Get the free Cornerstone Pensioner Plan

Get, Create, Make and Sign cornerstone pensioner plan

Editing cornerstone pensioner plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cornerstone pensioner plan

How to fill out cornerstone pensioner plan

Who needs cornerstone pensioner plan?

A comprehensive guide to the Cornerstone Pensioner Plan form

Understanding the Cornerstone Pensioner Plan

The Cornerstone Pensioner Plan is a structured program designed to provide financial security to retirees. This plan ensures that pensioners receive a consistent income throughout their retirement years, catering to their essential needs. It serves as a vital tool in managing post-retirement finances, making it indispensable for members who have contributed towards a pension scheme during their working life.

Opting for the Cornerstone Pensioner Plan not only promises a steady income but also provides various benefits that enhance the overall retirement experience. For instance, members can designate beneficiaries for their benefits, providing peace of mind regarding how their funds are allocated, especially in unfortunate circumstances.

Benefits of the Cornerstone Pensioner Plan

The primary advantage of the Cornerstone Pensioner Plan lies in its ability to provide consistent financial support. This is essential, considering that many retirees find themselves relying solely on their pension for daily expenses. Furthermore, certain features are tailored to help retired individuals with their specific needs, including provisions for additional assistance in case of medical emergencies or sudden financial challenges.

Beyond just financial support, the plan often includes access to tailored resources aimed at helping retirees manage their funds effectively, thereby allowing for a better quality of life. This support typically comes in various forms, such as financial planning advice, health benefits, and community resources designed to assist retirees.

Eligibility criteria for the Cornerstone Pensioner Plan

To enroll in the Cornerstone Pensioner Plan, individuals typically need to meet specific eligibility criteria. Most often, this involves having contributed to a recognized pension fund for a set amount of time before retirement. It’s essential to review these criteria closely to avoid any potential issues during the application process.

Moreover, some plans might require proof of retirement age or full disclosure of financial details to ascertain the level of benefits applicable to each member. As each pension fund can differ, reviewing detailed requirements with the relevant authorities or through the provided documentation becomes critical.

