Get the free Mpac

Get, Create, Make and Sign mpac

Editing mpac online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mpac

How to fill out mpac

Who needs mpac?

MPAC Form: The Comprehensive Guide

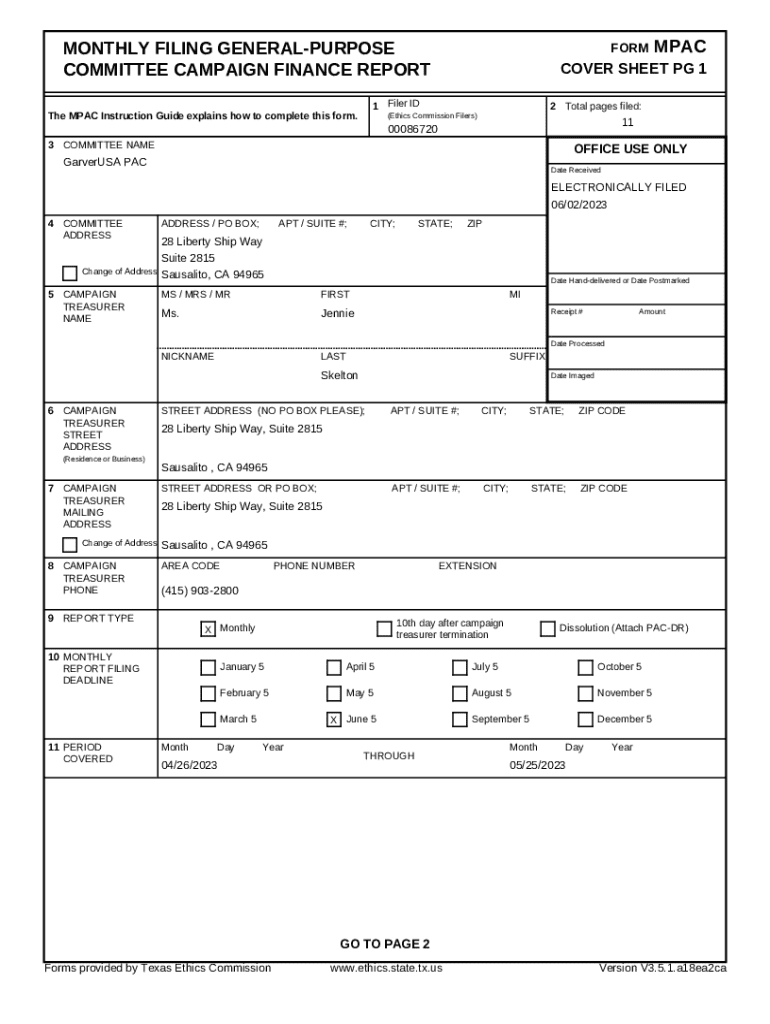

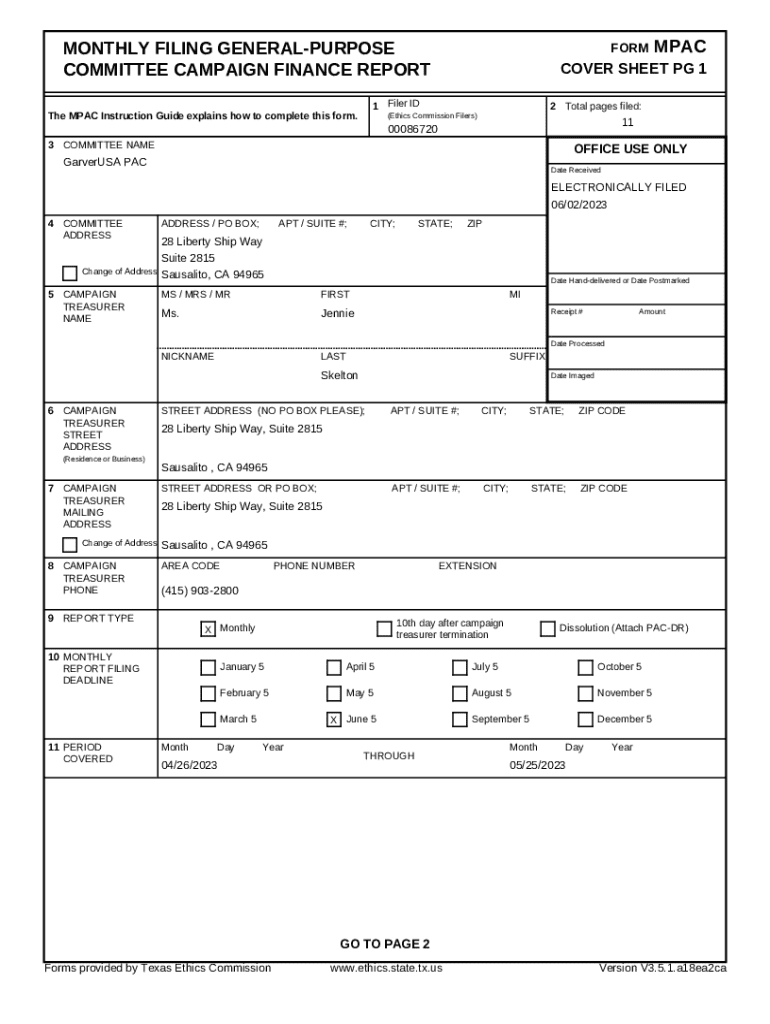

Understanding the MPAC Form

The MPAC form, or Municipal Property Assessment Corporation form, is a crucial document for property owners in Ontario, Canada. It's primarily designed to assess the value of properties across the province. When property assessments are conducted, the MPAC form ensures that the correct data is collected for accurate evaluations. This form is often required in various situations, such as when owners wish to challenge a property assessment or when filing for property evaluations conducted by the MPAC.

In scenarios where property values are disputed, the MPAC form serves as the official request for reconsideration of the assessed value. Submitting this form properly is essential for initiating appeals against the assessed value or decisions made regarding property assessments.

Why is the MPAC Form Important?

The importance of the MPAC form cannot be overstated. For property owners, it plays a vital role in ensuring that their properties are evaluated fairly. A correct assessment is crucial because property taxes are directly influenced by the value assigned to a property. If a property assessment is too high, it can lead to excessive property taxes, which could impact financial stability. The MPAC form allows property owners to respond to and challenge potentially inaccurate assessments.

