Get the free Tax Exempt Nonprofit Organizations - Department of Revenue - tax utah

Get, Create, Make and Sign tax exempt nonprofit organizations

How to edit tax exempt nonprofit organizations online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax exempt nonprofit organizations

How to fill out tax exempt nonprofit organizations

Who needs tax exempt nonprofit organizations?

Tax exempt nonprofit organizations form: A comprehensive guide

Understanding tax exemption for nonprofit organizations

Tax exemption is a legal status that allows nonprofit organizations to operate free from federal, state, and local taxes. This designation is vital for nonprofits, as it enables them to allocate more resources towards their missions and community impact rather than tax liabilities. Achieving this status not only fosters sustainability but also enhances the organization's credibility, attracting more donations and grants.

In the United States, several classifications provide tax-exempt status under Section 501 of the Internal Revenue Code (IRC). The most recognized type is the 501(c)(3) organization, which encompasses charitable, educational, and religious groups. However, there are other classifications such as 501(c)(4) for social welfare organizations and 501(c)(6) for business leagues. Each category has distinct requirements and benefits, making it crucial for organizations to understand which designation aligns best with their purposes.

The importance of proper documentation

Documentation is fundamental in securing and maintaining tax-exempt status. The IRS mandates specific forms for nonprofit organizations to apply for exemption, most commonly IRS Form 1023 for 501(c)(3) organizations and Form 1024 for others. These forms require detailed information about organizational purposes, governance, and financial projections. Properly completing these forms is vital as inaccuracies or omissions can lead to delays or outright denial of tax-exempt status.

Common pitfalls that organizations encounter include failing to provide a clear statement of their mission and objectives or presenting insufficient details on their fund allocation. Moreover, a lack of thorough record-keeping can jeopardize an organization's ability to prove its compliance with IRS regulations. For nonprofit leaders, ensuring accurate and complete documentation is paramount, as even minor errors can result in significant setbacks.

The tax exempt nonprofit organizations form process

Completing IRS Form 1023 can seem daunting, but following a structured approach simplifies the process. Here’s a step-by-step guide to ensure you navigate it effectively.

After completing the form, organizations can submit it through online platforms or by mail. It's important to note the processing times can vary; expect anywhere from 3 to 6 months before receiving a determination letter from the IRS regarding approval or denial of the tax exemption.

Once approved, maintaining tax-exempt status is crucial. Organizations must adhere to annual reporting requirements through the Form 990 series, and any significant changes in structure or mission should be communicated to the IRS promptly.

