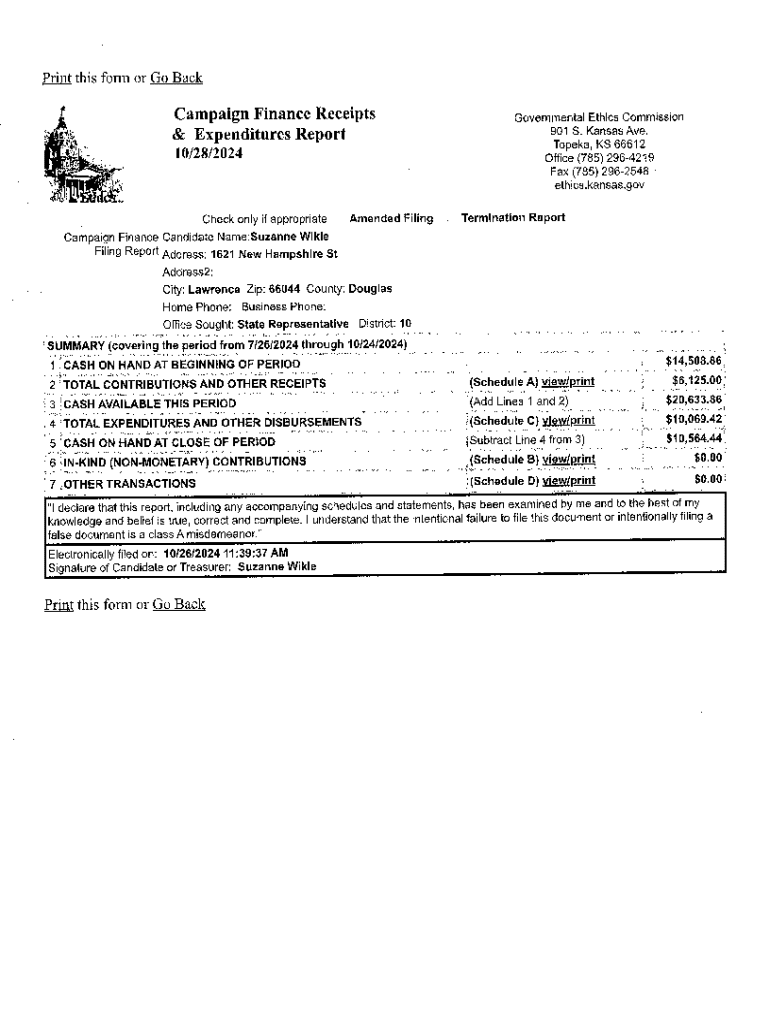

Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Mastering the Campaign Finance Receipts Expenditures Form

Understanding campaign finance forms

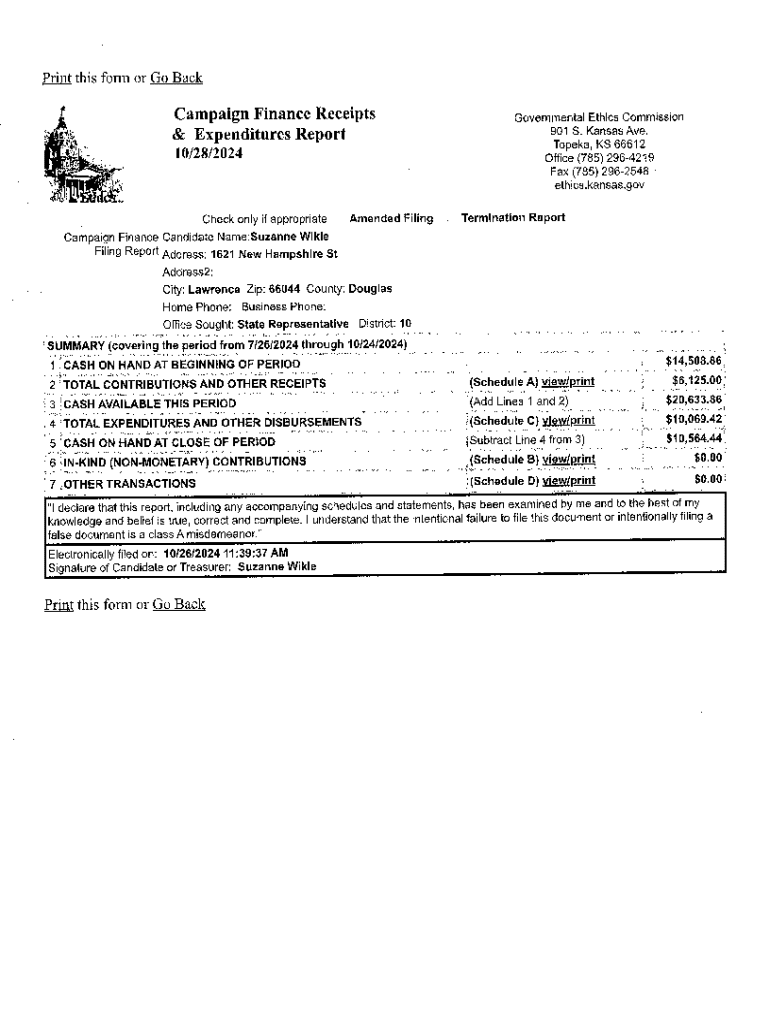

Campaign finance forms are essential documents used in political campaigns to track the flow of money. They provide a structured way to report contributions (receipts) and spending (expenditures). These forms are critical for maintaining financial transparency and ensuring adherence to various regulatory requirements that govern campaign funding.

