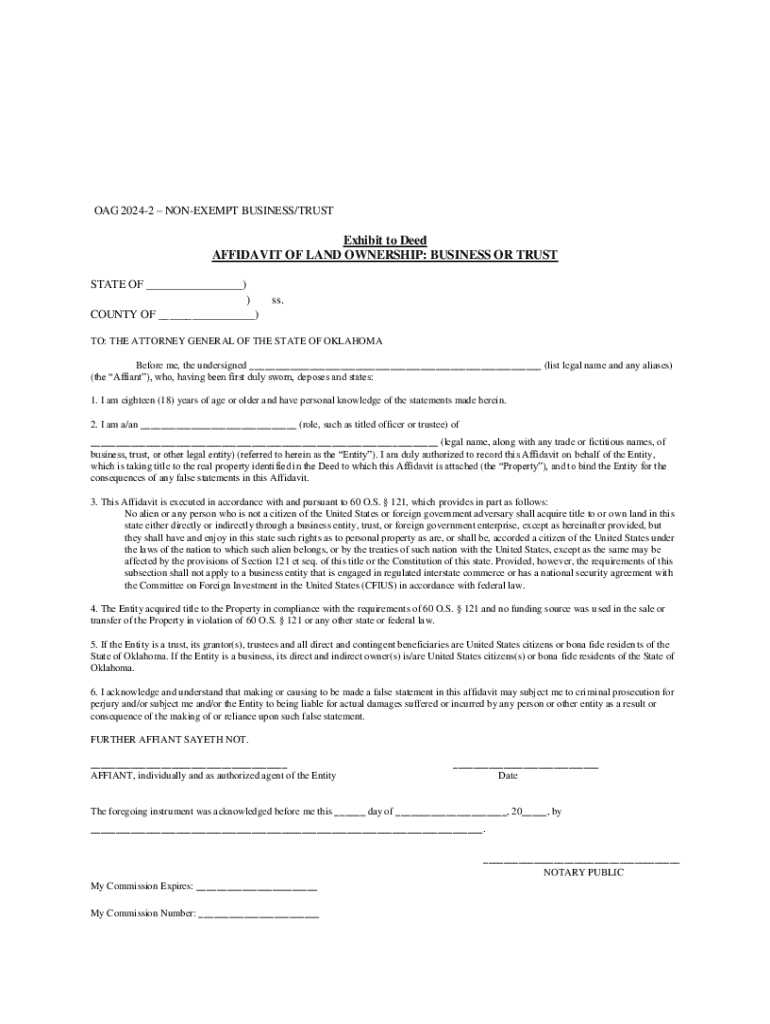

Get the free Oag 2024-2 – Non-exempt Business/trust

Get, Create, Make and Sign oag 2024-2 non-exempt businesstrust

How to edit oag 2024-2 non-exempt businesstrust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oag 2024-2 non-exempt businesstrust

How to fill out oag 2024-2 non-exempt businesstrust

Who needs oag 2024-2 non-exempt businesstrust?

