Get the free U.s. Individual Income Tax Return - financialaid ucmerced

Get, Create, Make and Sign us individual income tax

Editing us individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out us individual income tax

How to fill out us individual income tax

Who needs us individual income tax?

US Individual Income Tax Form: A Comprehensive How-to Guide

Understanding the US individual income tax form

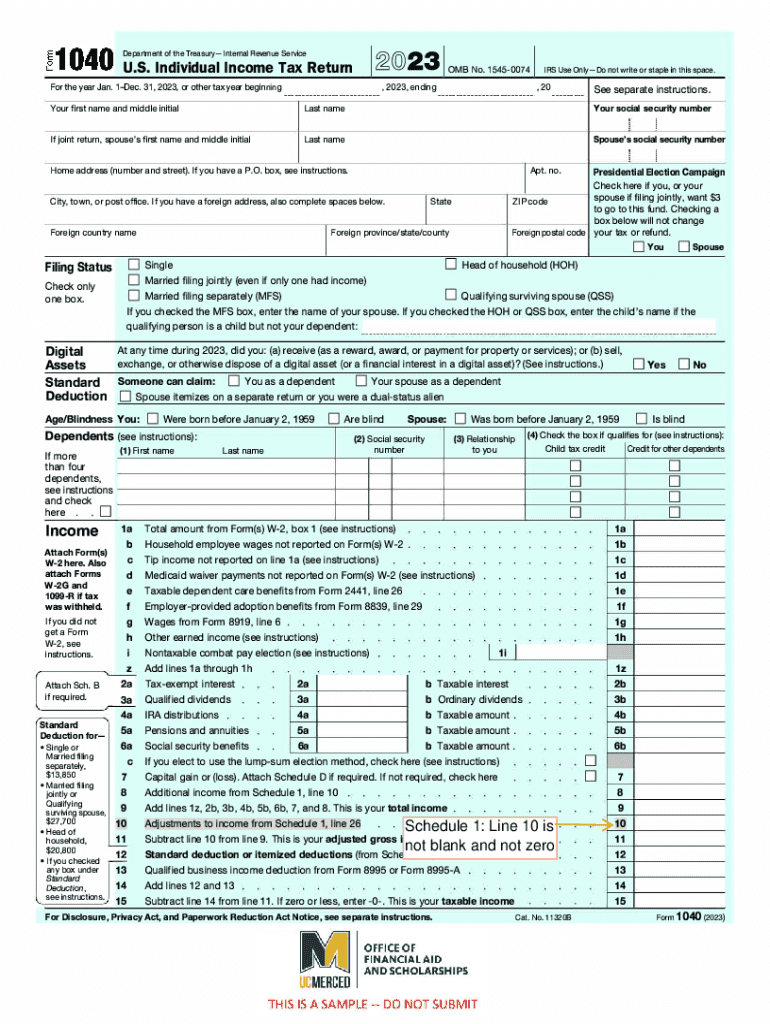

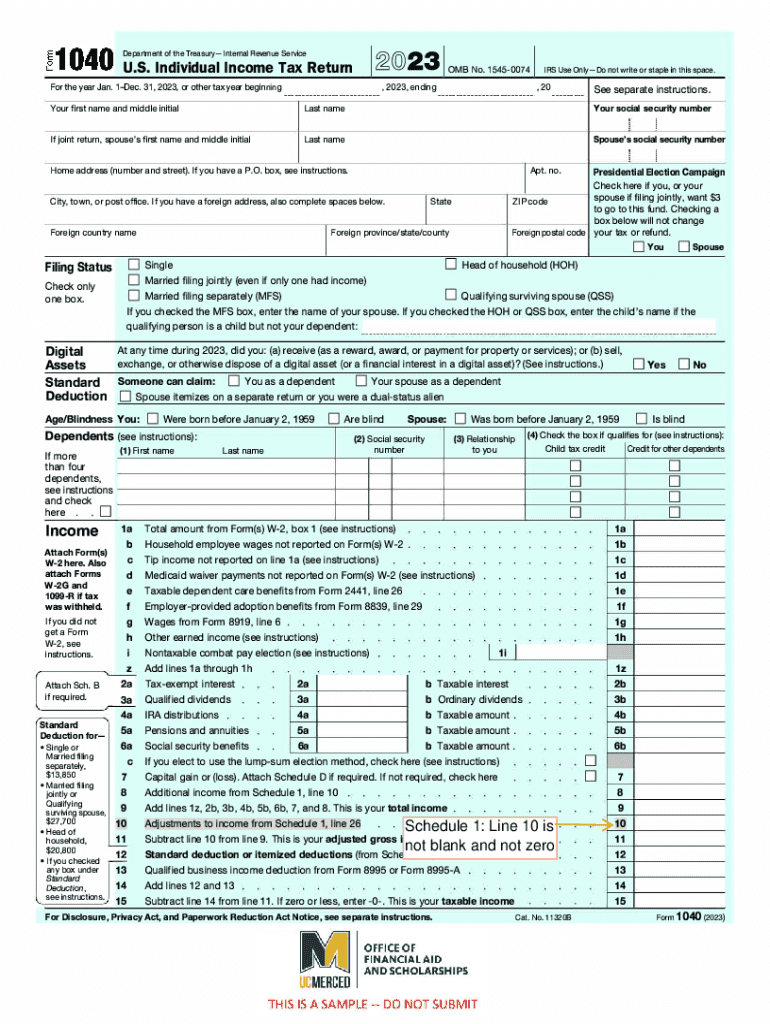

The US individual income tax form is essential for declaring income, calculating taxes owed, and determining potential refunds. The form serves multiple purposes, primarily ensuring compliance with federal tax laws while helping taxpayers manage their financial responsibilities. The most common forms filed include the IRS 1040, 1040A, and 1040EZ.

Form 1040 is the standard individual tax return, allowing for various income types, deductions, and credits. Form 1040A is a simplified version for taxpayers with straightforward financial situations, enabling certain income exclusions but not itemized deductions. The 1040EZ is even more basic, suitable for single or married filers whose taxable income is below $100,000, without dependents or complex deductions.

Who needs to file?

Filing requirements depend on various factors, including income thresholds set by the IRS. Generally, if your gross income exceeds the standard deduction, you must file a tax return. Self-employed individuals have unique requirements, as they must file if their net earnings surpass $400. Retirees must also consider pensions and Social Security benefits that impact their filing needs.

Certain demographics may face specific filing situations. For example, students with part-time jobs earning taxable income must file, while those solely dependent on scholarships or grants might not. Understanding these thresholds and demographics is critical to ensure compliance and avoid potential penalties.

