Get the free Brokerage Trading Authorization

Get, Create, Make and Sign brokerage trading authorization

How to edit brokerage trading authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out brokerage trading authorization

How to fill out brokerage trading authorization

Who needs brokerage trading authorization?

A comprehensive guide to the brokerage trading authorization form

Understanding brokerage trading authorization forms

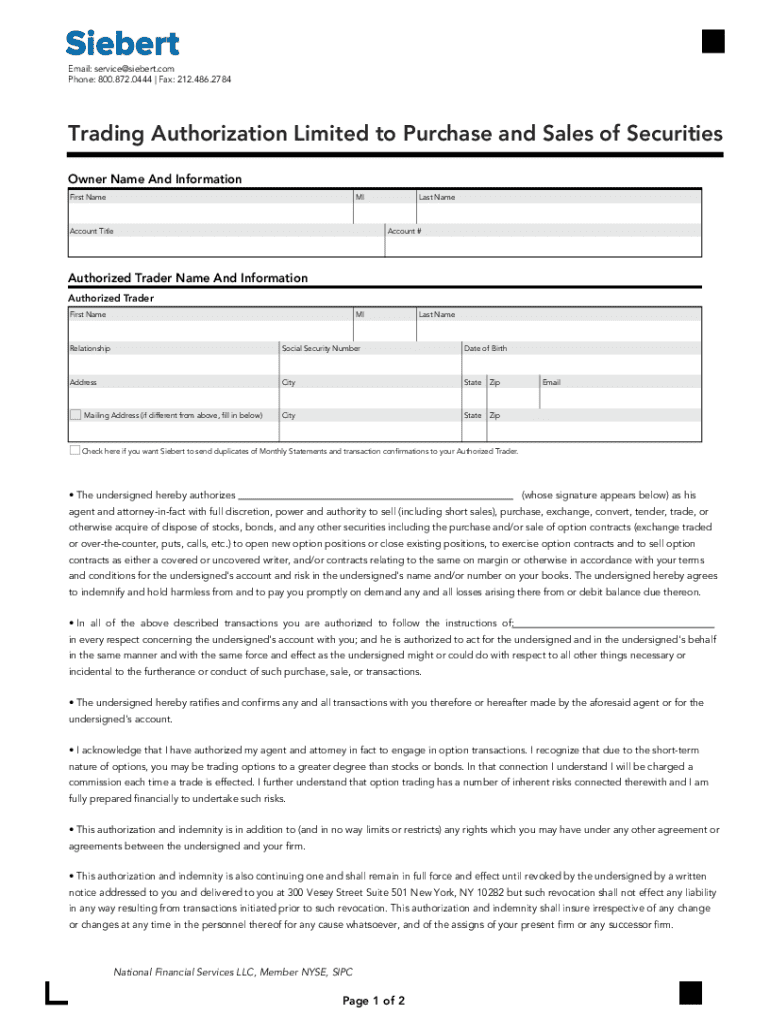

A brokerage trading authorization form is a legal document that allows one individual or entity (the authorized person) to manage and trade within another person's or entity's brokerage account. This form plays a critical role in facilitating financial transactions by establishing trust and clarity between the parties involved. By granting trading authority, the account owner can empower a trusted individual or advisor to make investment decisions, execute trades, and manage their portfolio efficiently.

The importance of this form cannot be overstated; it ensures that both parties have a clear understanding of the authorized actions, which can greatly reduce the possibilities of disputes or misunderstandings. Common use cases for the brokerage trading authorization form include personal investments, where an individual might want someone else to manage their portfolio, and business scenarios, where companies delegate trading duties to financial advisors or investment firms.

Key components of a brokerage trading authorization form

To properly complete a brokerage trading authorization form, certain essential information is required. This includes personal identification details such as the account holder's name, Social Security number, and contact information. Account information will typically require the brokerage account number and type. Additionally, the document should outline the specifics of the authorization levels and limits, defining precisely what actions the authorized individual can perform on behalf of the account holder.

