Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide for Nonprofits

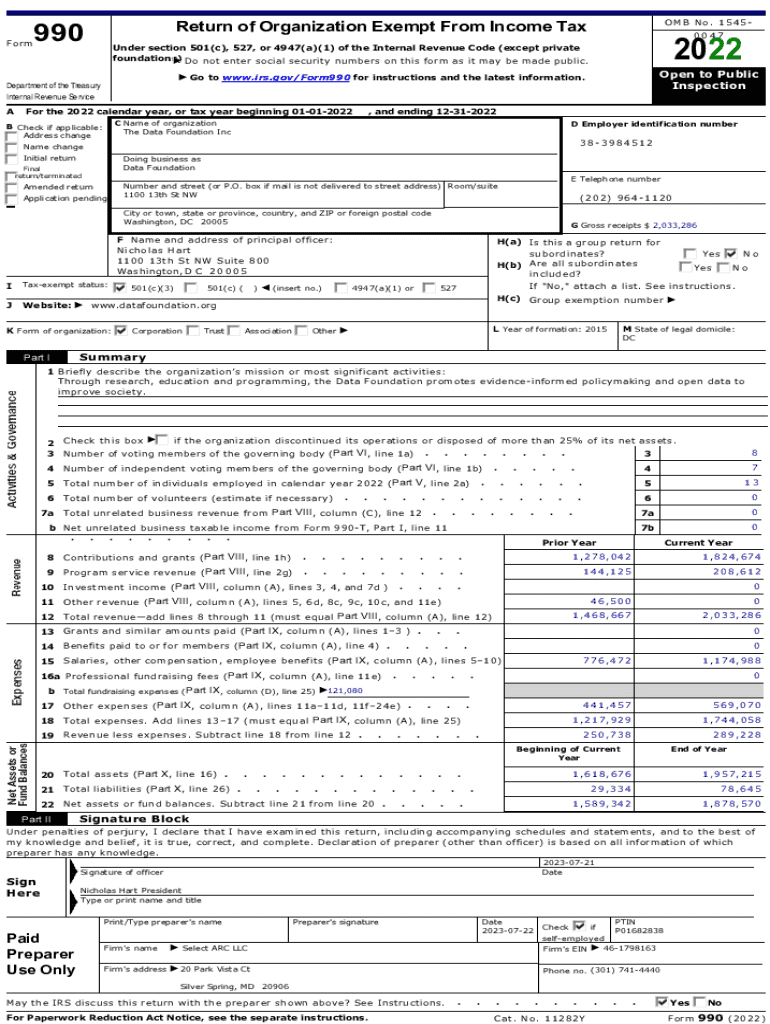

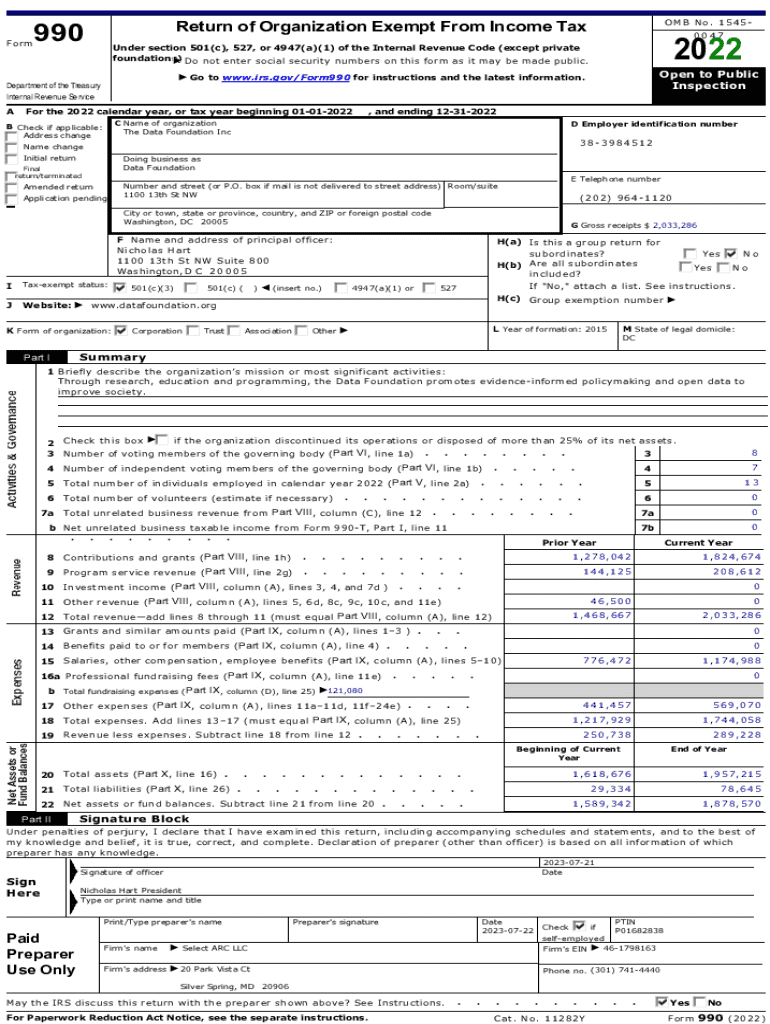

Understanding Form 990

Form 990 is an essential document for tax-exempt organizations in the United States. It serves as an annual information return that provides the Internal Revenue Service (IRS) and the public with a transparent snapshot of a nonprofit's financial activities. The primary purpose of Form 990 is to promote transparency and accountability within the nonprofit sector, ensuring that these organizations uphold their obligations to their constituents and donors.

The importance of Form 990 cannot be overstated. It allows various stakeholders, including donors and grant-making organizations, to assess how nonprofit organizations utilize their resources. For instance, detailed revenue and expenditure reporting can help potential contributors determine the impact and efficiency of a nonprofit's programs before deciding to invest financially.

Types of Forms 990

There are three primary versions of Form 990 tailored to fit different organization sizes and financial thresholds:

Choosing the appropriate version of the form is vital, as filing the incorrect form could lead to penalties or loss of tax-exempt status.

Who Needs to File Form 990?

Nonprofit organizations, including charities, foundations, and educational institutions, must file Form 990 if they hold tax-exempt status. However, some organizations are required to file based on specific income thresholds, making it crucial for entities to know their obligations. Generally, organizations earning over $200,000 in gross receipts or possessing total assets exceeding $500,000 must file the full Form 990.

Filing exemptions

Certain organizations may be exempt from filing Form 990, including:

Understanding whether your organization is required to file Form 990 is imperative to maintaining tax-exempt status and avoiding penalties.

Key components of Form 990

Form 990 consists of several key sections that provide crucial information about a nonprofit’s financial health and governance, including:

In addition to these sections, Form 990 includes various schedules that detail more specific information, such as:

Understanding these components is essential for accurately completing the form and ensuring compliance.

Step-by-step instructions for completing Form 990

Filing Form 990 can be a daunting task, but having a well-structured approach can simplify the process significantly. Here's a preparation checklist to ensure you have everything needed before diving in:

Filling out Form 990

To effectively fill out Form 990, follow these steps:

