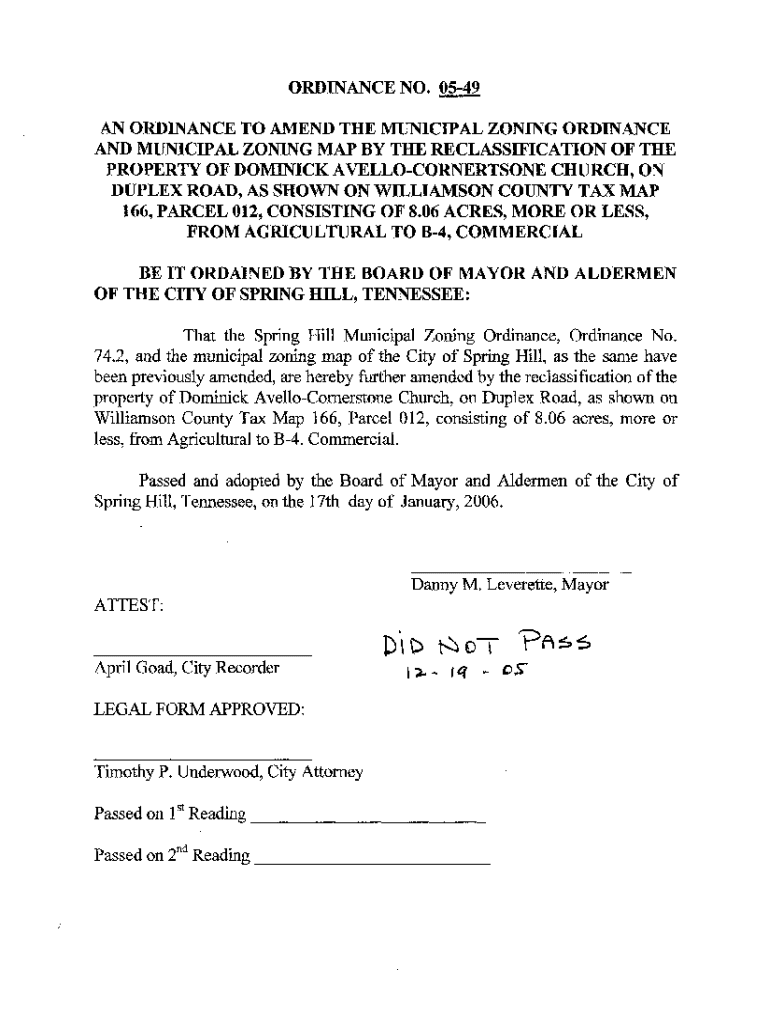

Get the free Ordinance No. 05-49

Get, Create, Make and Sign ordinance no 05-49

Editing ordinance no 05-49 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ordinance no 05-49

How to fill out ordinance no 05-49

Who needs ordinance no 05-49?

Comprehensive Guide to Ordinance No 05-49 Form

Understanding Ordinance No 05-49

Ordinances are laws enacted by a municipal authority, aimed at regulating various activities within the jurisdiction. Ordinance No 05-49 specifically pertains to local tax regulations, providing guidelines for residents and businesses in compliant tax reporting.

The purpose of Ordinance No 05-49 is to ensure clarity in tax obligations and to streamline compliance processes. As tax regulations can significantly impact community funding and services, understanding this ordinance is essential for all affected parties.

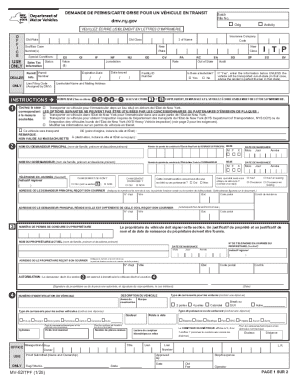

Detailed breakdown of the Ordinance No 05-49 Form

The Ordinance No 05-49 Form is structured into several key sections, each serving a distinct purpose in the tax reporting process. Familiarity with these sections will not only ensure accurate completion but also enhance compliance with local regulations.

The form includes sections on identifying information, taxpayer responsibilities, calculation of tax liabilities, and allowances for deductions and exemptions. Each of these categories tackles a unique aspect of tax reporting, ensuring comprehensive coverage.

Before submitting the form, it's essential to gather any required attachments and documents that back up the claims made within the form. Understanding common terminology used in the ordinance will further facilitate a smoother submission process.

Step-by-step instructions for completing the Ordinance No 05-49 Form

Completing the Ordinance No 05-49 Form can appear daunting initially, but by following a structured approach, you can simplify the process.

Utilizing recommended tools for checking for accuracy can further enhance your submission's success rate. Avoiding common mistakes, such as fields left blank or miscalculations, is vital for an effective submission.

