Get the free 2023 Form or-20-s

Get, Create, Make and Sign 2023 form or-20-s

How to edit 2023 form or-20-s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 form or-20-s

How to fill out 2023 form or-20-s

Who needs 2023 form or-20-s?

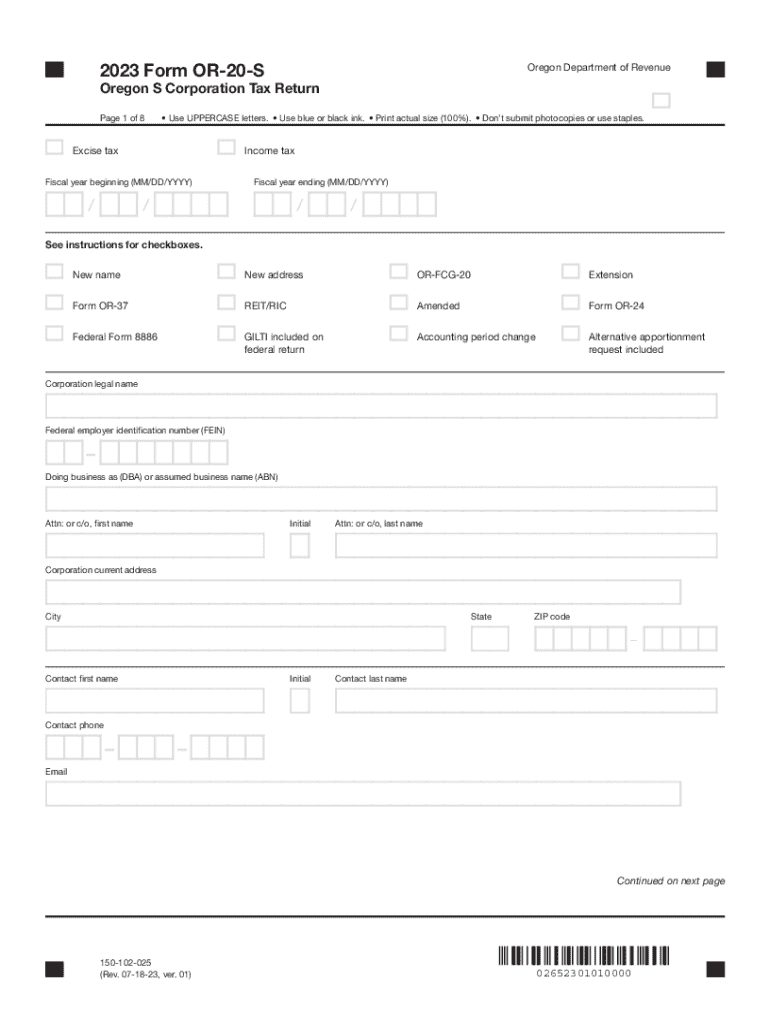

A comprehensive guide to the 2023 Form OR-20-S form

Understanding the 2023 Form OR-20-S Form

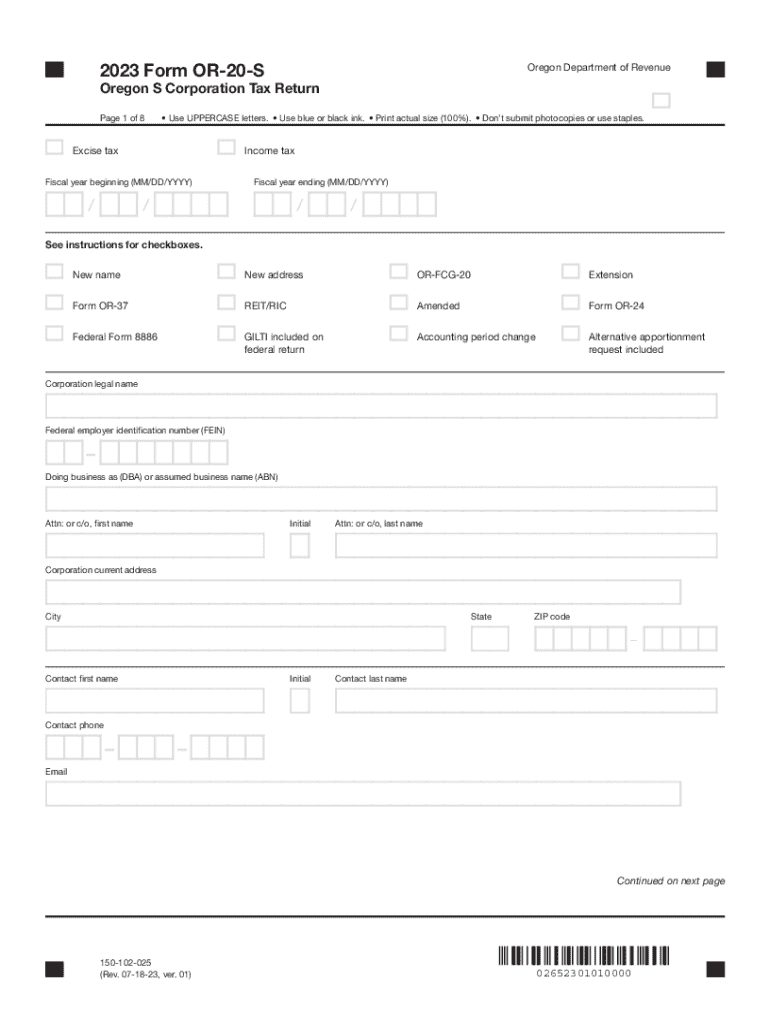

The 2023 Form OR-20-S form is a crucial document for S Corporations operating in Oregon, designed to report income and determine tax liabilities at the state level. This form is essential for ensuring compliance with Oregon's tax regulations, providing a streamlined approach for owners to report their business earnings accurately.

