Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A comprehensive guide to the Form 990 form

Understanding the Form 990

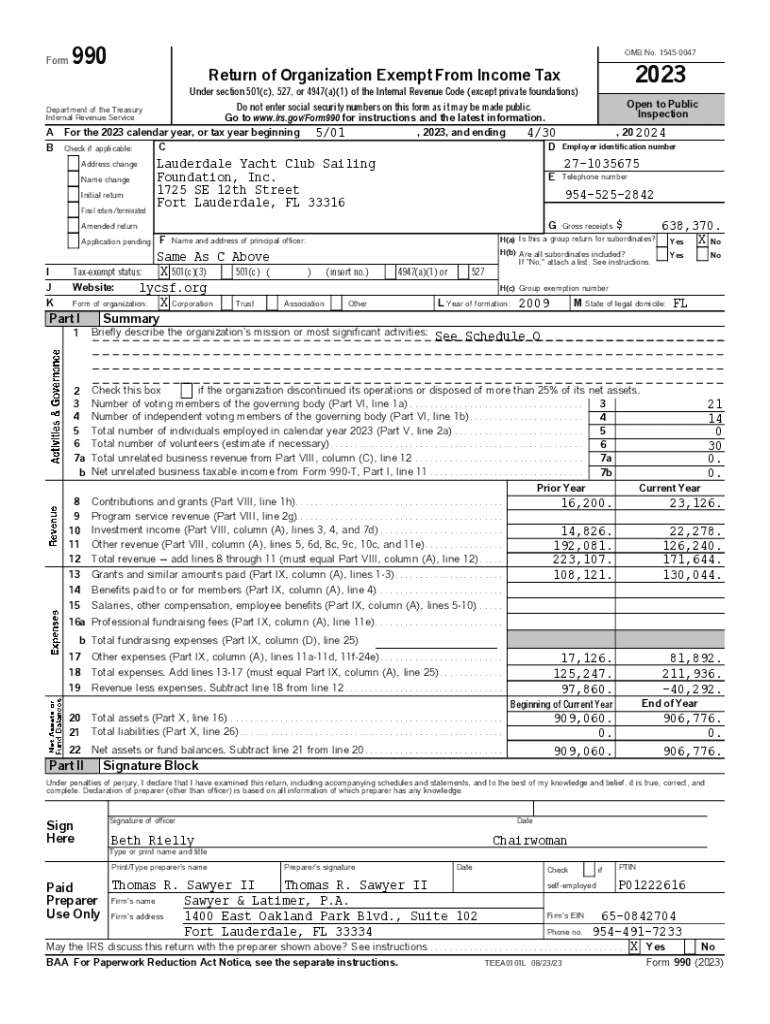

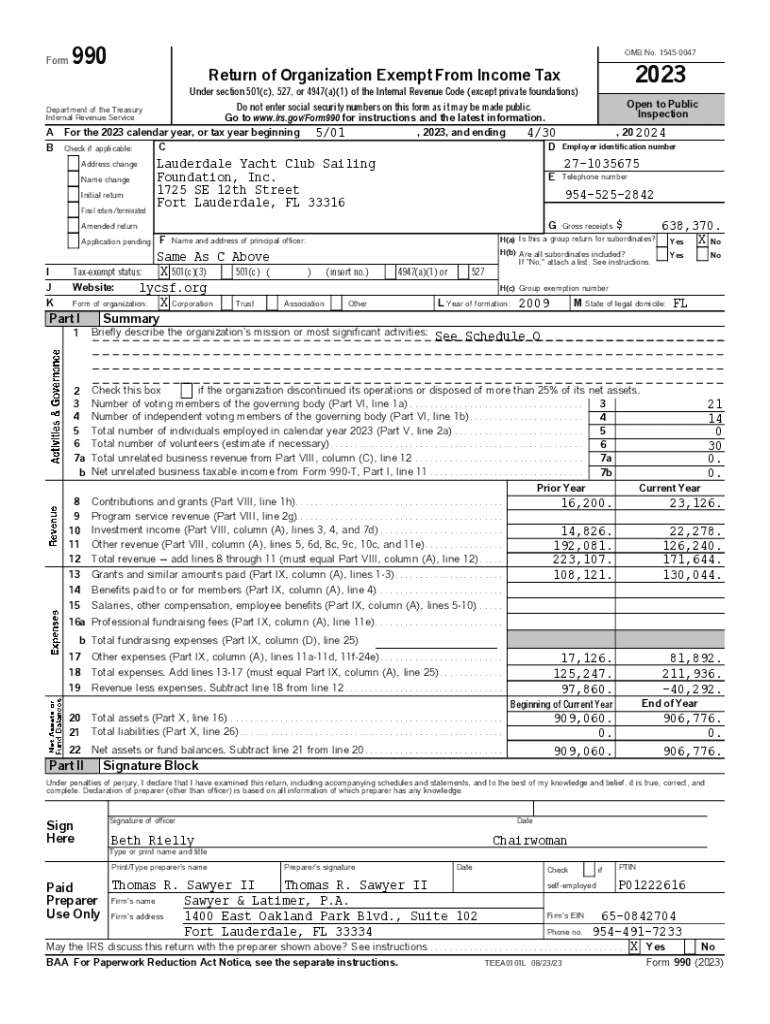

Form 990 is a crucial reporting return utilized by tax-exempt organizations, primarily non-profits, to provide the IRS and the public with updated information about their mission, programs, and finances. This form serves a dual purpose: it fosters transparency within the nonprofit sector while allowing stakeholders to assess an organization's financial health and operational sustainability. By examining these forms, potential donors or partners can gauge an organization's impact and accountability, making it a vital resource in philanthropy.

