Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K: A Comprehensive Guide for Document Management

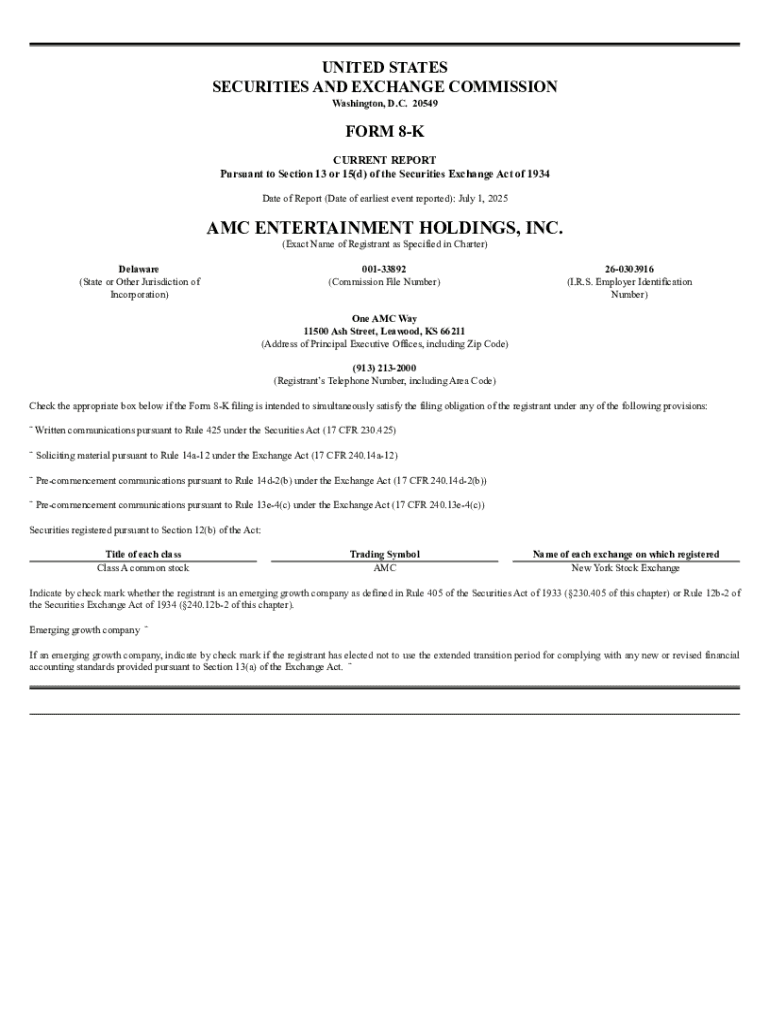

Understanding Form 8-K

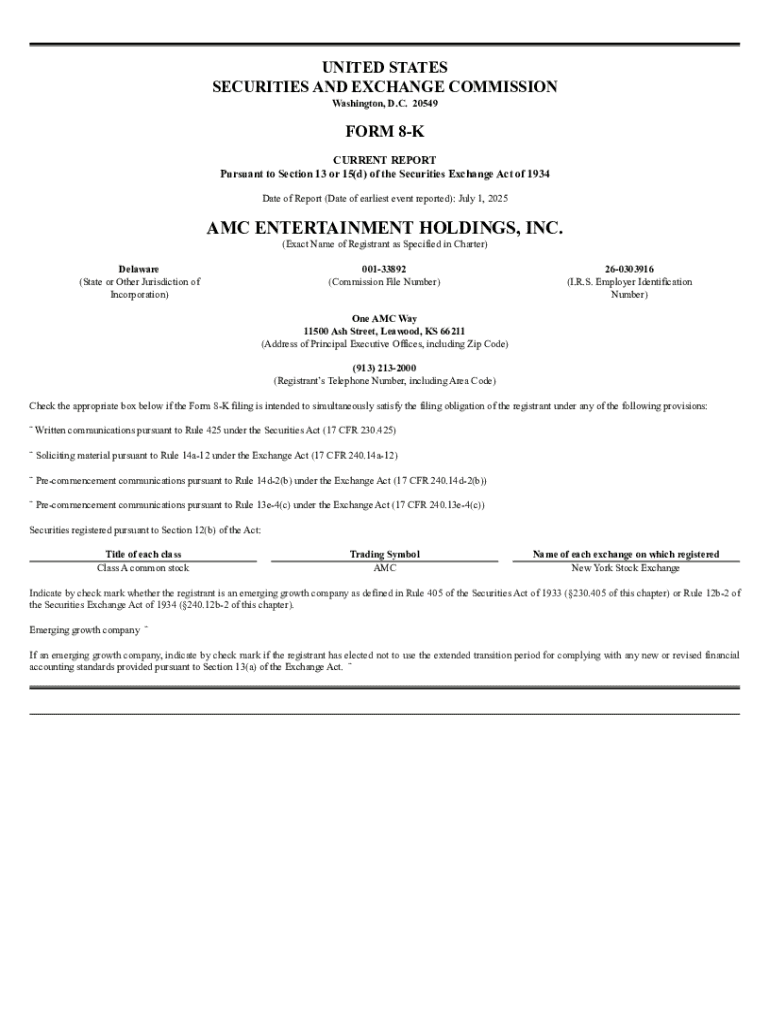

Form 8-K is an essential document that publicly traded companies in the U.S. submit to the Securities and Exchange Commission (SEC) to report major events that may be significant to shareholders or the public. The form serves as a vehicle for timely disclosure of material information that impacts the company’s operations, financial status, or other elements pertinent to an investor’s decision-making process.

This critical filing ensures transparency in the corporate environment and helps maintain investor trust. It opens a channel of communication between companies and their investors, providing timely updates that can indicate changes in strategy, financial health, or management direction. In doing so, it fulfills both legal obligations and ethical responsibilities towards stakeholders.

