Get the free Ilm Damage Claim

Get, Create, Make and Sign ilm damage claim

How to edit ilm damage claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ilm damage claim

How to fill out ilm damage claim

Who needs ilm damage claim?

Damage Claim Form - How-to Guide Long-read

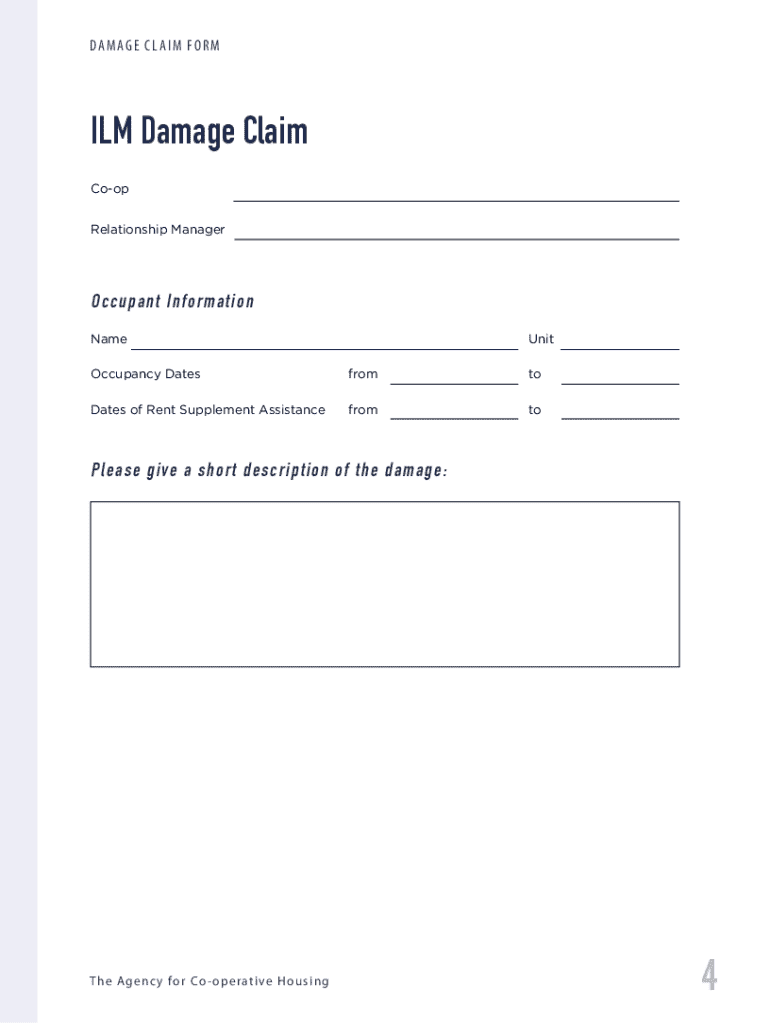

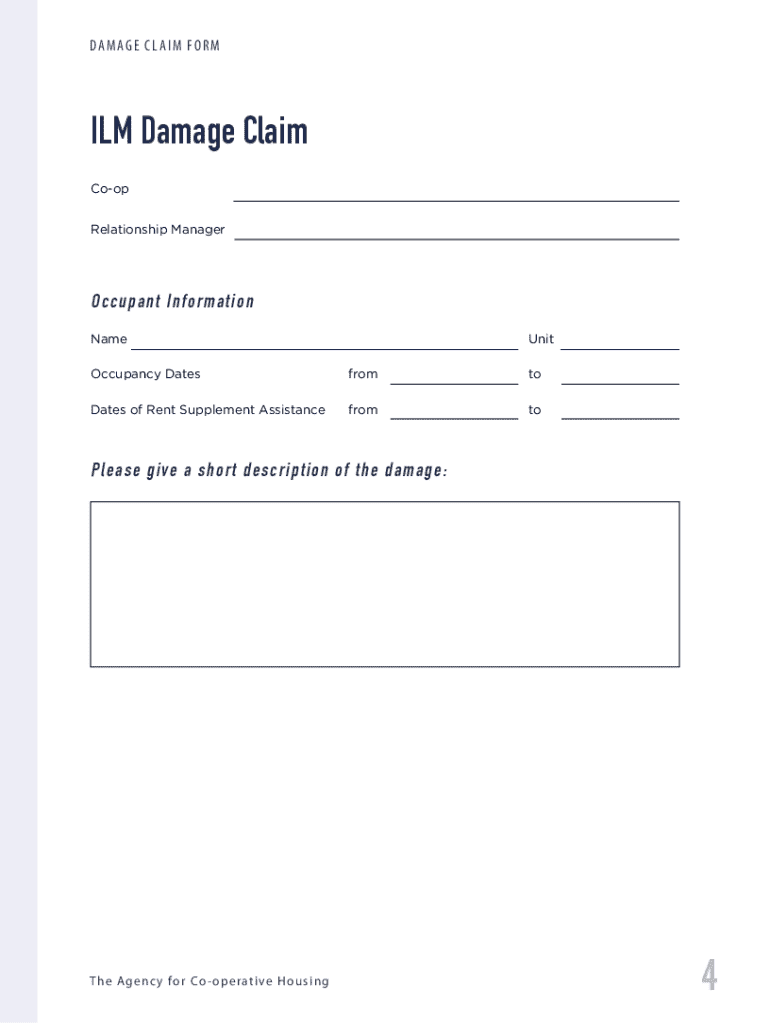

Understanding the Damage Claim Form

The ILM Damage Claim Form is a crucial document used in the claims process for individuals who have suffered damages covered under insurance policies related to motor vehicles, property, or other purchases. Its primary purpose is to facilitate a straightforward claims process, providing insurers with the necessary information to assess the claim, investigate the incident, and initiate compensation.

Filling out the ILM Damage Claim Form accurately is vital since it can significantly impact the speed and outcome of your claim. A properly completed form not only aids in the timely processing of your claim but also ensures that you present a complete picture of the damages incurred.

Who should use the Damage Claim Form?

The ILM Damage Claim Form is specially designed for individuals and teams who are seeking to claim damages covered by their insurance policies. This includes anyone who has experienced incidents such as auto accidents, property damage due to natural disasters, or any other unexpected events resulting in financial loss.

Common scenarios requiring the form include car accidents where your vehicle is damaged, home incidents such as fire or water damage, or general liability claims where personal injury occurred. Understanding your situation and knowing that the form is applicable can streamline the claims process.

Preparing to complete the Damage Claim Form

