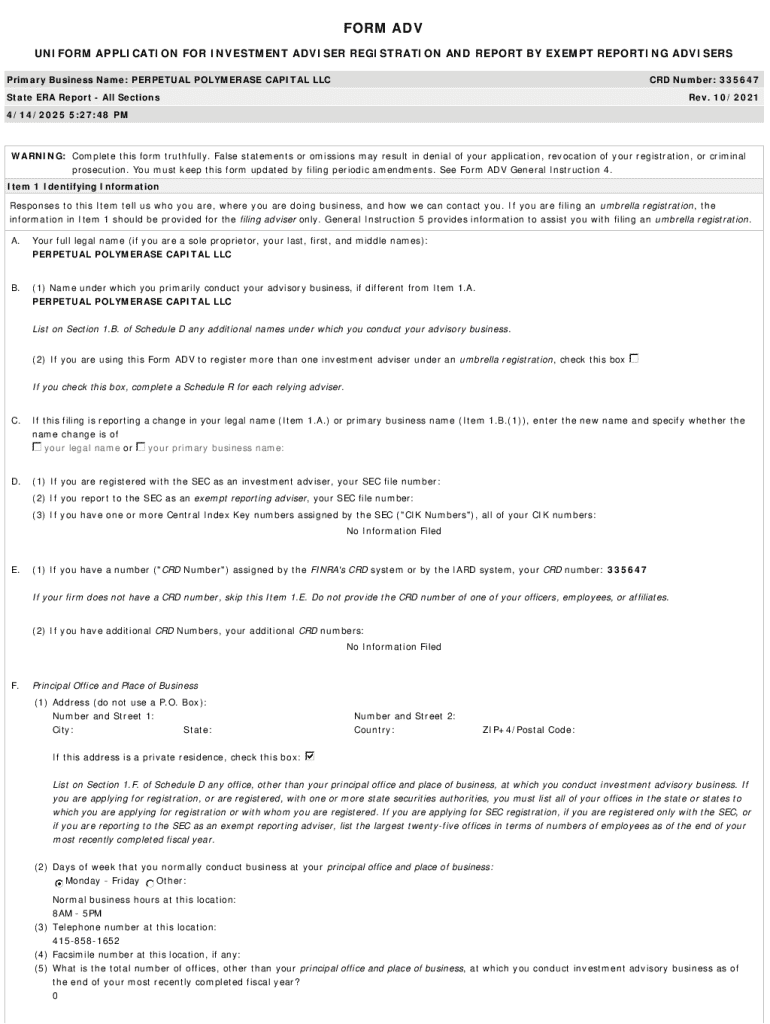

Get the free Form Adv

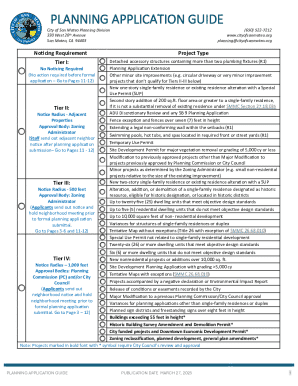

Get, Create, Make and Sign form adv

How to edit form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Form ADV: Your Comprehensive Guide to Understanding and Managing Your Investment Adviser's Form

