Get the free New Mexico Title Insurance Underwriters Statistical Report

Get, Create, Make and Sign new mexico title insurance

Editing new mexico title insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new mexico title insurance

How to fill out new mexico title insurance

Who needs new mexico title insurance?

Navigating the New Mexico Title Insurance Form: A Comprehensive Guide

Understanding title insurance

Title insurance serves as a safeguard for property owners and lenders against losses due to defects in the title of a property. When you acquire a property, crucial research is conducted to ensure the title is free from disputes or claims. However, despite the thoroughness of these investigations, there may be unknown risks such as errors in public records, undisclosed heirs, or fraud. Title insurance provides peace of mind by protecting against these potential pitfalls.

In New Mexico, title insurance holds particular significance in real estate transactions, given the unique historical and geographical context of the area. It's essential for anyone involved in a property deal to be familiar with how title insurance operates within the framework of state laws and market practices.

New Mexico title insurance form: an overview

The New Mexico title insurance form is a document designed to outline the terms and guarantees associated with a title insurance policy. Its main purpose is to provide protection against any defects in the title, ensuring secure property transactions. This form is essential for both buyers and lenders, as it elucidates the rights of the insured parties and details about the property in question.

Key components of the New Mexico title insurance form typically include several critical elements: the names of the insured parties, a detailed description of the property being insured, and comprehensive details concerning the title policy. These components ensure that all parties have a clear understanding of their coverage and can effectively manage their expectations.

Steps to obtain a New Mexico title insurance form

Obtaining a New Mexico title insurance form begins with identifying your specific needs. Understanding the different types of title insurance policies available—such as owner's policy and lender's policy—is crucial. Each type has distinct coverage that serves varied purposes; for instance, an owner's policy protects the buyer, while a lender's policy safeguards the lender's investment.

Once you have a good grasp of your needs, the next step is to determine the appropriate coverage amounts based on the value of the property in question. Many title companies can provide insights on standard practices within the state. After defining your requirements, you can access the New Mexico title insurance form through numerous channels.

Completing the New Mexico title insurance form

Filling out the New Mexico title insurance form accurately is vital to ensure proper coverage. Essential information required includes personal details of the insured, a comprehensive description of the property, and any existing liens or claims that may affect coverage. This information should be accurate to avoid complications later and ensure that you're adequately covered against potential issues.

To facilitate completion, digital tools such as pdfFiller offer user-friendly editing features. Users can input their information directly into the form, ensuring everything is up to date. To maximize clarity, it is important to verify each entry and double-check for any typographical mistakes. Taking these steps will help prevent misunderstandings or disputes with insurers.