Moreover, the MPAC form aids in maintaining the integrity of the property market. Accurate assessments contribute to informed decisions for buyers, sellers, and investors, ensuring a more stable real estate environment. Consequently, anyone interacting with the MPAC, whether they are homeowners, real estate professionals, or legal advisors, must understand the significance of this form in property management and taxation.

Who needs the MPAC Form?

The MPAC form is primarily targeted toward property owners in Ontario, including homeowners and real estate investors. Individuals who own residential, commercial, or industrial properties may find themselves needing to complete this form, especially during property assessments or when addressing issues with MPAC evaluations. Furthermore, teams of real estate professionals and legal advisors also utilize this form regularly to assist clients in navigating the property evaluation process.

Common scenarios where the MPAC form is required include filing for property assessments when a property is newly acquired, requesting reconsiderations if an owner believes their property value has been assessed incorrectly, or preparing for appeals against property values established by MPAC.

How to access the MPAC Form

Accessing the MPAC form is straightforward. For those who prefer digital solutions, you can easily find and download the MPAC form on pdfFiller. Simply navigate to the pdfFiller website and use the search function to locate the MPAC form. Once found, you can either fill it out online or download it as a PDF to complete later.

If you prefer to obtain a physical copy of the MPAC form, you can request one from your local municipal office. Municipal offices typically have physical copies available upon request, making it easy for those who may not have access to a printer or prefer handling forms in person.

