Get the free Institutional investors may now hold a larger stake in ...

Get, Create, Make and Sign institutional investors may now

Editing institutional investors may now online

Uncompromising security for your PDF editing and eSignature needs

How to fill out institutional investors may now

How to fill out institutional investors may now

Who needs institutional investors may now?

Institutional investors may now form

Overview of institutional investors

Institutional investors serve as cornerstone entities within the financial market, wielding significant influence due to their substantial capital reserves. Defined as organizations that invest large sums of money on behalf of clients, these investors play a pivotal role in providing liquidity and stability in the marketplace.

The landscape of institutional investing includes various types, among which pension funds, insurance companies, mutual funds, and hedge funds are prominent. Each type differs not only in its investment strategy but also in its regulatory environment and client obligations.

The importance of institutional investors in the financial market cannot be overstated. They not only enhance market efficiency through their ability to absorb large trades but also exert a stabilizing influence during periods of volatility.

Evolution of institutional investment practices

Historically, institutional investing has undergone significant transformations influenced by market dynamics and regulatory changes. In the earlier decades, investment strategies were often conservative, focusing on bonds and blue-chip equities. However, the 2000s witnessed an increase in alternative investments, notably hedge funds, spurred by the search for higher returns.

Recent regulatory changes, such as the Dodd-Frank Act in the U.S., have further reshaped institutional investment practices. These regulations promote transparency and risk management, compelling institutional investors to adopt more rigorous compliance frameworks while also fostering opportunities for collaborative investments.

Advantages of forming institutional investor groups

The ability to form institutional investor groups presents multiple advantages. Collaborative investment opportunities arise as institutions pool resources, allowing them to tap into broader markets and diversified asset classes. This strategy not only enhances potential returns but also mitigates individual investment risks through diversification.

Moreover, by banding together, institutional investors significantly enhance their negotiation power. Collective bargaining can lead to improved terms on fees and better pricing on investments. This collaboration also grants access to resources and expertise that individual investors might lack, fostering a richer investment environment.

