lodgment advice form

Using pdfFiller's editing tools gives you the flexibility to modify your non-lodgment advice form path efficiently. The platform offers a range of features allowing you to add or remove information without hassle.

Customization options also extend to the layout of your document, ensuring clarity in presentation. Incorporating an eSignature is another crucial aspect. eSignatures are legally valid for tax documents, making it easier to submit your forms electronically.

Submitting the non-lodgment advice form

The submission process for the non-lodgment advice form can be carried out online through the ATO portal, making it quick and efficient. Alternatively, for those who prefer traditional methods, submissions can be mailed or delivered in person to your local tax office.

Once submitted, taxpayers should expect confirmation from the ATO. Tracking the status of your non-lodgment advice is crucial, as it provides peace of mind, ensuring that your submission has been received and processed.

Managing your documents after submission

Proper document management post-submission is vital for future reference. Storing your non-lodgment advice securely ensures that you have access to it should questions arise about your tax situation. Best practices for management include categorizing your documents and utilizing cloud storage services.

Utilizing pdfFiller enhances your document management capabilities, allowing for easy sharing and collaboration. You can share your non-lodgment advice easily with advisors or team members, using collaboration tools that the platform offers.

Common questions and troubleshooting

As you navigate the non-lodgment advice form, you might encounter questions or challenges. Frequently asked questions include what steps to take if you realize you made a mistake after submission or how to update your non-lodgment advice if your circumstances change.

It's essential to remain proactive and address such issues promptly. If you need help or have specific queries regarding your submission, contacting ATO or pdfFiller's customer service can provide the necessary support and guidance.

Learn more about tax compliance and documentation

Understanding the requirements for the non-lodgment advice form opens the door to exploring other related forms and filings that may affect your tax responsibilities. The ATO provides a plethora of additional forms that you might need, depending on your personal tax situation.

Equipping yourself with knowledge about relevant tax documentation ensures you remain compliant. Resources for tax planning and compliance are readily available through the ATO and external financial advisement services.

Provide feedback or share your experience

Your experience with the non-lodgment advice process matters. Submitting feedback can lead to improved systems and support for all users. Community insights help refine the process, allowing for better guidance in the future.

Engaging with other users of pdfFiller can also yield valuable tips and suggestions that may enhance your own approach to tax compliance and document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non-lodgment advice in Chrome?

Can I create an eSignature for the non-lodgment advice in Gmail?

How do I edit non-lodgment advice on an iOS device?

What is non-lodgment advice?

Who is required to file non-lodgment advice?

How to fill out non-lodgment advice?

What is the purpose of non-lodgment advice?

What information must be reported on non-lodgment advice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.