Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

How to Complete Form 10-Q: A Comprehensive Guide

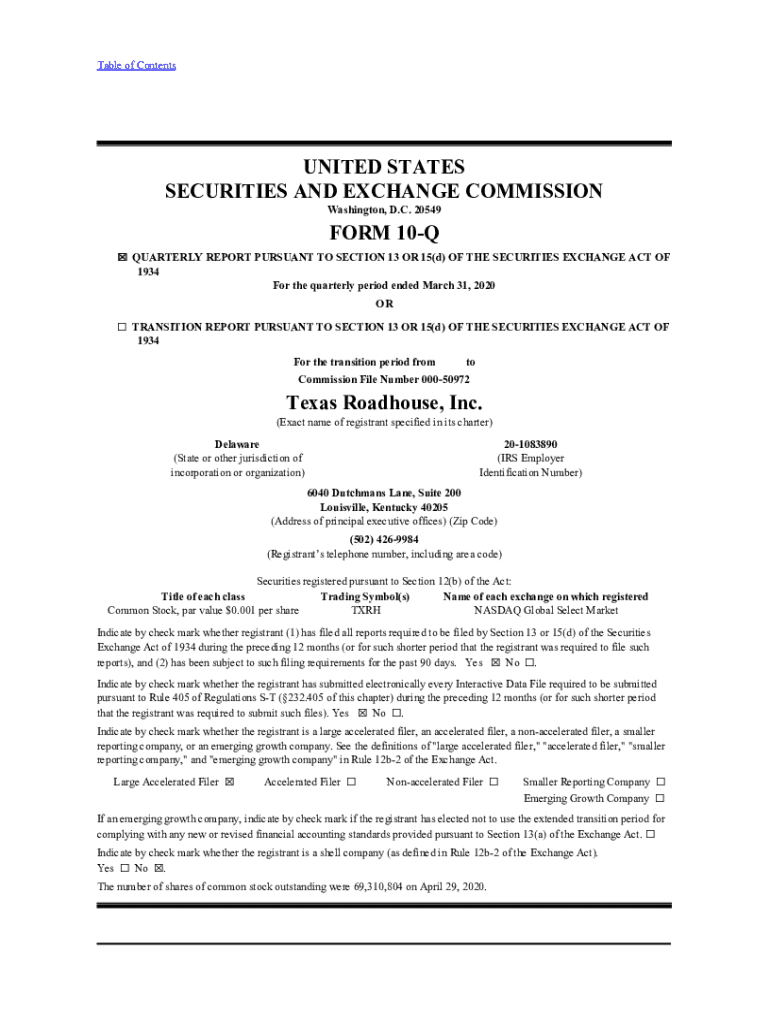

Understanding Form 10-Q

Form 10-Q is a standardized report required by the U.S. Securities and Exchange Commission (SEC) that companies must file quarterly to provide an update on their financial performance and condition. Unlike the annual report submitted through Form 10-K, which gives a comprehensive overview of a company's operations, the 10-Q focuses on financial statements and relevant updates from the previous quarter. It's essential for offering insights into a company's ongoing business performance.

The importance of Form 10-Q for public companies cannot be overstated. It helps maintain transparency with investors, equips stakeholders with up-to-date information for better decision-making, and assists in regulatory compliance. By regularly submitting this form, companies can establish a level of trust and credibility in the market that is vital for attracting and retaining investors.

When comparing Form 10-Q to other SEC filings, key differences arise. Form 10-Q is filed quarterly, contains unaudited financial statements, and focuses on specific updates within the fiscal year, while other forms—such as the Form 10-K and proxy statements—are submitted annually and may include audited financial data and broader operational insights. This distinction is critical for investors evaluating a company's performance.

Components of Form 10-Q

The framework of Form 10-Q includes several critical components that provide a clear picture of a company's performance and risks. These sections are designed to assist investors and analysts in assessing the financial health of the organization. The required financial statements form the backbone of the filing.