Regulatory bodies, including the Federal Election Commission (FEC) in the U.S., require candidates and committees to submit these reports regularly. This promotes accountability and allows voters to understand the funding sources of their candidates. Non-compliance can lead to severe penalties, making accurate reporting vital.

Campaign finance receipts vs. expenditures

The distinction between campaign finance receipts and expenditures is fundamental for accurate reporting. Receipts refer to any money received by the campaign, including individual contributions, corporate donations, and funds from political action committees (PACs). On the other hand, expenditures represent the funds spent on campaign activities such as advertising, staff salaries, and operational costs.

Accurate reporting of both receipts and expenditures is essential not only for legal compliance but also for maintaining the integrity of the campaign. Discrepancies in reporting can lead to audits, financial penalties, and damage to the candidate's reputation.

Key components of the campaign finance receipts expenditures form

The campaign finance receipts expenditures form comprises several essential components that ensure comprehensive and transparent reporting. Personal and campaign identification details must be filled out, including the candidate's name, campaign address, and election details to which the finances pertain.

Moreover, categorization is paramount. Different types of receipts, such as contributions, loans, and refunds, need to be distinctly reported. Likewise, expenditures should be clearly classified into various categories such as advertising costs, operational expenses, and administrative fees. Each transaction also requires a date entry, which is crucial for compliance as it correlates to specific reporting periods.

Step-by-step guide to filling out the form

Filling out the campaign finance receipts expenditures form can seem daunting, but with a systematic approach, the process becomes manageable. The first step is to gather all necessary information, ensuring you have detailed records of all financial transactions, contributions, and receipts. This preparation streamlines the completion of the form.

The next step involves completing the receipts section. Document all funds received in an organized manner. Include the source of each contribution and correctly categorize them as individual donations, corporate contributions, or public funding. Following this, fill out the expenditures section, categorizing every expense related to the campaign. Accurate categorization helps avoid potential compliance issues. Finally, review and verify all entries against your documentation to ensure completeness and correctness before submission.

Common mistakes to avoid

One of the most frequent issues encountered in the campaign finance receipts expenditures form is incomplete reporting. Failing to disclose all receipts and expenditures can result in significant consequences, including fines and the loss of credibility. Every transaction should be accounted for, regardless of size.

Another common mistake is the misclassification of expenses. For instance, categorizing advertising costs as administrative expenses could lead to penalties. It's essential to familiarize yourself with reporting categories to avoid errors. Lastly, the failure to keep documentation is a significant oversight. Campaigns should maintain detailed records of all receipts, bank statements, and invoices to support their reported figures for transparency.

Using interactive tools for form management

pdfFiller provides comprehensive tools to streamline the management of the campaign finance receipts expenditures form. With its intuitive interface, users can easily edit, fill out, and manage their forms. Interactive editing tools offer flexibility, allowing candidates and their teams to input data seamlessly.

Additionally, pdfFiller’s eSigning capabilities enable users to sign documents electronically, making the submission process quicker and more efficient. The platform also features collaboration tools, which allow team members to work on the form simultaneously, enhancing productivity and ensuring that no detail is overlooked.

Best practices for compliance and reporting

To achieve compliance and effective reporting, regular monitoring of financial transactions is essential. Establishing a routine for tracking all receipts and expenditures helps ensure that records are up to date and accurate. Utilizing tools within pdfFiller can facilitate this process, allowing campaigns to manage their finances efficiently.

Staying informed about regulatory changes is also crucial. Campaign finance laws may change, affecting how reports should be filed and what information must be disclosed. Following resources dedicated to campaign finance, such as FEC updates or local election boards, can provide timely information. Moreover, utilizing cloud-based solutions allows teams to access necessary documents anytime, anywhere, enhancing security and reliability in reporting.

Navigating the filing process

Understanding submission deadlines is vital for compliance. Each state has different timelines for reporting campaign finances, and missing these deadlines can lead to hefty penalties. Make sure to note key dates relevant to your campaign and set reminders to ensure timely reporting.

The completed form can usually be submitted online through your state’s election office portal or the FEC website. It's essential to verify that the form is properly filled out before submission to avoid complications. Familiarize yourself with the required submission methods to ensure a smooth filing process.

Advanced insights: analyzing your campaign’s financial health

Financial transparency is vital in building voter trust and can significantly influence the success of a campaign. Regular analysis of the campaign finance receipts expenditures form helps campaigns understand the flow of money, identify potential funding deficiencies, and strategize future expenses more effectively.

Using data derived from careful analysis can guide candidates when reallocating funds for various campaign strategies. For example, if excessive funds are allocated to advertising but yield minimal engagement, resources could be redirected towards grassroots efforts to maximize impact. This analytical approach to finances can ultimately pave the way for more successful electoral outcomes.

Frequently asked questions (FAQs)

What if my receipts exceed expenditures? It's not uncommon for campaigns to find themselves in this situation. Any surplus can be carried forward to future election cycles or used under specific conditions for campaign-related expenses. Clearly reporting how these funds will be used in your finances is crucial to maintain compliance.

How do I amend a filed form? If you need to correct submitted information, the process typically involves submitting an amended form, clearly indicating the corrections made. It's wise to do this promptly to avoid any potential issues with regulatory bodies.

What are the consequences of inaccurate reporting? Failing to report accurately can lead to legal ramifications, including fines or even criminal charges in severe cases. Moreover, lacking transparency may result in a loss of voter confidence, directly affecting your campaign's success. Maintaining accuracy and compliance is thus pivotal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute campaign finance receipts expenditures online?

Can I create an electronic signature for the campaign finance receipts expenditures in Chrome?

How do I fill out campaign finance receipts expenditures on an Android device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.