Get the free Arizona Form 140ez

Get, Create, Make and Sign arizona form 140ez

Editing arizona form 140ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 140ez

How to fill out arizona form 140ez

Who needs arizona form 140ez?

A Comprehensive Guide to Arizona Form 140EZ

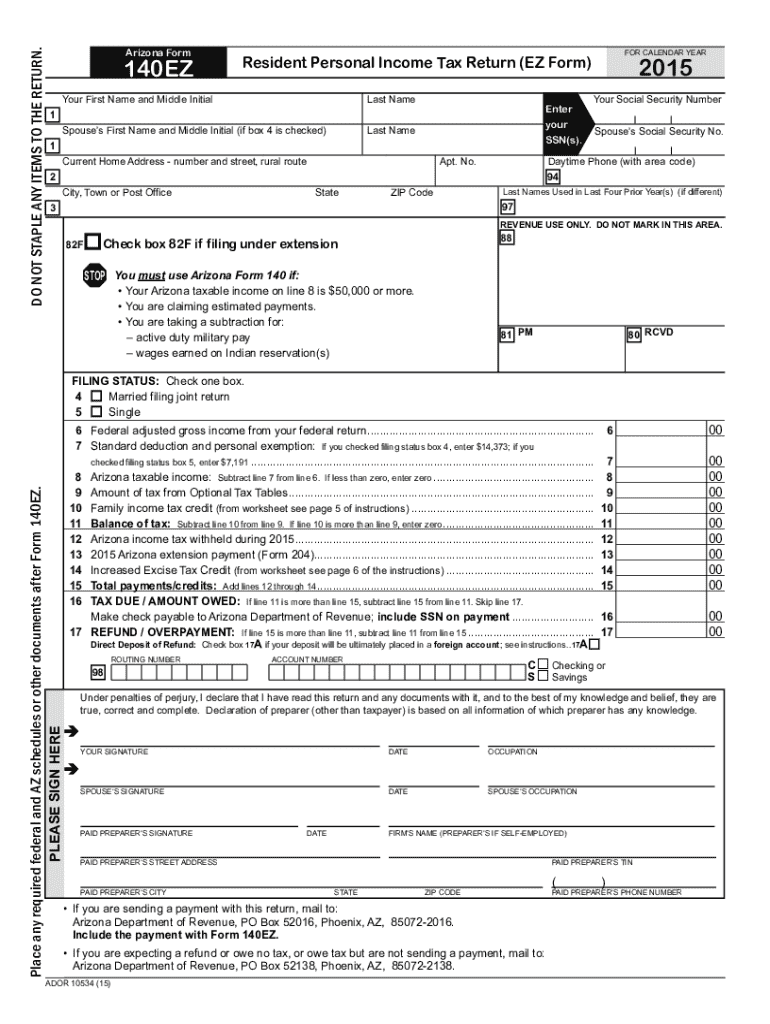

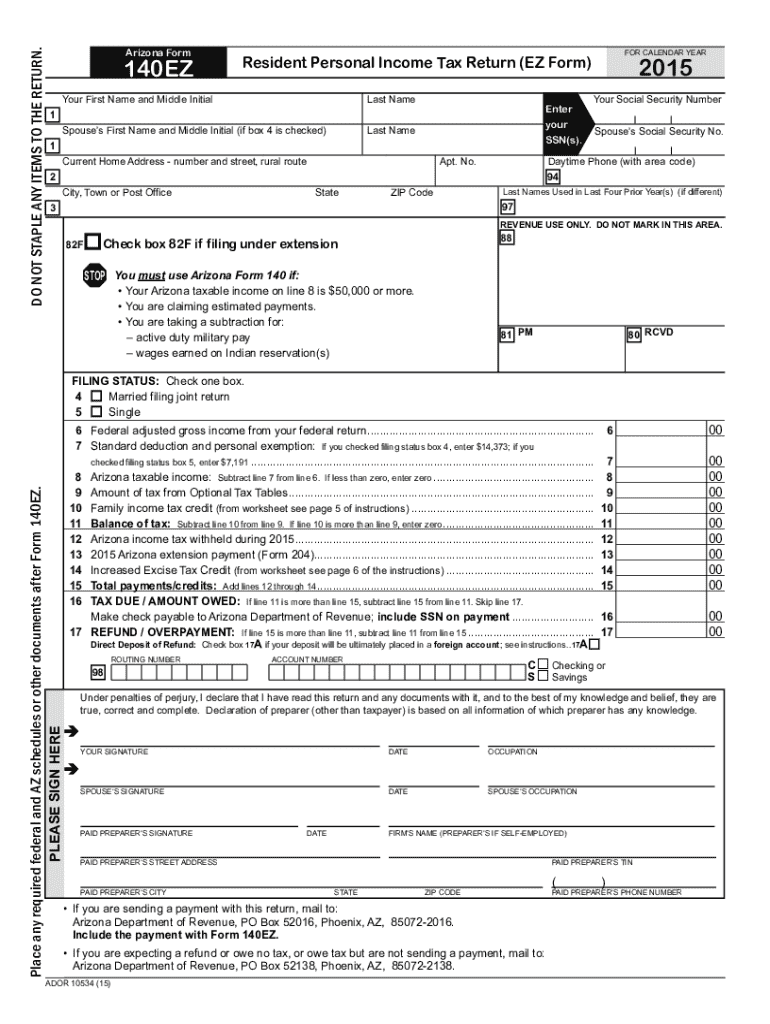

Overview of Arizona Form 140EZ

Arizona Form 140EZ is a streamlined personal income tax return designed specifically for eligible taxpayers in Arizona. This form simplifies the filing process, allowing residents who meet certain criteria to easily report their income and calculate their tax responsibilities. By using Form 140EZ, taxpayers can submit their returns with minimal complexity, thus saving time and reducing the risk of errors.

The primary purpose of Form 140EZ is to provide a straightforward alternative for individuals who have simpler tax situations. It is ideal for taxpayers with straightforward income sources, those who do not require itemized deductions, and those who seek a more efficient way to manage their tax return.

Eligible users include individuals filing as single or married filing jointly, residents with income from salaries, wages, pensions, and certain business earnings. This form is beneficial for anyone looking to reduce paperwork associated with more complex tax forms like Form 140 or 140A.

Eligibility criteria for using Form 140EZ

To qualify for Arizona Form 140EZ, you must meet specific income thresholds and other criteria. Generally, the eligible taxable income must not exceed $50,000 for single filers and $100,000 for married couples filing jointly. It’s crucial to review your income sources since not all income types are permissible for this form.

