Get the free Draft Form W-9

Get, Create, Make and Sign draft form w-9

How to edit draft form w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out draft form w-9

How to fill out draft form w-9

Who needs draft form w-9?

Understanding and Utilizing the Draft Form W-9 Form

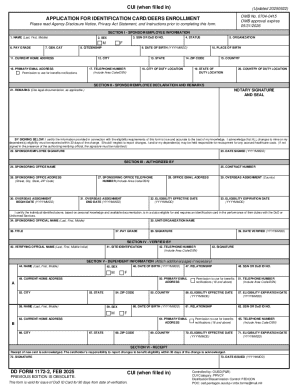

1. Understanding the W-9 Form

The W-9 form is an essential document in the U.S. tax system designed for individuals and entities to furnish their taxpayer identification information to others, primarily to facilitate accurate taxation. Its primary purpose is to collect information needed to report income paid to you during a given tax year.

Almost anyone who is self-employed or receives income from businesses may need to fill out a W-9 form. This includes freelancers, independent contractors, consultants, and vendors, as well as corporations that require contractor services. It is crucial that these individuals provide accurate information to avoid complications during tax season.

2. Current updates in the draft form W-9

The IRS periodically updates the W-9 form to reflect changes in tax laws and policies. Recent updates have focused on enhancing clarity and efficiency in the form's structure. Users should closely review these updates to ensure compliance and avoid potential tax pitfalls.

Implications of these updates can vary. For example, new reporting requirements might necessitate additional documentation for certain income sources, affecting not only individual contractors but also businesses that hire them. To avoid unnecessary delays or rejections, understanding the latest version of the W-9 is crucial.

3. Step-by-step guide to completing the draft form W-9

Completing the W-9 form may seem daunting, but breaking it down into manageable steps makes it straightforward. First, you need to clearly identify your information.

3.1. Identifying your information

Start by entering your full name as it appears on IRS documents. If you're submitting this form for a business, include the business name in the appropriate field. Address information is also required; ensure it's complete and accurate to facilitate seamless communication.

3.2. Taxpayer Identification Number (TIN)

Next is the Taxpayer Identification Number (TIN). This can be your Social Security Number (SSN) or your Employer Identification Number (EIN). It's vital to choose the correct identifier based on your classification (individual or business). If you don’t have a TIN, consider applying for one through the IRS to ensure you can complete this form accurately.

3.3. Certification Process

After filling out your details, you need to certify the information is accurate. This involves signing and dating the form. Common mistakes to avoid include leaving fields blank or entering incorrect information, as either can delay processing and tax reporting.

4. Tools for filling out the draft form W-9

Utilizing digital tools can significantly enhance the experience of filling out the draft form W-9. pdfFiller offers interactive features to simplify the completing process. You can quickly fill in the W-9, ensuring you don't miss any fields.

Moreover, pdfFiller provides options for saving and editing your draft form easily. With cloud storage, you can access your documents from anywhere. eSigning options are also available, allowing you to finalize the form securely and efficiently.

5. Submitting the draft form W-9

Once your draft form W-9 is complete, it's essential to know where to send it. Typically, this form is sent to clients or businesses that need it for tax reporting. Ensure to inquire explicitly with the requesting party regarding their submission process and any additional requirements.

Best practices for submission include sending your W-9 securely. If transmitting electronically, consider using encrypted email or secure document sharing platforms like pdfFiller. Additionally, maintaining a dashboard for document management on pdfFiller can help you track submissions efficiently.

6. Managing your draft W-9 forms

Document retention is crucial for anyone filling out a W-9 form. Maintaining copies ensures you have access to your submitted forms for future reference or in case of audits. With pdfFiller, organizing and accessing your forms becomes a seamless experience, allowing you to categorize them effectively.

The platform also allows you to share your W-9 forms with team members or clients securely. Efficient document sharing can streamline processes, especially for companies employing multiple contractors.

7. Common questions and answers about the draft form W-9

Many users have questions about how the W-9 differs from other tax forms, such as the 1099. The W-9 form is essential for the requester to obtain the correct taxpayer information needed to issue payments, while the 1099 form reports the payments made. If you've made a mistake on your W-9, promptly update it with the requesting party, and clarify your responsibility to provide accurate information to ensure compliance.

8. Best practices for using the W-9 form in a digital environment

Implementing best practices in a digital environment is crucial for data privacy and security. Ensure that any personal information entered in your W-9 is protected, especially when using online forms. Utilizing secure, cloud-based solutions like pdfFiller not only assists in safeguarding your information but also supports remote workflows.

Migrating to a digital solution streamlines the process. By integrating your W-9 forms into a digital workflow, you can significantly reduce redundancy, enhance productivity, and ensure compliance with tax regulations.

9. Insights on compliance and documentation with the W-9 form

Understanding IRS requirements related to the W-9 form is essential for any taxpayer engaged in contracting. This form plays a vital role in tax reporting for individuals and businesses, ensuring that payments are correctly reported for tax purposes. Each submission of the W-9 helps clients prepare accurate 1099 forms for reporting payments made to you.

Successful compliance strategies often involve staying informed about IRS updates and maintaining organized documentation of all submissions. Regular audits of your forms and processes can reveal areas for improvement, further ensuring adherence to federal regulations.

10. Future trends in document management and forms

The shift towards digital and remote solutions is rapidly changing how individuals and businesses manage documents. Advancements in electronic signature technologies are a part of this trend, offering users more robust options for authenticating documents beyond traditional methods.

As the landscape of tax forms continues to evolve, staying ahead of future changes requires vigilance. Taxpayers should be prepared for innovations in form design and compliance requirements, which will likely be influenced by emerging technologies and shifts in federal policies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my draft form w-9 in Gmail?

How do I edit draft form w-9 in Chrome?

Can I edit draft form w-9 on an iOS device?

What is draft form w-9?

Who is required to file draft form w-9?

How to fill out draft form w-9?

What is the purpose of draft form w-9?

What information must be reported on draft form w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.