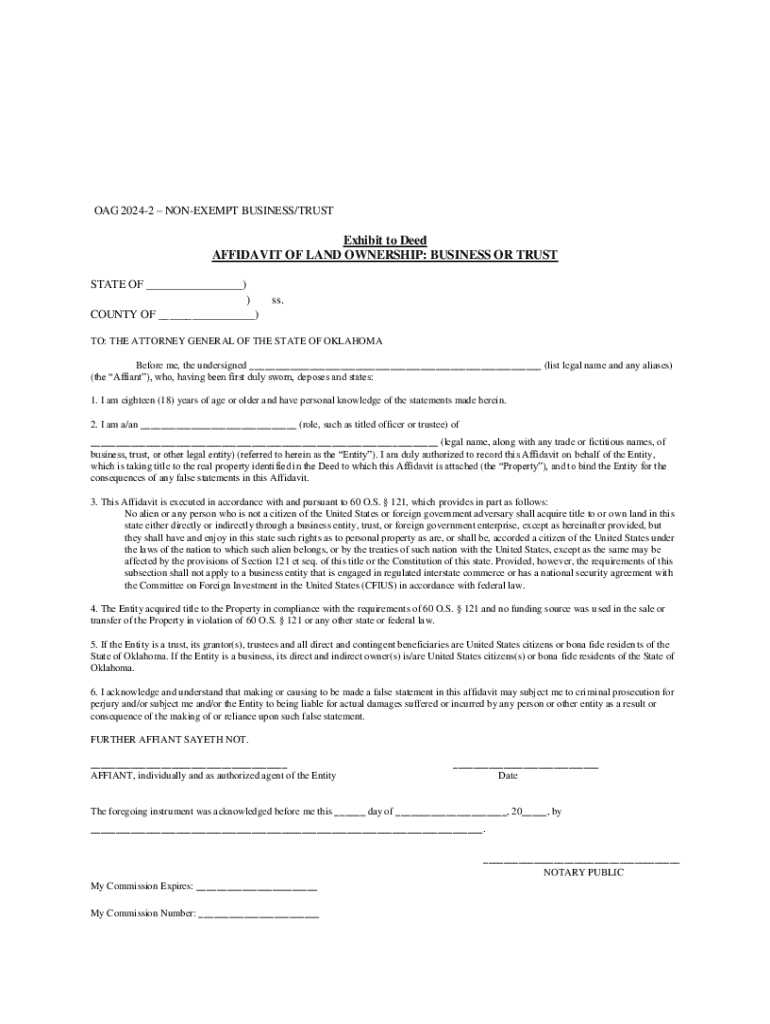

Understanding the OAG 2024-2 Non-Exempt Business Trust Form

Overview of the OAG 2024-2 Non-Exempt Business Trust Form

The OAG 2024-2 Non-Exempt Business Trust Form is a critical document designed for business trusts that do not qualify for exemption under specific regulations. Its primary purpose is to ensure transparency and compliance with state laws, facilitating proper reporting and operational integrity.

Key features of this form include the requirement for detailed financial disclosures, identification of trust beneficiaries, and guidance on governance structures. Using this form assists in establishing legal clarity and accountability for business trusts, benefiting both trustees and beneficiaries.

Compliance and accuracy in the submission of the OAG 2024-2 is vital. Errors or omissions can lead to penalties, delays, or even the invalidation of the trust, emphasizing the importance of an adept understanding of its structure.

Who needs to use the OAG 2024-2 Non-Exempt Business Trust Form?

The individuals and organizations required to complete the OAG 2024-2 Non-Exempt Business Trust Form typically include corporate trustees, legal representatives, and entities involved in trust management. Anyone overseeing a business trust that does not meet exempt criteria must submit this form.

Common scenarios for using this form arise in contexts such as real estate investments, family-owned businesses established as trusts, or when managing a collective group of assets. Failure to accurately complete and submit the form can lead to legal challenges, complications, and fines, stressing the necessity for careful evaluation of its usage.

Step-by-step guide to filling out the OAG 2024-2 Non-Exempt Business Trust Form

A. Gather necessary information

Before filling out the OAG 2024-2 form, collect essential documents such as the trust’s articles of incorporation, financial statements, and beneficiary identification. Having these documents on hand will streamline the process and reduce errors.

Organizing information efficiently is crucial. Consider creating a checklist to ensure all required details are available, which includes details about trust governance, asset types, and revenue sources.

B. Completing the form

Each section of the form must be filled out with precision. Start with the trust’s general information, including its name, registration number, and address. Next, detail the governance structure by listing trustees and their respective responsibilities. Ensure that all financial data reflects accurate and up-to-date figures.

Common mistakes to avoid include omitting essential details, failing to proofread for typos, and not providing signatures where required. Always double-check before submitting to mitigate these risks.

. Review process

After completing the form, verifying the information is paramount. Take the time to scrutinize each entry, ensuring consistency and correctness. Consider involving a trusted advisor or legal expert to review the document for an additional layer of scrutiny.

A final checklist should include validating all signatures, confirming document completeness, and ensuring the paperwork adheres to submission standards. These steps will significantly reduce potential issues during processing.

