Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: A Comprehensive Guide for Companies

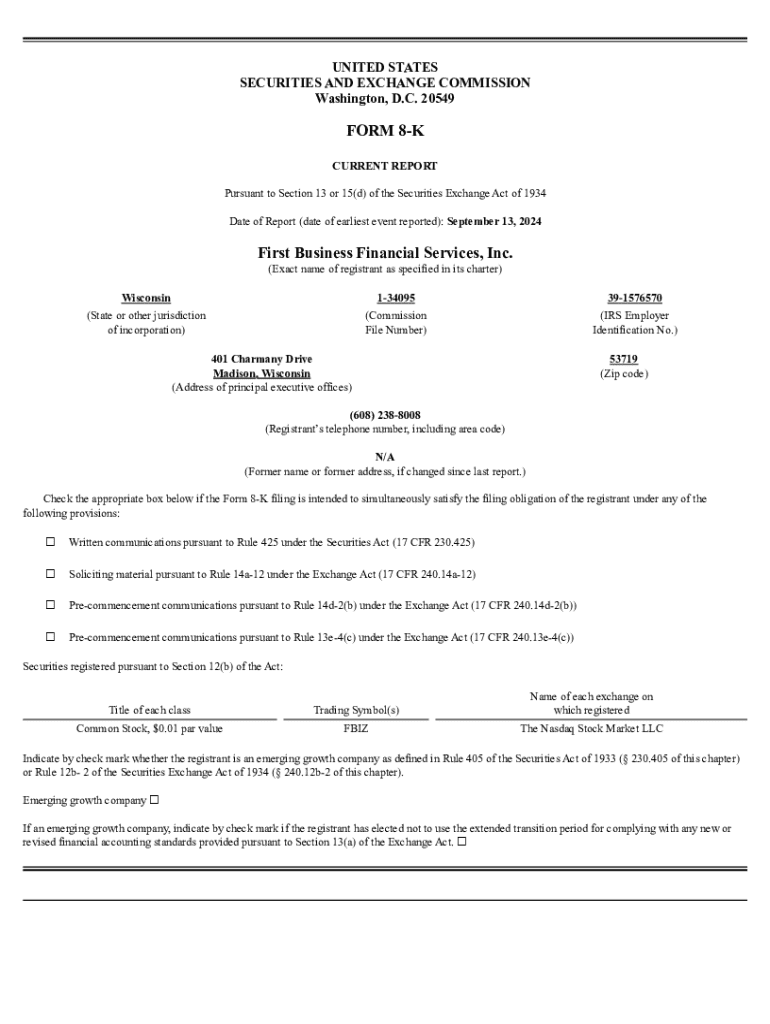

Understanding Form 8-K

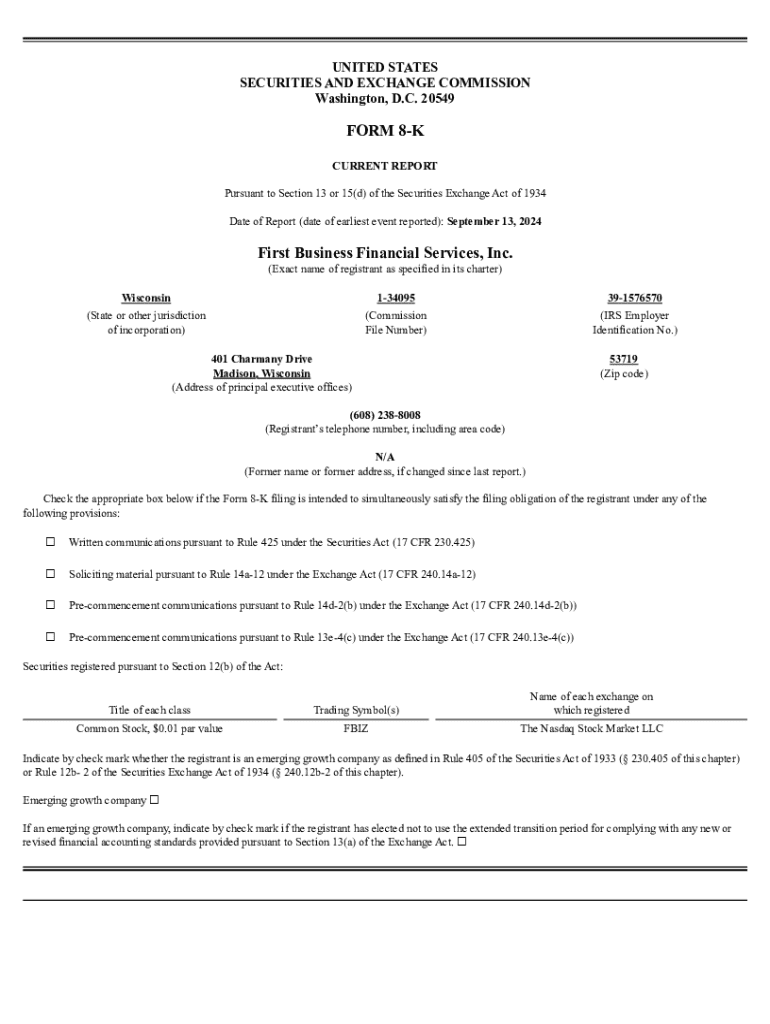

Form 8-K is a crucial document that publicly traded companies in the U.S. must file with the Securities and Exchange Commission (SEC). This form serves as a report of unscheduled material events or corporate changes that may be important for investors or regulators to be aware of in a timely manner. Its primary purpose is to ensure transparency and keep the market informed about developments that could affect a company's stock price.