Essential components of the US individual income tax form

Personal information forms the first layer of your tax return. Crucial elements include your full name, current address, and Social Security number. Providing accurate information helps the IRS process your return efficiently and ensures you receive any applicable refund promptly.

When it comes to income reporting, taxpayers must include all sources of income, such as wages (documented on W-2s), freelance earnings (reported on 1099s), and any additional income, such as interest or dividends. Compiling this information can be straightforward with proper organization.

Deductions and credits form the backbone of tax reduction strategies. Taxpayers can choose between the standard deduction, which simplifies the filing process, and itemized deductions, which require detailed documentation of eligible expenses. Additionally, tax credits like the Earned Income Tax Credit and Child Tax Credit can significantly lower tax liabilities.

Calculating your tax liability is a pivotal aspect. This involves applying the appropriate tax rate to your taxable income, factoring in any credits and deductions to derive the final amount owed or the expected refund.

Step-by-step guide to filling out your US individual income tax form

Preparation is crucial for a smooth tax filing process. Start by gathering all necessary documents, including W-2s, 1099s, and any relevant deduction records. This also includes receipts for medical expenses, charity contributions, and mortgage interest documents. By being organized, you can streamline the entire process.

Filling out the form itself requires careful attention to detail. Begin by providing your personal details in the designated sections. When reporting income from multiple sources, ensure accurate entry of amounts from each relevant form. Calculating whether to take the standard deduction or itemize can be complex, so compute potential savings based on your financial situation.