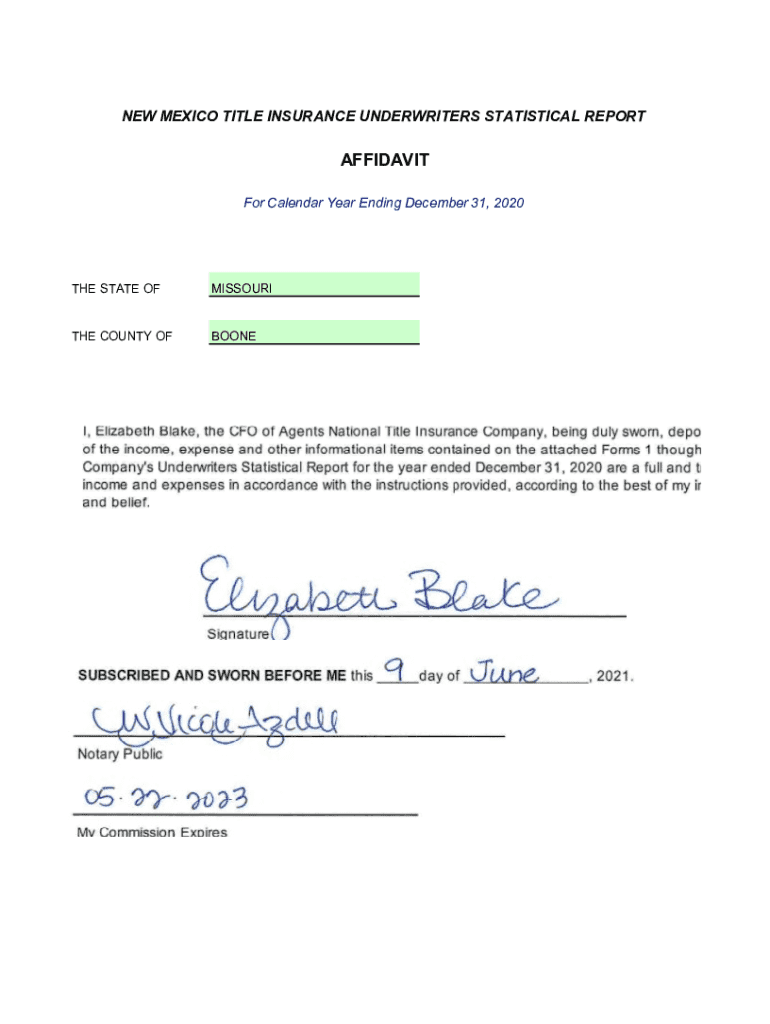

eSigning the New Mexico title insurance form

With the increasing trend towards digital transactions, eSigning the New Mexico title insurance form has become a common practice. Electronic signatures hold legal validity in New Mexico, provided they meet specific criteria laid out by state law. This method not only streamlines the process but also enhances the security and efficiency of document management.

Using platforms like pdfFiller, you can sign the title insurance form electronically in just a few steps. After completing the necessary fields, you simply follow the prompts to apply your signature. The platform also ensures that the signed document is securely stored, allowing for easy retrieval when needed.

Collaboration on the title insurance form

Collaborating with real estate agents, attorneys, and other stakeholders is often necessary when handling the New Mexico title insurance form. It promotes transparency and facilitates effective communication throughout the property transaction process. Tools like pdfFiller have built-in features that allow multiple users to work on the document simultaneously, making sharing and feedback management seamless.

With pdfFiller, users can track changes, leave comments, and review modifications made by others, thereby enhancing teamwork and ensuring all parties are on the same page regarding document accuracy and requirements. Keeping a dialogue open among all stakeholders prevents misunderstandings and ensures a smoother transaction process.

Managing your title insurance documents

Proper document management is crucial after securing a New Mexico title insurance form. Best practices include organizing files by type, date, and significance, which makes retrieval straightforward when needed. Using a digital tool like pdfFiller allows users to store all title insurance documents safely in the cloud, ensuring they can be accessed from anywhere, anytime.

In addition to organization, it's essential to monitor important dates associated with your title insurance, such as policy renewals, inspections, and other obligations. Keeping these dates in check minimizes the risk of losing coverage or missing out on potential claims that might arise from unforeseen circumstances.

Common questions and troubleshooting

Property owners often have questions regarding their title insurance in New Mexico, particularly related to discrepancies in the title or potential disputes. Knowledge of how to resolve these issues is crucial. If there are discrepancies, the first step is to contact your title insurance provider for guidance on how to correct these errors. Engaging legal counsel might be necessary to address complex issues or disputes surrounding your title.

When using the New Mexico title insurance form through platforms like pdfFiller, challenges may arise. Common issues include difficulties in uploading documents or technical glitches during the eSigning process. To mitigate these issues, ensure your internet connection is stable, and refer to user support for step-by-step troubleshooting assistance.

Additional considerations

Understanding local regulations governing title insurance in New Mexico is paramount. The state has laws that dictate the terms of coverage, and it is crucial to be aware of these to ensure compliance. Familiarity with these regulations empowers property owners and professionals alike to navigate the complexities of title insurance with confidence.

Moreover, evaluating different title insurance providers can make a significant difference in securing adequate coverage. Factors such as their reputation, claims history, and customer service should be taken into account when selecting a provider. This diligence can prevent future complications and ensure that you are well-protected in your real estate endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new mexico title insurance for eSignature?

How do I edit new mexico title insurance on an iOS device?

How do I edit new mexico title insurance on an Android device?

What is new mexico title insurance?

Who is required to file new mexico title insurance?

How to fill out new mexico title insurance?

What is the purpose of new mexico title insurance?

What information must be reported on new mexico title insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.