A meticulous approach to completing Form 990 not only ensures compliance but also strengthens the organization's standing among donors and the public.

Common mistakes to avoid when filing Form 990

When filing Form 990, nonprofits often encounter common pitfalls. Awareness of these can help organizations evade costly errors. Here are some frequent mistakes that should be avoided:

Avoiding these mistakes helps maintain compliance, fosters greater transparency, and fortifies trust with stakeholders.

Tools for managing Form 990 filing

Utilizing effective tools can significantly streamline the process of preparing and filing Form 990. pdfFiller presents interactive features designed to enhance user experience during the completion of Form 990.

Interactive tools and features of pdfFiller

With pdfFiller, users can rely on an intuitive platform that provides interactive tools for filling out Form 990. Key features include:

The accessibility of pdfFiller means that users can collaborate on documents, allowing team members to review and contribute to the preparation of Form 990, enhancing the overall accuracy and quality of the submissions.

FAQs about Form 990

Navigating Form 990 may raise various questions, particularly regarding the process and requirements. Here are some frequently asked questions about Form 990:

Addressing these common inquiries can provide clarity for organizations preparing to submit their Form 990.

Updating your Form 990 filing

Maintaining compliance while ensuring that filings reflect current organizational information is crucial. After an organization files Form 990, there may be circumstances requiring updates or corrections. Here are approaches to consider for keeping filings accurate:

Proactively updating your filing demonstrates a commitment to transparency and accountability, vital aspects of maintaining public trust.

Additional considerations

The implications of Form 990 extend beyond mere compliance; it also plays a role in fundraising and shaping public perception. An organization’s transparency as displayed in its Form 990 can enhance donor trust and engagement.

Moreover, nonprofits should be aware of any state-specific requirements. While Form 990 is a federal requirement, many states have their own legislation governing nonprofit filings, which may necessitate additional documentation or compliance actions. Understanding these state-level mandates is crucial for maintaining overall compliance and engaging effectively with local stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 990 online?

How do I edit form 990 online?

How can I fill out form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.