Claiming credits follows income reporting. Each tax credit has specific eligibility requirements, so be sure to reference guidelines carefully. Once you've filled everything in, reviewing your tax form becomes critical. Common entry errors, such as incorrect Social Security numbers or math mistakes, can lead to processing delays or unnecessary audits.

Tools and resources for managing your US individual income tax form

Using tools like pdfFiller can make document management seamless. Its features include editing capabilities for easy form completion, eSigning for electronic signatures, and collaborative options for teams working on shared financial documents. Utilizing pdfFiller saves time and reduces errors in the tax preparation process.

Interactive tools for tax preparation are also invaluable. Tax calculators on websites like pdfFiller can help estimate your tax refund or liability. Templates designed for various forms allow users to start from a solid foundation, simplifying the filling process. These tools ensure that individuals can manage their filings accurately and efficiently.

eSigning and submitting your US individual income tax form

eSigning your tax form with pdfFiller streamlines the submission process significantly. To eSign, simply navigate to the signing section, add your signature electronically, and save your document. This eliminates the need to print, sign, and scan back, saving both time and resources.

When it comes to submission, you have options. E-filing is the fastest method as the IRS processes electronic submissions almost instantly, allowing for quicker refunds. Alternatively, mailing your paper return requires proper addressing and does not always guarantee timely processing. After submission, tracking confirmation can ensure that your return is received, guarding against potential issues.

Troubleshooting common issues with the US individual income tax form

Mistakes can happen, and understanding how to address them is vital post-filing. If errors are identified after submission, the IRS permits amendments via Form 1040X. Timely action can help resolve discrepancies without penalties.

Taxpayers may also face audits and inquiries. If selected for an audit, it is crucial to stay calm and organized. Prepare documentation in advance to facilitate the process. The IRS typically sends notifications by mail, and being responsive can mitigate complications. Stay prepared with original documents, as they may be required for verification purposes.

FAQs about the US individual income tax form

Filing, deadlines, and penalties often raise questions among taxpayers. Common inquiries include the annual filing deadline, which usually falls on April 15, and the penalties for late filings. Understanding these elements can help taxpayers navigate potential issues effectively.

For additional questions regarding your specific situation, resources like pdfFiller's support team can provide further clarity and guidance. Engage with FAQs available online or access dedicated customer service for tailored assistance.

Connect with tax professionals

There are times when engaging a tax professional can be beneficial. If your financial situation is complex, such as having multiple income streams or investments, a tax advisor can provide tailored strategies to maximize deductions and minimize liabilities.

Professional tax help brings the advantage of expertise and familiarity with current tax laws, which can lead to significant savings for taxpayers. When seeking a trusted tax advisor, consider references, credentials, and reviews to ensure that you find someone suitable for your needs.

Language assistance resources for tax filers

For non-English speakers, various multilingual tax resources are available through the IRS. These can provide essential information and guidance, ensuring all taxpayers can understand their obligations. Additionally, government services often have staff available to assist with language barriers, facilitating smoother communications and compliance.

Accessing these resources can help individuals navigate their filings with confidence, minimizing the risk of errors stemming from misunderstandings of tax language or processes.

Additional insights on tax preparation

Filing early comes with numerous benefits, such as avoiding last-minute rushes and receiving refunds sooner. Early filers can also better anticipate tax liabilities and strategize effectively to manage their finances throughout the year.

Understanding how tax refunds work is essential. These refunds may result from overpayments or credits, potentially serving as a financial boost after tax season. Keeping abreast of changes in tax laws can also empower you, as alterations may impact future filings positively or negatively.

The future of income tax filing continues to evolve, emphasizing digital solutions and streamlined processes. Enhanced technology aims to merge efficiency with compliance, ensuring a more user-friendly experience for taxpayers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my us individual income tax in Gmail?

Can I edit us individual income tax on an iOS device?

How do I fill out us individual income tax on an Android device?

What is US individual income tax?

Who is required to file US individual income tax?

How to fill out US individual income tax?

What is the purpose of US individual income tax?

What information must be reported on US individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.