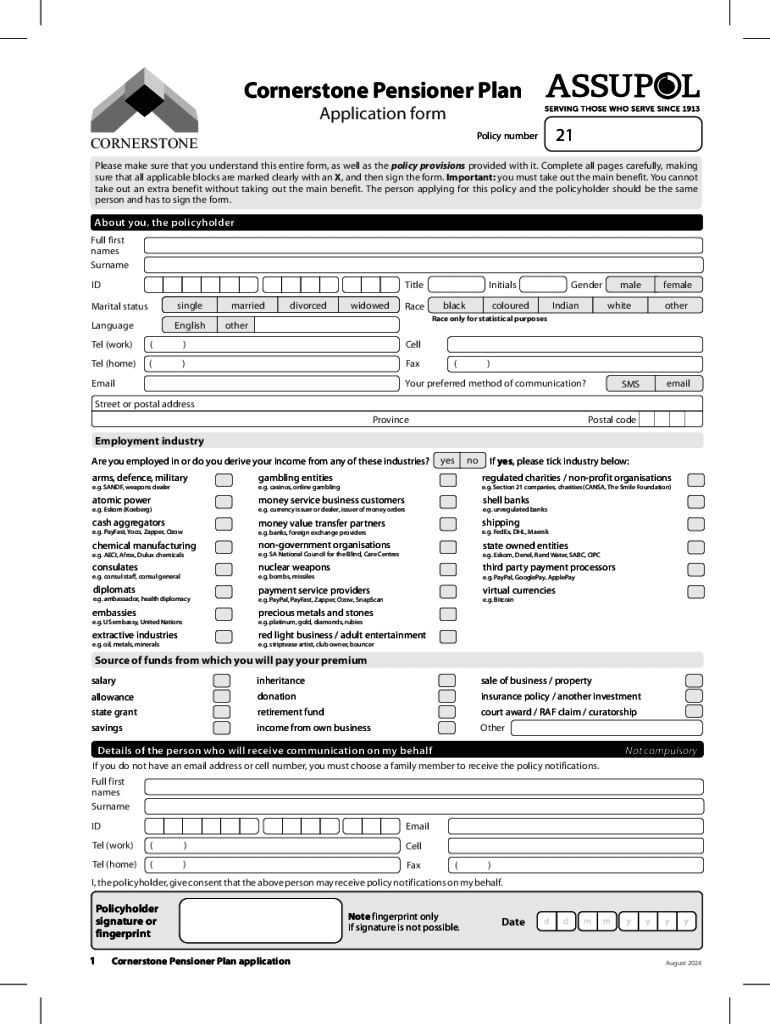

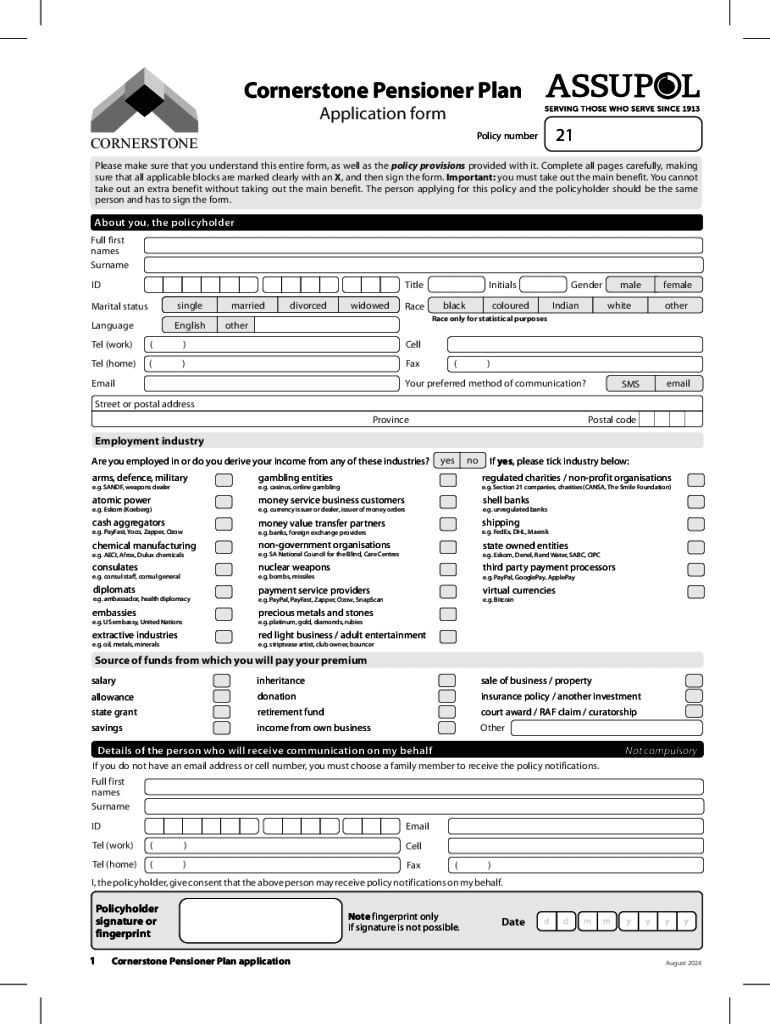

The importance of accurate documentation

When dealing with the Cornerstone Pensioner Plan form, the accuracy of documentation cannot be overemphasized. Proper completion of this form plays a pivotal role in ensuring seamless processing of applications and subsequent benefit disbursements. An incomplete or improperly filled form could lead to delays, complications, or even disqualification from the plan's benefits.

Every detail matters, whether it be the spelling of names, dates of birth, or financial details. Common issues can arise from miscommunication or misunderstanding of what is required. Therefore, a systematic approach to form completion is advisable.

Utilizing tools such as pdfFiller can significantly enhance accuracy and compliance. With its user-friendly interface and features designed for electronic form completion, it minimizes human error and optimizes the documentation process, paving the way for successful applications.

Why proper form completion matters

Correctly completing the Cornerstone Pensioner Plan form not only ensures adherence to the application process but also establishes a clear record of your information for future reference. This clarity helps trustees manage the plan effectively over time and ensures that funds are disbursed according to your stipulations.

Additionally, poorly filled forms can lead to disputes or unintended consequences, particularly in cases involving beneficiary nominations or financial details. Accuracy and precision are essential to guarantee that your intentions for your loved ones—which can include spouses, children, or other family members—are honored.

Common mistakes to avoid when filling out forms

While you may feel confident about your ability to fill out the Cornerstone Pensioner Plan form, it’s crucial to recognize some of the common pitfalls that could lead to complications. Many applicants inadvertently miss entire sections or fail to provide the required proof of identity and financial status. It’s also common to confuse details—like personal dates or beneficiary information—which can lead to longer processing times.

Another frequent oversight involves leaving out signatures or the date on your form, which may appear trivial but can stall the necessary processing. A good practice is to review each section after completion and have someone else double-check your form for additional assurance of accuracy.