Certain organizations are required to file Form 990, including nonprofits, charities, and private foundations, among others. However, not all nonprofits file the same version of the form. The main types include Form 990, typically used by larger organizations, Form 990-EZ for smaller organizations, and Form 990-N for the smallest nonprofits earning under a specified threshold. Understanding which version your organization must file is essential in complying with federal regulations.

The structure of Form 990

Form 990 is divided into key sections, each designed to capture a different aspect of an organization's activities. The Summary Page offers a snapshot overview, highlighting significant financial data alongside details of the nonprofit's mission, laying the groundwork for transparency. Following this, the financial statements present a comprehensive review of income, expenses, and net assets, enabling organizations to track their financial metrics effectively.

Another vital section is dedicated to the governing body and management, where organizations disclose information about their board members and executive management, which is crucial for governance and accountability. Additionally, the Program Service Accomplishments section allows nonprofits to outline their programmatic impacts and metrics, effectively communicating mission achievements to stakeholders.

Popular schedules associated with Form 990 include Schedule A, which verifies public charity status; Schedule B, detailing contributor information; and Schedule C, which covers political campaign and lobbying activities. Each of these components is crucial in providing transparency and promoting trust within the nonprofit sector.

How to fill out Form 990 step-by-step

Filling out Form 990 can be a daunting task, but breaking it down into manageable steps can simplify the process. Begin by preparing your organization's information, which involves gathering essential documentation and financial records. This data should include your latest financial statements, internal policies, governance structures, and contact information for key personnel responsible for filing the report.

When completing Form 990, start by inputting general information about your organization, such as its name, address, and mission statement. Following this, you will input financial data, detailing all revenues and expenses accurately to ensure compliance with IRS regulations. Addressing governance questions is equally important; ensure all board structures are documented properly. An essential final step includes a thorough review and verification process to ensure the accuracy and completeness of the data before submission.

Editing and finalizing your Form 990

Once you've completed the bulk of the Form 990, utilizing pdfFiller can significantly enhance your document management. This platform allows users to upload and edit PDF forms effortlessly, giving nonprofits the ability to sign and manage their Form 990 efficiently. The collaborative features allow team members to provide commentary and approvals, fostering teamwork and minimizing errors.

Once finalized, signing and submitting your Form 990 is straightforward. Understanding the protocols for electronic signatures is key, as this is the primary method for submission through the IRS e-Services. Be sure to confirm your submission to ensure compliance and capture all necessary information accurately to maintain good standing with the IRS.

Common pitfalls and FAQs about Form 990

Filing Form 990 can be fraught with potential pitfalls. Common mistakes include insufficient detail, late filings, and errors in financial reporting. Nonprofits risk penalties that can affect their tax-exempt status if not careful. To avoid these issues, be diligent about timelines, gather all necessary information early, and confirm the accuracy of every entry on the form.

Frequently asked questions generally revolve around eligibility requirements for different types of organizations, deadlines for submission, and the implications of late filings. Nonprofits must be aware of the specific requirements that apply to their type and ensure compliance to maintain tax-exempt status and public trust.

Managing changes and updates post-submission

Should a need arise to amend your Form 990 after submission, the process is straightforward but requires attention to detail. Organizations need to file an amended form, noting the specific changes made and ensuring that all data aligns with the most current information. Understanding the potential impact of these amendments can ensure that nonprofits maintain clarity and transparency in their reporting.

To facilitate continuous improvement and reporting, nonprofits should leverage insights gathered from previous Form 990 submissions. By analyzing past reports, organizations can identify trends, enhance fundraising strategies, and adapt programs to better meet their mission objectives. Regular reviews of financial performance and program metrics are essential.

Best practices for nonprofits in utilizing Form 990

Maintaining transparency and accountability is pivotal in leveraging Form 990. Nonprofits can build trust with stakeholders through accurate and timely reporting. Regularly acknowledging and communicating results, challenges, and aspirations can strengthen relationships with donors and the community, thus enhancing philanthropic support.

Additionally, using reported data for strategic planning is paramount for long-term success. Nonprofits should use their Form 990 data to inform fundraising initiatives, allocate resources efficiently, and design programs that align with their mission. By actively engaging with stakeholders about their financial health and programmatic impacts, organizations can foster a culture of continuous improvement.

Advanced tools for managing nonprofit documents

Managing Form 990 is only part of a nonprofit organization’s documentation landscape. Other required documents, such as state-specific filings, financial statements, and donor records, must also be tracked diligently. Utilizing a comprehensive document management solution like pdfFiller can streamline all aspects of document handling from one platform, making it easier to maintain organizational compliance and efficiency.

By leveraging advanced features within pdfFiller, nonprofits can not only manage Form 990 but also ensure that every necessary document is up to date and readily accessible. This integrated approach minimizes errors, enhances collaboration, and supports overall operational excellence, enabling organizations to focus on their core mission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form 990 in Gmail?

How do I fill out the form 990 form on my smartphone?

Can I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.