Filling out the MPAC Form

Filling out the MPAC form requires specific information to ensure accurate processing. First, gather all necessary documents related to your property, which include the property address, the type of property (residential, commercial, etc.), and ownership details. It's essential to include the owner's name and up-to-date contact information on the form. Additionally, any existing assessments or notices from the MPAC should be included.

By carefully completing each section of the MPAC form, you can minimize the risk of delays or complications in the assessment process.

Editing the MPAC Form

Editing the MPAC form is made easier with tools from pdfFiller. When using pdfFiller, users can access a suite of editing tools that allow for seamless changes to the document. Whether you need to update your contact details or add additional information about a property, the platform's features facilitate easy editing. Collaboration features are also available, allowing teams to work together on the same form efficiently.

To save changes, pdfFiller provides options to save and access different versions of the form. This feature is particularly useful for tracking changes over time or for collaborative purposes, ensuring everyone involved can review the latest updates.

Signing the MPAC Form

Signing the MPAC form can be done electronically through pdfFiller's eSigning capabilities. This option is not only convenient but also legally recognized, streamlining the submission process. When utilizing electronic signatures, it is essential to be aware of any legal considerations, such as ensuring that all parties required to sign are present and their consents are properly documented.

Before submitting the MPAC form, review a checklist to confirm that the document is complete. This checklist should include verifying the accuracy of all personal and property information, ensuring that all required signatures are collected, and that the form is free from errors. A thorough review can significantly reduce the chances of complications during processing.

Submitting the MPAC Form

Submitting the MPAC form can be done through various channels depending on preference. Online submission is available for those who fill out the form digitally on pdfFiller. Following the completion and eSignature process, simply click the submission button to send your form directly to the MPAC. Alternatively, you may choose to mail your completed MPAC form to the appropriate MPAC office; mailing instructions can usually be found on the form itself or on the MPAC website.

After submitting the form, it’s important to establish follow-up procedures. Keeping a copy of your submission proof, whether digital or physical, allows you to track the status of your form. If you need to inquire about the submission's progress, contacting the MPAC directly can provide updates or clarification on their response times.

Frequently asked questions (FAQs)

Understanding the MPAC form can raise several questions among users. One common query is what to do if a mistake is made on the form after submission. In most cases, the process for amending a submitted form involves contacting MPAC and following their established procedures for corrections. It's important to address any errors promptly to avoid potential complications with your property assessment.

Another frequent concern involves changes in property value after the submission of the form. It's crucial to understand your appeal rights, particularly if you receive a new assessment post-submission. Familiarizing yourself with the timelines and processes associated with property appeal rights can help you navigate any future issues with MPAC evaluations.

Related information

For property owners looking for additional resources, it's beneficial to explore related forms that interact with the MPAC form. Links to other essential documents and resources can simplify the overall process of property management. Understanding how the MPAC form fits into the larger landscape of property law and local regulations allows for more informed decision-making for property owners.

Furthermore, integrating the MPAC form with other legal documents ensures that property owners have a comprehensive set of paperwork when dealing with assessments or appeals. Ensuring all necessary documents align with the information on the MPAC form can significantly improve the quality of submitted requests.

Conclusion

Completing the MPAC form accurately is essential for ensuring that property assessments reflect true market values. Whether you're challenging an assessment or filing for a new property valuation, the importance of diligence cannot be overstated. By leveraging tools offered by pdfFiller, property owners can streamline the process of form management, from editing to eSigning, ensuring a seamless experience from start to finish.

In an environment where property values directly impact financial obligations, having a clear understanding of the MPAC form and its processes is invaluable. For both individuals and teams, utilizing a cloud-based document management solution like pdfFiller can make navigating the complexities of property assessments much more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mpac from Google Drive?

How do I execute mpac online?

How do I fill out the mpac form on my smartphone?

What is mpac?

Who is required to file mpac?

How to fill out mpac?

What is the purpose of mpac?

What information must be reported on mpac?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.