Accessing the Cornerstone Pensioner Plan form

Accessing the Cornerstone Pensioner Plan form is straightforward with pdfFiller. Its intuitive navigation ensures that users can find the template quickly and efficiently. The platform is designed for users of all computer literacy levels, allowing individuals and teams to manage their documents without the need for extensive training.

Once on the pdfFiller platform, you can utilize the search functionality to locate specific documents, such as the Cornerstone Pensioner Plan form, directly. Furthermore, the platform offers a secure environment, ensuring that your personal information and pension details remain confidential.

Navigating the pdfFiller platform

The pdfFiller platform's structured layout guides users through each step seamlessly. Beginning from the dashboard, users can easily access all their documents and manage them efficiently. For those unfamiliar with digital document management, pdfFiller offers an array of tutorials and support options tailored to enhance the user experience.

Not only is the interface user-friendly, but it also integrates various tools that allow users to edit, e-sign, and collaborate on documents in a cloud-based environment. This feature is critical as it allows instant updates and access, enabling individuals to manage their forms from anywhere securely.

Finding the Cornerstone Pensioner Plan form template

To find the Cornerstone Pensioner Plan form template on pdfFiller, begin by accessing the platform's template section. A quick search using relevant keywords such as 'pension' or 'Cornerstone' will yield the necessary templates. Users can also filter results based on document type or category, which helps narrow down their options effectively.

Each template is designed to be customizable and user-friendly. You can fill in information directly into the form, saving time and resources while ensuring factual accuracy. Users have the ability to save often-used forms as favorites for easier future access.

Ensuring secure access to your form

Security is a top concern for everyone dealing with sensitive documents, particularly those related to personal finance. With pdfFiller, users can feel confident that their information is protected through advanced encryption and security measures. The system ensures that only authorized users have access to specific documents.

Moreover, pdfFiller allows users to create a secure authentication process, ensuring that the integrity of their documents is never compromised. This attention to security means users can focus on completing their forms without unnecessary worry.

Step-by-step guide to filling out the Cornerstone Pensioner Plan form

Filling out the Cornerstone Pensioner Plan form involves several critical steps. By following a systematic approach, members can ensure they complete their forms accurately and efficiently. The first step begins with gathering all necessary information that you may need as you fill out the form.

Essential information required

1. Personal Information: This section will require your full name, date of birth, Social Security number, and identification details. Ensure these match your official documents to avoid discrepancies.

2. Financial Details: Here, you will need to provide information regarding your employment history and, if applicable, the names of previous employers. You may also need to include any additional financial details that could affect your pension.

3. Contact Preferences: Specify your preferred method of contact, whether through email, phone, or postal service, so that communication remains clear and accessible.

Instructions for each section

Section 1: Personal Details: In this section, ensure that all personal details such as your current address, phone number, and email are accurately entered. Missing information can lead to delays in processing your form.

Section 2: Employment History: List your most recent jobs along with relevant employment dates. This is essential for assessing your pension eligibility and any supplementary benefits you may qualify for, given your unique work history.

Having this information consolidated beforehand can streamline the process and lessen the chances of missing any critical data.

Tips for accuracy and clarity

It’s advisable to approach the form with care. Write clearly and legibly when filling out information by hand, utilizing the available editing tools on pdfFiller effectively if you are completing digitally. Ensure all terms, especially financial figures and dates, are accurate to prevent any misunderstandings.

Taking a moment after completing each section to review your work can help catch any mistakes early. Remember, accuracy is vital, especially when dealing with elements that dictate where your money will go and how your loved ones will be cared for after your death.

Editing the Cornerstone Pensioner Plan form

Editing the Cornerstone Pensioner Plan form can be remarkably efficient with the pdfFiller tools at your disposal. Whether you need to correct errors or make updates after filling out the form, the platform allows for flexible editing options to cater to users’ needs. Changes can be made seamlessly, allowing for real-time adjustments without the risk of overwriting or damaging original documents.

Users can add comments or notes directly on the form, which is particularly useful for clarifying reasons for changes, or for drawing attention to details that might warrant discussion with trustees later. This function is especially handy for collaborative efforts, ensuring all stakeholders are on the same page.

Utilizing pdfFiller tools for form editing

pdfFiller provides a comprehensive suite of editing tools tailored to enhance document management. Users can easily add or remove information, insert new sections, or even highlight critical parts of their forms. This versatility empowers individuals and teams to maintain organized, accurate records that reflect their current circumstances.

Accessing these editing features is as simple as clicking on the desired area of the form and making the necessary amendments. The intuitive design minimizes the learning curve, allowing users to become proficient quickly.

