Get the free How can I pay my reinstatement fees? - State of Tennessee

Get, Create, Make and Sign how can i pay

How to edit how can i pay online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how can i pay

How to fill out how can i pay

Who needs how can i pay?

How Can Pay Form: A Comprehensive Guide

Understanding the pay form process

A pay form is an essential document used to facilitate transactions, enabling users to submit payments securely and efficiently. Typically, these forms are utilized for various purposes, including tax payments, online purchases, or settling service bills. For taxpayers, a pay form helps mitigate complexities associated with personal income tax return payments and ensures timely remittances to the tax department. The significance of a pay form cannot be understated; using it properly reduces the risk of tax scams and ensures that financial obligations are accurately recorded.

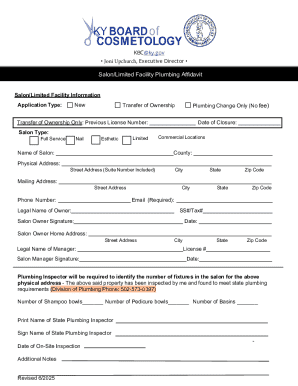

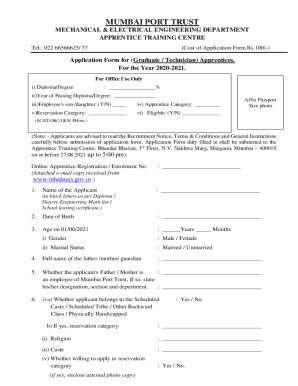

Preparing to use a pay form

Preparing to fill out a pay form involves collecting all necessary information beforehand. This preparation minimizes errors and facilitates smoother transactions. Essential personal identification details include your name, address, and social security number, particularly important when dealing with tax payments. Payment details should include your bank account or credit/debit card numbers, ensuring you have easy access to these documents. Always check if any additional documentation is needed for certain transactions.

When it comes to choosing a payment method, it’s vital to understand the options available. Credit/Debit cards are commonly accepted and provide instant transaction confirmation, making them a preferred choice for many users. Alternatively, bank transfers offer a sense of security. Lastly, eChecks are becoming increasingly popular for electronic transactions. Evaluate each method based on your needs, preferences, and the specific payment context.

Step-by-step guide on how to pay with a pay form

The first step in using a pay form is navigating to the appropriate page on pdfFiller. You can easily find this by searching for the pay form you need, or by accessing your account if you’re a registered user. The pdfFiller platform is designed to enhance your user experience through a variety of features, such as intuitive navigation and easy document access.

Once on the appropriate page, filling out the pay form is relatively straightforward. Start with the personal information section, ensuring that every detail is accurate and up-to-date. Next, input your payment details carefully, as discrepancies can lead to payment processing delays. If there are any additional instructions mentioned on the form, be sure to adhere to them closely.

After completing the form, take a moment to review your payment information. Create a checklist to ensure all parts of the form are filled correctly. Verifying your entries is crucial to prevent unfortunate delays in processing your payment, especially when it concerns things like income tax return payments or urgent bills.

Submitting your payment

Once you are confident that your pay form is completed accurately, you can submit it through the pdfFiller platform. The submission process is streamlined for user convenience; simply follow the on-screen instructions to finalize your payment. You also have the option to save or print your pay form, which can be beneficial for future reference or record-keeping.

After submission, you will receive a confirmation regarding the status of your payment. Most payment methods provide instant feedback, while others may take additional time. To keep track of your payment status using pdfFiller, utilize the tracking options available within your user dashboard or through notifications sent via email.

Issues you might encounter

Despite careful preparation and execution, errors can occur during the payment process. One common issue is insufficient funds, which may prevent a transaction from processing successfully. Should you face entry errors in your pay form, pdfFiller provides features to correct information easily before submitting. Always double-check all entries to minimize such errors.

If your payment fails, it’s crucial to troubleshoot effectively. Start by reviewing your entries and payment methods, then double-check your account status. If problems persist, contacting pdfFiller support can provide necessary assistance. They are equipped to handle various inquiries related to payment forms and ensuring seamless processing.

Enhancing your document management experience

Utilizing pdfFiller not only aids in processing your pay forms but also significantly enhances document management. Users can save and organize multiple pay forms on the cloud, providing easy access from anywhere. Additionally, team collaboration features allow for efficient management of shared forms, particularly valuable in team environments such as businesses or organizations handling payments collectively.

Moreover, pdfFiller seamlessly integrates eSignature features, allowing users to sign forms digitally without the need for printing. The platform’s editing capabilities further ensure that adjustments can be made quickly and efficiently, particularly beneficial in times of change or unexpected requirements.

Resources for further assistance

If you encounter difficulties while completing your pay form, pdfFiller offers extensive online support options. Their website provides FAQs that cover common issues related to pay forms, ensuring users have access to valuable resources at their fingertips. Whether you’re facing issues or looking for guidance, these resources can be instrumental in resolving concerns.

For personalized assistance, consider reaching out to pdfFiller’s customer service. Their team can assist with specific inquiries or technical problems, ensuring your experience remains smooth and satisfactory.

Conclusion

Successfully managing your pay forms through pdfFiller can simplify financial transactions considerably. By following the steps outlined in this guide, users can ensure that they handle payments efficiently, whether for personal bills or tax obligations. The convenience offered by a digital platform allows flexibility and security, empowering users to engage confidently with their financial responsibilities.

By taking advantage of pdfFiller’s capabilities, individuals and teams can navigate pay forms with ease, making the payment process less daunting. Engage with your payments through pdfFiller—efficient, straightforward, and accessible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit how can i pay from Google Drive?

How can I send how can i pay to be eSigned by others?

Can I create an electronic signature for signing my how can i pay in Gmail?

What is how can i pay?

Who is required to file how can i pay?

How to fill out how can i pay?

What is the purpose of how can i pay?

What information must be reported on how can i pay?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.