Get the free M&s Cash Isa Switching Form

Get, Create, Make and Sign ms cash isa switching

Editing ms cash isa switching online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ms cash isa switching

How to fill out ms cash isa switching

Who needs ms cash isa switching?

Your Comprehensive Guide to the MS Cash ISA Switching Form

Understanding cash ISAs

A Cash Individual Savings Account (ISA) is a tax-efficient savings account that allows individuals to save money without incurring tax on the interest earned. This makes Cash ISAs a popular choice for people looking to maximize their savings potential while minimizing tax liabilities. Cash ISAs come with several benefits, which include flexible access to funds, protection against inflation, and the ability to transfer the accumulated savings tax-free.

The current market landscape for Cash ISAs is characterized by varying interest rates and offers from numerous institutions. In recent years, there has been a notable trend towards digital banking platforms providing competitive rates, driving traditional banks to enhance their offerings. With rising inflation, savers are on the lookout for Cash ISAs that not only offer reasonable interest rates but also ensure their savings retain value over time.

The importance of the MS Cash ISA switching form

The MS Cash ISA Switching Form is essential for individuals who wish to transfer their Cash ISA from one provider to another seamlessly. This form facilitates the process by ensuring all necessary information is accurately provided to both the current and new ISA providers, minimizing the risk of complications during the transfer.

Common scenarios for wanting to switch ISAs include dissatisfaction with current interest rates, poor customer service experiences, or simply seeking added features such as online access and better terms. Utilizing the MS Cash ISA Switching Form not only streamlines the process but typically ensures that users can retain their tax-free allowances efficiently and without penalties.

What's on this page?

In this guide, you will learn everything you need to know about the MS Cash ISA Switching Form, including its importance and how to fill it out correctly. We’ll provide detailed insights into preparing for the switch, managing your new Cash ISA, and navigating the transfer rules. Additionally, you'll find FAQs addressing common concerns and interactive tools to assist throughout the process.

Why switch your Cash ISA?

There are several compelling reasons to consider switching your Cash ISA. One of the primary motivations is to secure a better interest rate. Many individuals find themselves trapped in accounts offering below-average rates, especially in a fluctuating market. By switching, savers can take advantage of more competitive rates that align with their savings goals.

Another common reason is the desire for improved customer service. Switching ISAs can provide an opportunity to move to a provider that prioritizes customer support, ensuring that users have easy access to assistance when needed. Additionally, some providers may offer additional features such as introductory bonuses, online account management, or financial planning tools that can enhance the overall savings experience.

Despite these advantages, some misconceptions persist, such as the belief that switching ISAs is overly complicated or that it could lead to loss of benefits. In reality, using the MS Cash ISA Switching Form entrusted with proper documentation can ease the transition, making it efficient and straightforward.

ISA transfer rules

The rules governing Cash ISA transfers are designed to protect individual savers. Funds must be transferred holistically between ISAs, meaning that you cannot take cash directly out of one and pay it into another to retain the tax-free allowance. The process involves completing the MS Cash ISA Switching Form and submitting it to your new provider, who will manage the transfer.

Eligibility for transferring involves ensuring that both the current and new accounts are Cash ISAs and abide by other specific regulations. It’s crucial to check if your existing ISA has any fixed-term conditions that could incur penalties if you switch before the term ends. Understanding the tax implications of the transfer will also aid in maintaining your annual allowance, which for the tax year 2023/2024 is set at £20,000.

Preparing to switch your Cash ISA

Before filling out the MS Cash ISA Switching Form, you should thoroughly evaluate your current Cash ISA. Consider assessing the interest rate you currently receive—if it’s significantly lower than the market average, switching may be beneficial. Additionally, review the terms and conditions for any penalties associated with early withdrawal or switching, as this could affect your decision.

Gathering the necessary documentation will help speed up the switching process. This typically includes your current ISA account details, such as account numbers and provider information, along with any personal identification documents required by the new provider. Being well-prepared will facilitate the switch and maintain your investments without hassle.

