Get the free Arizona Form 141az Es

Get, Create, Make and Sign arizona form 141az es

Editing arizona form 141az es online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 141az es

How to fill out arizona form 141az es

Who needs arizona form 141az es?

A comprehensive guide to Arizona Form 141AZ ES

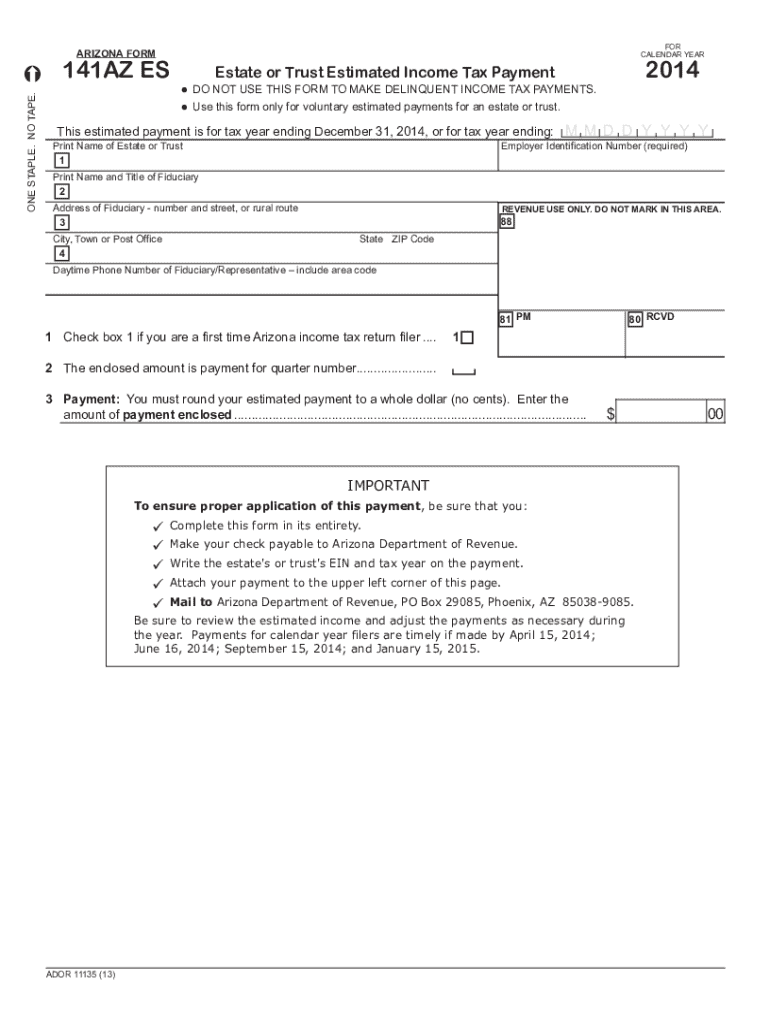

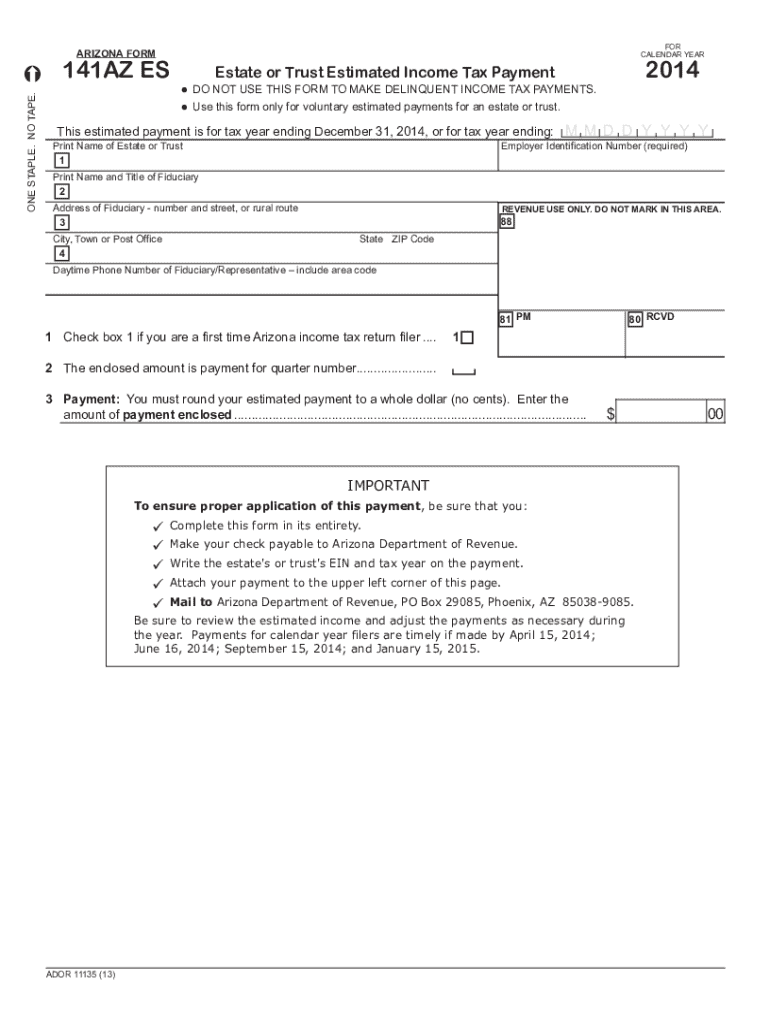

Overview of Arizona Form 141AZ ES

Arizona Form 141AZ ES is a state tax form used primarily for Arizona residents to report estimated income tax owed for the upcoming tax year. This form assists individuals and businesses in calculating their estimated tax payments. Properly completing this form is crucial as it helps taxpayers avoid underpayment penalties and assists in better financial planning throughout the year.