Specific considerations for nonprofit purchases

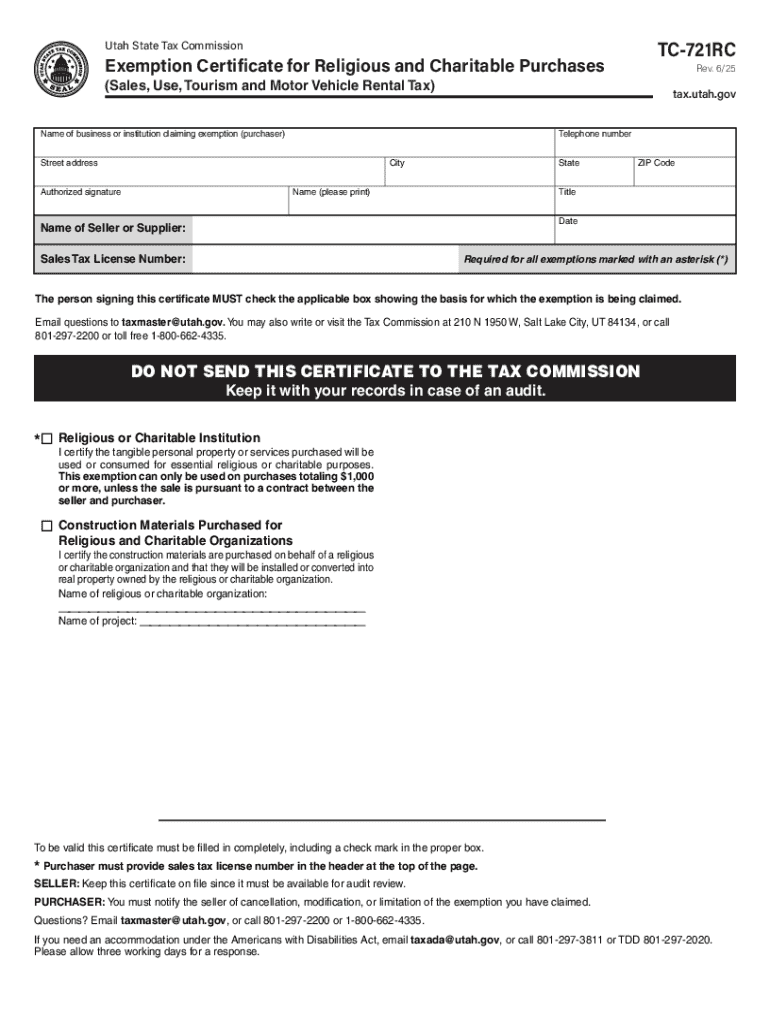

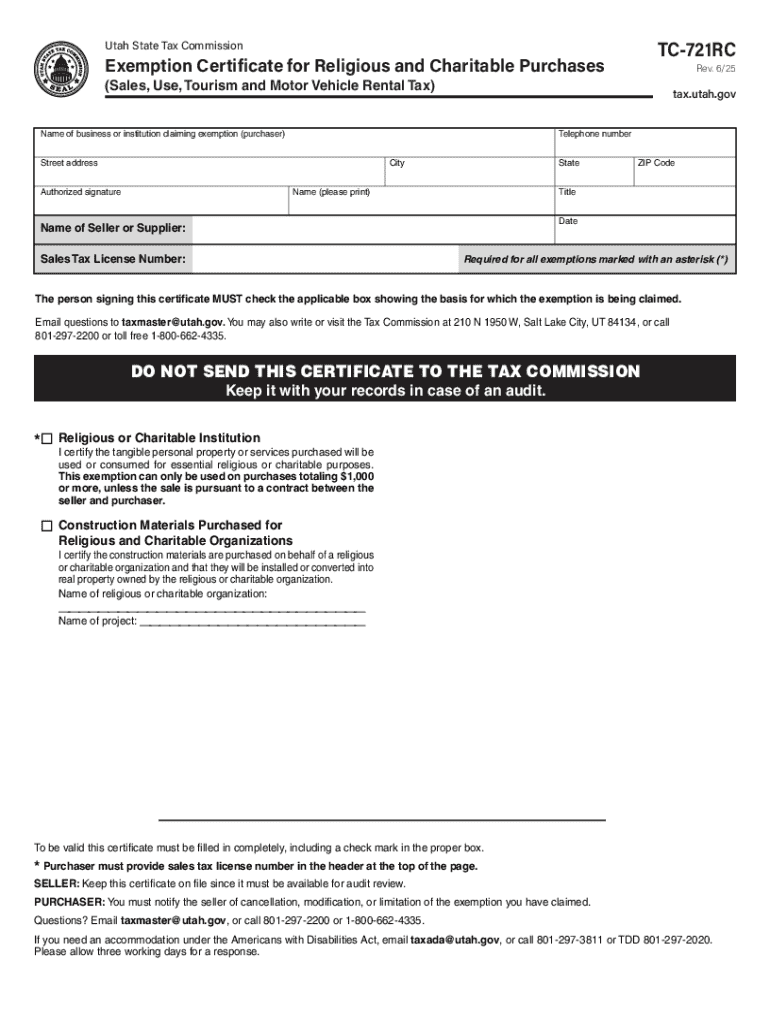

Nonprofits often benefit from tax-exempt purchases of goods and services, but understanding the rules is imperative. Generally, an organization must possess a valid tax-exempt certificate to make tax-free purchases. Each state has unique requirements governing how these certificates can be applied, and nonprofits need to be diligent in ensuring compliance.

Sales tax implications also vary significantly among states. For example, certificates issued by the department of revenue service need to be presented at the point of sale to avoid incurring taxes on purchases. Additionally, the tax treatment surrounding meals and lodging for nonprofit functions can also provide savings, where exemptions may apply under specific conditions. Understanding when to apply for these exemptions ensures nonprofits are maximizing their funding.

Fundraising events introduce further complexities in sales tax obligations. While sales made during fundraising events may qualify for tax exemptions, nonprofits must ensure they comply with state regulations governing sales tax on such transactions. Using a comprehensive tool like pdfFiller can aid in managing the documentation involved in these processes.

Exploring related tax exemption programs

Organizations must consider that tax exemption statuses can vary significantly by state. Each state may have corresponding exemptions from state and local taxes that associations must explore. State department of revenue services often provide resources to assist in navigating these regulations, compiling necessary documentation specific to state requirements.

Additionally, tax-exempt organizations should pursue grants and funding opportunities available to them. Many foundations and government programs specifically aim to support nonprofit efforts, and understanding the compliance requirements for these grants is essential for proper management and reporting. Utilizing online document management platforms can streamline both the application processes and the necessary reporting procedures.

Critical insights for nonprofit leaders

As nonprofit leaders navigate the complexities of maintaining tax-exempt status, certain best practices can help ensure ongoing compliance. Regular audits and reviews of documentation and processes should be standard practice to catch any discrepancies early. Additionally, staying informed on changes in tax law that may affect nonprofit organizations is vital for continued compliance.

Tools for document management have become indispensable in this process. For example, pdfFiller’s platform allows users to seamlessly edit PDFs, eSign, collaborate, and manage various essential documents from a single, cloud-based solution. This integrated approach promotes operational efficiency and minimizes the risks associated with improper documentation.

Conclusion: Empowering your nonprofit journey

The journey to becoming a fully tax-exempt organization may seem complex, but understanding the requirements and processes involved can significantly demystify the endeavor. By prioritizing accurate documentation, adhering to compliance requirements, and using effective management tools, organizations can streamline their operations and focus on their charitable missions.

Utilizing resources such as pdfFiller can effectively enhance the process of handling tax exempt nonprofit organizations forms and related documentation. Doing so empowers nonprofits to remain compliant and focused, ensuring every dollar raised can maximize their impact on the community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax exempt nonprofit organizations in Gmail?

How do I execute tax exempt nonprofit organizations online?

How do I edit tax exempt nonprofit organizations online?

What is tax exempt nonprofit organizations?

Who is required to file tax exempt nonprofit organizations?

How to fill out tax exempt nonprofit organizations?

What is the purpose of tax exempt nonprofit organizations?

What information must be reported on tax exempt nonprofit organizations?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.