Legal requirements for Form 8-K

The SEC mandates that registrants—companies that have publicly traded securities—are subject to specific regulations for Form 8-K. Under these regulations, companies must file this form within four business days following the occurrence of a triggering event. Compliance with these requirements is critical, as delays or omissions can lead to penalties or damage to the company’s reputation.

The frequency of filings largely depends on the company’s activities. For example, a company may file an 8-K multiple times in a month if significant events arise, or it may go periods without needing to submit a filing if no material changes occur. Keeping abreast of these requirements is crucial for corporate governance and effective document management.

Triggers for filing a Form 8-K

Certain significant events trigger the need for a Form 8-K filing. These events can vary widely but typically include changes in corporate leadership, major acquisitions, sales of substantial assets, or the resignation of key members of management. Each event has ramifications for how the company is viewed by investors and can significantly affect stock prices.

Understanding these triggers is essential for companies, as failing to report material changes can lead to accusations of misinformation or even legal repercussions. To aid in this process, companies must establish a protocol for identifying and assessing material events promptly.

Understanding materiality in 8-K filings

Determining whether an event is material is subjective but crucial for compliance with SEC regulations. A material event is typically defined as one that a reasonable investor would consider important when making an investment decision. Companies must evaluate the potential impact of events, which may often require legal counsel or advisory opinions.

Common metrics for assessing materiality include changes in revenue, earnings, or business operations. The guidance provided by the SEC helps registrants frame their judgment regarding materiality, ensuring that they avoid omissions that could mislead investors.

Disclosures in a Form 8-K

Filing a Form 8-K necessitates a comprehensive disclosure of relevant information. Companies must include details about the triggering event, its implications, and any future impacts anticipated. This typically encompasses financial statements and analyses that provide context about how the event influences the company's health.

In addition to mandated disclosures, certain events may possess exemptions based on the nature of the activity. Companies should be fully aware of what must be included, as incomplete filings could lead to regulatory scrutiny or loss of investor confidence.

Formatting requirements

The structure of a Form 8-K is critical, as it ensures clarity and compliance. It typically requires specific sections, including a brief summary of the event, followed by detailed descriptions, financial impacts, and other material disclosures. Clarity in writing and organization promotes transparency.

Common pitfalls include unstructured data presentation, lacking clarity, and failing to adhere to prescribed formats. Companies should diligently check their filings against SEC requirements to avoid unnecessary complications.

Benefits of filing Form 8-K

Timely and accurate disclosures through Form 8-K filings significantly enhance corporate governance and sustain investor confidence. By addressing material events promptly, companies demonstrate accountability and transparency, key attributes that stockholders seek.

Moreover, compliance with 8-K filing requirements mitigates risks of legal penalties while promoting a positive image among investors and the public. Additionally, well-maintained disclosure practices may lead to less market volatility and a more stable investment environment.

Tips for completing and submitting a Form 8-K

When preparing to fill out a Form 8-K, it’s essential to gather all relevant information and ensure accuracy. Each triggering event typically requires specific data points, including financial metrics, legal advisories, and strategic considerations that may impact investors' decisions.

Using tools like pdfFiller can streamline the editing and submission process, making it easier to collaborate on document creation and review. Following a structured approach ensures clarity and enhances the likelihood of successful compliance.

Leveraging technology for efficient filing

The role of technology in managing the Form 8-K filing process cannot be understated. Platforms like pdfFiller offer cloud-based solutions that integrate document management seamlessly with collaborative features. This enhances the efficiency of document creation, review, and filing processes.

By leveraging such technology, teams can ensure secure handling of sensitive information, timely submissions, and track revisions effectively, making the process smoother and more organized. This capability is particularly valuable during periods of rapid changes where multiple filings may be necessary.

Managing ongoing compliance with Form 8-K

Once a Form 8-K is filed, maintaining compliance is a continuous process. Companies need to be aware of key timelines, updating materials, and re-evaluating events as they unfold. Regular reminders and monitoring change events help in timely filings of amendments when needed.

If circumstances change after the initial filing, such as additional material information or corrections, an amendment may be required. Understanding the nuances of what constitutes a mandatory versus optional amendment can save companies from potential pitfalls.

Common challenges and solutions

Companies face various challenges with Form 8-K filings, including late submissions, misinterpretations of materiality, and incomplete disclosures. These issues often stem from lack of awareness or inadequate processes when reporting significant events.

To mitigate these challenges, companies can implement structured protocols and employ technology solutions to streamline the filing process. Involving legal and compliance teams early can also minimize risks associated with non-compliance and enhance the overall integrity of disclosures.

Interactive tools for form management

Utilizing interactive tools is essential for effective document management, especially regarding crucial filings such as Form 8-K. A platform like pdfFiller not only simplifies the creation and editing of documents but also enhances collaborative efforts among team members working on compliance and filings.

Features that allow e-signing, real-time collaboration, and secure storage of files collectively empower companies to manage their document workflows efficiently. Creating tailored workflows within such platforms ensures that everyone involved in the filing process is aligned and informed.

Future of Form 8-K and corporate reporting

As the landscape of corporate reporting continues to evolve, so too does the filing system for Form 8-K. Expectations for timely disclosures are increasing, and regulatory changes are often on the horizon. Companies must stay informed about these trends and prepare their document management systems accordingly.

With the rise of technology, platforms like pdfFiller stand at the forefront of transforming how disclosures are managed. As these tools integrate more intelligent features, the future of Form 8-K filings will likely offer greater efficiency and security for companies navigating the compliance landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8-k in Gmail?

How do I fill out form 8-k using my mobile device?

How can I fill out form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.