Get the free Edge Tax Credit Agreement

Get, Create, Make and Sign edge tax credit agreement

How to edit edge tax credit agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out edge tax credit agreement

How to fill out edge tax credit agreement

Who needs edge tax credit agreement?

Edge Tax Credit Agreement Form: How-to Guide

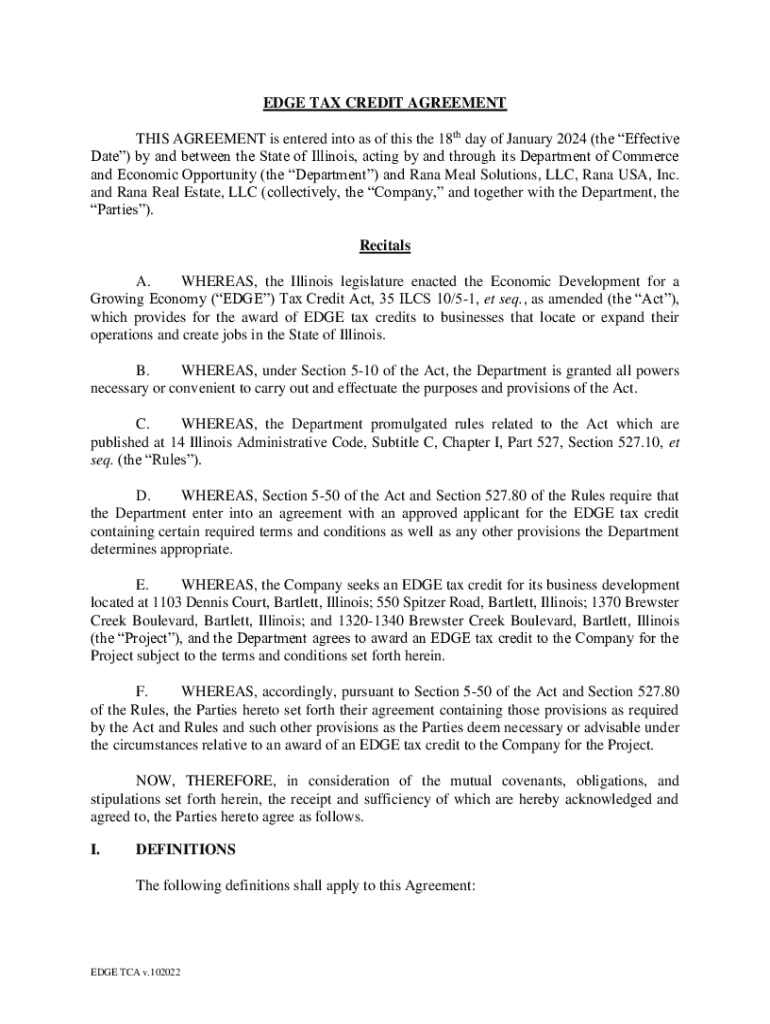

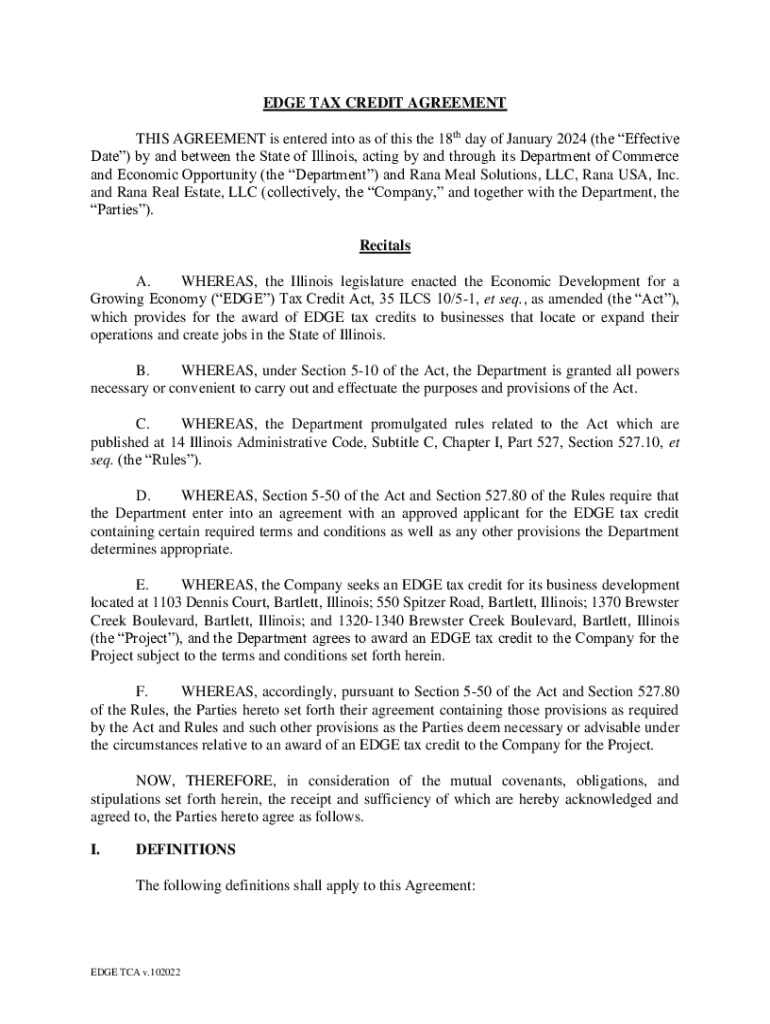

Understanding the Edge Tax Credit Agreement

The Edge Tax Credit is a financial incentive provided by various state governments aiming to stimulate economic growth by encouraging businesses to create jobs and invest in specific industries. This tax credit can significantly lower a business’s tax burden, making it easier for eligible companies to thrive in competitive markets.

