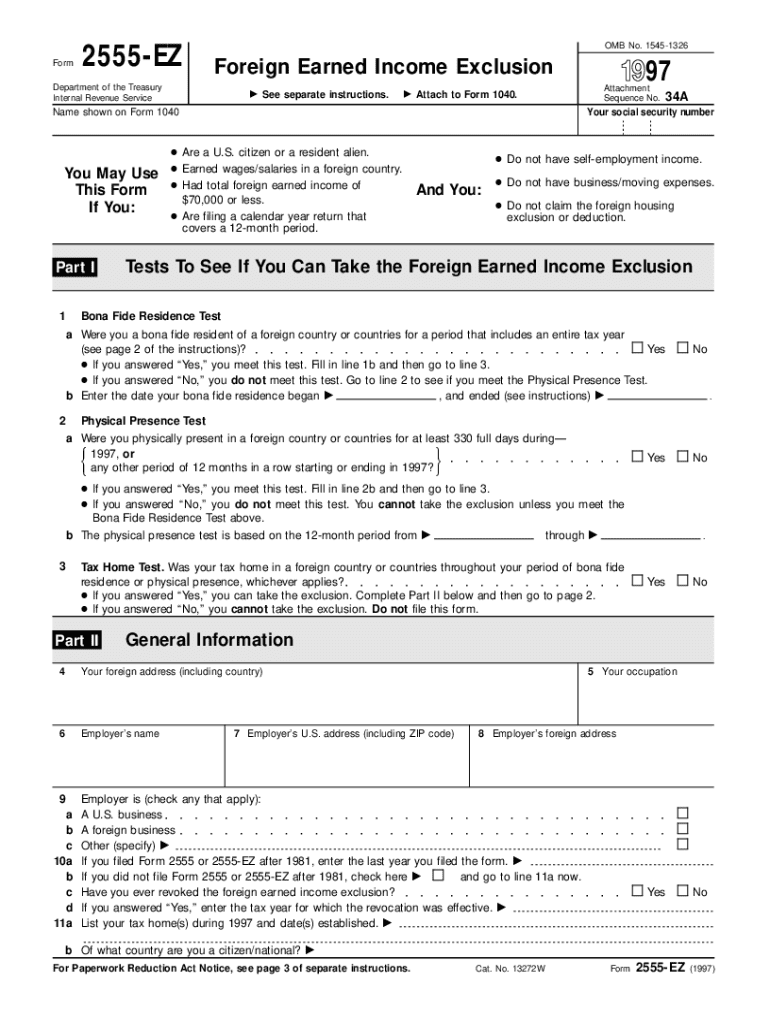

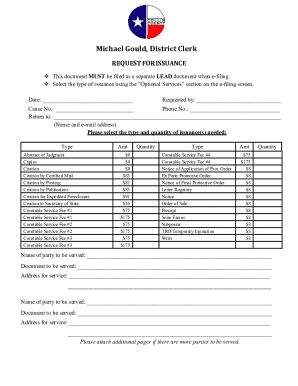

Get the free Form 2555-ez

Get, Create, Make and Sign form 2555-ez

Editing form 2555-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 2555-ez

How to fill out form 2555-ez

Who needs form 2555-ez?

