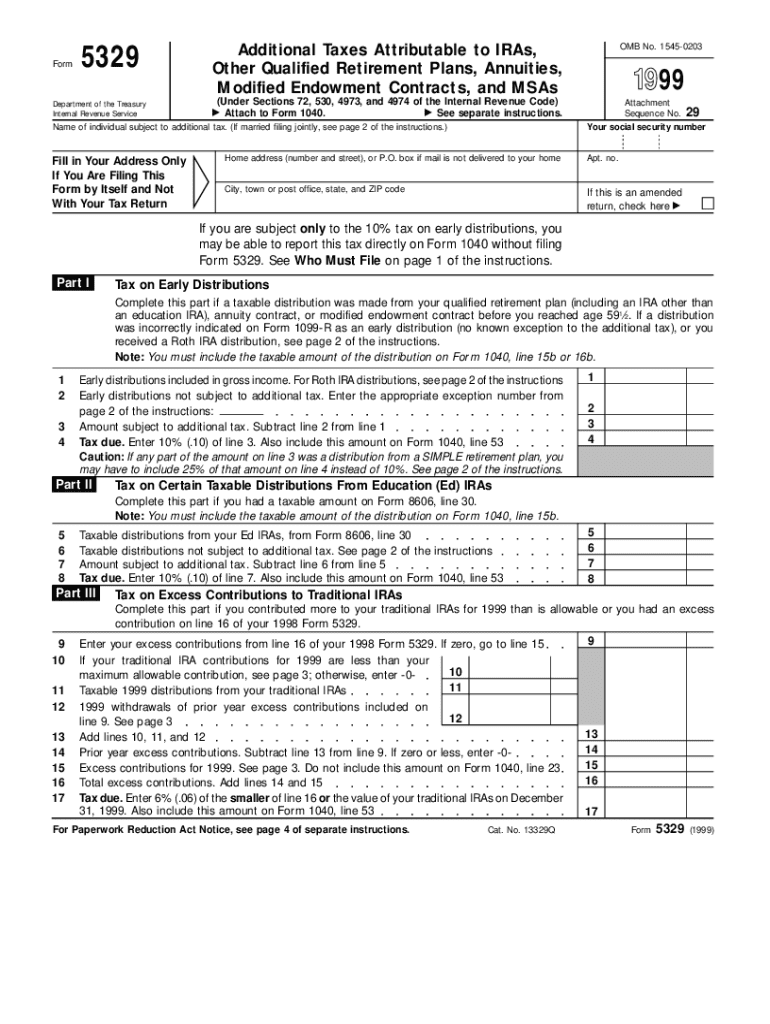

Get the free Form 5329

Get, Create, Make and Sign form 5329

Editing form 5329 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5329

How to fill out form 5329

Who needs form 5329?

