Get the free Critical Illness Insurance Claim Form

Get, Create, Make and Sign critical illness insurance claim

How to edit critical illness insurance claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out critical illness insurance claim

How to fill out critical illness insurance claim

Who needs critical illness insurance claim?

A Comprehensive Guide to Critical Illness Insurance Claim Form

Understanding critical illness insurance

Critical illness insurance offers financial protection in the event of a severe health condition. This policy provides a lump sum payout to help cover medical expenses, lost income, and associated costs when diagnosed with specific illnesses outlined in the policy.

Having a critical illness policy is essential as it alleviates financial stress during a health crisis. This allows you to focus on recovery rather than worrying about mounting bills. A typical policy covers ailments such as heart attack, stroke, cancer, and other life-altering conditions.

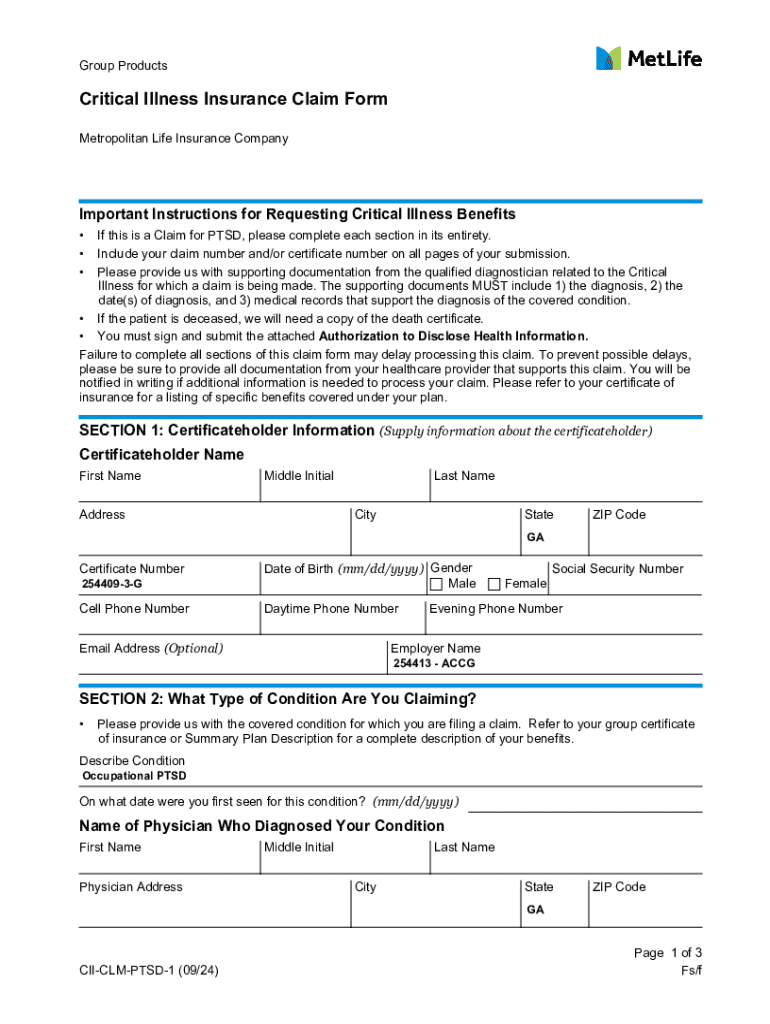

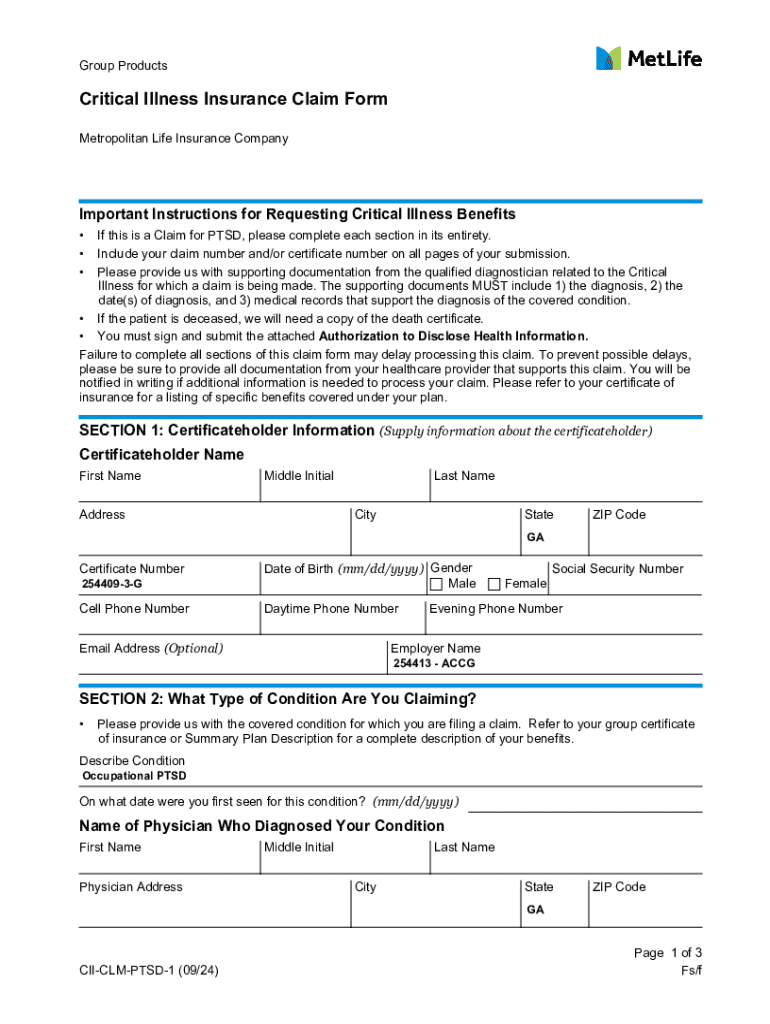

Preparation for filing a claim

Before you fill out a critical illness insurance claim form, ensure you have essential documents ready. These documents include your medical records that clearly outline the diagnosis, details of your insurance policy like coverage and terms, and your identification information.

It’s crucial to review the claim process and know the specifics required by your insurance provider as requirements can vary significantly. Be mindful of deadlines for filing claims, which will help to avoid unnecessary delays.

Step-by-step guide to completing the critical illness insurance claim form

Step 1: Accessing the claim form

You can find the critical illness insurance claim form on the pdfFiller platform. Ensure you select the most recent version of the form to avoid complications during processing. It's crucial to check if your insurer has any specific requirements regarding the claim form.

Step 2: Filling out personal information

In the claimant's section, input required personal details accurately including your name, address, and relationship to the policyholder. This information is fundamental for insurance verification.

Step 3: Providing policy details

Clearly include your policy number and any relevant coverage confirmations. This step ensures that your claim is authenticated against the correct policy.

Step 4: Detailing medical information

Accurately disclose your medical history and the specifics of your diagnosis. Include the names and contact details of healthcare providers as they will often need to provide further verification to the insurer.

Step 5: Documenting the critical illness

Detail your diagnosed condition specifically, as insurers require clarity on how it aligns with the covered illnesses. Consider attaching supporting medical documents, such as test results or treatment plans.

Step 6: Completing the authorization section

This section ensures that you give consent for your documents and health records to be accessed by the insurance provider necessary for processing your claim. Read this section carefully before signing.

Step 7: Reviewing your claim

Before submitting the claim form, double-check every detail for accuracy. This includes cross-referencing the personal information, policy details, and medical information to avoid potential rejections.