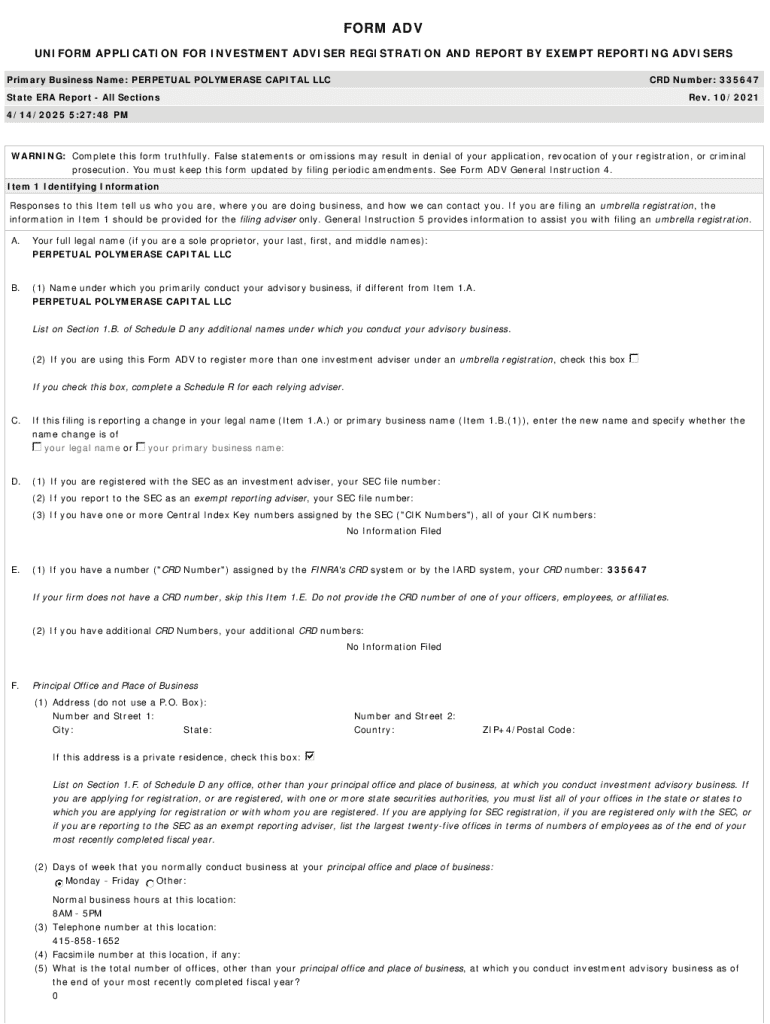

Understanding Form ADV

Form ADV is a crucial document used by investment advisers to register with the Securities and Exchange Commission (SEC) and various state authorities. It serves several purposes, one of which is to provide potential clients with essential information about an advisor's business practices, services offered, and any conflicts of interest. Given that investment advisers manage client assets and provide substantial financial advice, the importance of transparency and disclosure cannot be overstated.

The investment advisory industry relies heavily on Form ADV to foster trust and clarity between advisers and their clients. By understanding the nuances of this form, both advisers and clients can make informed decisions that align with their financial goals and risk tolerance.

Types of Form ADV

Form ADV consists of three distinct parts, each designed to serve a specific purpose.

Key components of Form ADV

Understanding the key components of Form ADV is essential for both investment advisers and clients. The advisory business overview lays out the framework of services an adviser offers along with the types of clients they serve. This information allows clients to assess whether the adviser’s services align with their investment goals.

Another vital component involves fees and compensation structures. Advisers must disclose the types of fees they charge—whether it’s hourly, flat, or a percentage of assets under management (AUM). Such transparency is indispensable for clients to evaluate the cost-effectiveness of engaging a particular adviser.

Investment strategies and risks

Part of the transparency required of investment advisers is to disclose their investment strategies and any associated risks. This information equips clients to make informed choices about their portfolios, recognizing both potential gains and risks involved. Furthermore, understanding these strategies can help clients gauge how an adviser might respond in various market conditions.

Navigating the Form ADV filing process

Filing Form ADV is a critical step for compliance in the investment advisory space. It's necessary for any investment adviser managing over a certain threshold of assets. However, some exemptions exist based on size and type of services offered. Understanding who must file is crucial to avoid non-compliance.

Step-by-step filing instructions

Preparing for the Form ADV filing can be straightforward when using the right processes. Here are the steps:

Common filing mistakes to avoid

Common errors during the filing process can lead to compliance issues. Some frequent pitfalls include inaccuracies in reporting your business model, underselling or overpromising services, and failing to disclose conflicts of interest effectively. Missing these crucial components could tarnish your firm's reputation and affect client trust.

Using pdfFiller to manage Form ADV

pdfFiller provides an excellent platform for managing Form ADV through intuitive tools and features, making the editing process seamless. Users can upload their existing Form ADV files directly to the platform for convenient modifications.

How to edit Form ADV with pdfFiller

Once your Form ADV is uploaded, pdfFiller allows for easy edits utilizing an array of editing features such as text insertion, deletion, or format changes. Customized templates for Form ADV may also be available to help streamline the process.

eSigning your Form ADV

pdfFiller enables users to electronically sign their Form ADV effortlessly. The platform ensures compliance with eSignature laws, facilitating a straightforward signing process without needing to print and email documents.

Collaboration features

Another significant advantage of pdfFiller is its collaboration tools. Users can invite team members to review and edit the document simultaneously. The platform tracks changes and comments to promote transparency amongst team members, which is vital for compliance and integrity in financial disclosures.

Best practices for maintaining compliance

Keeping Form ADV updated is vital for compliance. Regulatory changes and firm updates necessitate regular reviews. Advisers should be proactive about scheduling updates, aiming to amend the form whenever significant changes occur, such as acquisitions or shifts in your business model.

Monitoring changes in regulations

Keeping abreast of the SEC rules and requirements is another essential element of compliance. Frequent checks of regulatory websites or subscribing to industry newsletters can be beneficial. Knowledge of these changes helps advisers stay compliant and avoid penalties.

Keeping accurate records

Maintaining accurate records is not only crucial for compliance but also for building trust with clients. pdfFiller's document management features facilitate easy access to records, making it simple for advisers to retrieve and review past forms as needed.

Additional resources for financial advisors

Investment advisers should leverage the wealth of resources available to better understand Form ADV. The SEC’s website offers various guidelines and templates that can aid in compliance. Engaging with community forums can also provide insights and tips regarding best practices.

Subscribe for updates

Advisers should consider subscribing to newsletters that deliver insights into industry trends and changes in compliance requirements. Ongoing education can help advisers stay at the forefront of their professional practice, ensuring clients receive the best advice.

Frequently asked questions about Form ADV

Investors often have queries regarding Form ADV and its implications for their advising relationships. Some commonly asked questions include:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form adv?

How do I complete form adv online?

How do I edit form adv on an Android device?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.