How to add or remove information

Adding information to the Cornerstone Pensioner Plan form is user-friendly on pdfFiller. You can click on the editable section and insert text directly. If you find that you’ve added incorrect or unnecessary details, simply delete the text, and the system will automatically adjust for the change.

For users who need to shift entire sections or rearrange content for clarity, pdfFiller enables drag-and-drop functionality, making it possible to keep documentation organized and presenting data logically.

Incorporating comments or notes

Incorporating notes can be beneficial for ensuring clarity on specific items that may require further explanation. With pdfFiller, users can add text boxes for comments next to relevant sections. This helps clarify the purpose of each detail included in the Cornerstone Pensioner Plan form.

Comments can also serve as reminders for things like proof of documents required for submission and other instructions for beneficiaries or involved parties.

E-signing the Cornerstone Pensioner Plan form

E-signatures have changed the way individuals manage their documentation and hold legal weight comparable to traditional signatures. With the Cornerstone Pensioner Plan form, utilizing e-signatures through pdfFiller simplifies the process for all parties involved, making document submission faster and hassle-free.

The steps to e-signing the form via pdfFiller are straightforward: after completing your form, navigate to the e-signature option and select it. The platform will guide you through the process of creating your electronic signature, which can then be applied directly onto the form.

Legal validity of e-signatures in pension documents

E-signatures are legally recognized in most jurisdictions across the world, including for pension documentation. Such validity is acknowledged in laws like the Uniform Electronic Transactions Act in the U.S., ensuring that e-signatures hold the same weight as traditional handwriting.

This legal backing gives users confidence in their e-signatures’ acceptance, ensuring their plans for beneficiaries are processed accurately and respecting their wishes. Furthermore, e-signatures are a great way to expedite the documentation process, greatly enhancing overall efficiency.

Collaborating on the Cornerstone Pensioner Plan form

Collaboration among team members when filling out the Cornerstone Pensioner Plan form can significantly augment its accuracy and completeness. With pdfFiller, you can invite team members to review and contribute to the form, thus ensuring that all necessary viewpoints are considered before submission.

Real-time document-sharing enables multiple users to work together, whether for joint application submissions or comprehensive checks on the accuracy of details. This feature is especially crucial when discussing options for family benefits or nominations, as it ensures that everyone's voice is reflected.

Inviting team members to collaborate

To invite team members to collaborative efforts on the form, simply click the share option available on the pdfFiller platform. You can write personalized messages to inform them of the task, ensuring that they understand the role they will play. This engagement tends to heighten accountability and can facilitate open discussions regarding benefit distribution and financial planning.

Furthermore, involving trusted colleagues or family members can give additional insights that you might overlook, especially when considering nominations of beneficiaries or documenting information accurately.

Best practices for effective collaboration

For collaboration to be successful, establishing clear roles and responsibilities is essential. Some individuals should focus solely on specific sections of the form, while others can handle overlapping areas, ensuring that all bases are covered. Furthermore, regular updates among the team can lead to enhanced clarity on what requirements have been completed and what remains pending.

Employing a systematic approach ensures that no detail is overlooked and all necessary conversations occur in the planning process, such as identifying the right appropriate measures for funeral benefits or planning for potential future expenses once members transition into retirement.

Submitting the Cornerstone Pensioner Plan form

After ensuring that the Cornerstone Pensioner Plan form is filled out accurately and all necessary sections are completed, the submission process can commence. With pdfFiller, submitting your documents is efficient and straightforward.

Simply review the form one last time to catch any potential errors before sending it off. Submissions can often be made directly through the pdfFiller platform, allowing users to send forms via email or print them out for traditional mail. Different options cater to varying user preferences.

Tracking your submission status

To track your submission status with the Cornerstone Pensioner Plan, utilize the built-in tracking features available on pdfFiller. Users can see when their forms have been opened and processed, providing transparency during the waiting period.

This feature ensures users remain updated and informed regarding the status of their application, aiding in peace of mind as pension documents are reviewed. Checking these updates can also help you identify if any changes need to be made during later processing phases.

What to expect after submission

Following submission of your Cornerstone Pensioner Plan form, members can expect confirmation of receipt from the relevant authorities. Depending on the processing duration, your plan may take several weeks to review, but updates will typically be communicated through your preferred contact method.

Additionally, members should be open to any follow-up queries or verification requests from the pension trustees. Being prepared with the required documentation can expedite this process should any clarifications be needed.

Managing your Cornerstone Pensioner Plan documents

Managing documents related to the Cornerstone Pensioner Plan is crucial for ongoing financial security. Using pdfFiller, members can organize and store their important pension documents efficiently. The ability to categorize forms and documents into specific folders ensures easy retrieval whenever needed.