S Corporations, as pass-through entities, benefit from a unique tax structure that allows income to be taxed at individual rates rather than at the corporate level. This alignment with individual tax rates is significant for many small business owners in Oregon, as it can lead to reduced overall tax liabilities when filed correctly.

The 2023 version of the form includes several updates designed to enhance usability and reporting accuracy. Key updates this year include clarified guidelines for reporting various income types and adjustments to certain deduction categories, reflecting changes in the IRS regulations and Oregon tax laws.

Detailed insights into form structure

Understanding the structure of the Form OR-20-S is vital for accurate completion. The form is divided into specific sections, each requiring detailed information about the S Corporation’s operations and finances. The first section typically consists of basic information such as the entity name, identification number, and contact details.

Following the basic information, the form requires detailed reporting of different types of income, along with deductions that the S Corporation is entitled to claim. This can include ordinary income from business operations, interest income, and royalties, among others.

Additionally, S Corporations in Oregon may be eligible for various tax credits that can help reduce their overall tax burden. It's crucial to be aware of the specific credits available, as they can significantly impact the company’s tax situation.

Interactive tools for form completion

Completing the 2023 Form OR-20-S can be simplified with the help of interactive tools. Platforms like pdfFiller offer users the ability to fill out forms seamlessly, with features that aid in creating accurate documents efficiently. Users can easily enter their information and adjust details as needed, ensuring a smooth filing process.

Moreover, pdfFiller integrates well with various accounting software, streamlining the process further. This means that users can import necessary data directly from their existing systems, minimizing the risk of errors and maximizing accuracy.

In addition, e-signature capabilities are an essential feature that allows users to sign documents electronically. This offers not only convenience but also aligns with legal standards for electronic signatures in Oregon, ensuring your submissions are both compliant and valid.

Step-by-step instructions for filling out the 2023 OR-20-S form

Filling out the 2023 Form OR-20-S requires careful organization and attention to detail. Here’s a step-by-step guide to assist you in navigating the process.

Step 1: Gather necessary information

Before starting, it's essential to compile all necessary documentation to streamline the filing process. Important documents include prior year tax returns, income statements, and payment records.

Step 2: Complete the entity identification section

Start your filing by accurately completing the entity identification section. This includes entering your business name, Federal Employer Identification Number (FEIN), and contact details.

Step 3: Report your income accurately

Next, accurately report your income by categorizing it into various sources. Make sure to indicate ordinary income, rental income, and any other income types relevant to your business activities.

Step 4: Calculate tax credits

Research all available tax credits and ensure you apply them correctly on your form to optimize your tax responsibility. Detailed instructions on applying these credits can typically be found in the guidelines accompanying the OR-20-S form.

Step 5: Review and finalize the form

Before submitting, carefully review all entries for accuracy. Utilize tools provided by pdfFiller, which can help flag discrepancies and ensure all required fields are completed. This step is critical to avoid any potential issues with your filing.

Managing your OR-20-S filing

Once your form is completed, you have several options for filing. Oregon allows for electronic submissions through its tax services platform, providing a quicker and more efficient way to submit your paperwork. Electronic filing is generally preferred due to its speed and the ease of tracking submission status.

To verify your submission, Oregon's tax website offers a tracking feature that allows you to confirm whether your OR-20-S has been accepted. In case of any issues, immediate steps can be taken to resolve discrepancies or file corrections as needed.

Common FAQs about the 2023 Form OR-20-S form

As with any tax form, questions often arise surrounding its completion and submission. Here are some frequently asked questions that can help clarify concerns.

Best practices for S Corporation year-end tax planning

Effective year-end tax planning is essential for S Corporations to maximize deductions and credits while optimizing income reporting. Sharing these strategies can greatly benefit your overall tax posture.

Maximizing deductions and credits

One strategy includes proactively identifying allowable expenses and deductions to lower taxable income. Employing approaches such as timing your expenses and accelerating deductions can have a favorable impact on your taxes.

Using pdfFiller for ongoing document management

Maintaining organized, accurate records throughout the year is key. pdfFiller's document management capabilities provide a comprehensive solution for tracking financial data, facilitating collaboration among team members, and ensuring preparedness for year-end filings.

Staying updated on tax regulations

Tax regulations are always evolving, making it imperative for S Corporations to remain informed. Changes in the Oregon tax laws can have immediate implications on how the OR-20-S is filled out and the responsibilities of S Corporations.

To stay updated, resources such as the Oregon Department of Revenue's website provide vital information about current tax laws and filing requirements. Additionally, platforms like pdfFiller can assist in tracking document compliance and ensure that your filing aligns with the latest regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2023 form or-20-s without leaving Google Drive?

Can I create an electronic signature for signing my 2023 form or-20-s in Gmail?

How can I edit 2023 form or-20-s on a smartphone?

What is form or-20-s?

Who is required to file form or-20-s?

How to fill out form or-20-s?

What is the purpose of form or-20-s?

What information must be reported on form or-20-s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.