Submitting your claim

Once your claim form is completed, you can submit it through various methods. The most convenient way is to use the pdfFiller platform for online submission, which allows for instant processing. Alternatively, you can opt for traditional mailing.

After submission, expect varying timelines depending on the insurer. Typically, it takes around 14 to 30 days for claims to be processed, but some cases may require additional information that could delay the process.

Managing your claim post-submission

After submission, use the tracking tools provided by pdfFiller to monitor your claim status. It's essential to check this regularly to catch any issues early on.

Common issues that may arise include incomplete information or delays in receiving medical documentation. Prompt communication with your insurer regarding these points can aid in resolving problems quickly.

If your claim is denied, understand the reasons stated in the denial letter. Each insurer has an appeal process, and you should not hesitate to seek professional legal advice if you're unsure how to proceed.

Additional tips for a smooth claims experience

To ensure a smooth claims experience, prioritize organizing your documentation from the beginning. This makes it easy to retrieve necessary documents when they are required. Keep copies of everything you send to your insurer.

Effective communication is key when dealing with insurance companies. Don't hesitate to ask questions if you find terms or requirements confusing. Leveraging tools on pdfFiller can help you edit and eSign documents securely, ensuring you remain compliant with all necessary regulations.

Industry insights and resources

Navigating critical illness claims can present several challenges, from understanding specific policy details to ensuring timely submissions. Keeping abreast of changes in industry regulations may offer advantages and insights into tackling potential issues.

Experts suggest fostering direct communication with your insurer and healthcare providers throughout the claims process to ensure all parties are aligned. Additionally, various online resources can assist you further in understanding your rights and obligations regarding critical illness claims.

Collaborating with healthcare professionals

Involving your healthcare provider in the claims process is critical for successful outcomes. They can provide the necessary documentation, which validates your claim, and their insights can be essential in addressing questions from your insurer regarding your diagnosis.

Maintain open communication with your medical professionals. This ensures that they are aware of your claims journey and can assist with any medical inquiries from the insurer without delay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit critical illness insurance claim from Google Drive?

How do I complete critical illness insurance claim online?

How do I make changes in critical illness insurance claim?

What is critical illness insurance claim?

Who is required to file critical illness insurance claim?

How to fill out critical illness insurance claim?

What is the purpose of critical illness insurance claim?

What information must be reported on critical illness insurance claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.