In addition to these financial statements, the Management Discussion and Analysis (MD&A) section is crucial for contextualizing the numbers. It allows management to provide insights on operations, trends, and future expectations that may not be apparent from the financial data alone.

Moreover, disclosures about risks, legal proceedings, and internal controls are vital for compliance. This section informs stakeholders of ongoing challenges or issues that could impact the company, ensuring transparency and responsible reporting.

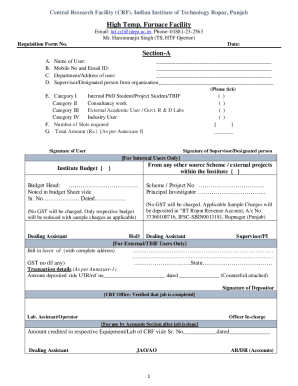

Filing requirements for a 10-Q

Filing a Form 10-Q involves adhering to specific timelines and rules set by the SEC. Public companies are required to file this report on a quarterly basis. The deadlines vary depending on the classification of the filer, which affects when the report must be submitted to ensure compliance.

Eligibility criteria are also crucial; any public company trading on a stock exchange must file a 10-Q. Furthermore, the requirements differ for large accelerated filers compared to smaller reporting companies, which have fewer obligations and less stringent disclosure rules.

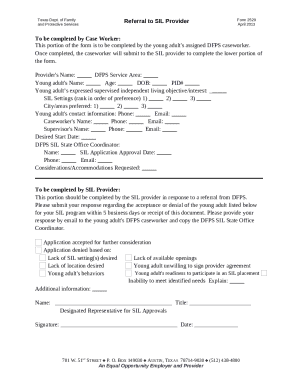

Step-by-step guide to filling out form 10-Q

Preparing to file Form 10-Q begins long before the deadline. An organized pre-filing preparation is essential to ensure compliance and accuracy.

Filling out each section is crucial. When completing the financial statements, it is important to follow specific document formatting guidelines mandated by the SEC. Ensure that all figures are accurate and clearly presented. The MD&A should incorporate best practices by providing insightful analysis rather than merely repeating statistics.

Finally, a thorough review of the completed Form 10-Q is a critical step. Implement internal review processes within your organization to catch potential errors and confirm that all legal requirements have been met.

Editing and signing your form 10-Q

Once the Form 10-Q is drafted, utilizing pdfFiller can streamline the editing process significantly. You can upload and access your 10-Q documentation quickly, making revisions as necessary attributes to effective collaboration.

As companies continue to evolve, securing eSignatures through specialized platforms brings about a centralized solution for enhancing compliance, providing convenience for management and teams responsible for filing.

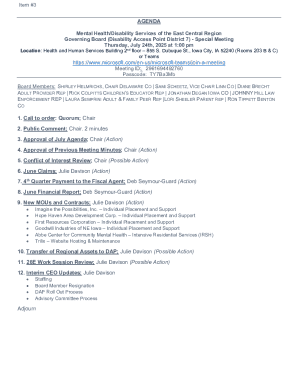

Managing your 10-Q filing

Post-filing management of the Form 10-Q is as crucial as the filing process itself. Companies benefit from organizing and archiving their Form 10-Q documents properly, which can save time in future filings and audits.

By managing your Form 10-Q filing effectively, your organization not only remains compliant but can also respond more rapidly and strategically to evolving market conditions.

Common mistakes to avoid when filing form 10-Q

Navigating the filing of a Form 10-Q requires precision. There are several common pitfalls that companies should steer clear of to avoid regulatory issues.

Awareness and training regarding these pitfalls can substantially mitigate risks and streamline the filing process for Form 10-Q.

Support and resources

For many companies, accessing the necessary support during the 10-Q filing process can be invaluable. Platforms like pdfFiller provide an extensive library of resources and tools specifically designed to ease the filing process.

In conclusion, understanding and navigating the Form 10-Q filing process is essential for public companies aiming to maintain regulatory compliance and transparency for investors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 10-q from Google Drive?

Can I create an electronic signature for signing my form 10-q in Gmail?

How do I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.