Before diving into filling out the ILM Damage Claim Form, it's essential to gather all necessary information. This begins with your personal details such as your name, address, contact information, and policy number. Companies often require detailed information directly associated with the incident which includes descriptions of the damage, the date the incident occurred, and the specific location where it took place.

Additionally, collecting supporting documentation is critical. This could include photographs of the damages, receipts for repairs, medical records, or any additional evidence that provides further context to your claim. Organizing this information in advance will save you time and ensure you don't overlook any critical details during the claim submission process.

Understanding the sections of the form

The ILM Damage Claim Form is structured into key sections that guide users in providing the required information systematically. Breaking down each section will highlight its significance: - Personal Information: This section collects details to identify the claimant and the policyholder. Accuracy in this section is vital to prevent delays. - Incident Details: This requires a comprehensive account of what led to the damage incident. Specificity here can help in quicker investigation and processing. - Damage Description: Elaborating on the damages incurred is essential for the assessment of claims. Be as thorough as possible. - Supporting Evidence: This section allows you to attach all necessary documentation that corroborates your claim.

Filling each section thoroughly bolsters your case, ensuring that the insurer has all pertinent details to consider during the assessment phase.

Step-by-step guide to filling out the Damage Claim Form

Step 1: Completing your personal information

Start by entering your personal information clearly and accurately. Ensure your name spelled correctly, double-check the contact details, and make certain that your policy number matches what your insurance document states. This information allows the claims department to quickly identify your account in their system.

