Get the free Income support client reporting online. Income support client reporting online. Inco...

Get, Create, Make and Sign income support client reporting

How to edit income support client reporting online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income support client reporting

How to fill out income support client reporting

Who needs income support client reporting?

Comprehensive Guide to the Income Support Client Reporting Form

Understanding the income support client reporting form

The income support client reporting form is a critical document used by individuals receiving public assistance benefits. Its primary purpose is to collect accurate and up-to-date information regarding a client's financial status and household circumstances. This form ensures that recipients continue to receive the correct amount of benefits, tailored to their current needs.

Accurate reporting is essential, as it helps maintain the integrity of the income support programs. When benefits are accurately aligned with a client’s situation, it minimizes the risk of overpayments or underpayments, which can significantly impact a client's financial stability. Individuals must understand that submitting false information, even unintentionally, can lead to repercussions such as program suspension or legal actions.

Anyone receiving income support must complete this form periodically, as specified by local guidelines. This includes individuals on disability assistance, as well as those benefiting from supplemental nutrition assistance programs, childcare assistance, or any other government aid. Regular completion of this form provides a transparent overview of a client's ongoing eligibility for benefits.

Overview of the income support client reporting process

Once clients understand the purpose of the income support client reporting form, it's essential to navigate the reporting process effectively. Clients have a few key responsibilities in this regard, starting with ensuring they understand what information is required. This includes detailed information about their income, household composition, and any additional benefits they may receive.

The timeline for reporting can vary by program or region, but generally, clients are required to submit updated forms at least every three to six months. Keeping track of these deadlines is crucial to maintain uninterrupted benefits. Additionally, clients should be aware of common pitfalls such as forgetting to report changes in income, family size, or address, which can lead to delays or discrepancies in benefits.

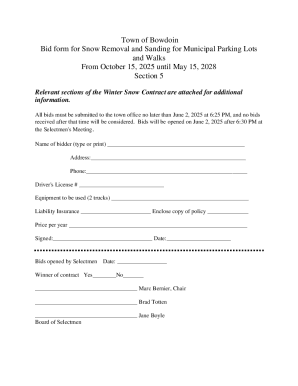

Step-by-step guide to completing the income support client reporting form

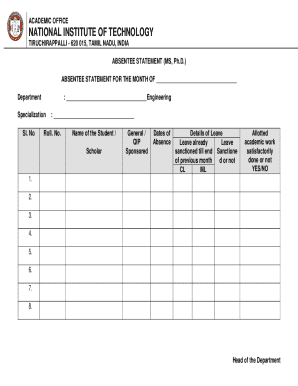

Completing the income support client reporting form may seem daunting, but breaking it down into manageable steps can simplify the process. First, gather the required information. Essential documents typically include proof of income, tax returns, and information on all household members. Clients should verify their current income information, ensuring that all figures are accurate and up-to-date before beginning to fill out the form.

Filling out the form involves several sections, each designed to capture specific information. The personal information section typically requires basic data such as name, address, and identification numbers. Following this, clients must provide details on household members, including their ages and relationships. The income sources section is crucial; clients must list all forms of income accurately, including wages, benefits, and any supplemental resources. Finally, clients should disclose any additional benefits they receive.

Gathering required information

Review and double-check

Completing the form is only part of the process; reviewing and double-checking your responses is equally important. This review should focus on ensuring all entries are correct and complete, which helps avoid common errors like entered figures that don’t match supporting documents or over-explaining information in sections where brevity is required.

Common errors include leaving sections blank, miscalculations in total income, and missing signatures. By taking the time to carefully review submissions, clients can save themselves potential headaches down the line, ensuring their financial support remains stable.

Editing and making changes to your submission

If you find it necessary to make changes to your income support client reporting form after submission, it’s essential to know the correct procedures. Most income support programs allow for updates via online portals or through direct communication with caseworkers. Clients should quickly inform their respective agencies about any significant changes to ensure their records remain accurate. Deadlines for revisions typically align with the reporting intervals; therefore, timely updates are crucial.

Best practices for document management involve keeping organized records of all submitted forms and correspondence regarding changes. Digital tools like pdfFiller provide users with the ability to track changes, ensuring that they can access previous versions if needed while retaining an organized filing system.

