Get the free Non Motor Takaful Claim Form

Get, Create, Make and Sign non motor takaful claim

Editing non motor takaful claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non motor takaful claim

How to fill out non motor takaful claim

Who needs non motor takaful claim?

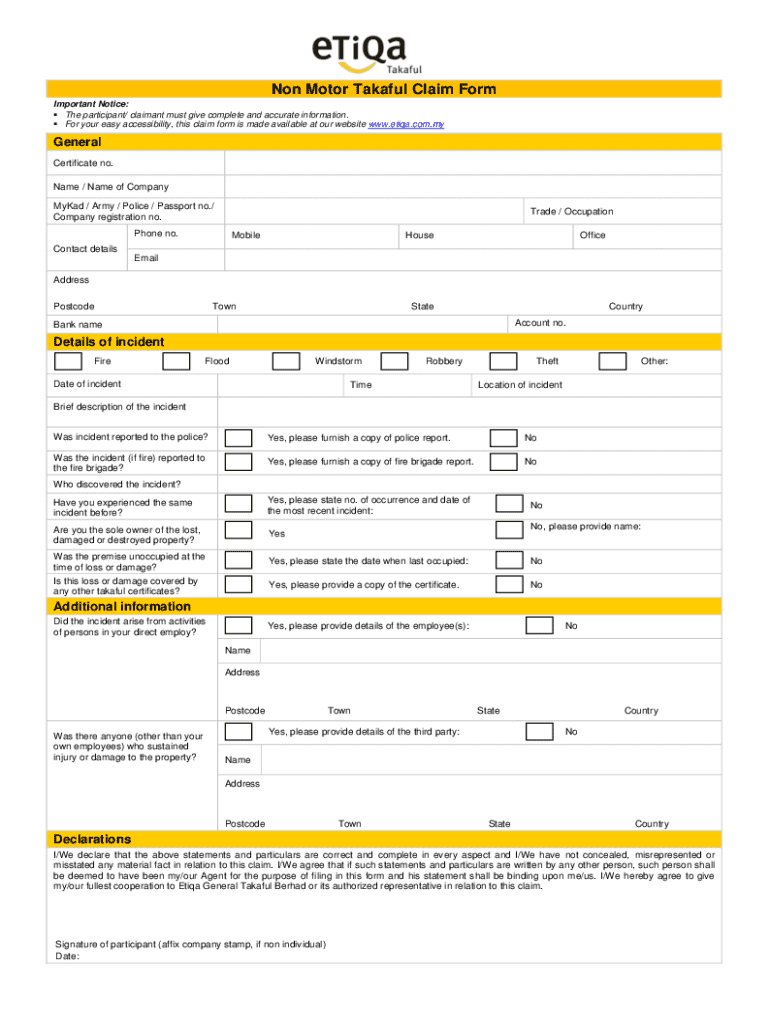

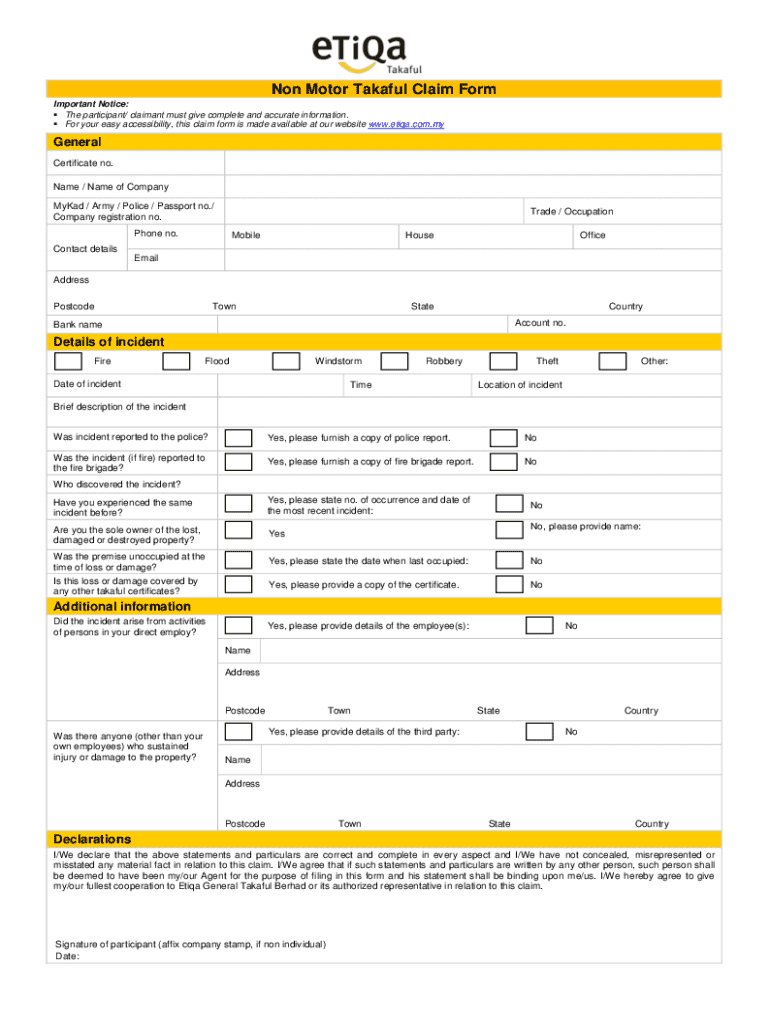

Your Complete Guide to the Non-Motor Takaful Claim Form

Understanding non-motor takaful insurance

Non-motor takaful insurance serves as a risk-sharing financial model distinct from traditional insurance. It covers various asset categories, such as health, travel, and property, enabling participants to contribute to a pool used to support members facing genuine claims. This cooperative principle fosters community support and trust among participants, as the risk is shared instead of transferred to a profit-driven insurer.

The benefits of non-motor takaful include ethical compliance with Islamic finance principles, where contributions are treated as donations (tabarru'). Issues like uncertainty (gharar) are avoided. Additionally, non-motor takaful can offer competitive coverage options tailored for individual needs, whether for health emergencies or property damages.

The non-motor takaful claim form is essential in streamlining the claims process, ensuring participants can access their rightful financial support following an incident. Completing this form accurately and comprehensively is crucial for a smooth claims experience.

Components of a non-motor takaful claim form

A comprehensive non-motor takaful claim form typically consists of several essential sections that gather vital information about the claimant and the incident. Fulfilling these components properly is key to facilitating the processing of your claim. Here's an overview of the critical areas to address:

Utilizing interactive tools available on platforms like pdfFiller can significantly enhance the form completion experience, allowing users to edit and sign forms electronically. This way, participants can ensure that all details are accurately captured without tedious manual input.

Step-by-step instructions for filling out the claim form

Before diving into the claim form, preparation is key. Gather all necessary documents, which may include your identification, relevant policy documentation, and incident reports. Taking the time to acquire these materials will streamline the process significantly.

Now, let’s explore how to complete each section of the claim form effectively:

Helpful platforms like pdfFiller provide editable features to customize the form, ensuring that your submission reflects your specific situation and enhances the clarity of your claim.

Common mistakes to avoid when submitting your claim

