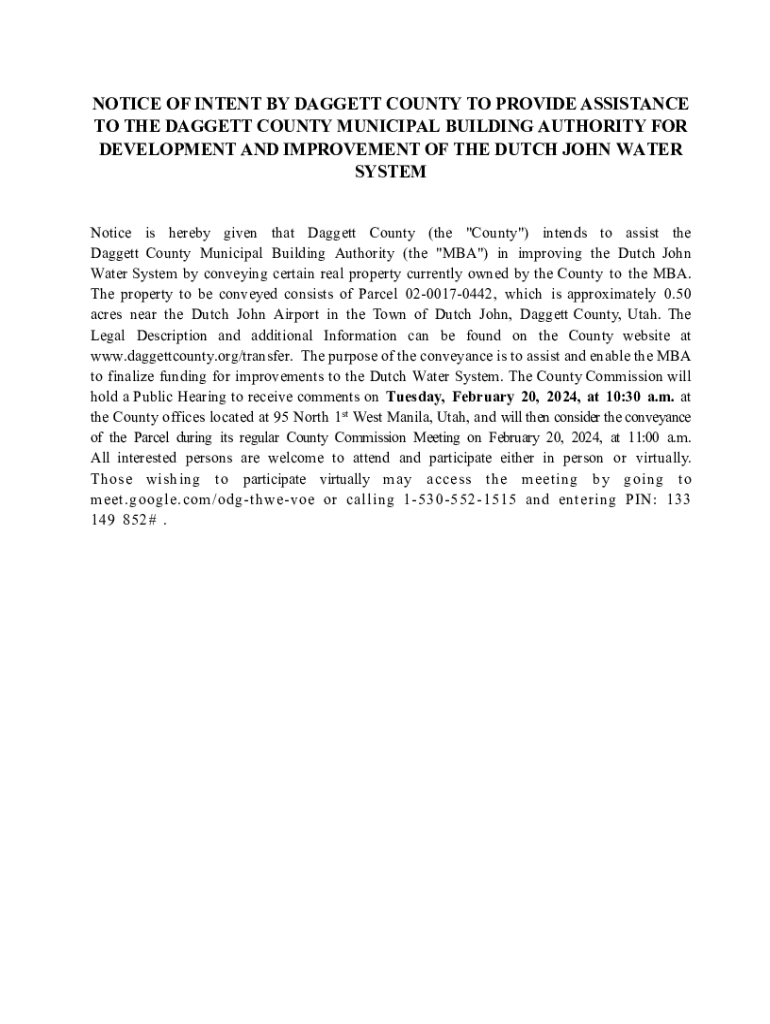

Get the free Notice of Intent by Daggett County

Get, Create, Make and Sign notice of intent by

Editing notice of intent by online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of intent by

How to fill out notice of intent by

Who needs notice of intent by?

Your Comprehensive Guide to the Notice of Intent by Form

Understanding the notice of intent by form

A notice of intent by form is an essential document that allows an individual or organization to formally express their intent regarding a specific matter. This document serves to notify relevant parties of your plans or actions, ensuring that all legal and procedural steps are adhered to. It can cover a myriad of situations, from tax-related decisions to intentions surrounding property changes.

Filing the notice of intent correctly is paramount. Incorrect filings could lead to delays, legal complications, or even the rejection of your intentions. It is crucial to understand the specific grounds and the nature of the notice before proceeding with the form.

Getting started with the notice of intent

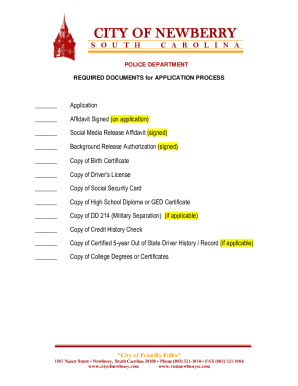

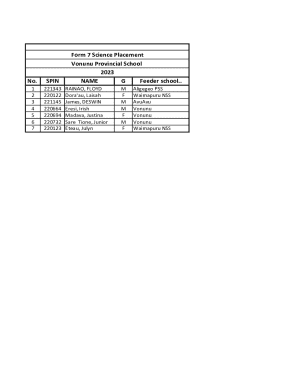

Before filling out the notice of intent by form, gathering all necessary information is vital. This includes your personal and organizational details, the specifics of your intent, and any relevant documentation to support your claims or actions. Checking your eligibility criteria is another crucial step; ensure that you meet all guidelines required for the specific notice instance.

