Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K: A How-to Guide

Understanding Form 8-K

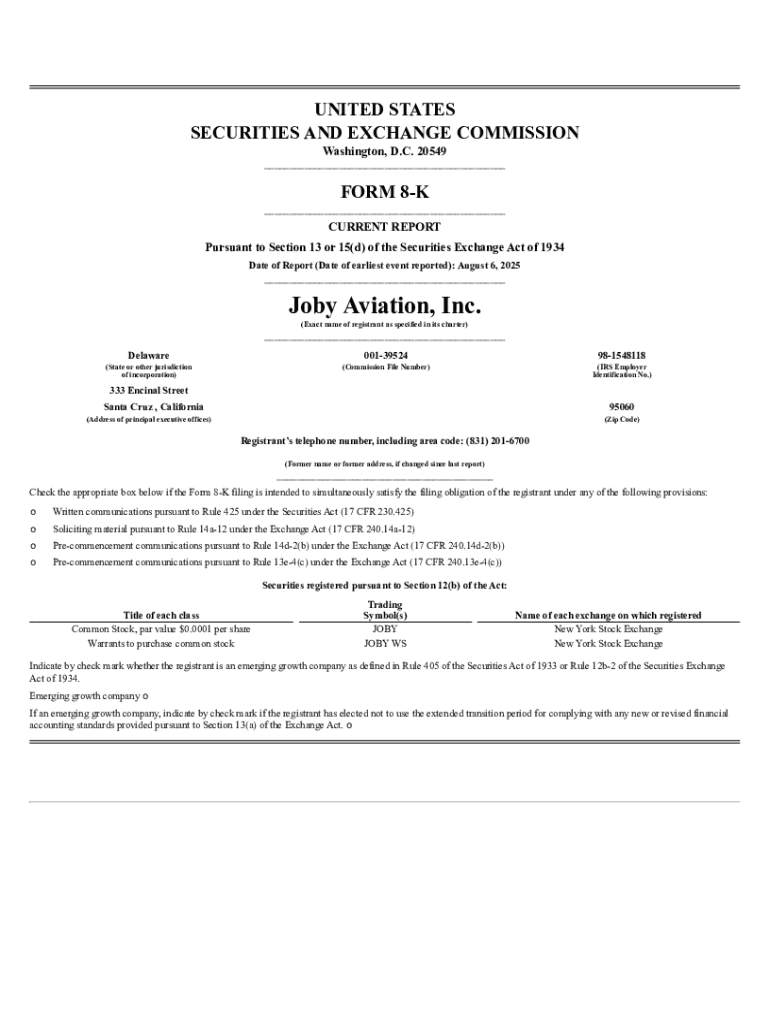

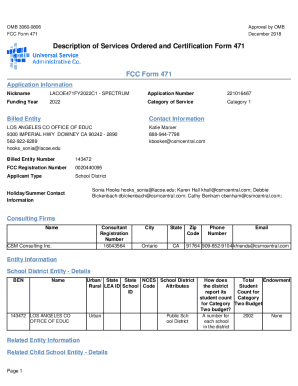

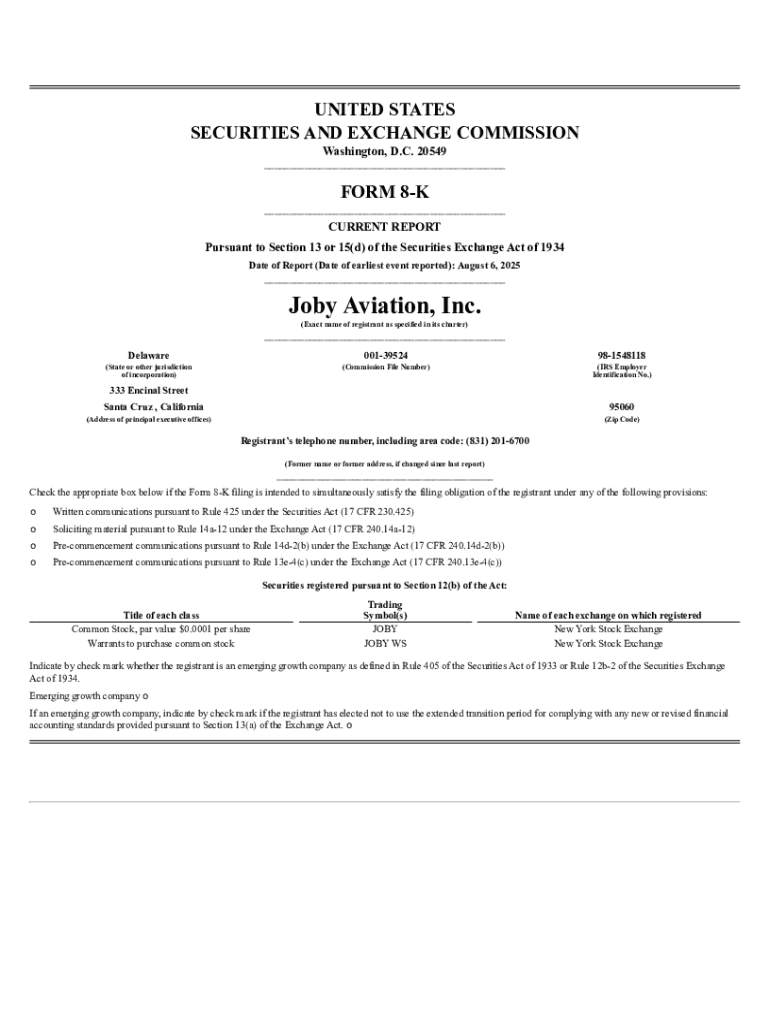

Form 8-K is a critical reporting requirement for publicly traded companies in the U.S. Filed with the Securities and Exchange Commission (SEC), it serves as the primary means for companies to disclose important events that may affect their financial performance or overall operations. The purpose of the Form 8-K filing is to provide timely information to investors and analysts, ensuring they stay informed about significant developments that could impact their investment decisions.

