Get the free pnb withdrawal slip philippines

Get, Create, Make and Sign philippine national bank withdrawal slip pdf form

Editing pnb withdrawal slip philippines online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pnb withdrawal slip philippines

How to fill out philippine national bank withdrawal

Who needs philippine national bank withdrawal?

Philippine National Bank Withdrawal Form: A Comprehensive Guide

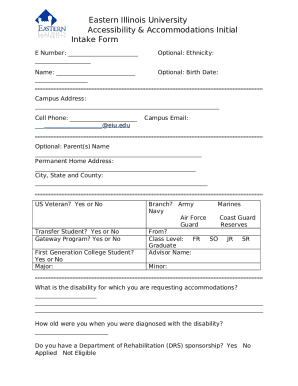

Understanding the Philippine National Bank withdrawal form

The Philippine National Bank withdrawal form is a crucial document for anyone managing their financial transactions. This form serves the purpose of officially requesting a cash withdrawal from an account, making it essential for account holders to be familiar with. Situations that may require the use of the withdrawal form include routine cash withdrawals, the closure of an account, or transferring funds from one account to another. Having a clear understanding of how to complete this form can alleviate common frustrations associated with banking.

Different types of accounts utilize this form, including savings accounts, checking accounts, and time deposits. Each account type may come with specific regulations and limits regarding withdrawals, underscoring the importance of accurately using the withdrawal form to meet compliance and operational standards.

Where to find the withdrawal form

Finding the Philippine National Bank withdrawal form is straightforward, with both online and offline options available. To access the form online, head over to the Philippine National Bank website, where you can easily navigate to the 'Forms' section. This enables you to download the withdrawal form in a PDF format, ensuring you have the latest version for your needs. Additionally, platforms like pdfFiller provide direct links to download or even fill out the form electronically, simplifying the process.

For those who prefer a physical copy, withdrawal forms are available at any Philippine National Bank branch. ATMs connected to the bank also typically have options for performing withdrawals without the need for the physical form, thus offering convenience to customers at all times.

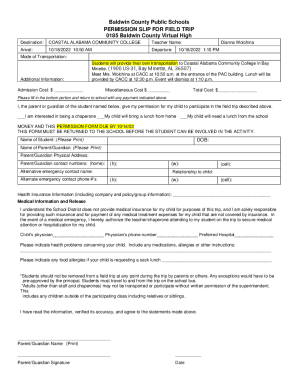

Step-by-step guide for filling out the withdrawal form

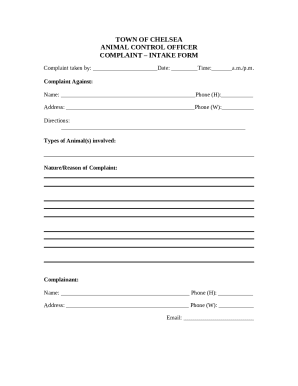

Completing the Philippine National Bank withdrawal form requires careful attention to detail. Ensure to include all required information, such as your personal identification details, the specific account number and type, and the exact amount to withdraw. A failure to provide all necessary information can lead to processing delays or rejection of your request, making this step essential.

Each section of the form must be completed accurately. Start with your personal identification, which often includes your name and contact information. Next, fill in the account details, specifying whether it’s a savings, checking, or time deposit account. Finally, indicate the amount you wish to withdraw, ensuring it adheres to your account's withdrawal limits. Sign and date the form at the bottom to authenticate your request.

Common mistakes to avoid include leaving any fields blank or using incorrect signatures. Double-check your details before submitting to prevent unnecessary complications.

Editing and customizing the form

Editing the Philippine National Bank withdrawal form has never been easier with pdfFiller. This platform allows users to upload the form for seamless editing, enabling you to fill out the necessary fields without printing the document. Additionally, users can add digital signatures directly on the form, streamlining the approval process.

The benefits of editing through pdfFiller include the ability to correct mistakes as you go along, saving both time and energy. Customizing frequently used forms, such as the withdrawal request, can save valuable time for potential future use. By ensuring adherence to compliance measures beforehand, you can prevent back-and-forth rejections and secure timely processes.

Signing the withdrawal form

Signatures play a pivotal role in the legitimacy of the Philippine National Bank withdrawal form. They act as a form of authentication, indicating that the information provided is accurate and that you consent to the transaction. This is crucial, especially in the context of huge sums that might be involved in business or personal withdrawals.

When it comes to signing, you have the option of physical or electronic methods. In light of rapid digital transformation, electronic signatures are increasingly popular. Users can eSign documents using the pdfFiller platform, which provides robust security features that ensure the integrity of the signatures. It's important to note that electronic signatures hold legal validity under Philippine law, providing users peace of mind during the withdrawal process.

Submitting the withdrawal form

Submitting your properly filled Philippine National Bank withdrawal form can be achieved through multiple channels. The most straightforward method is by visiting a bank branch personally and handing the form directly to a bank teller. Alternatively, for those who prefer submitting electronically, you might have the option to email your form or submit directly via the bank's online portal, taking care to ensure the document is sent securely.

After submission, processing times can vary depending on the nature of your request and the volume of transactions the bank is handling. Generally, withdrawals made in-person are processed the same day, while electronic submissions may take a bit longer. It is advisable to keep a record of your submission, including any reference numbers, to track the status of your request effectively.

Managing withdrawals efficiently

To manage your withdrawals efficiently, consider setting up regular scheduled withdrawals through your banking app. This allows you to automate the process, reducing the chances of forgetting important transactions. Most banking applications, including those offered by Philippine National Bank, feature user-friendly design and notifications, enabling clients to monitor their accounts in real time.

Using collaborative tools through pdfFiller can further enhance this process. Sharing withdrawal documents with team members streamlines the approval process, allowing all relevant parties to stay informed. Keeping templates or drafts of commonly used forms can expedite future requests without needing to start from scratch every time.

Frequently asked questions (FAQs)

As with any banking procedures, account holders often have questions regarding the Philippine National Bank withdrawal form and its use. A common concern is what to do if you lose your withdrawal form. In such cases, it is advisable to contact customer support immediately to reissue necessary documents.

Another frequent query revolves around modifying a form after submission. Modifications are typically not allowed once the document has been handed in, making it crucial to double-check your information beforehand. If a withdrawal is denied, it is essential to understand the reasons and rectify any issues for future requests. Lastly, you'll find that most withdrawals do not come with fees; however, it's always good to verify specifics relevant to your account type.

Customer support for additional assistance

If further assistance is needed regarding the Philippine National Bank withdrawal form, the bank’s customer support is readily available. Customers can reach out to dedicated care numbers or visit local branches for in-person support. The staff is trained to handle inquiries regarding documents and transactions, ensuring that you receive tailored assistance.

In addition to bank support, pdfFiller also offers various support options. Users can access online help, guides, and troubleshooting, making the process of managing their documents seamless. Having these resources at hand ensures that both document preparation and submission remain efficient, addressing any uncertainties that may arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pnb withdrawal slip philippines?

How can I fill out pnb withdrawal slip philippines on an iOS device?

How do I edit pnb withdrawal slip philippines on an Android device?

What is philippine national bank withdrawal?

Who is required to file philippine national bank withdrawal?

How to fill out philippine national bank withdrawal?

What is the purpose of philippine national bank withdrawal?

What information must be reported on philippine national bank withdrawal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.