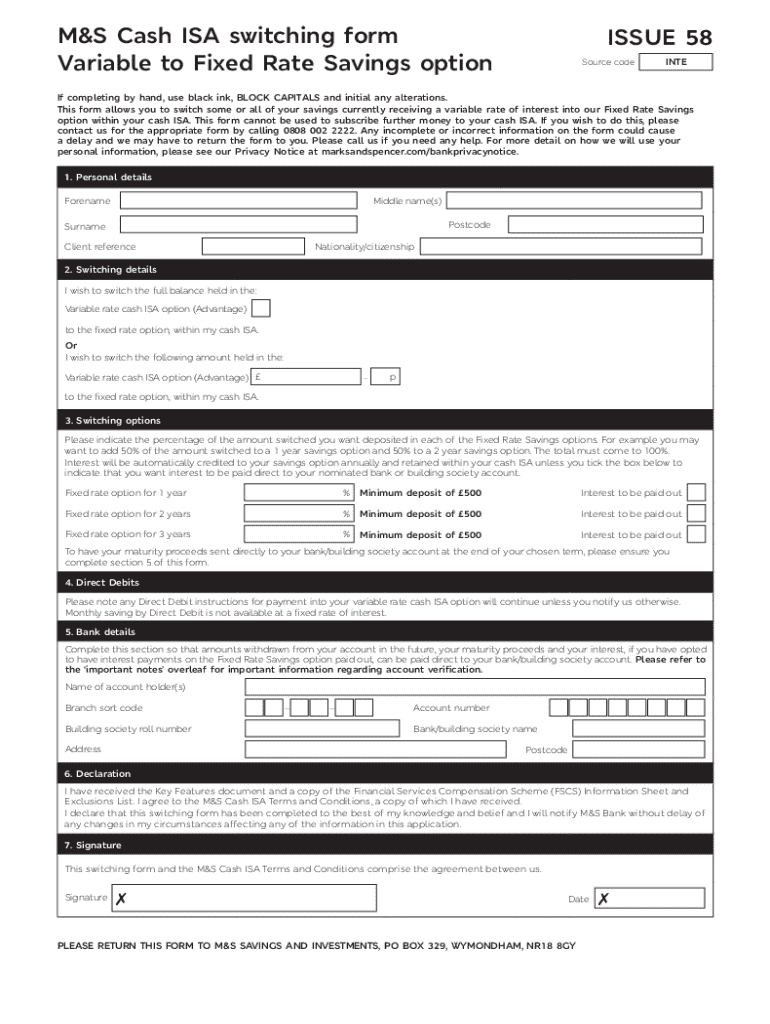

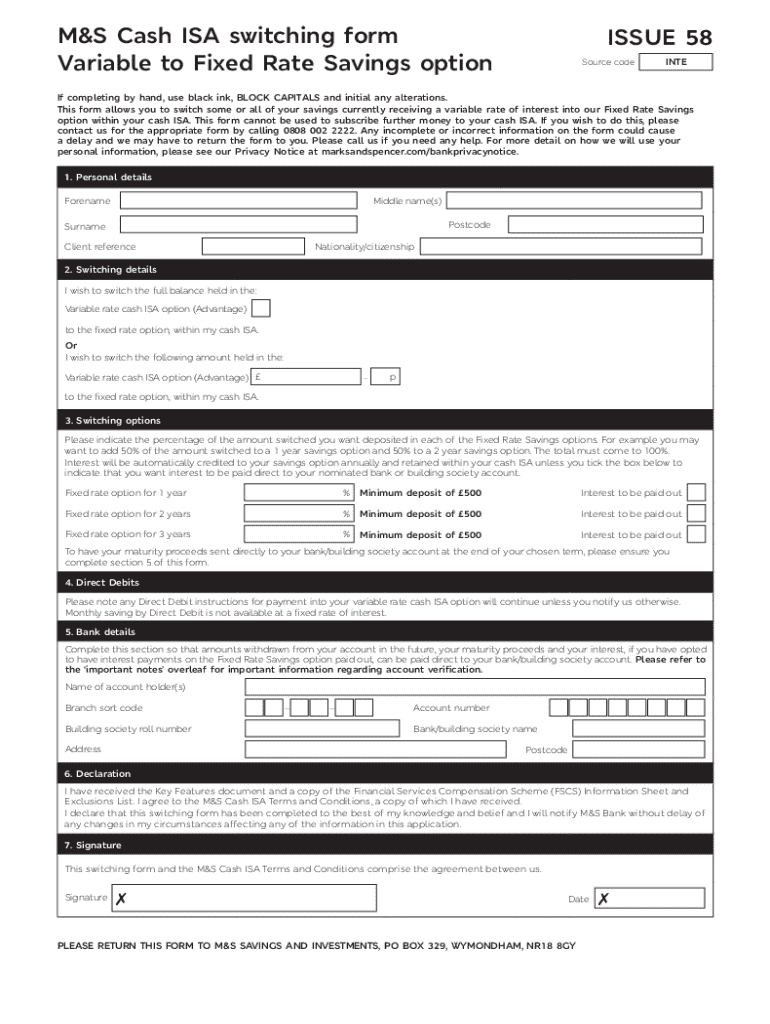

Steps to complete the MS Cash ISA Switching Form

Completing the MS Cash ISA Switching Form necessitates attention to several key sections. Start with your personal information, ensuring all details are accurate to avoid any confusion during processing. Next, provide your current ISA details, which ensure a smooth transfer of funds without disruption.

In the provider information section, clearly specify the new ISA provider you wish to move your savings to. Finally, the declaration and signatures section ensures you confirm that all the information provided is true to the best of your knowledge. A common error to avoid is overlooking any signature requirements, which could delay processing.

Submitting the MS Cash ISA Switching Form

Once you have filled out the MS Cash ISA Switching Form, submitting it is the next step. Depending on your new provider, you may have the option to submit the form online or via traditional mail. Online submission is often the most efficient method, allowing for quicker processing times, while mailing may require additional waiting time.

After submission, you can generally expect to receive confirmation from your new provider within a few days, along with a timeline for how long the transfer process will take. Typically, transfers can take anywhere from a few days to a few weeks, depending on the providers involved and any potential holdups related to documentation or account verifications.

Managing your new Cash ISA

After successfully switching to your new Cash ISA, it's important to manage it effectively. Start by setting up online access to easily monitor your account. This will enable you to track interest accruals, access your funds, and adapt your savings strategy as needed. Most providers will have online platforms to assist users in managing their accounts efficiently.

Engage in regular reviews, ideally on an annual basis, to ensure your Cash ISA remains aligned with your financial goals. This includes checking interest rates and features that may affect your savings strategy. Staying informed can prevent you from falling into the trap of complacency with your savings.

Interactive tools and resources

