Get the free Meal Tax Bond Requirements

Get, Create, Make and Sign meal tax bond requirements

Editing meal tax bond requirements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out meal tax bond requirements

How to fill out meal tax bond requirements

Who needs meal tax bond requirements?

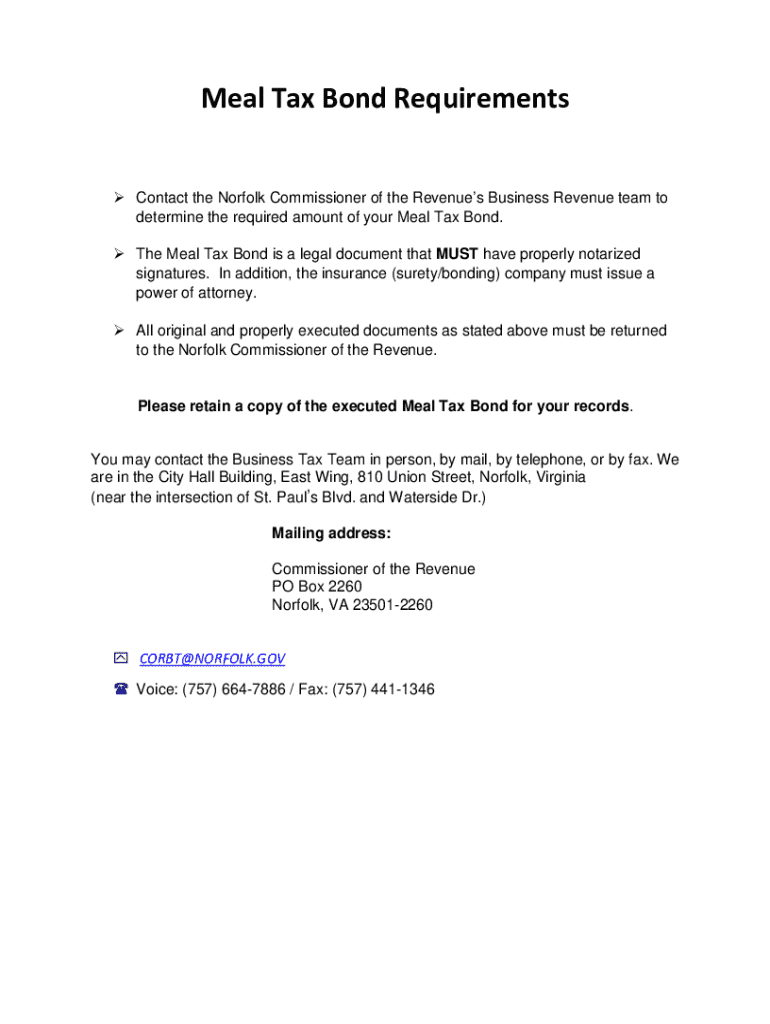

Understanding Meal Tax Bond Requirements Form

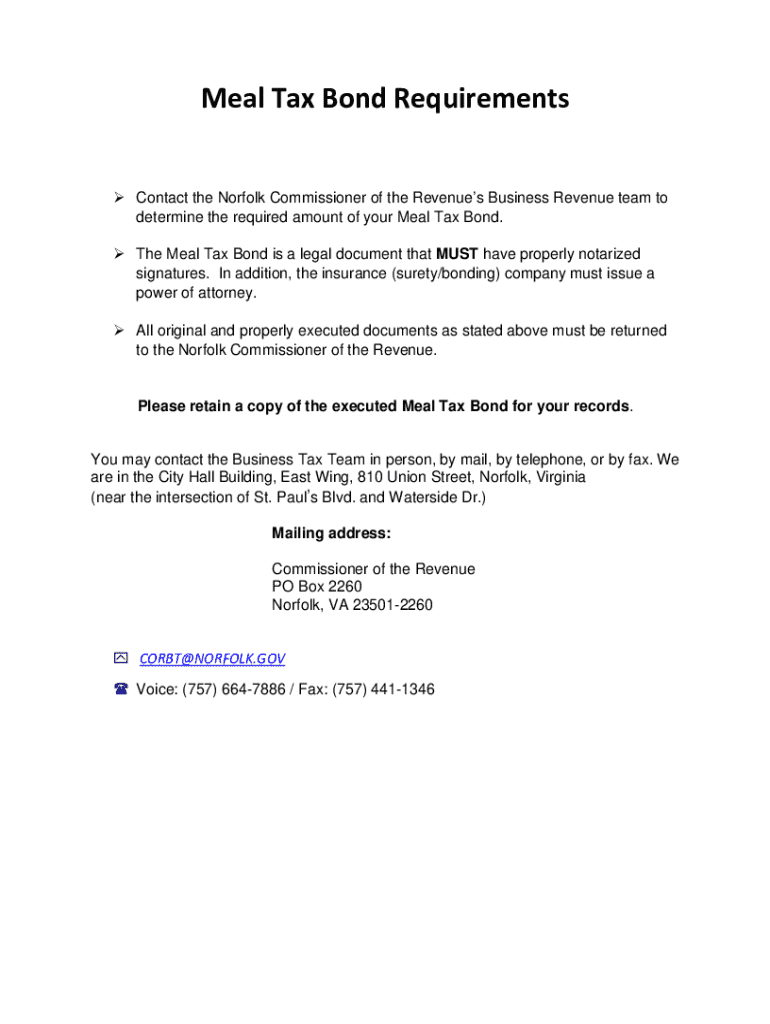

Understanding Meal Tax Bonds

A Meal Tax Bond is essentially a type of surety bond that serves to ensure compliance with state and local meal tax regulations within the food service industry. This bond acts as a financial guarantee that a restaurant, café, or any food provider will duly remit the collected meal taxes to the appropriate government authorities. Failure to comply can lead to financial penalties and legal ramifications, making this bond crucial for businesses that serve food and beverages.

The importance of Meal Tax Bonds cannot be overstated; they play a pivotal role in maintaining the integrity of tax revenue systems in the food service industry. By acting as a safety net, they help prevent tax evasion and ensure that funds collected from consumers are allocated for public services. The legal requirements for bonding vary by state but generally require businesses to secure a bond amount that corresponds with their projected meal tax revenues.

Who needs to file a meal tax bond?

A wide array of entities involved in the food service industry are required to file for a Meal Tax Bond. This includes but is not limited to:

Understanding who needs to file ensures that all stakeholders in the food service industry are compliant and aware of their obligations to manage meal taxes effectively.

Key requirements for meal tax bonds

The requirements for securing a Meal Tax Bond can differ significantly across states. However, some common elements prevail. Minimum bond amounts are generally specified by state regulations based on expected sales. In Rhode Island, for example, businesses might encounter specific bond thresholds that align with their revenue expectations.

Eligibility criteria for bond applicants usually entail demonstrating financial stability and a track record of compliance with tax statutes. Applicants are often required to submit financial statements and have their credit history reviewed. A solid credit score can facilitate quicker bond approval, while potential applicants with poor credit may face increased scrutiny or higher premium costs.

Steps to obtain a meal tax bond

Obtaining a Meal Tax Bond involves several essential steps:

Navigating these steps diligently can significantly improve the chances of obtaining a Meal Tax Bond without delays.

Common mistakes to avoid when filing for a meal tax bond

When filing for a Meal Tax Bond, several mistakes can hinder the process or lead to penalties. Common pitfalls include:

Taking time to double-check all submissions and seeking clarity on requirements can mitigate these risks significantly.