Editing and managing your Ordinance No 05-49 Form with pdfFiller

pdfFiller offers advanced editing tools for users working with the Ordinance No 05-49 Form. With its comprehensive platform, you can edit documents easily and manage them in the cloud, making access and collaboration a breeze.

Additionally, eSigning your Ordinance No 05-49 Form through pdfFiller is straightforward. This not only expedites the signing process but also guarantees the legal validity of your electronic signature, thereby adhering to regulatory standards.

Collaborating on your Ordinance No 05-49 Form

Collaboration is key when preparing your Ordinance No 05-49 Form, especially if multiple parties are involved. pdfFiller offers several features that facilitate sharing and feedback.

This collaborative environment not only streamlines the process but also ensures that multiple perspectives can enhance the accuracy and clarity of the completed form.

Frequently asked questions (FAQs)

When dealing with tax forms, questions are inevitable. Below are some frequently asked questions about the Ordinance No 05-49 Form.

Addressing these queries proactively can help alleviate the stress often associated with tax filing.

Best practices for navigating tax regulations

Staying informed about changes in tax regulations is crucial for anyone filing the Ordinance No 05-49 Form. Regularly check your local government’s website or subscribe to updates that outline new amendments or adjustments to tax policies.

By being proactive and utilizing available resources, individuals and businesses can better manage their tax obligations and avoid potential pitfalls.

Feedback and support

If you have questions or require support in managing your Ordinance No 05-49 Form, pdfFiller is here to help. Evaluating user feedback and experiences can guide you in maximizing the platform’s benefits.

Leveraging these support channels can enhance your understanding and effectiveness in managing the Ordinance No 05-49 Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ordinance no 05-49 online?

How do I make changes in ordinance no 05-49?

How do I edit ordinance no 05-49 on an Android device?

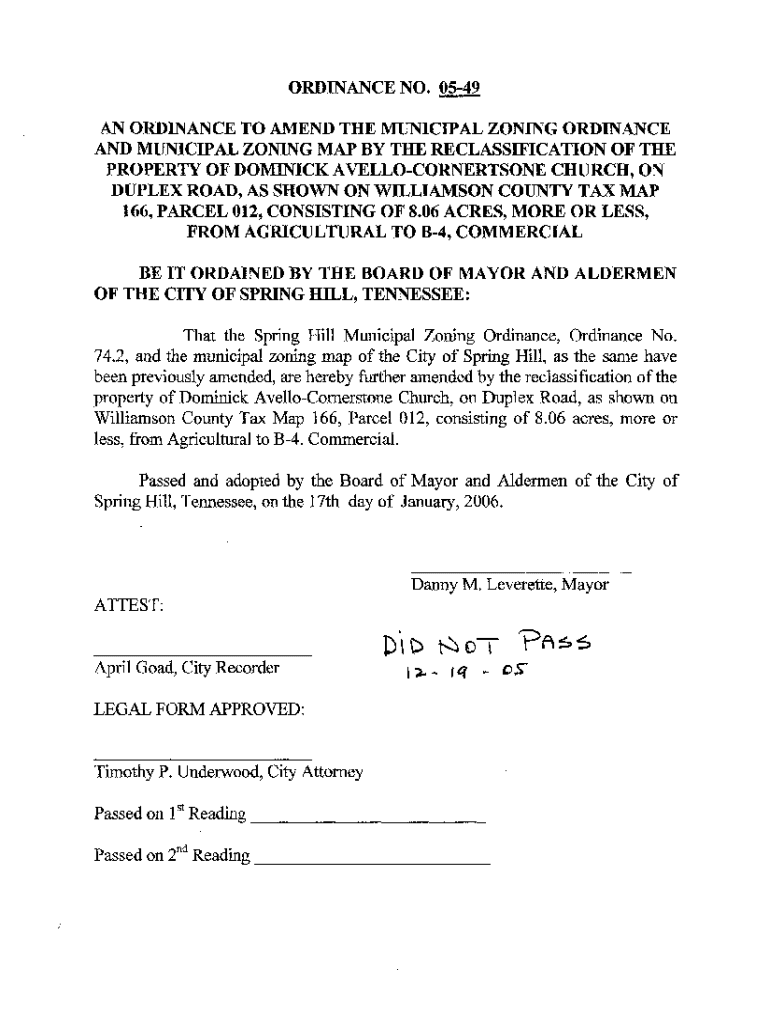

What is ordinance no 05-49?

Who is required to file ordinance no 05-49?

How to fill out ordinance no 05-49?

What is the purpose of ordinance no 05-49?

What information must be reported on ordinance no 05-49?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.