Filing status also plays an essential role. Only single and married filing jointly statuses can utilize Form 140EZ. If you have dependents, you may need to consider other forms that allow for their inclusion and associated tax credits.

Furthermore, residency requirements stipulate that you must be an Arizona resident for the entire tax year to use this form. Taxpayers over the age of 65 may have additional exemptions or considerations, but must still stay within the allowed income levels.

Key features of Arizona Form 140EZ

Form 140EZ stands out due to its simplified filing process. Unlike more complex forms, it limits the sections to key components, allowing taxpayer handwriting to be minimal, which translates to fewer chances for errors. Compared to Form 140 and Form 140A, this form is the preferred option for straightforward tax situations.

One major benefit of choosing Arizona Form 140EZ is the significantly reduced paperwork. You won’t be required to fill out extensive forms detailing deductions and credits typically found in other returns, making it faster to complete your filing. Alongside this, the processing times may also be quicker as fewer computational resources are necessary for simpler tax returns.

Step-by-step guide to completing Arizona Form 140EZ

Completing Arizona Form 140EZ begins with gathering the necessary documentation. You'll need your W-2s, 1099s, and any other documents reflecting your income. Collecting these documents early ensures a smoother filing process.

1. **Filling out personal information:** Enter your full name, current address, and Social Security Number accurately. This section is crucial as any inaccuracies here could delay processing.

2. **Reporting income:** Accurately report various income sources by referencing the documentation gathered. Ensure that each reported income type aligns with what the Arizona Department of Revenue expects.

