Get the free Employer’s Quarterly Federal Tax Return

Get, Create, Make and Sign employers quarterly federal tax

Editing employers quarterly federal tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employers quarterly federal tax

How to fill out employers quarterly federal tax

Who needs employers quarterly federal tax?

Comprehensive guide to the employers quarterly federal tax form

Understanding the employers quarterly federal tax form

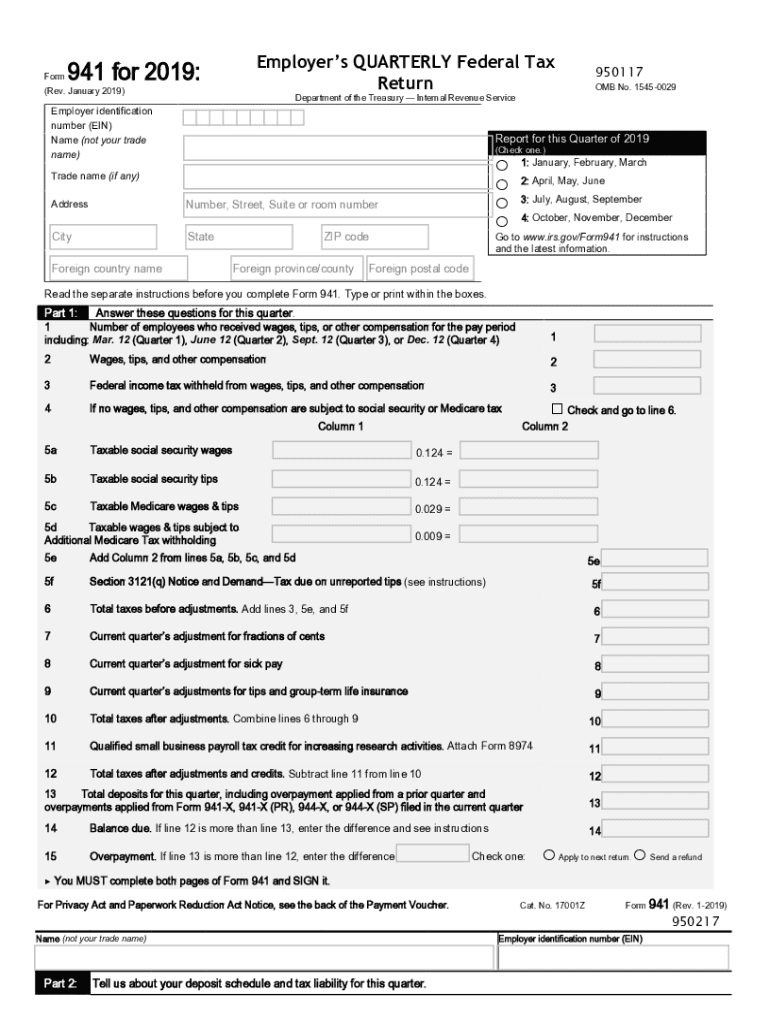

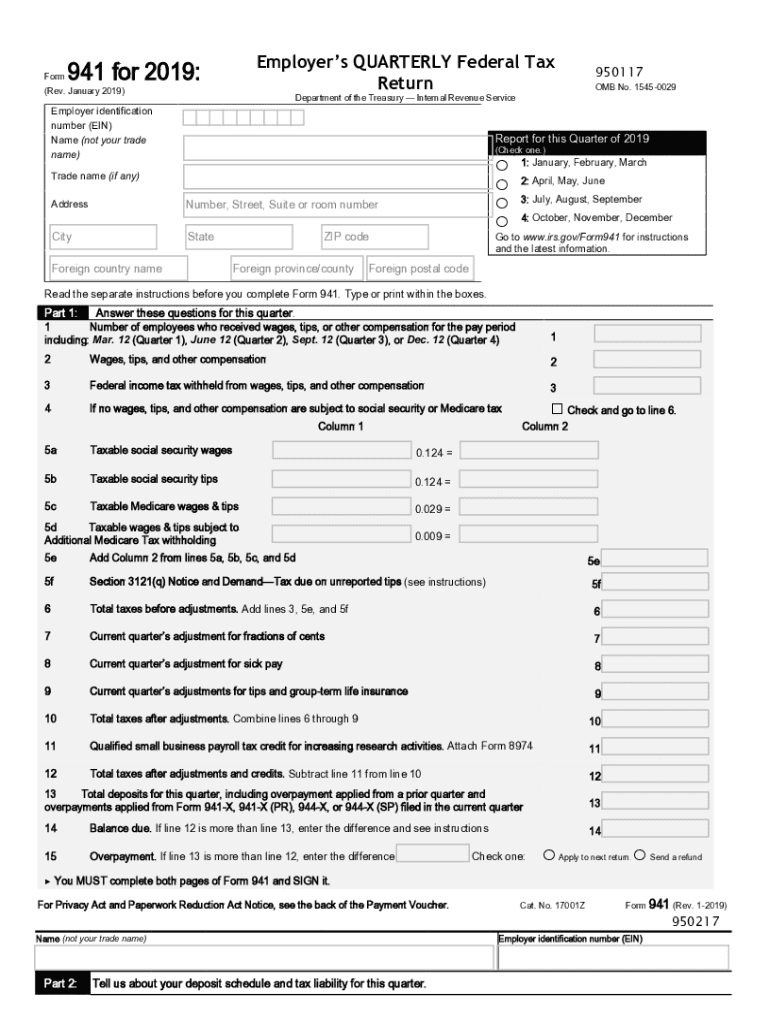

The Employers Quarterly Federal Tax Form, officially known as Form 941, plays a central role in tax compliance for businesses in the United States. This form is utilized by employers to report income taxes withheld from employee wages and the employer's portion of Social Security and Medicare taxes. It is crucial for maintaining accurate records of payroll taxes and ensuring that tax liabilities are settled in a timely manner.