Digital tools for editing and managing your OAG 2024-2 form

Leveraging digital tools can ease the challenges of managing the OAG 2024-2 Non-Exempt Business Trust Form. pdfFiller offers a range of features tailored for seamless form management, including editing capabilities and collaborative functionalities.

With pdfFiller, users can edit and customize the OAG 2024-2 form easily. This includes adding text, highlighting sections, and even reformatting elements to suit personal preferences. The cloud-based nature of pdfFiller also promotes easy access from any device, enhancing user efficiency.

Utilizing such cloud-based tools not only simplifies the document management process but also fosters collaboration among team members, making it easier to share insights and make necessary adjustments quickly.

eSigning the OAG 2024-2 Non-Exempt Business Trust Form

eSigning has become integral in modern document management, offering a legally recognized alternative to traditional signatures. Using pdfFiller, adding your eSignature to the OAG 2024-2 form is straightforward and secure.

To eSign the form, users can simply navigate to the signature field, where pdfFiller will prompt them to sign electronically. This process includes options for drawing, typing, or uploading an existing signature image. All eSignatures captured through pdfFiller are encrypted, ensuring their integrity and protecting user information.

Frequently asked questions (FAQs)

Questions regarding the OAG 2024-2 Non-Exempt Business Trust Form frequently arise, particularly around its eligibility criteria and submission process. For instance, prospective users often inquire about which entities must submit the form and the consequences of errors in the submission.

Eligibility for this form typically includes any business trust that isn't exempt under state law. Not utilizing the form correctly can lead to deferred processing or legal repercussions, highlighting the necessity for diligent attention to detail.

Moreover, users often seek clarifications on the distinctions between exempt and non-exempt forms. The primary difference lies in the operational criteria set forth by the governing laws, impacting compliance obligations significantly.

Resources for ongoing support and compliance

Navigating the complexities of the OAG 2024-2 Non-Exempt Business Trust Form can be intimidating. Therefore, having access to support resources is invaluable. Contact information for state offices, as well as support centers, is often provided on the official form repositories.

Additionally, users should take advantage of the wealth of online resources available, including guides for related business forms. Engaging with platforms like pdfFiller can ensure ongoing document management needs are met successfully, providing tools for streamlined compliance.

Case studies: Successful navigation of the OAG 2024-2 form

Real-world examples illustrate the effective utilization of the OAG 2024-2 Non-Exempt Business Trust Form. For instance, a family-owned business used pdfFiller to create and submit their trust documentation, leading to smooth processing and compliance with state regulations.

Testimonials from users reveal how pdfFiller simplified the documentation process overall, reducing time constraints and enhancing accuracy in submissions. These insights not only encourage users but also emphasize the platform's effectiveness in managing intricate forms.

OAG 2024-2 Non-Exempt Business Trust Form updates and changes

With updates occurring periodically, staying informed about changes to the OAG 2024-2 form is crucial to maintain compliance. The 2024 version may feature newly established criteria or adjustments to existing guidelines, impacting how users fill out the document.

Users are encouraged to regularly check for amendments to the form and utilize tools like pdfFiller to ensure they adapt promptly. An integrated document management solution allows users to stay updated on compliance requirements seamlessly.

Interactive tools and features for enhanced document management

Interactive tools on platforms like pdfFiller offer enhanced features for managing the OAG 2024-2 form effectively. Users can take advantage of collaborative elements to facilitate team-based approach, ensuring all necessary information is captured before submission.

Additionally, integrated functionalities such as approval workflows and sharing capabilities enhance document management, allowing for a smoother and more efficient process in securing the necessary endorsements and completing submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my oag 2024-2 non-exempt businesstrust in Gmail?

How can I send oag 2024-2 non-exempt businesstrust to be eSigned by others?

Can I sign the oag 2024-2 non-exempt businesstrust electronically in Chrome?

What is oag 2 non-exempt businesstrust?

Who is required to file oag 2 non-exempt businesstrust?

How to fill out oag 2 non-exempt businesstrust?

What is the purpose of oag 2 non-exempt businesstrust?

What information must be reported on oag 2 non-exempt businesstrust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.