Form 5329: A Comprehensive How-to Guide

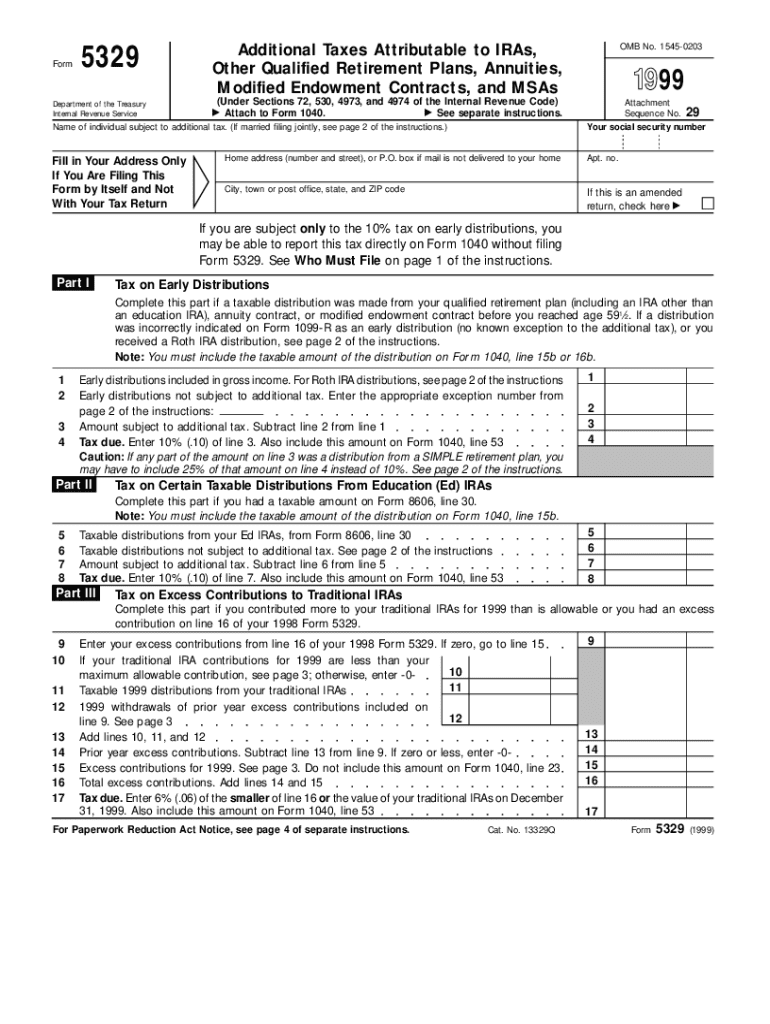

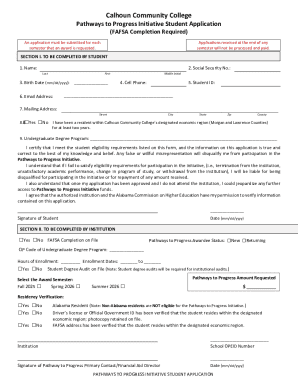

Understanding Form 5329

Form 5329 is a tax form that helps you report additional taxes on distributions from retirement plans and other tax-favored accounts, including education savings accounts (ESAs). This form ensures compliance with IRS regulations regarding penalty assessments for early distributions or excess contributions from retirement plans, traditional IRAs, and others. By correctly filing Form 5329, taxpayers can address any penalties they might owe and ensure they are reporting their retirement plan activities accurately.

The importance of Form 5329 cannot be overstated, particularly since non-compliance can lead to significant financial penalties. Whether you need to report additional taxes due to early distribution withdrawals or excess contributions, understanding the nuances of this form is crucial for maintaining good standing with tax obligations.

Who needs to file Form 5329?

Individuals or teams that have taken early distributions from retirement accounts or contributed excess funds to an individual retirement account (IRA) will typically need to file Form 5329. Scenarios that necessitate the filing of this form include:

Key sections of Form 5329

To ensure accurate reporting, understanding the structure of Form 5329 is essential. The form is divided into various parts, each addressing different tax situations associated with retirement accounts. Here's a breakdown of the key sections:

Each part will require specific data entry, which can be further explored through the detailed instructions provided by the IRS. Correctly navigating these sections will help in ensuring compliance and minimizing any penalties associated with incorrect filings.

Instructions for completing each section

Completing Form 5329 requires careful attention to detail. Here's a step-by-step guidance for the four main parts:

Common mistakes to avoid

While filing Form 5329, certain common mistakes can lead to erroneous tax filings, thereby increasing potential penalties. Familiarizing yourself with these pitfalls can save you time and money:

By being aware of these mistakes and actively working to prevent them, you can navigate the complexities of tax compliance more efficiently.

Special situations and exceptions

Understanding the exceptions related to additional tax on early distributions and excess contributions can be critical for taxpayers. Many individuals may qualify for exemptions based on specific circumstances. Common exceptions to the additional tax include:

When claiming exceptions, it's important to gather the necessary documentation to support your claims. This may include medical records, education expenses, or any other relevant records as mandated by the IRS.

Example scenarios

Consider a scenario where an individual withdraws funds from their retirement plan to cover medical expenses. If these expenses qualify as significant medical expenses, the individual can claim an exception on their Form 5329 to avoid the additional tax.

Filling out and submitting Form 5329

When filling out Form 5329, attention to detail is paramount. To ensure accuracy, consider the following guidelines:

After completing the form, it’s essential to submit it correctly. You have several options for filing Form 5329:

Interactive tools available on pdfFiller

pdfFiller offers a suite of interactive tools designed to streamline your document management processes related to Form 5329. Featuring collaborative capabilities, users can efficiently manage forms with teams, ensuring all inputs are tracked and modifications are made in real time.

By leveraging these interactive tools, users can improve their productivity and maintain an organized workflow, especially when handling sensitive forms like Form 5329.

FAQs about Form 5329

As families and individuals navigate the complexities of Form 5329, several common queries arise. Understanding these questions can provide clarity when filing this form:

Having answers to these questions helps individuals remain informed and compliant with their tax obligations.

Staying updated with tax regulations

Tax laws are not static; they often change, particularly regulations affecting Form 5329 and related tax obligations. It's vital for taxpayers to remain informed on these changes, which could impact their filing requirements and potential exceptions.

By keeping abreast of tax laws, taxpayers can proactively adapt their strategies and reduce the risk of non-compliance.

About pdfFiller

pdfFiller is a powerful document management platform designed to empower users with tools for editing, eSigning, and managing forms like Form 5329. The company strives to simplify complex processes, allowing individuals and businesses to effectively handle their tax obligations with ease.

Utilizing pdfFiller for managing Form 5329 not only facilitates accurate form completion but also enhances collaboration across teams, ensuring that all necessary information is captured effectively. User testimonials highlight improved efficiency and satisfaction with the flexible solutions provided by the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 5329 online?

Can I edit form 5329 on an iOS device?

How do I fill out form 5329 on an Android device?

What is form 5329?

Who is required to file form 5329?

How to fill out form 5329?

What is the purpose of form 5329?

What information must be reported on form 5329?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.