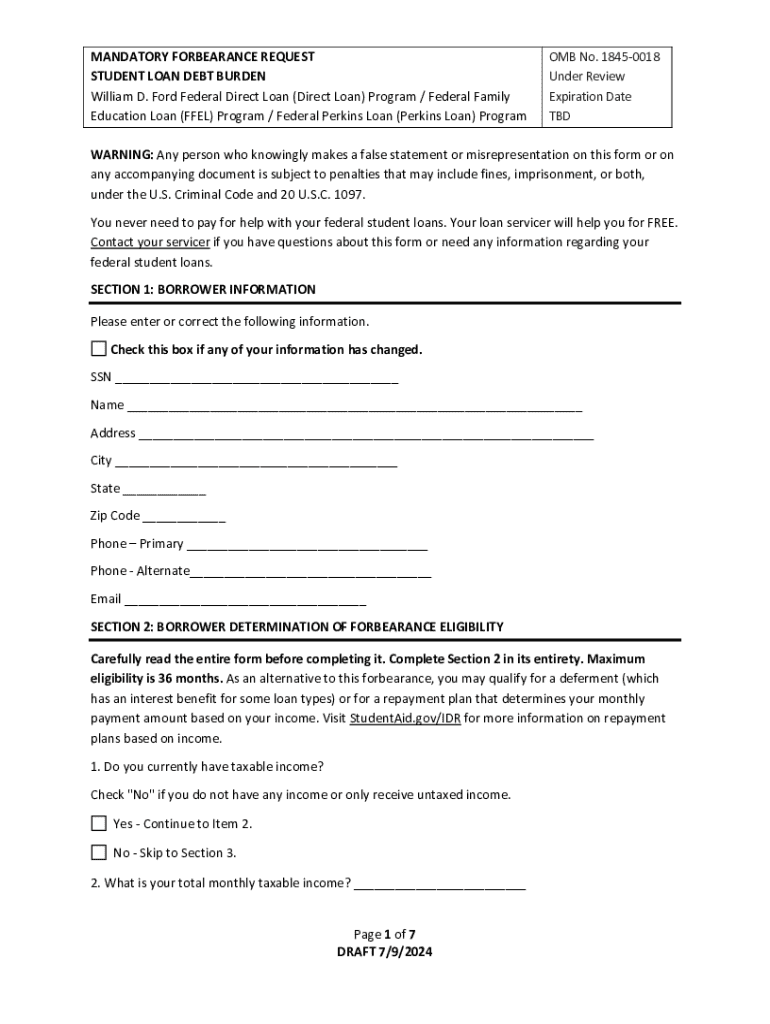

Get the free Mandatory Forbearance Request

Get, Create, Make and Sign mandatory forbearance request

How to edit mandatory forbearance request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mandatory forbearance request

How to fill out mandatory forbearance request

Who needs mandatory forbearance request?

Your Guide to the Mandatory Forbearance Request Form

Understanding mandatory forbearance

Mandatory forbearance offers borrowers the opportunity to temporarily postpone their student loan payments under specific circumstances. This type of forbearance is essential for individuals facing financial hardship, allowing them to manage their obligations without the immediate pressure of repayment.

Eligibility for mandatory forbearance can be determined by several factors. Borrowers must demonstrate a qualifying situation such as unemployment, medical issues, or active duty military service. Additionally, certain federal loans—like Direct Loans or other federal student loans—are typically eligible for this type of relief.