The importance of timely disclosure through Form 8-K cannot be overstated. Investors rely on this report to make informed decisions, and as such, it plays a pivotal role in corporate governance. Moreover, a company's adherence to these filing requirements indicates its commitment to transparency and accountability.

Who needs to file Form 8-K?

Public companies with securities registered under Section 12 of the Securities Exchange Act of 1934 are required to file Form 8-K. This includes companies listed on major exchanges such as the NYSE or NASDAQ. Private companies, in contrast, are not subject to these regulations unless they are preparing to go public. The filing of Form 8-K is essential for public companies, as it ensures compliance with SEC regulations and helps maintain investor confidence.

Failure to file the Form 8-K on time can have serious repercussions, including potential penalties from regulatory authorities and a loss of trust from investors. As such, understanding who is obligated to file and maintaining strict adherence to the filing requirements is fundamental for public corporations.

Key triggers for filing Form 8-K

Certain events necessitate the filing of Form 8-K. These triggering events typically include significant corporate events such as mergers, acquisitions, or the resignation of key executives. Additionally, any material changes in financial condition, including defaults on loans or modifications in business operations, will trigger this form's filing. Regulations or legal matters that could have material effects on a company should also be disclosed via Form 8-K.

Timeliness is crucial when filing Form 8-K. Companies have a standardized deadline of four business days to file after a triggering event occurs. Late filings can lead to fines or greater scrutiny from investors and regulators, making it critical for companies to stay on top of these deadlines.

What must be disclosed in Form 8-K?

When preparing a Form 8-K, companies must ensure they provide comprehensive and accurate information related to the triggering event. This can include details about the event itself, financial implications, changes within corporate governance, and any subsequent actions planned. Specific language and formatting guidelines provided by the SEC must also be followed to avoid misunderstandings. Making this information accessible and clear to stakeholders is vital.

In special circumstances, a company may request confidential treatment for certain information disclosed in Form 8-K. This request must include adequate rationales for confidentiality, and the SEC provides a specific process for seeking approval. Companies need to pay careful attention to these guidelines to ensure optimal compliance.

Benefits of filing Form 8-K

Filing Form 8-K offers multiple benefits for companies, primarily in terms of enhancing transparency and building investor trust. Adhering to these filing obligations demonstrates a commitment to accountability, which can positively influence a company's reputation in the market. Investors appreciate timely updates, as they feel more informed and secure in their investment decisions.

Moreover, adhering to the SEC's regulations helps companies avoid potential penalties or sanctions associated with late or inaccurate filings. By staying compliant with Form 8-K requirements, companies can mitigate risks and focus on fostering strong relationships with stakeholders. Improved communication through 8-K filings also allows for better alignment and engagement between shareholders and management.

The filing process for Form 8-K

Filing Form 8-K involves several vital steps that ensure compliance with SEC regulations. The process begins with gathering the necessary information related to the material event being disclosed. Following this, companies must navigate through the SEC's EDGAR system to submit their form, which is designed to streamline electronic filings. Properly preparing the form requires understanding the specific formatting and structuring that the SEC requires.

Once submitted, it's crucial for companies to monitor the acknowledgment of receipt from the SEC. Additionally, maintaining clear record-keeping practices for all filings can aid in addressing any inquiries down the line—ensuring a well-organized approach to this critical compliance task.

Best practices for preparing your Form 8-K

To ensure accurate and effective disclosures when preparing Form 8-K, companies should prioritize clarity and conciseness in their communication. Avoiding jargon and unnecessary complexity can enhance comprehension for all stakeholders involved. Creating a standard operating procedure for members of the team responsible for 8-K filings can greatly reduce errors and inaccuracies during preparation.

Employing collaborative tools can also significantly enhance the efficiency of the filing process. Platforms like pdfFiller provide document management solutions that can streamline the preparation and submission phases. Collaborative methods within teams encourage input and consensus, ultimately leading to more comprehensive filings.

Interactive tools for Form 8-K management

Utilizing platforms like pdfFiller can drastically improve the filing experience for companies looking to manage their Form 8-K submissions. This cloud-based platform allows users to seamlessly edit PDFs, e-sign documents, and collaborate in real-time, reducing the friction typically associated with preparing important compliance documents.

Features available through pdfFiller empower users to streamline the preparation process, such as editing tools, customizable templates, and sharing functionalities. Version tracking can significantly enhance collaborative efforts within teams, allowing members to keep abreast of changes and maintain clear communication throughout the filing process.

Additional insights and resources

The landscape of Form 8-K filings continues to evolve, with current trends highlighting a greater emphasis on technology and automation in corporate reporting. Analyzing recent filings shows a move towards more comprehensive and standardized disclosures of material events, driven by investor demand for transparency and accuracy. This shift not only enhances the overall quality of filings but also reflects the growing importance of timely corporate communication.

For companies navigating these processes, understanding the frequencies and types of events filed can lead to improved best practices in their own disclosures. Engaging with resources available through platforms like pdfFiller can also provide valuable tools and insights for new and experienced filers alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8-k in Gmail?

How can I modify form 8-k without leaving Google Drive?

How do I edit form 8-k in Chrome?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.