Historically, the requirement for Form 8-K stems from the need to maintain high levels of transparency in corporate governance. When companies undergo significant events such as mergers or changes in management, the SEC mandates that they report these events promptly. This historic regulation enhances accountability and promotes trust between companies and their shareholders.

Triggers for filing Form 8-K

Certain events trigger the need for a Form 8-K filing. Typically, these pertain to major corporate actions that could sway investor opinions or affect stock prices. Companies must file Form 8-K for events such as mergers and acquisitions, changes to the management team or board of directors, and instances requiring financial restatements.

Understanding materiality is crucial when assessing whether an event necessitates a filing. Material events are those that a reasonable investor would consider important when deciding to buy or sell a company’s stock. For example, a merger might significantly alter the company's trajectory, thus triggering a Form 8-K filing. Conversely, a minor internal change may not warrant such a disclosure.

Detailed disclosure requirements

When completing Form 8-K, companies must disclose specific information relevant to the triggering event. For instance, if a leadership change occurs, the company must provide the name of the departing executive, the effective date, reasons for departure, and any related material implications. The aim is to present a complete narrative that allows investors to make informed decisions.

Misinterpretation of what constitutes a material event is a common mistake in filings. Companies sometimes overlook details that can lead to inaccurate disclosures. Therefore, ensuring all relevant information is captured accurately is essential for compliance and maintaining investor trust.

The benefits of timely Form 8-K filing

Timely filing of Form 8-K enhances corporate transparency and helps to build investor trust. When companies communicate important information promptly, they demonstrate their commitment to transparency and corporate governance, which can positively influence market perception and investor relations.

Additionally, adhering to filing requirements also carries legal and compliance advantages. Companies that fail to file timely reports may face penalties or legal challenges. A proactive approach to disclosures reduces the risk of fallout from non-compliance, fostering confidence among investors and stakeholders.

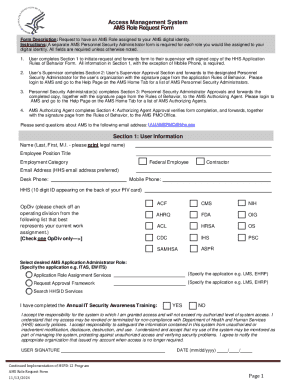

Completing the Form 8-K

Filling out Form 8-K involves a series of steps that require careful attention to detail. The first step is to gather all necessary information pertinent to the event being disclosed. This includes dates, relevant documents, and statements that clarify the implications of the event.

Once the information is gathered, each section of the form should be completed according to the guidelines set forth by the SEC. Best practices suggest using clear language and ensuring data accuracy, as even minor errors can lead to significant misunderstandings or compliance issues.

Filing Form 8-K

Submitting Form 8-K is a critical process that involves electronic filing through the SEC's EDGAR system. Companies must familiarize themselves with the filing procedures, including important deadlines and the required submission formats. Timely submission is essential; generally, filings must occur within four business days of the relevant event.

After submission, companies should monitor investor reactions to their disclosures and prepare for follow-up communications. This ensures that any concerns or questions from shareholders are addressed swiftly, reinforcing the company's commitment to transparency.

Leveraging technology for efficient filing

Utilizing tools like pdfFiller can significantly streamline the Form 8-K filing process. This cloud-based platform provides users with features designed specifically for document management and collaboration. With options for e-signatures and customizable templates, companies can enhance their filing efficiency, ensuring a smooth workflow.

Additionally, pdfFiller supports collaboration among team members, allowing for remote work and secure document management. By integrating Form 8-K into their document workflows, companies can maintain accurate records and track document versions, minimizing compliance risks.

Frequently asked questions (FAQs) about Form 8-K

For those navigating Form 8-K, several common questions arise. For instance, many wonder when it is necessary to file. As a guideline, any event considered material to investors should prompt a filing. Additionally, inquiries about amending Form 8-K frequently surface; companies can amend filings, but they must adhere to specific SEC guidelines for doing so.

Various support resources are available, including tools offered by pdfFiller to assist with questions and concerns related to filing. These resources help ensure that companies are well-equipped to meet SEC requirements and maintain compliance.

Expert insights on Form 8-K

Gaining insights from financial and legal experts can significantly enhance a company's understanding of Form 8-K. Experts often emphasize the importance of accuracy in disclosures and the need for a comprehensive approach to materiality. Their perspectives shed light on the nuances of corporate governance and investor relations, illustrating how timely communication can aid in maintaining a positive corporate image.

Continuous learning is imperative in this field, and there are many courses and educational materials available for deepening this knowledge. These resources can empower registrants with effective strategies for navigating the complexities of Form 8-K.

User testimonials and success stories

Customer experiences utilizing pdfFiller for Form 8-K filings underscore its effectiveness in simplifying the document management process. Users frequently highlight the ease of use and the platform's ability to facilitate timely disclosures, ultimately leading to smoother investor interactions.

In addition to testimonials, analyzing specific case studies where companies improved their filing processes with pdfFiller can provide valuable insights. These examples illustrate how leveraging modern technology not only simplifies compliance but enhances overall corporate communication.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 8-k on a smartphone?

Can I edit form 8-k on an iOS device?

How do I fill out form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.