A comprehensive guide to Form 2555-EZ for American expats

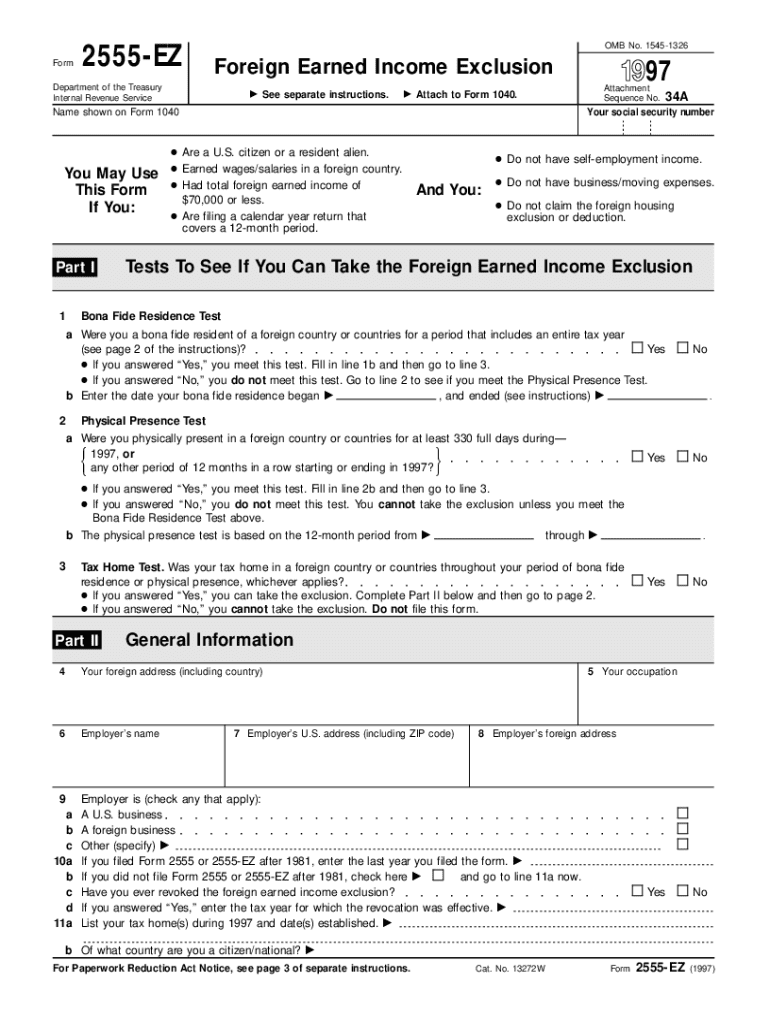

Understanding Form 2555-EZ

Form 2555-EZ is a simplified version of the IRS Form 2555, designed specifically for eligible American citizens living and working abroad. This form allows expats to exclude certain foreign earned income from their taxable income, making it a useful tool in minimizing their U.S. tax liabilities. By using Form 2555-EZ, filers can navigate the complexities of foreign income tax more easily compared to the standard Form 2555.

The key difference between Forms 2555 and 2555-EZ lies in the eligibility requirements and the complexity of information required. Form 2555-EZ is intended for individuals with straightforward foreign income, while Form 2555 accommodates more complicated scenarios, including those with self-employment income or those claiming deductions for housing expenses.

Eligibility criteria for using Form 2555-EZ

Before considering Form 2555-EZ, it's essential to understand the eligibility criteria. You must be a U.S. citizen or a resident alien living outside the United States to qualify. Moreover, your foreign earnings must not exceed certain limits, which cap the amount eligible for exclusion annually.

Two tests determine your eligibility: the Bona Fide Residence Test and the Physical Presence Test. The Bona Fide Residence Test requires that you establish residency in another country for an entire tax year, while the Physical Presence Test focuses solely on the number of days you are physically in a country.

What income does Form 2555-EZ cover?

Form 2555-EZ allows you to exclude foreign earned income, which can include wages, salaries, and professional fees earned while living and working outside the U.S. It's crucial to realize, however, that not all forms of income are eligible. For instance, income derived from U.S. sources or rental properties located in the U.S. does not qualify for exclusion.

One must ensure to analyze the specific income streams to grasp what is included. An example scenario might involve a U.S. citizen teaching at an international school in England, receiving a salary that qualifies for exclusion but struggling with the complications of filing taxes in both countries.

Benefits of using Form 2555-EZ

Using Form 2555-EZ provides pivotal tax benefits for American expats. The most pronounced advantages include the exclusion of up to $108,700 in foreign earned income, reducing taxable income significantly and potentially lowering tax bills. Moreover, using this streamlined form can save time and effort in completing your taxes.

Compared to the standard Form 2555, the EZ version simplifies the process, allowing filers to complete their forms quicker. The intricate calculations and additional schedules required for Form 2555 are minimal or absent entirely, reducing the workload significantly for those eligible.

Step-by-step guide to completing Form 2555-EZ

Completing Form 2555-EZ can be straightforward if you follow these steps carefully. Below is a detailed guide to assist you in the filing process:

Essential tips for successfully filing Form 2555-EZ

Filing Form 2555-EZ can pose challenges, but a few essential tips can streamline your process:

What if you're behind on filing Form 2555-EZ?

Missing deadlines for filing Form 2555-EZ can lead to significant penalties or issues with the IRS. If you find yourself behind, understanding the repercussions is vital for rectifying the situation. Late filings may incur penalties or interest charges, making it pressing to address immediately.

Options for rectifying past mistakes include filing an amended return if necessary, and paying any due taxes as quickly as possible to lessen penalties. For those who haven't filed in several years, consider consulting with a tax professional who specializes in expatriate tax issues to explore your options.

Key deadlines for filing Form 2555-EZ

Understanding deadlines is crucial when dealing with Form 2555-EZ. Generally, the deadline for filing this form aligns with the standard U.S. tax deadline, which falls on April 15. However, expats are entitled to an automatic extension until June 15, providing extra time for filing.

It’s essential not to overlook these dates — failure to submit your form on time may exacerbate issues with the IRS and complicate your tax situation.

Real-life expat scenarios: How Form 2555-EZ works

Examining real-life scenarios helps contextualize the application of Form 2555-EZ. For instance, one might observe a dual citizen living in Canada, earning a substantial salary that falls below the exclusion limit, allowing them to potentially pay zero U.S. taxes.

Enhancing your document management experience with pdfFiller

Managing forms like the Form 2555-EZ can be made seamless with pdfFiller's powerful tools. This cloud-based platform not only allows users to edit and eSign documents but also provides collaboration features for teams working on tax filings.

The interactive features of pdfFiller streamline the entire documentation process, ensuring that you can easily adjust and manage your tax forms as needed, from anywhere.

Final thoughts: Navigating your tax obligations efficiently

Successfully navigating the waters of tax obligations as an expat mandates understanding the nuances of Form 2555-EZ. To wrap up, it is crucial to recognize the valuable tax benefits available through smart use of this form and to remain diligent in filing accurately and on time.

Utilizing tools like pdfFiller not only simplifies the process but empowers users to manage their tax documents efficiently, ensuring compliance and minimizing stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 2555-ez from Google Drive?

Can I create an eSignature for the form 2555-ez in Gmail?

How do I fill out the form 2555-ez form on my smartphone?

What is form 2555-ez?

Who is required to file form 2555-ez?

How to fill out form 2555-ez?

What is the purpose of form 2555-ez?

What information must be reported on form 2555-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.