Common terminology that you will encounter includes terms like account holder, authorized trader, and limit of authority. Notably, there are differences between full authorization, which grants complete control for trading and decision-making, and limited authorization, which restricts the authority to specified activities, such as buying but not selling securities. Understanding these definitions helps ensure clarity and prevent miscommunication.

Step-by-step guide to completing the brokerage trading authorization form

Completing a brokerage trading authorization form is a straightforward process that can be broken down into four main steps. First, gather all necessary documents, which typically include proof of identity such as a driver’s license or passport, and information related to the existing brokerage account. This ensures that all required details are at hand, making the form-filling process smoother.

Next, proceed to fill out the form meticulously, paying close attention to each section. You'll start with account holder information, followed by details about the authorized trader including their name and contact information. Additionally, you may be required to disclose the investment strategy you expect your authorized trader to follow.

Once you’ve filled out the necessary information, take time to review for accuracy. Common mistakes can include incorrect account numbers or typos in names, which can lead to rejections of the form. Thus, ensuring clarity and completeness is paramount. Finally, when you're confident that all information is accurate, sign the form. Understand that e-signatures and digital signing options are widely accepted today, but be aware of any notarization requirements that might apply.

Best practices for submitting your authorization form

Submitting your brokerage trading authorization form can be done through several methods. You can typically use online portal uploads if your brokerage offers this service, making it the fastest option. Alternatively, traditional methods like mailing or faxing the form are also available. Regardless of the method chosen, ensuring secure submission is crucial due to the sensitive nature of the information involved.

Protecting your data during submission entails using secure connections and trusted platforms. After you've submitted your authorization form, it's wise to follow up to confirm receipt and approval. A simple call to your brokerage can clarify the status of your form and reassure you that everything is in order.

Troubleshooting common issues

In some cases, your brokerage trading authorization form may be rejected. Understand that common reasons include missing information, incorrect formatting, or failure to sign where required. If your authorization is denied, the best course of action is to contact your brokerage's customer service for specific guidance on why the rejection occurred.

They can help troubleshoot the issues and provide insight on necessary corrections. Becoming familiar with frequently asked questions can also aid in resolving submission problems quickly; inquiries often revolve around processing times, required documentation, and changes to existing authorizations.

Managing your brokerage trading authorization

After successfully setting up your brokerage trading authorization, managing it effectively becomes essential. If you need to modify or cancel your authorization, understanding the steps for updates and changes is crucial. Typically, this requires submitting a new authorization form outlining the desired modifications or stating your intent to revoke the existing authority. This revocation can have significant implications, as it may halt ongoing transactions unless a new authorization is agreed upon.

Keeping track of authorized transactions is also vital for transparency and risk management. Regularly reviewing account statements and any transactions executed by the authorized trader ensures that you remain informed about your investments and financial position.

Interactive tools and resources

pdfFiller offers a suite of features to enhance the process of completing your brokerage trading authorization form. Editing PDFs simplifies form completion; you can easily add your information without the hassle of printing and scanning. The eSigning feature allows for fast and legal signing solutions directly within the platform, streamlining the submission process.

Moreover, collaborative features enable you to work alongside financial advisors. Whether you're seeking input on your investment strategy or ensuring your form is filled out accurately, these tools can provide extensive support. A demo of these interactive tools illustrates how you can efficiently fill out the form and ensure its readiness for submission, making document management hassle-free.

Conclusion

Navigating the complexities of financial documentation, such as the brokerage trading authorization form, doesn’t have to be cumbersome. By employing the tools and tips outlined in this guide, you can create a seamless experience in document management. Integrating financial forms into your workflow, especially with solutions offered by pdfFiller, allows for effective oversight of your financial assets.

Take proactive steps toward effective document management and ensure that your brokerage trading authorization forms are completed accurately and submitted securely. With pdfFiller as your ally, managing your financial documentation has never been easier.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in brokerage trading authorization?

How do I edit brokerage trading authorization straight from my smartphone?

How do I edit brokerage trading authorization on an iOS device?

What is brokerage trading authorization?

Who is required to file brokerage trading authorization?

How to fill out brokerage trading authorization?

What is the purpose of brokerage trading authorization?

What information must be reported on brokerage trading authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.