Get the free New Retail Bank Guarantee (bg) Application Form

Get, Create, Make and Sign new retail bank guarantee

How to edit new retail bank guarantee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new retail bank guarantee

How to fill out new retail bank guarantee

Who needs new retail bank guarantee?

New Retail Bank Guarantee Form: A How-to Guide

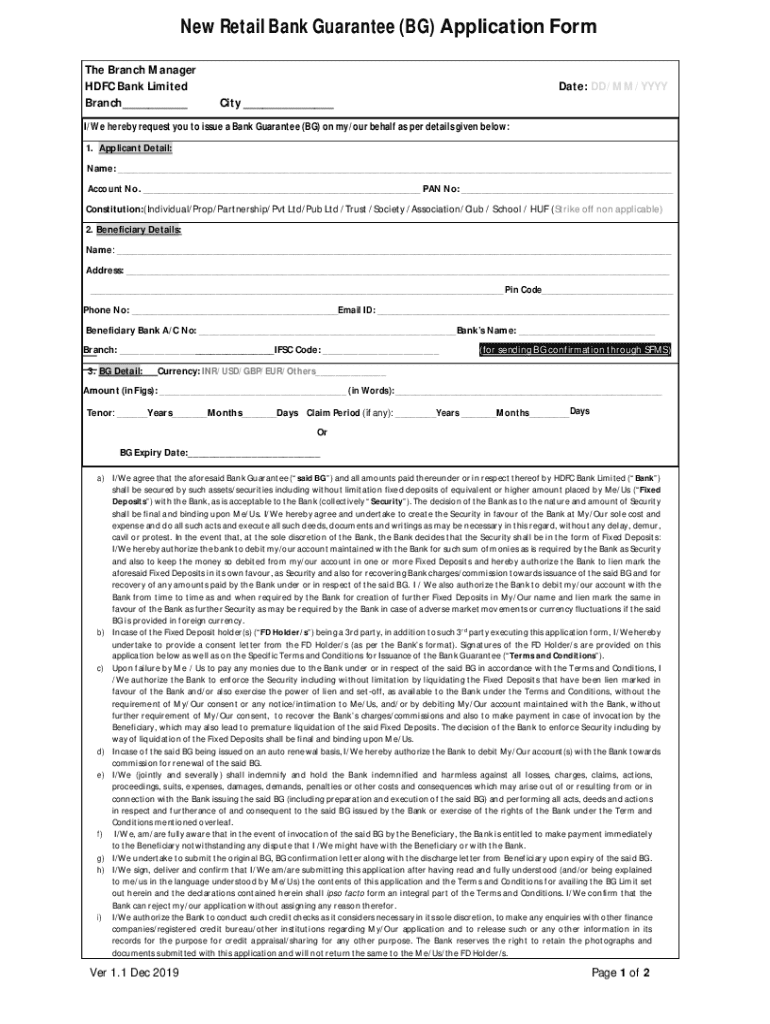

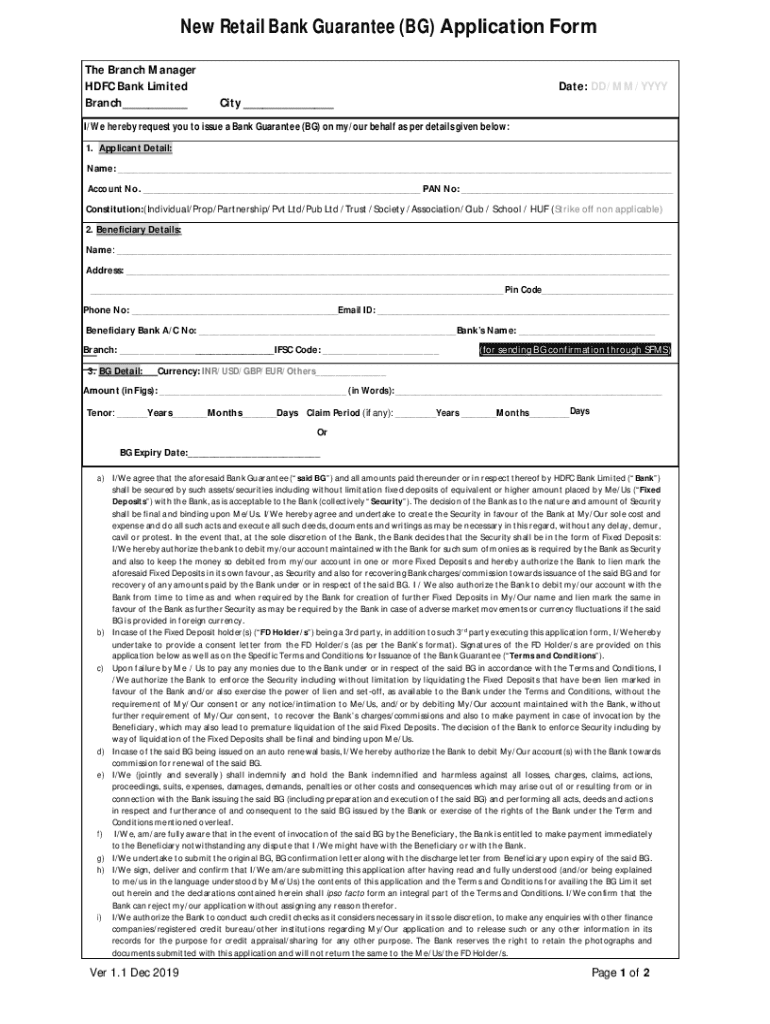

Understanding the new retail bank guarantee form

A bank guarantee is a promise made by a bank or financial institution to fulfill a debtor's financial obligation in the event that they default. It serves as a security mechanism ensuring that the beneficiary is compensated if the obligor fails to meet their contractual terms. The new retail bank guarantee form is crucial in facilitating this process, providing a structured way for individuals and businesses to secure financial transactions confidently.