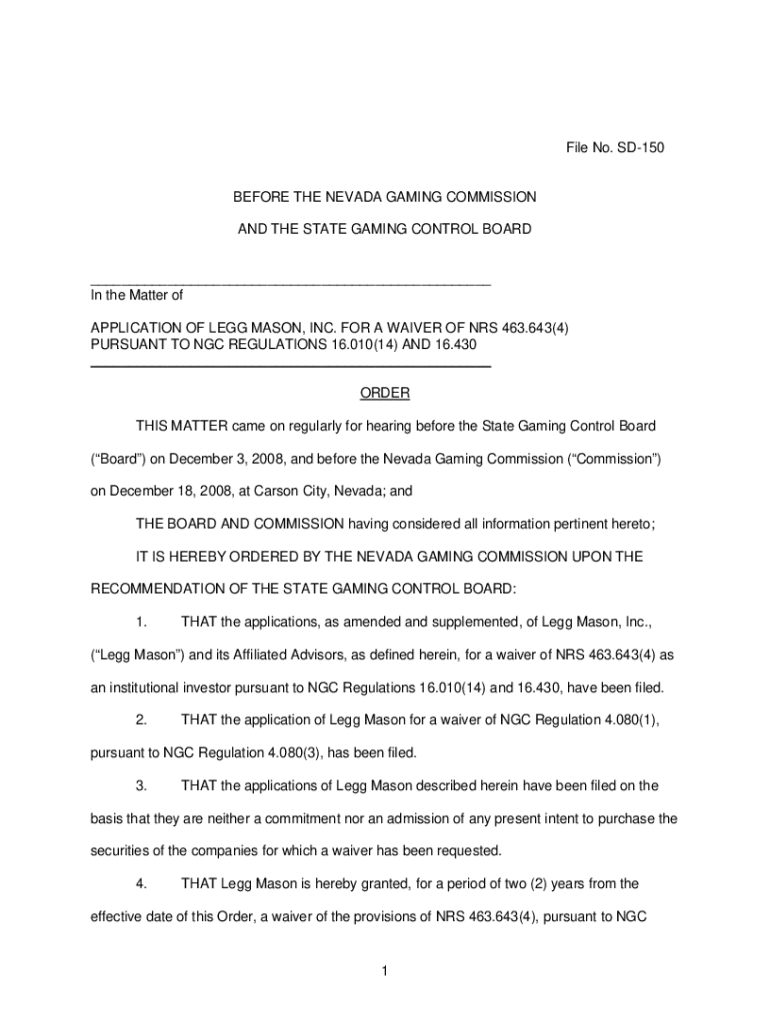

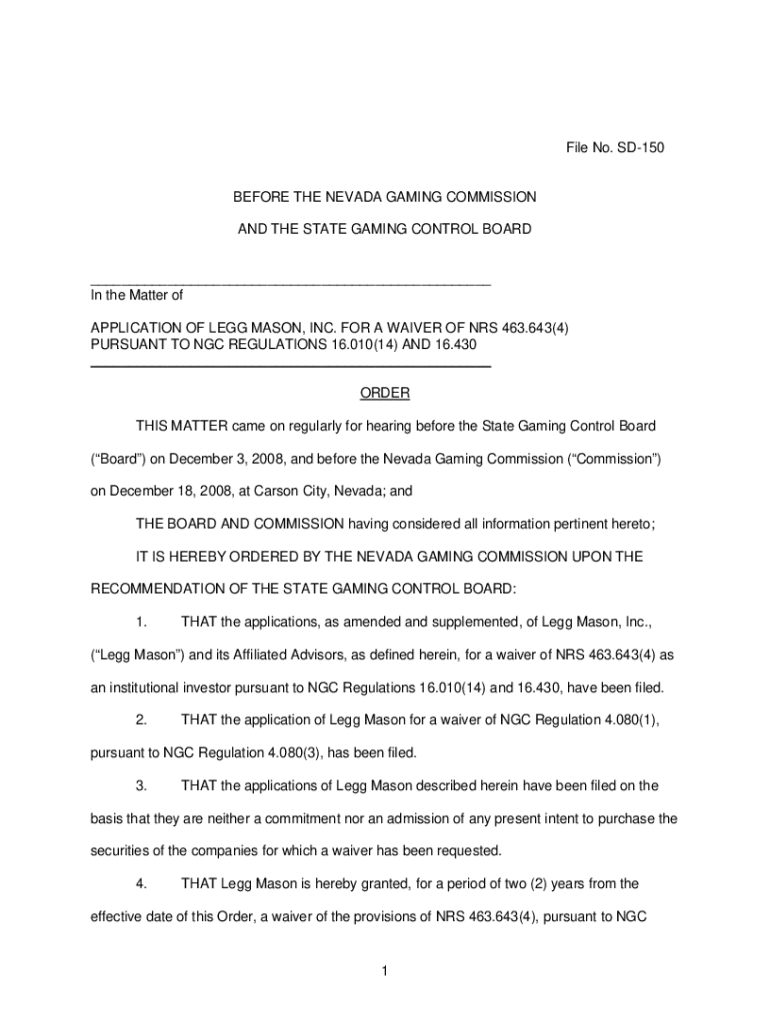

Legal framework for institutional investors

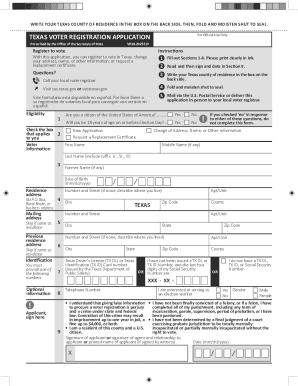

Forming an institutional investor group requires a robust understanding of the legal framework that governs investment activities. Regulatory requirements play a crucial role in how these groups operate, mandating compliance with securities laws and the Investment Company Act. Organizations must navigate various regulations that dictate their investment practices and reporting obligations.

