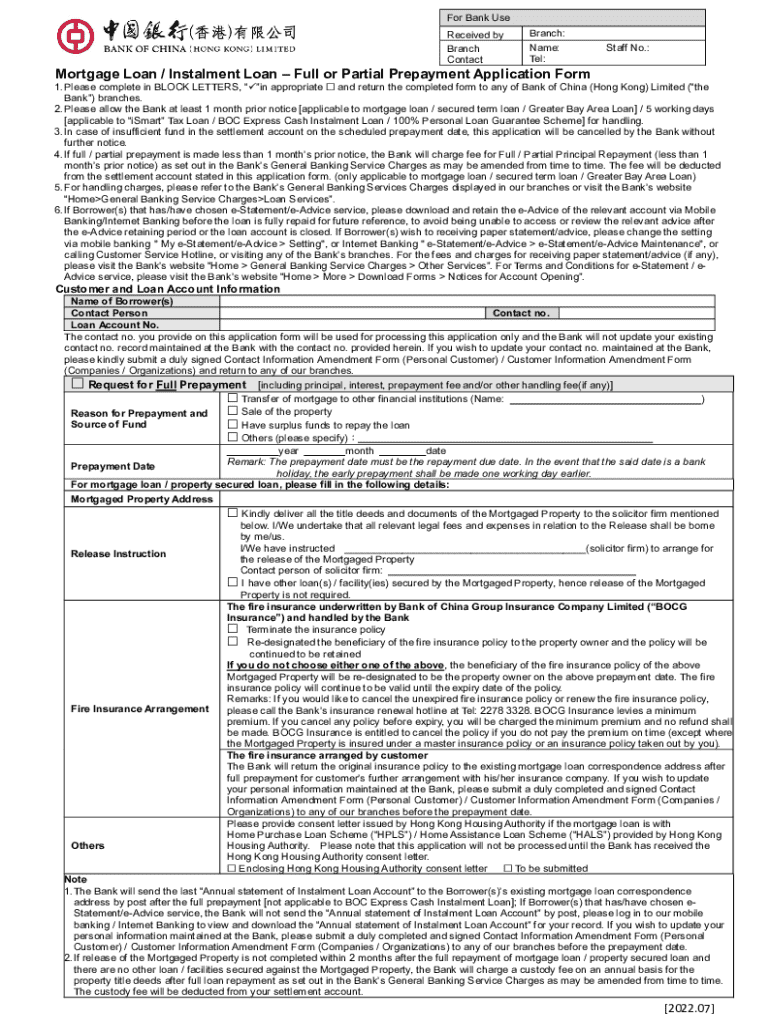

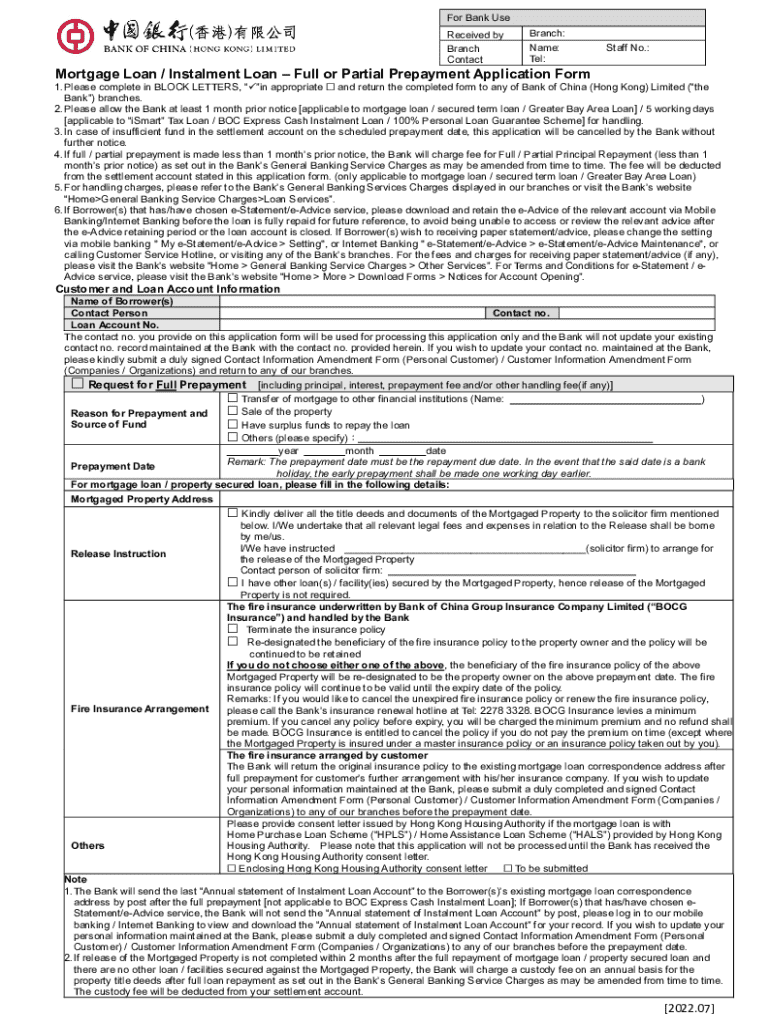

Get the free Mortgage Loan / Instalment Loan – Full or Partial Prepayment Application Form

Get, Create, Make and Sign mortgage loan instalment loan

How to edit mortgage loan instalment loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage loan instalment loan

How to fill out mortgage loan instalment loan

Who needs mortgage loan instalment loan?

Understanding the Mortgage Loan Instalment Loan Form

Understanding mortgage loan instalment loans

Mortgage loan instalment loans represent a structured way to finance the purchase of real estate. Unlike traditional loans, these are specifically designed for home purchases and operate on an amortization schedule, meaning borrowers pay back their loans in equal monthly payments that cover both principal and interest over an extended period.

One of the key features of mortgage loan instalment loans is the choice between fixed and variable interest rates. Fixed-rate loans ensure that your monthly payment remains the same throughout the loan’s duration, offering predictability. In contrast, variable-rate loans can fluctuate, potentially leading to lower initial payments but greater uncertainty over time.

Loan terms can vary significantly, typically ranging from 15 to 30 years, which allows borrowers to choose the plan that best fits their financial situation. Furthermore, a strong credit score is crucial in determining eligibility and the interest rate you might receive. A better score often translates to lower rates and reduced overall costs.

Types of mortgage loan instalment loans

Mortgage loan instalment loans fall into several categories. Each type offers different characteristics and eligibility requirements, allowing borrowers to select the best fit based on their financial situation and status.

Detailed breakdown of the mortgage loan instalment loan form

The mortgage loan instalment loan form is essential in the application process. It collects all the necessary information that lenders require to assess your borrowing capability and determine the loan amount that can be extended.