Eligibility for the Edge Tax Credit typically includes criteria such as the business’s location, the industry sector, and the number of new jobs created. For example, businesses in manufacturing, technology, and other targeted sectors may qualify if they meet certain investment thresholds.

The Edge Tax Credit Agreement Form is integral to the application process, serving as a binding agreement between the applicant and the issuing authority. A properly completed form is essential to access these tax benefits. Missteps in submission can result in delays, loss of eligibility, or even rejection of the application.

Accessing the Edge Tax Credit Agreement Form on pdfFiller

To begin the application process, you need access to the Edge Tax Credit Agreement Form. pdfFiller offers an easy-to-navigate platform where you can find this form. Start by visiting the pdfFiller website and using the search bar displayed prominently on the homepage.

Search for 'Edge Tax Credit Agreement Form' using keywords relevant to your location or specific needs. This approach ensures you find the most applicable version of the form. For example, if you are in New Jersey, specify 'New Jersey Edge Tax Credit Agreement Form' for precise results.

Creating an account on pdfFiller is crucial for form access. With an account, you can save your completed forms, make edits, and collaborate with team members efficiently. The account creation process involves providing basic information like your name and email, as well as creating a password.

Step-by-step instructions for filling out the form

Filling out the Edge Tax Credit Agreement Form can seem daunting at first, but breaking it down into sections makes it manageable. Each section of the form requires specific details that are crucial for eligibility assessment.

The primary sections often include company information, employee count, investment details, and projected job creation. It's vital to read each section carefully and provide accurate information. Ensure that financial figures are current and reflect your company’s actual projections.

Common mistakes include entering incorrect figures, omitting essential documentation, or failing to provide requested signatures. Always double-check your entries before submission to avoid having your application delayed or denied.

Editing and customizing the agreement form

pdfFiller provides comprehensive editing tools to assist you in completing the Edge Tax Credit Agreement Form effectively. These tools allow you to make necessary modifications, correct errors, or add additional information as needed.

Utilizing these features ensures that your form is correctly filled out and customized to meet your needs. The platform allows you to insert text, highlight important details, and adjust formatting—making your document not only accurate but also visually appealing.

Clarity and professionalism in your submission can significantly impact its acceptance. Ensure that the language is straightforward, and avoid jargon that might confuse reviewers. A well-structured form enhances your application’s chances of approval.

Signing the Edge Tax Credit Agreement Form

Once your form is correctly filled out, the next step is to sign it. Electronic signatures are legally recognized in many jurisdictions, and pdfFiller provides an efficient eSigning process that is secure and user-friendly.

To eSign the Edge Tax Credit Agreement Form on pdfFiller, follow the prompts on the screen. You can draw your signature, type it, or upload an image file. After signing, ensure that any additional signatories required for your form also complete their signatures.

Including all relevant signatures is crucial, as the absence of any required signature can render the agreement ineffective. Ensure everyone involved in the application process understands their role in signing.

Submitting the Edge Tax Credit Agreement

After you have filled out and signed the Edge Tax Credit Agreement Form, the submission process begins. You typically have multiple submission options, including online portals or mail, depending on your location and local regulations.

Be sure to follow the specific submission guidelines prescribed by your state or locality, as failure to comply with these can lead to delays or rejection of your application. Double-check that you have included all necessary supporting documents and that your form is fully completed.

Tracking the status of your submission is vital. pdfFiller enables you to monitor the progress of your application easily. Check back periodically to verify that your submission has been processed, and address any follow-ups or additional requests from the issuing authority promptly.

Managing and storing your documents

Using pdfFiller for document management comes with numerous advantages, particularly for keeping your Edge Tax Credit Agreement Form organized. With cloud storage features, you can access your documents anywhere, ensuring you never lose critical information.

Moreover, the platform’s categorization tools allow for seamless organization, enabling you to retrieve documents quickly when needed. As an added security feature, pdfFiller safeguards your documents against unauthorized access.

Establishing a clear system for your Edge Tax Credit Agreement Form and other related documents ensures you are prepared for any inquiries or inspections from tax authorities, further streamlining your compliance process.

Frequently asked questions about the Edge Tax Credit Agreement

As you navigate the Edge Tax Credit process, you may encounter several common concerns related to the agreement form. Understanding these frequently asked questions can clarify any confusion you may have and enhance your submission experience.

Common queries involve the specific eligibility requirements, what documentation must accompany the agreement, and how to amend a submitted application. Many applicants also wonder about the timeframe for approval and any potential appeals process in case of denial.

Clarifying these points before submission can greatly enhance your chances of a smooth and successful application process.

Engaging with the pdfFiller community

Engaging with the pdfFiller user community can provide valuable insights from individuals who have successfully navigated the Edge Tax Credit Agreement Form process. Sharing experiences can illuminate best practices and potential pitfalls to avoid.

On pdfFiller, users often share success stories and insights in various forums. Participating in these discussions can not only enrich your understanding of the process but also establish connections with others facing similar challenges.

Advancing your document skills

Mastering the Edge Tax Credit Agreement Form is just one aspect of leveraging pdfFiller. The platform offers a variety of features that can enhance your overall document creation and management skills.

Exploring additional functionalities, such as advanced editing tools and collaborative features, built into pdfFiller can save time and increase productivity. The more familiar you are with these tools, the more efficient your document workflow becomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the edge tax credit agreement in Gmail?

How do I edit edge tax credit agreement on an iOS device?

How do I complete edge tax credit agreement on an iOS device?

What is edge tax credit agreement?

Who is required to file edge tax credit agreement?

How to fill out edge tax credit agreement?

What is the purpose of edge tax credit agreement?

What information must be reported on edge tax credit agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.