Legal considerations such as group formation agreements are essential to delineate roles, responsibilities, and liabilities. Establishing a clear framework surrounding liability and risk sharing ensures that all parties involved are sufficiently protected against potential downturns and obligations.

Forming an institutional investor group: step-by-step guide

1. Identifying common goals and objectives: Begin by aligning underlying investment strategies and establishing a shared vision for the group. Define what members aim to achieve together, whether that's exploring new asset classes or collaboratively participating in larger deals.

2. Researching potential partners: Assess potential partners by evaluating their financial strength and stability, ensuring they share similar investment philosophies. Additionally, consider cultural fit and governance structures to promote harmony within the group.

3. Structuring the group: Decide on the formation model that best suits the objectives, whether a joint venture, partnership, or another structure. Establish a governance framework and a clear decision-making process to ensure efficiency.

4. Developing investment policies: Draft comprehensive investment policies that outline the group’s strategy, risk tolerance, and return expectations. Transparent policies help maintain focus and ensure adherence to group objectives.

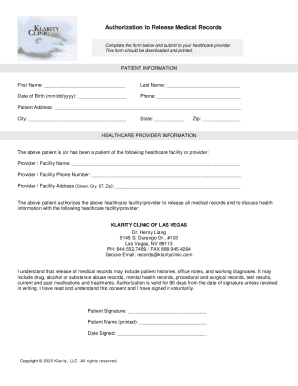

5. Implementing operational processes: Choose appropriate service providers such as custodians or fund administrators. Establish robust reporting and monitoring mechanisms to track investments and ensure compliance.

Tools and technologies for institutional investors

An integrated document management system is pivotal for institutional investors. Tools like **pdfFiller** streamline document creation and collaboration, enabling seamless editing, signing, and management of investment group agreements. With capabilities to handle complex paperwork efficiently, institutional investors can focus more on strategic decision-making rather than administrative overhead.

Moreover, utilizing technology for compliance and reporting can significantly simplify operations. Investment management software and data analytics tools help monitor performance, assess risks, and ensure regulatory compliance, all crucial for maintaining investor trust and operational integrity.

Best practices for managing institutional investor groups

Establishing clear communication channels is fundamental for the success of institutional investor groups. Regular meetings, updates, and reports help ensure all members remain engaged and informed, fostering a collaborative environment conducive to strategic alignment.

Continuous assessment and performance evaluation are essential in adapting to changing market conditions. By regularly reviewing group performance against set goals, the group can make informed adjustments to investment strategies, ensuring resilience and sustained growth.

Future prospects for institutional investors

The future of institutional investing will undoubtedly be shaped by emerging trends such as technology integration and a growing focus on sustainable investing. Digital transformation continues to influence investment processes, leading to more efficient operations and improved access to global markets.

Predicting the impact of technology on investor collaboration, it is evident that enhanced data sharing and analytical tools will lead to smarter, more informed investment decisions. Furthermore, the rising demand for environmental, social, and governance (ESG) criteria will encourage institutional investors to incorporate sustainability into their strategies, appealing to a broader base of investors committed to ethical investing.

Tailored positioning for pdfFiller

**pdfFiller** plays a crucial role in facilitating the documentation process for institutional investors looking to form groups. By enabling seamless editing, signing, and management of investment group agreements, **pdfFiller** ensures that all necessary paperwork is efficiently handled.

The cloud-based platform simplifies collaboration among institutional investors, making it easier to access and manage essential documents from anywhere. This allows investment groups to remain agile, responsive to market changes, and maintain compliance without sacrificing time on administrative tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit institutional investors may now from Google Drive?

How do I make edits in institutional investors may now without leaving Chrome?

Can I create an eSignature for the institutional investors may now in Gmail?

What is institutional investors may now?

Who is required to file institutional investors may now?

How to fill out institutional investors may now?

What is the purpose of institutional investors may now?

What information must be reported on institutional investors may now?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.