Tools and resources also facilitate the process. Utilizing platforms like pdfFiller, which offers comprehensive features for creating, editing, and managing forms, can expedite this process significantly. You can easily access their database of templates and utilize their user-friendly interface.

Step-by-step guide to completing the notice of intent form

To begin, verify your personal details ensuring your full name, address, and contact information are accurate. This is a crucial step because any discrepancies can cause delays in processing your notice. Confirming all information is an effort toward efficiency and reduces the risk of having to resubmit your form.

Next, move on to fill in the specific intent details in the form. This section should clearly articulate your intentions, whether it involves a tax deduction claim or another matter. Providing context or the reasoning behind your notice will strengthen your submission and help reviewers understand your purpose.

If your notice involves any affiliations, such as partnerships or associations, be sure to provide all necessary information in the respective section. This ensures that private and public interests are recognized in your notice.

Finally, before submission, a thorough review of your form is essential. Tips for effective document review include reading your entire submission or asking a colleague for a second opinion. Common mistakes to avoid include missing signatures, incorrect dates, and incomplete fields that could put the integrity of your notice at risk.

Submitting the notice of intent

With the form completed, there are several methods to submit your notice of intent. One popular option is online submission through pdfFiller, which allows you to submit your document directly after your final review. This method usually ensures a quicker processing time compared to traditional submission.

Alternatively, you can print and mail the notice if you prefer the traditional route. Make sure to use a secure mailing service that provides tracking. After submission, expect certain processing times, which can vary based on your local regulations and the nature of your notice. Following up through the appropriate channels helps ensure your submission is recorded and being acted upon.

Common FAQs about the notice of intent by form

One common concern is, what should I do if I make a mistake on my form? If you realize there's an error after submission, reach out to the relevant authority for guidance on rectifying the mistake. Depending on the situation, they may allow amendments or require you to file a new notice.

Another frequently asked question is how long the notice of intent remains valid. Generally, it varies based on the type of notice you are filing, so it’s important to check local regulations. Lastly, can I edit the form after submission? Typically, once submitted, forms cannot be modified. However, you can submit a new notice to correct any discrepancies or changes.

Leveraging pdfFiller for your document needs

pdfFiller serves as an invaluable resource, simplifying the creation and management of forms like the notice of intent. The platform streamlines the editing of PDFs and forms to ensure your document meets all necessary standards before submission. With cloud capabilities, users can access their forms anywhere, fulfilling the needs of individuals and teams alike.

The benefits of utilizing a cloud-based document solution extend beyond mere accessibility. Enhanced collaboration features allow multiple users to work on a document simultaneously or review critical details before submission. Furthermore, employing eSignatures on pdfFiller ensures your notice carries legal weight and confirmation.

Special considerations

When dealing with a notice of intent by form, understanding the legal implications is crucial. This document is not just a formality; improper handling can lead to significant repercussions, whether financial or legal. For complex situations, seeking professional assistance is often wise to navigate any potential pitfalls.

Additional documentation may be required alongside your notice, particularly for tax deduction claims, various forms of contributions, or appeals. These documents help reinforce your intent and ensure a complete submission, enhancing the chances of a favorable response.

Interactive tools and templates

pdfFiller offers a variety of available templates specifically designed for the notice of intent. Utilizing these templates can streamline the process significantly, allowing for easy customization that is tailored to your unique needs. Accessing and customizing these templates is straightforward, making it an ideal solution for first-time users and seasoned professionals alike.

Additionally, pdfFiller's interactive tools enable users to fill out, sign, and share documents efficiently. Such features enhance the overall experience, ensuring that you can manage your documents from a single, cohesive platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notice of intent by in Gmail?

Where do I find notice of intent by?

Can I sign the notice of intent by electronically in Chrome?

What is notice of intent by?

Who is required to file notice of intent by?

How to fill out notice of intent by?

What is the purpose of notice of intent by?

What information must be reported on notice of intent by?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.