pdfFiller offers a range of interactive tools for users handling the MS Cash ISA Switching Form. Their platform allows users to edit, eSign, and manage documents seamlessly. By utilizing pdfFiller’s online tools, you can easily create, save, and share your filled-out forms, all while staying compliant with document management requirements.

For those seeking additional documentation related to ISAs, pdfFiller’s template library contains useful resources. You can also utilize eSignature capabilities to make the process even smoother—ensuring your documents are signed and ready for submission right from your browser.

Frequently asked questions (FAQs)

As with any financial process, questions can arise regarding the MS Cash ISA Switching Form. Some of the most common queries include concerns about tax implications, waiting periods for transfers, and how to effectively compare interest rates between different providers. Understanding the nuances of the switching process can demystify it and lead to better financial decisions.

For example, many savers wonder if they will lose their tax-free allowance when switching. The fact is that if you follow the proper transfer procedures outlined above—including using the MS Cash ISA Switching Form—you will retain your tax benefits. Addressing these concerns can empower individuals to feel confident in their financial choices.

Additional considerations

While switching your Cash ISA can offer many benefits, there are instances where it may not be the wise choice. For example, if you're close to the end of a high-interest fixed-term ISA, the penalties for breaking the contract may outweigh potential gains from switching. Therefore, it’s important to assess your situation carefully.

Seeking professional financial advice can also clarify whether switching is the best course of action. Additionally, be aware of any upcoming regulatory changes that could impact Cash ISAs in the near future. Staying informed helps you make strategic decisions that align with your financial strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ms cash isa switching for eSignature?

How do I fill out ms cash isa switching using my mobile device?

How do I edit ms cash isa switching on an Android device?

What is ms cash isa switching?

Who is required to file ms cash isa switching?

How to fill out ms cash isa switching?

What is the purpose of ms cash isa switching?

What information must be reported on ms cash isa switching?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.