Managing your meal tax bond post-approval

After securing a Meal Tax Bond, ongoing management is essential to ensure continued compliance. Businesses should pay attention to renewal processes and timelines, as bonds typically have expiration dates. Keeping track of compliance requirements is also crucial, as local tax statutes can change over time.

Furthermore, businesses should proactively update their bond information if circumstances evolve, such as changes in ownership or significant operational shifts. Being proactive can prevent lapses in coverage that may expose the business to financial risks.

Utilizing pdfFiller for meal tax bond management

pdfFiller offers a suite of features for document creation and management that can significantly streamline the meal tax bond process. Users can create, edit, and securely eSign documents online, which simplifies compliance with state regulations.

With collaborative tools available, teams can work together seamlessly to prepare necessary documentation. Furthermore, pdfFiller's robust templates for Meal Tax Bonds can save time and ensure accuracy in submissions, enhancing overall efficiency.

FAQ section on meal tax bonds

Understanding common questions can help demystify the Meal Tax Bond process. Here are some frequently asked questions:

Addressing these FAQs can greatly enhance awareness and prepare businesses for potential challenges.

Case studies and testimonials

Real-life examples provide insight into the practicalities of securing a Meal Tax Bond. For instance, several restaurants in Rhode Island have shared success stories where having a Meal Tax Bond helped them efficiently manage tax obligations and avoid complications with local authorities.

Challenges faced often include gathering required documentation or navigating the bonding process. However, businesses that proactively educate themselves about these requirements successfully overcome these hurdles and continue functioning smoothly.

Interactive tools and resources

To assist new and ongoing applicants, a variety of interactive tools can streamline the meal tax bond application process. For businesses trying to ascertain exact bond amounts, a bond amount calculator can be beneficial. Additionally, it’s crucial to have links to state regulatory agencies that oversee meal tax bonds to ensure compliance with the latest updates.

A checklist for new applicants can help ensure that no critical steps are missed during the application and submission process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute meal tax bond requirements online?

How do I edit meal tax bond requirements in Chrome?

Can I create an eSignature for the meal tax bond requirements in Gmail?

What is meal tax bond requirements?

Who is required to file meal tax bond requirements?

How to fill out meal tax bond requirements?

What is the purpose of meal tax bond requirements?

What information must be reported on meal tax bond requirements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.