Preparing your mandatory forbearance request

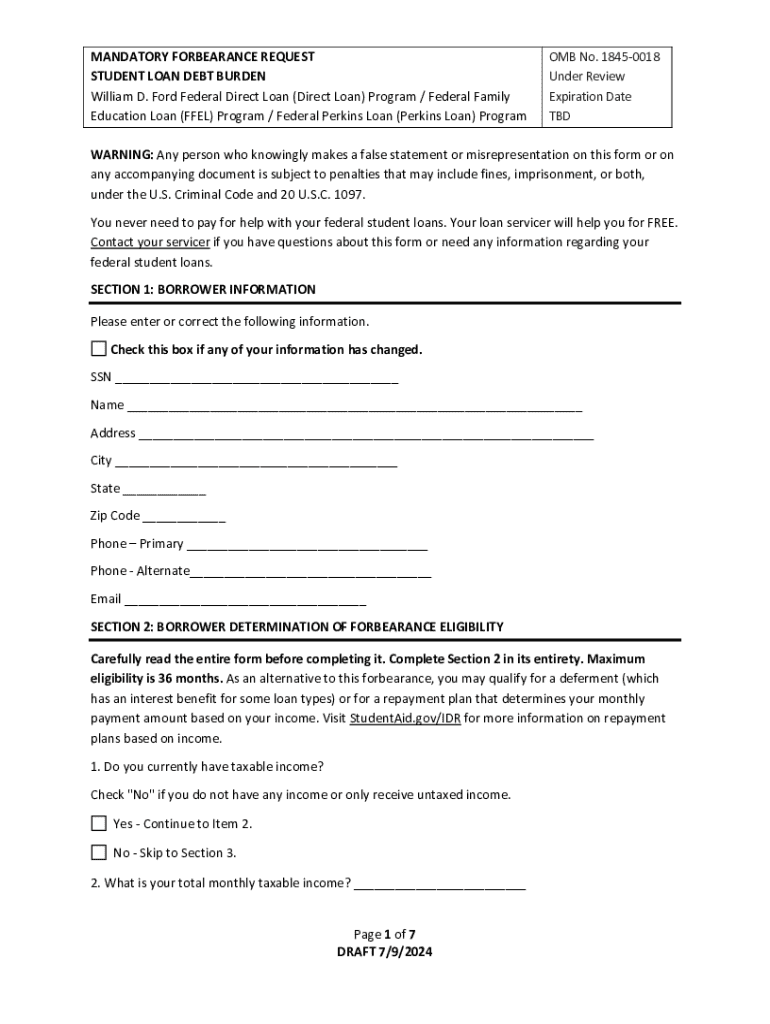

To successfully complete the mandatory forbearance request form, gather all necessary documents prior to starting the application process. This includes your loan papers, any proof of eligibility such as letters indicating unemployment, medical documentation, or military orders. Ensuring you have these documents ready will streamline your request.

When filling out the form, you’ll need to provide personal details including your full name, address, Social Security number, and the details of your loan, such as the account number and the name of your loan servicer. Accuracy is crucial, as errors can lead to delays.

Step-by-step guide to filling out the mandatory forbearance request form

Filling out the mandatory forbearance request form involves several key sections. Start with Section 1, which requires your information as the borrower. Ensure that all details are entered correctly to avoid confusion with your loan servicer.

Next, move to Section 2 to detail your loan information. Here, document your account number and the name of your loan servicer. In Section 3, specify your request for forbearance by explaining the reasons for your request and indicating the desired duration.

In Section 4, you'll need to certify the information is accurate, thus confirming its veracity with your signature. To maximize your chances of approval, double-check that each section is completed fully, and if necessary, utilize clear, legible handwriting or opt for digital input.

Submitting your forbearance request

Once the mandatory forbearance request form is completed, decide on a submission method. Many loan servicers offer an online submission option through their respective websites, which is typically faster and more efficient than mailing the form.

Assess the pros and cons of electronic versus mail submission. While electronic submissions provide immediate confirmation, mailing offers a physical copy for your records. Whichever route you choose, ensure your request is submitted in a timely manner to avoid potential issues.

Monitoring your forbearance status

After submitting your forbearance request, it's essential to monitor its status actively. Most loan servicers provide online account access where borrowers can check the progress of their application. This feature can alleviate anxiety and keep you informed about any updates.

If online tracking is unavailable or if you have questions, don’t hesitate to contact your loan servicer directly for confirmation. Be prepared to inquire about potential approval or denial scenarios; understanding the reasons for a denial can provide clarity and help you address issues promptly.

Managing your loans during forbearance

While in forbearance, borrowers should remain aware of their payment options. Some may choose to make partial or interest-only payments if allowed, as this can help minimize the impact of interest accrual during the forbearance period. Understanding exactly how interest accumulates during this time is crucial to avoiding larger payments down the line.

Additionally, effective financial management during forbearance is vital. Practicing budgeting can help you maintain control over your finances, particularly if you’ve experienced a loss of income. Seek resources for financial counseling if navigating this transition feels overwhelming.

Exploring other forbearance options

Besides mandatory forbearance, borrowers may also explore voluntary forbearance options, which are typically initiated by the borrower. This flexibility may allow for more tailored solutions according to individual financial needs. Different forbearance programs can address various situations, such as temporary financial hardship or medical conditions.

It's essential to understand the distinctions between voluntary and mandatory forbearance. While mandatory forbearance is automatic under certain conditions, voluntary forbearance requires proactive communication with your loan servicer to assess all options available.

Additional considerations

Utilizing the mandatory forbearance request form can have implications for your overall financial health, including potential effects on your credit score. It’s crucial to know how forbearance affects your credit standing—while it does not directly damage your credit score, it may impact your overall credit utilization and future borrowing abilities.

Upon ending your forbearance, transitioning back to regular payment plans is essential. Communicate with your loan servicer regarding repayment options and create a plan that accommodates your current financial situation. This proactive approach is essential in avoiding any missed payment, fostering better financial management.

Leveraging pdfFiller for effective document management

The mandatory forbearance request form can be effectively managed using pdfFiller’s comprehensive platform. With its user-friendly interface, borrowers can easily edit, sign, and store their documents securely. The ability to collaborate in real-time with financial advisors or family can significantly enhance the request process.

Being cloud-based, pdfFiller allows users to access their forbearance request form from anywhere, making it adaptable to busy lifestyles. This flexibility ensures that you can manage your documents and paperwork on your schedule, alleviating some of the stress associated with financial management.

Frequently asked questions (FAQs)

Understanding the intricacies of the mandatory forbearance request form may lead you to several common questions. For instance, what happens if your forbearance ends? Generally, once it concludes, borrowers should revert to their standard repayment terms unless otherwise arranged with the servicer.

Additionally, forbearance can often be extended upon request and with the appropriate documentation. It's essential for borrowers to communicate openly with their loan servicers to ensure a smooth transition back to regular payments and understand any changes that may occur in their repayment schedule.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the mandatory forbearance request electronically in Chrome?

Can I create an electronic signature for signing my mandatory forbearance request in Gmail?

How do I fill out the mandatory forbearance request form on my smartphone?

What is mandatory forbearance request?

Who is required to file mandatory forbearance request?

How to fill out mandatory forbearance request?

What is the purpose of mandatory forbearance request?

What information must be reported on mandatory forbearance request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.