Accessing your form history, including previous versions of documents, allows users to see changes over time. This capability ensures clarity and keeps track of how financial arrangements evolve, making it easier to manage future updates or adjustments.

Organizing and storing your documents with pdfFiller

Using pdfFiller's organizational features, members can label their documents according to date, category, or urgency. Such a system not only saves time but significantly reduces the risk of losing critically important paperwork related to financial planning and benefits.

Additionally, the platform provides options for document sharing and collaboration, enabling other stakeholders, such as family members or trusted advisors, to access necessary documentation when required.

Accessing your form history and versions

Reviewing form history is an essential aspect of managing your pension documents. pdfFiller makes accessing previous versions of your documents easy, allowing users to compare updates or revert to prior editions if needed.

This capacity to track changes means that in situations where discrepancies arise, referring to earlier versions offers clarity in understanding the intentions of previous documents, particularly with regards to claims or distributions.

Tips for secure document management

To ensure secure document management, always use strong passwords and enable two-factor authentication on your pdfFiller account. Regularly back up your important files and remain vigilant for any anomalies in your account activity.

For users handling sensitive financial documentation, maintaining a rigorous organizational system is essential. This ensures that all relevant documents are readily available and easy to manage, directly impacting your efficiency in responding to future requirements.

Frequently asked questions (FAQs)

Among the common queries surrounding the Cornerstone Pensioner Plan are concerns about eligibility, types of documents required during submission, and procedure timelines. Addressing these FAQs can provide clarity for potential members as they move forward in the application process.

Members often seek to understand how to navigate changes in their financial status and how that might affect their entitlements under the pension plan. Detailed answers from trusted sources ensure members are well-informed and prepared for their future.

Common queries about the Cornerstone Pensioner Plan

FAQs generally include inquiries about what to do if there are changes in beneficiaries or if a loved one passes away. Members want to know the procedures to follow in these sensitive instances, ensuring that they are following best practices to ensure the intended distribution of funds.

Other queries can focus on how often benefits are paid out and how beneficiaries can access funds upon the member's passing. Clarity on these points not only elevates member knowledge but also ensures efficient management of benefits.

Troubleshooting issues with the form

To navigate troubleshooting, individuals might encounter issues such as trouble accessing the pdfFiller site or problems when filling out the form. Having clear guidelines or a dedicated support function can assist users in overcoming these barriers effectively.

Furthermore, the platform provides customer support, enabling users to reach out for assistance with technical issues or if clarification is needed on form-related questions.

Contact information for further assistance

For further assistance regarding the Cornerstone Pensioner Plan form, members can visit the pdfFiller support page. Here, a range of helpful resources, including video tutorials and FAQs, are available to guide users through any difficulties they may face during the process.

Additionally, members can directly contact the support team for personalized assistance when needed, ensuring that their concerns are addressed efficiently.

The value of choosing pdfFiller

Choosing pdfFiller as your document management solution for the Cornerstone Pensioner Plan form empowers users to experience a wealth of benefits designed for modern document processing. Its cloud-based features ensure that users can create, edit, and share documents seamlessly, no matter where they are located.

Moreover, pdfFiller’s user-oriented approach limits the barriers for access and ensures individuals can manage their forms without needing extensive technical knowledge.

Advantages of using pdfFiller for document management

Some advantages of using pdfFiller include:

Overall, utilizing pdFFiller allows users to engage with their documents dynamically, keeping everything organized and accessible, which is especially valuable when managing crucial pension documents.

Testimonials from satisfied users

Feedback from users of pdfFiller consistently emphasizes how the platform has simplified their document management processes. Many report feeling more organized and confident about managing their financial documentation, including pension-related forms.

Such testimonials reflect how crucial pdfFiller has been in allowing individuals to secure their retirement plans and effectively manage related documentation during challenging times.

Comparing pdfFiller with competitors

When comparing pdfFiller with competitors, it’s evident that pdfFiller stands out due to its expansive capabilities. Features such as e-signatures, collaborative tools, and mobile platform access create a unique value proposition.

This comprehensive suite of services enhances the document experience, making pdfFiller a preferred choice for individuals and teams managing the Cornerstone Pensioner Plan form and similar documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cornerstone pensioner plan without leaving Google Drive?

Where do I find cornerstone pensioner plan?

How do I make edits in cornerstone pensioner plan without leaving Chrome?

What is cornerstone pensioner plan?

Who is required to file cornerstone pensioner plan?

How to fill out cornerstone pensioner plan?

What is the purpose of cornerstone pensioner plan?

What information must be reported on cornerstone pensioner plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.