The importance of the retail bank guarantee form lies in its standardization, which leads to clarity in financial agreements. It mitigates risks for both parties, especially in industries where large sums of money are at stake, such as construction, leasing, and trade.

Key terminology

Key terms associated with bank guarantees are essential for understanding the mechanics at play. The 'obligor' is the party whose obligation is guaranteed, while the 'beneficiary' is the entity that will receive compensation in the event of non-performance. The 'guarantor' is the bank or financial institution providing the guarantee.

Who needs a retail bank guarantee?

The target audience for retail bank guarantees includes both individuals and businesses. For individuals, bank guarantees can be a necessary component when applying for personal loans or securing rental agreements. For businesses, they are often essential for performance guarantees in contracts, ensuring that project milestones are met, and financial commitments are honored.

Using a retail bank guarantee can significantly enhance trust between parties in a financial transaction. It provides a layer of security for contractual obligations, essentially assuring the beneficiary that they will be compensated should the obligor fail to fulfill their obligations. This assurance can improve business relations and facilitate smoother transactions.

Steps for acquiring a new retail bank guarantee

The first step in acquiring a new retail bank guarantee is an initial assessment. Understanding your specific needs, whether it's for a loan, a lease, or contractual obligation, helps define the type and amount of guarantee needed. This critical assessment informs subsequent decisions, ensuring that you approach the right financial institution with an adequate proposal.

Choosing the right financial institution involves several factors. Consider the bank's reliability, reputation, fees, and the specific services they offer. Different banks may have varying policies, so it’s essential to compare your options thoroughly. You might find it beneficial to consult with a mortgage advisor or find resources online that summarize bank capabilities.

Filling out the new retail bank guarantee form

Filling out the new retail bank guarantee form correctly is crucial. Each section of the form will require specific information related to the obligor, beneficiary, and the guarantor. Start by reading through the entire form to understand what information is required. This step will help you avoid common pitfalls such as incomplete sections or incorrect information.

To ease the completion process, utilizing interactive tools like pdfFiller can be incredibly helpful. Built-in features allow users to fill the form digitally and provide tips on what to consider as you progress through each section.

Submitting the form

Once you’ve filled out the new retail bank guarantee form, you’ll need to submit it through the appropriate channels. Most banks offer online submission, making it easier and faster than mailing in physical documents or visiting a branch in person. However, check with your selected bank to confirm their preferred method and any specific requirements they may have for submission.

After submitting your application, it’s essential to understand the typical processing timelines. These can vary widely, so follow up if you haven’t received confirmation within the expected timeframe. Keeping communication open with the bank can streamline the process.

Managing your bank guarantee

Upon receiving your new retail bank guarantee, understanding the terms and conditions is essential. This encompasses the length of the guarantee, any fees involved, and the circumstances under which the guarantee can be invoked. Familiarity with these details prepares you for any necessary actions in the future.

If you need to modify the guarantee, knowing when and how to make those requests can save you potential headaches. Similarly, it’s crucial to be proactive as the expiration of your guarantee approaches, as you might need to either renew the guarantee or seek other arrangements.

Common scenarios and FAQs

Handling disputes related to bank guarantees can be challenging. It's crucial to keep all documentation related to your guarantee accessible. In case of a dispute, gathering evidence and maintaining communication with your bank and the involved parties can facilitate resolution.

Commonly asked questions often pertain to specific scenarios, such as what to do if your guarantee is called upon or issues with payment. Understanding the processes involved can make for a smoother experience.

Utilizing pdfFiller for document management

pdfFiller provides a comprehensive document management solution that allows users to seamlessly manage their bank guarantees online. The platform is designed for easy access and collaboration, making it a powerful resource for individuals and teams seeking efficiency in document creation and management.

To streamline your document handling, consider leveraging pdfFiller’s features. The platform supports editing, e-signing, and sharing documents in a cloud-based environment, which enhances collaboration and reduces administrative burdens.

Real-life application examples

Consider case studies highlighting the pivotal role that retail bank guarantees play in real-world scenarios. For instance, a construction company may require a bank guarantee to secure a government contract. The guarantee assured the client of project completion and adherence to safety standards, ultimately fostering trust and business continuity.

User testimonials can also provide insights into the utility and effectiveness of the retail bank guarantee form. Those who have navigated the process through pdfFiller often report a smoother experience overall, particularly due to the platform’s user-friendly features and its ability to simplify complex document workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new retail bank guarantee without leaving Google Drive?

Can I edit new retail bank guarantee on an Android device?

How do I complete new retail bank guarantee on an Android device?

What is new retail bank guarantee?

Who is required to file new retail bank guarantee?

How to fill out new retail bank guarantee?

What is the purpose of new retail bank guarantee?

What information must be reported on new retail bank guarantee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.