Step-by-step guide to filling out the mortgage loan instalment loan form

Completing the mortgage loan instalment loan form may seem daunting, but a systematic approach can simplify the process significantly. Here’s how to get started:

Common mistakes to avoid when completing the form

When it comes to the mortgage loan instalment loan form, certain pitfalls can lead to delays or even denials. Awareness of these common mistakes can save you time and frustration.

Editing, signing, and submitting the form

Utilizing pdfFiller can transform your experience with the mortgage loan instalment loan form. The platform simplifies the editing process, enabling users to amend any sections of the form without hassle.

Adding electronic signatures through pdfFiller is quick and legally valid, making it easier to finalize your mortgage loan application. Once completed, securely submit the form to your lender through their preferred channels, ensuring that you receive confirmation of submission for peace of mind.

Frequently asked questions (FAQs) about mortgage loan instalment loan forms

When navigating the mortgage process, having clear answers to common inquiries can alleviate stress. Here are some frequently asked questions:

Interactive tools for managing your mortgage loan

While submitting the mortgage loan instalment loan form is a crucial step, managing your finances effectively thereafter is equally important. Various interactive tools are available to assist you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mortgage loan instalment loan?

How do I fill out the mortgage loan instalment loan form on my smartphone?

How do I complete mortgage loan instalment loan on an Android device?

What is mortgage loan instalment loan?

Who is required to file mortgage loan instalment loan?

How to fill out mortgage loan instalment loan?

What is the purpose of mortgage loan instalment loan?

What information must be reported on mortgage loan instalment loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.