Step 2: Documenting the incident

Provide a narrative of the incident leading to your claim. Detail the events leading up to the disaster or accident in chronological order. Avoid vagueness — provide timestamps and conditions that contributed to the event. Clarity is crucial.

Step 3: Detailing damage description

Be explicit when describing the damage. Instead of stating 'the car was damaged,' specify 'the front bumper was crushed in a collision, causing a dent of approximately six inches.' Such specificity helps insurance adjusters assess damages accurately.

Step 4: Attaching supporting documentation

Compile your supporting documents neatly. Organize photos, receipts, and any relevant paperwork sequentially, referencing each in your claim. Use clear labels to highlight what each document substantiates.

Step 5: Reviewing the completed form

Before submitting, thoroughly review the completed form. Mistakes or overlooked details may lead to delays or rejection. Cross-check against your original documentation to ensure all information aligns and is represented correctly.

Interactive tools to assist with the Damage Claim Form

Using pdfFiller’s editing features

pdfFiller simplifies the process of completing the ILM Damage Claim Form with its intuitive editing tools. Users can edit PDF documents seamlessly, allowing for easy adjustments to the form as new information arises. Having access to this functionality can streamline your claims process, enabling you to make any necessary corrections uncomplicating the submission.

eSigning your claim form

Utilizing pdfFiller for secure electronic signatures enhances convenience. eSigning allows you to sign documents from any location, anywhere access is available, ensuring prompt submission of your claim. This modern process eliminates delays associated with traditional pen-and-paper signatures, making it a preferable choice in today's digital age.

Submitting your Damage Claim Form

Choosing the right submission method

When it comes to submitting the ILM Damage Claim Form, you may choose between email submission or physical mail. Each method has its advantages and disadvantages. Submitting electronically via email allows for instant delivery and reduces the chances of your document being lost in transit. On the contrary, physical submission may feel more traditional, but it may result in longer response times.

Tracking the status of your claim

After submission, monitoring your claim’s status is essential. Many insurers provide tracking systems to follow up on your submission. Familiarizing yourself with these resources can help you understand what to anticipate in terms of timelines for resolution. Don’t hesitate to contact your insurer if updates take longer than expected.

Common challenges and solutions

Handling rejections or requests for more information

It’s not uncommon for claims to get rejected or for insurers to request additional information during processing. If you encounter this, carefully read any correspondence for the specific reasons and address each point proactively. Providing necessary documentation or clarification can often resolve the issues efficiently.

Understanding timeframes for claims processing

Claims processing times can vary significantly among insurers, often taking anywhere from a few days to several weeks. Understanding typical timelines can set realistic expectations and alleviate stress. If applicable, inquire if there are methods to expedite your claim, ensuring you present any urgent circumstances convincingly.

Frequently asked questions about the Damage Claim Form

Addressing common queries regarding the ILM Damage Claim Form can provide clarity. If you don't have all necessary documentation at the time of completing the form, provide as much information as possible and detail what is still pending. Regarding appeals for denied claims, it's vital to understand your insurer's appeal process, which generally requires submitting new evidence that supports your case. Lastly, adhere to submission deadlines as insurers typically impose strict timeframes to submit claims post-incident.

Final tips for successfully navigating the Damage Claim process

Enhancing your claim's success requires careful attention to detail throughout the process. Ensure every aspect of the ILM Damage Claim Form is filled out accurately, and maintain organized records of all documentation and communications with your insurance provider. Utilizing pdfFiller’s features allows for a seamless management experience, ensuring you can always revisit and edit your documents as needed.

Building a reliable document management system

In the realm of document management, selecting the right tools can make all the difference. Cloud-based solutions, such as pdfFiller, support better collaboration and organization, allowing users to manage their documents efficiently. This platform not only simplifies edits but enables real-time collaboration, ensuring seamless access to critical documents when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ilm damage claim from Google Drive?

How can I get ilm damage claim?

How do I execute ilm damage claim online?

What is ilm damage claim?

Who is required to file ilm damage claim?

How to fill out ilm damage claim?

What is the purpose of ilm damage claim?

What information must be reported on ilm damage claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.