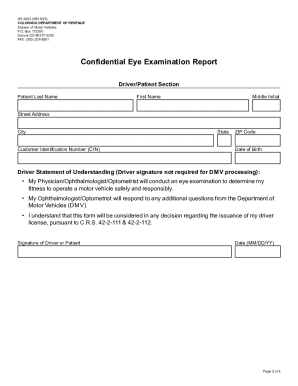

eSigning the income support client reporting form

Electronic signatures are becoming more prevalent in the digital documentation world, including with the income support client reporting form. Using platforms like pdfFiller, clients can easily eSign their forms to streamline the submission process. The steps usually involve clicking the designated signature field, following prompts to create or upload a signature, and applying it directly to the form.

It’s important to understand the legal implications of eSigning any document. An eSignature holds the same legal weight as a traditional handwritten signature, ensuring that clients' commitments are legally binding. Additionally, security features, such as encryption and activity tracking, on platforms like pdfFiller, protect client data and maintain confidentiality for sensitive information.

Submitting the income support client reporting form

Submitting the income support client reporting form through pdfFiller involves a simple set of instructions. Clients can upload their completed forms directly to the platform, where they can review them once more before submitting them to the relevant government agency. After submission, clients can track the status of their forms online, enabling them to confirm that their applications were received and are being processed.

Post-submission, clients can anticipate follow-up communications. They may receive notifications regarding any needed clarifications or reminders for future reporting deadlines. Keeping an eye on communication from income support agencies can help clients stay compliant with requirements and ensure that their benefits continue uninterrupted.

Managing your income support documents

Effective management of income support documents, such as the income support client reporting form, is vital for clients relying on public assistance. Tools like pdfFiller enable users to organize their documents efficiently, making it easier to find critical information when it's needed. By creating folders for each client document and assigning labels, users can quickly access forms and supporting documentation.

Collaboration features also simplify the process for individuals working with caseworkers or assistance teams. Multiple users can access, edit, and review documents, promoting an integrated approach to managing benefits. Furthermore, clients can store and access their forms from anywhere, ensuring that they are equipped to address queries or updates promptly.

Troubleshooting common issues

Encountering issues while filling out or submitting the income support client reporting form is not uncommon. Clients may have questions about specific entries or deadlines, and it’s crucial to address these promptly. Frequently asked questions regarding the form often include inquiries about how to include self-employment income or what to do if there are discrepancies in household size.

For additional assistance, clients can reach out to the appropriate government agency or explore resources available online through pdfFiller. Quick access to assistance can alleviate anxiety and ensure the client remains compliant with requirements. Clients should also be familiar with the key contacts for official help to resolve their issues effectively.

Benefits of using a cloud-based solution for document management

Adopting a cloud-based solution like pdfFiller for document management when handling the income support client reporting form brings several benefits. Firstly, the streamlined nature of cloud-based platforms allows for quicker document processing and sharing. Clients can seamlessly collaborate with caseworkers and support teams, enhancing communication and ensuring no details are overlooked.

Additionally, the accessibility of documents from anywhere means clients are never far from their critical information, even when on the go. This level of convenience also leads to significant time and cost efficiency as clients spend less time managing paperwork and more time focusing on their needs and securing support. It also allows easy access to vital documents when applying for various assistance programs.

User testimonials and success stories

Many users of pdfFiller have shared their positive experiences with managing the income support client reporting form. Clients often appreciate how the platform simplifies the submission process, reducing the time spent dealing with paperwork. A common testimony is how users can easily track their submissions, which alleviates the stress of wondering whether their forms reach the correct departments.

Moreover, receiving faster approvals for benefits has been a notable benefit, as the clear organization and tracking capabilities built into pdfFiller allow users to respond to requests efficiently. These success stories illustrate how efficient reporting not only streamlines management of income support but also positively impacts clients’ lives considerably.

Further learning and support

Clients looking to deepen their understanding of the income support client reporting form and relevant processes can leverage interactive tools available on pdfFiller. For those who prefer hands-on instruction, workshops and tutorials are available that cover advanced features of the platform and guide users on maintaining compliance with income support regulations.

Staying updated on changes in income support regulations is also critical to ensuring continued eligibility. Regularly checking resources offered by local government agencies or income support organizations can provide insights into any new policies or reporting requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send income support client reporting for eSignature?

Can I create an electronic signature for signing my income support client reporting in Gmail?

Can I edit income support client reporting on an iOS device?

What is income support client reporting?

Who is required to file income support client reporting?

How to fill out income support client reporting?

What is the purpose of income support client reporting?

What information must be reported on income support client reporting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.