The importance of properly completing the Arizona Form 141AZ ES cannot be overstated. Inaccuracies can lead to financial liabilities and unnecessary penalties, both of which can be avoided through careful documentation and accurate calculations. Individuals who are self-employed, receive miscellaneous income, or have significant investment earnings typically need to use this form.

Detailed instructions for completing Arizona Form 141AZ ES

Completing Arizona Form 141AZ ES requires diligence and attention to detail. Here is a step-by-step guide to help ensure accuracy:

When filling out each section, there are common mistakes to avoid. In Section 1, ensure your name and Social Security number are correctly matched to IRS records. For Section 2, accurately report your employment status; leaving out information could lead to inaccuracies in tax calculations. In Section 3, meticulously document all sources of income; errors can occur if omitted details lead to a miscalculation. Lastly, in Section 4, double-check your math to prevent potential overpayment or underpayment of taxes.

Interactive tools for Arizona Form 141AZ ES

Utilizing digital tools can significantly enhance your experience when completing the Arizona Form 141AZ ES. One excellent resource is pdfFiller, which offers features for digital editing and completion.

Best practices for using pdfFiller include familiarizing yourself with the editing tools, such as text fields for entering your information and signature fields for most pages of the form. Editing and customizing your form is straightforward; simply upload the PDF, make your changes, and download the updated version.

eSignature integration

Signing your Arizona Form 141AZ ES electronically can streamline the submission process. To do this through pdfFiller, navigate to the eSignature section after you have completed the form. Follow the steps to create a digital signature, then apply it to the document securely. It's essential to ensure that your digital signature complies with all legal requirements to maintain the document's authenticity.

Managing your Arizona Form 141AZ ES

Once you've completed and signed your Arizona Form 141AZ ES, managing your document effectively is crucial. Tips for saving and storing your completed form include using a robust file-naming system that includes the date and your name for easy retrieval.

Version control is also essential. If you need to edit previous submissions, keep track of changes by saving versions separately and noting what has been amended. Collaboration features within pdfFiller facilitate teamwork; you can share the form for review easily and utilize features for real-time editing and feedback, ensuring everyone involved can contribute without hassle.

Frequently asked questions (FAQs) about Arizona Form 141AZ ES

Many individuals have questions when it comes to completing Arizona Form 141AZ ES. Common confusions often arise regarding the specific information required for various sections and how to report certain types of income. For instance, unclear guidelines on reporting freelance or self-employed income can be a significant concern.

If you're stuck, seeking help is easy. Utilize online resources such as the Arizona Department of Revenue's website or consult tax professionals for personalized guidance. Numerous resources are available to assuage any difficulties encountered while completing the form, ensuring a smooth filing process.

Enhancing document management with pdfFiller

pdfFiller offers robust document management features tailor-made for users like you seeking efficient solutions. Its cloud-based platform simplifies form management, providing easy access from anywhere. You can integrate the Arizona Form 141AZ ES with other essential documents, such as supporting tax statements and receipts, allowing for seamless organization.

With the ability to categorize documents and establish connections between various forms, pdfFiller enhances overall document management efficiency. Not only does this comprehensiveness reduce time spent searching for files, but it also minimizes the risk of losing critical financial information.

Case studies: Successful completion of Arizona Form 141AZ ES

Real-life examples demonstrate the effectiveness of careful management of the Arizona Form 141AZ ES. For instance, a small business owner utilized pdfFiller to track their estimated tax payments over a year. By habitually documenting income and expenses, they minimized their tax liabilities while ensuring compliance.

This success story highlights how effective document management made a significant difference, with the business owner appreciating the user-friendly interface of pdfFiller and the accuracy in tracking payments and deadlines.

Final tips for streamlining your document process

Utilizing pdfFiller can make your experience with the Arizona Form 141AZ ES more efficient. Recommendations for staying organized include setting reminders for filing deadlines and regularly reviewing your forms to ensure accuracy. Taking a proactive approach to managing documents helps avoid last-minute stress and potential penalties from late or incorrect tax filings.

Keeping track of submission guidelines is equally important. Staying informed about any changes in tax laws or guidelines will ensure that you are compliant and making the most accurate reports possible, protecting yourself from any future tax issues.

User testimonials and experiences

Feedback from users of pdfFiller emphasizes the ease of use and efficiency of managing the Arizona Form 141AZ ES. Many have praised its intuitive interface and the ability to collaborate with teams during the preparation process. Personal accounts often highlight how quickly users can navigate to complete forms without the stress of dealing with paper documentation.

After integrating pdfFiller into their workflow, users report significant time savings and reduced frustration levels, particularly when completing tax-related forms like Arizona Form 141AZ ES. This positive feedback demonstrates the value of having a modern, cloud-based solution for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona form 141az es to be eSigned by others?

Can I create an electronic signature for signing my arizona form 141az es in Gmail?

How can I edit arizona form 141az es on a smartphone?

What is arizona form 141az es?

Who is required to file arizona form 141az es?

How to fill out arizona form 141az es?

What is the purpose of arizona form 141az es?

What information must be reported on arizona form 141az es?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.