The significance of Form 941 extends beyond simple tax reporting; it serves as a key instrument for the IRS to monitor and ensure that businesses are fulfilling their payroll tax obligations. Additionally, providing accurate Form 941 submissions helps employers avoid issues with the IRS, including penalties for misreporting or underpayment.

Key components of the form include information about the number of employees, total wages paid, and amounts withheld for federal taxes. Understanding these components is essential for keeping your business compliant and avoiding unnecessary complications.

Who needs to file the employers quarterly federal tax form?

Not every employer is required to file Form 941, but specific eligibility criteria do exist. Generally, any business that pays wages to employees on which income tax, Social Security, or Medicare taxes are withheld must file this form. This requirement applies whether the employees are full-time, part-time, or seasonal.

Exemptions to this rule exist for certain types of organizations, such as government agencies or certain non-profit entities, which may have been granted specific exemptions under tax law. It is essential for all businesses to determine whether they are indeed required to file Form 941, as failure to do so on time can lead to severe financial penalties and complications with tax compliance.

Essential filing deadlines and due dates

Filing Form 941 is a quarterly obligation, meaning employers must keep track of specific due dates throughout the year. The IRS lays out a clear timeline for submissions, which are generally due on the last day of the month following the end of each quarter.

For example, the due dates for Form 941 are as follows:

Timely submission of Form 941 is important not only to maintain compliance but also to avoid penalties. The IRS imposes financial repercussions for late filings which can accumulate quickly, leading to additional strain on businesses. Taking proactive measures such as setting reminders and maintaining organized records can help ensure that deadlines are met.

Preparing to file Form 941

Preparation is key when it comes to filing Form 941 accurately. Employers should gather all relevant information beforehand, including detailed records of employee wages, hours worked, and any tax payments that have already been made throughout the quarter. This could include withholding details for federal income tax, Social Security, and Medicare, which are essential for accurately completing the form.

Establishing a final checklist before filing can help streamline the process and prevent costly errors. Steps may include verifying that employee information is up-to-date, confirming the total wages reported, and ensuring all tax liabilities are calculated correctly. Small mistakes can lead to larger issues, so attention to detail is critical.

Step-by-step instructions for completing the employers quarterly federal tax form

Completing Form 941 may appear straightforward, but each section must be filled out correctly to ensure compliance and accuracy. The form consists of various sections that require specific types of information — from reporting wages paid to detailing tax payments made to the IRS. Taking a line-by-line approach can facilitate a more streamlined filling process.

One primary area to focus on while filling out Form 941 is the calculation of tax liability. Understanding the current tax rates for Social Security and Medicare is essential, as they change periodically based on government policy and economic conditions. Thus, keeping abreast of the latest rates is a must for any employer.

How to file Form 941

Employers have options when it comes to filing Form 941, including online filing and traditional paper submission. Many prefer e-filing due to its convenience and efficiency. Filing electronically often reduces the chance of errors and speeds up the processing time significantly, allowing employers to receive confirmation of receipt quickly.

To file Form 941 online, follow a step-by-step process:

For employers who opt for paper filing, ensure to mail the form to the appropriate IRS address, and keep copies for your records to prevent discrepancies.

Common challenges and solutions when completing Form 941

Despite the clarity of Form 941, some common challenges can arise that pose difficulties during filing. Incorrect employee information gathered over the quarter can lead to complications; for instance, if Social Security numbers or names do not match IRS records, it can result in delays or penalties.

Miscalculations on tax owed is another challenge. The complexities of payroll taxes can make it easy to misreport total tax obligations, leading to potential audits or incorrect penalties. Fortunately, resources are available to help resolve disputes and clarify any uncertainties about filing. The IRS website provides detailed instructions and assistance, while consulting with tax professionals can provide personalized solutions based on your specific business needs.

Interactive tools for managing your tax filing

For businesses seeking efficient document management solutions, pdfFiller's online platform provides a comprehensive toolset for handling Form 941. The power of pdfFiller lies in its capabilities, allowing users to edit, manage, and collaborate on documents remotely. This service is especially valuable for teams, as it streamlines the workflow, reducing the need for in-person meetings or excessive paper exchanges.

Features such as digital signatures enhance the filing experience, enabling businesses to e-sign and securely share Form 941 without needing to print or fax documents. This not only saves time but also improves security and accuracy, ensuring that your submissions to the IRS are handled properly.

Key points to remember about the employers quarterly federal tax form

Managing taxes effectively involves more than just filing a form; it requires an ongoing commitment to staying informed and organized. Employers must maintain accurate records and engage in practices that facilitate compliance throughout the year. Regularly updating employee information, understanding payroll obligations, and setting proactive reminders for filing dates can significantly ease the annual tax burden.

Understanding your responsibilities as an employer extends beyond completing Form 941. Employers must remain vigilant to stay updated about changes in tax laws and regulations, which can affect workloads and tax liabilities. Having resources and tools at hand for compliance can lead to better planning and reduced stress when it comes time to file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employers quarterly federal tax in Chrome?

Can I create an electronic signature for signing my employers quarterly federal tax in Gmail?

How do I fill out employers quarterly federal tax on an Android device?

What is employers quarterly federal tax?

Who is required to file employers quarterly federal tax?

How to fill out employers quarterly federal tax?

What is the purpose of employers quarterly federal tax?

What information must be reported on employers quarterly federal tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.