3. **Calculating deductions and credits:** Although the 140EZ has limited deductions, you can report standard deductions. Make sure to review common deductions to see if you qualify.

4. **Reviewing and signing the form:** Meticulously go through your entries and sign the form, opting for electronic or manual signing based on your preferences.

Interactive tools to assist with Arizona Form 140EZ

Utilizing tools like pdfFiller can significantly streamline your experience with Arizona Form 140EZ. The interactive editor allows you to drag and drop elements, making it easier to complete and edit your form efficiently. This feature not only supports users in filling out forms but also in adjusting various sections quickly.

Additionally, built-in calculators are available to assist in estimating deductions and potential refunds. Using these calculators can help avoid common mistakes and ensure that you are claiming what you’re entitled to without overstating requests.

Common mistakes to avoid when filing Form 140EZ

Despite the simplified nature of Form 140EZ, several common errors can lead to issues for taxpayers. One frequent mistake is providing incorrect Social Security Numbers, which can cause significant delays in processing. Always ensure your information matches your documents.

Another area to watch out for includes failing to report all sources of income. Each source must be accounted for, or it may lead to complications. Lastly, adhere strictly to filing deadlines; late submissions can incur penalties or additional interest on any taxes owed.

FAQs about Arizona Form 140EZ

What happens if you need to amend a submitted Form 140EZ? You can file an amended return using Form 140X. It’s essential to rectify any errors before the IRS processes your tax return to avoid repercussions.

What if you exceed income limits after filing? In the event that your income exceeds the threshold post-filing, you should file the appropriate forms based on your new income assessment. Seek assistance from the Arizona Department of Revenue if you're unsure.

For assistance with filing inquiries, the Arizona Department of Revenue offers resources via their website and helplines for taxpayer issues. It's advisable to take advantage of these resources for clarity.

How to eSign and submit your Arizona Form 140EZ via pdfFiller

Submitting your Arizona Form 140EZ electronically is made effortless with pdfFiller. Once you've completed the form, navigate to the eSignature feature, and sign using a digital method that suits your preference.

After signing, you have the option to submit your form online or by traditional mail. For online submissions, pdfFiller provides instructions to ensure correct submission practices. You can also track the status of your submission directly through your user account menu.

Benefits of using pdfFiller for Arizona Form 140EZ

Utilizing pdfFiller for your Arizona Form 140EZ has several advantages. The platform provides secure cloud storage for your documents, allowing easy access from any device. This feature is particularly beneficial to individuals and teams that need to collaborate on their filing process.

Moreover, pdfFiller's customer support options ensure that users have access to help when encountering tax-related queries. The combination of convenient document management with reliable support streamlines the overall tax-filing experience.

Related Arizona tax resources

For additional information regarding Arizona taxes, visiting the Arizona Department of Revenue website is invaluable. This resource provides access to forms, detailed explanations about tax regulations, and insights on potential changes in tax laws.

Furthermore, reviewing federally related tax documentation can be useful for keeping your filings consistent between state and federal returns. Ensure you are internally aware of important tax deadlines and modifications regarding forms annually.

Privacy and security considerations

When using pdfFiller, privacy and security measures are paramount. The platform implements robust encryption methods to protect your personal information during the filing process. Understanding privacy policies and user rights is essential for ensuring your information remains confidential throughout your use.

Users should familiarize themselves with pdfFiller’s commitment to maintaining security, providing peace of mind as they manage their sensitive tax-related documents.

State-specific information and updates

Regularly staying updated with Arizona’s tax laws is crucial for taxpayers. The Arizona Department of Revenue frequently issues updates relevant to filing methods and forms. Engaging with newsletters or notifications from the department can help taxpayers remain informed.

Annual reviews of form guidelines and regulations are advisable to ensure compliance, especially for changes that may affect eligibility for simpler forms like Arizona Form 140EZ.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the arizona form 140ez in Gmail?

How can I edit arizona form 140ez on a smartphone?

Can I edit arizona form 140ez on an iOS device?

What is arizona form 140ez?

Who is required to file arizona form 140ez?

How to fill out arizona form 140ez?

What is the purpose of arizona form 140ez?

What information must be reported on arizona form 140ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.