When submitting a non-motor takaful claim, it’s essential to avoid common pitfalls that can lead to delays or even denials. Here are some frequent errors and how to steer clear of them:

Maintaining attention to detail and accuracy is paramount. Always cross-check your submission multiple times, ensuring that every piece of information is correct. This diligence is vital to prevent claim delays and hassles.

Submitting your non-motor takaful claim

Once the non-motor takaful claim form is complete, you have several options for submission. Depending on your preference and the capabilities of your chosen takaful provider, you can opt for one of the following methods:

After submission, it’s essential to understand that claim processing times may vary. On average, processing can take from a few days to weeks, depending on the complexity of the claim. You can track your claim status using tools provided through pdfFiller, ensuring you stay informed throughout the process.

Managing your non-motor takaful claims effortlessly

Efficient document management is critical in handling non-motor takaful claims effectively. Platforms like pdfFiller offer robust features to streamline this process, allowing users to easily manage and store their documentation in one place.

Additionally, collaborative features enable teams to work on multiple claims simultaneously, ensuring transparency and efficiency. By utilizing reminders and follow-up notifications, users can stay organized, monitoring various claims with ease and ensuring nothing falls through the cracks.

Frequently asked questions (FAQs)

Navigating non-motor takaful claims can raise various questions. Here are some frequently asked questions that clarify the process:

Final thoughts on navigating non-motor takaful claims

Successfully navigating the non-motor takaful claims process hinges on meticulously filling out the claim form. Every detail matters, as it contributes to establishing the legitimacy of your claim. Leveraging tools like pdfFiller ensures not only correct form completion but also simplifies document management and collaboration.

From enhanced efficiency to thorough tracking, users are empowered to take control of their claims process, minimizing stress and maximizing the chances of a successful claim. It's this empowerment that enhances the user experience in managing their takaful policies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute non motor takaful claim online?

How do I fill out non motor takaful claim using my mobile device?

Can I edit non motor takaful claim on an Android device?

What is non motor takaful claim?

Who is required to file non motor takaful claim?

How to fill out non motor takaful claim?

What is the purpose of non motor takaful claim?

What information must be reported on non motor takaful claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.