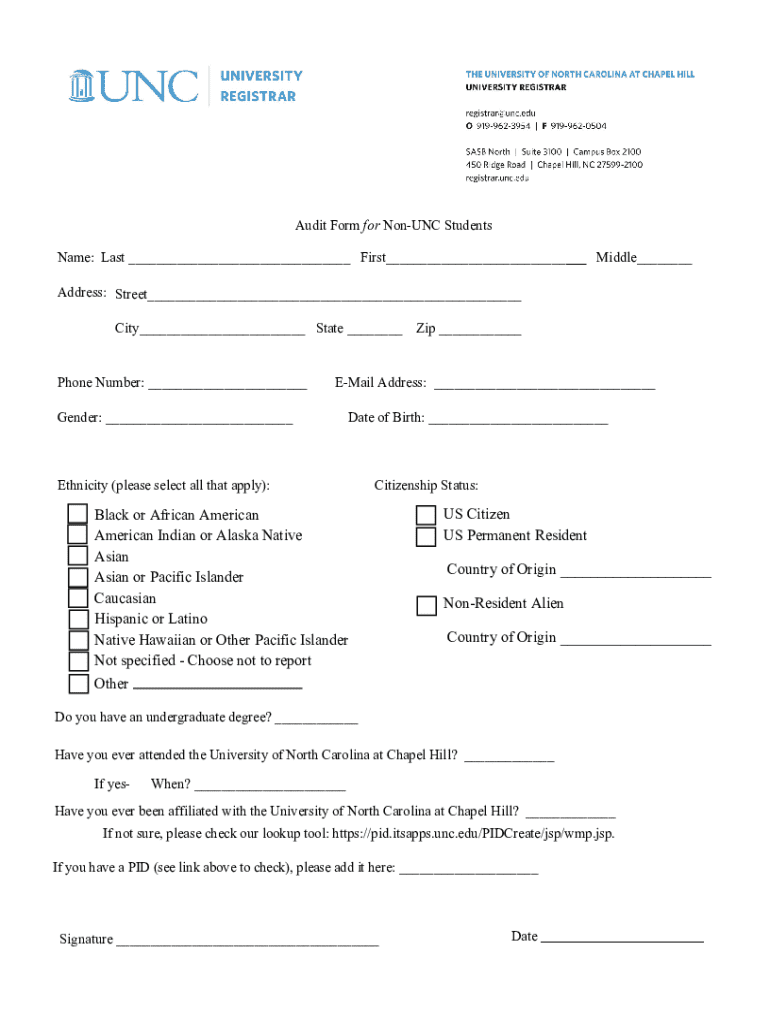

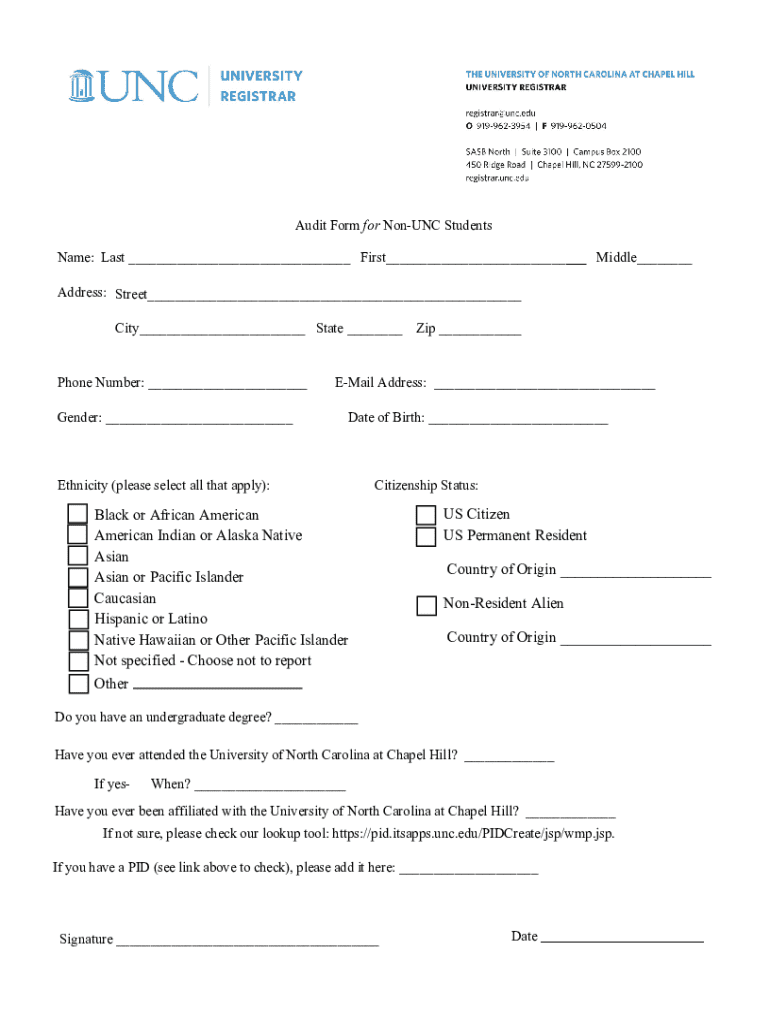

Get the free Audit Form for Non-unc Students - registrar unc

Get, Create, Make and Sign audit form for non-unc

Editing audit form for non-unc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out audit form for non-unc

How to fill out audit form for non-unc

Who needs audit form for non-unc?

Comprehensive Guide to Audit Form for Non-UNC Form

Overview of audit forms

Audit forms play a vital role in ensuring compliance and accuracy in various organizational processes. They are structured documents designed to collect, record, and present specific information essential for the auditing process. This structure allows auditors to gather qualitative and quantitative data that supports effective evaluations. The importance of using the correct form cannot be overstated; utilizing the appropriate audit form can significantly impact the timeliness, accuracy, and effectiveness of the audit results.

When discussing audit forms, distinctions need to be made between UNC (Uniform Non-Consolidated) forms and Non-UNC forms. UNC forms adhere to specific standardized guidelines set forth for consistent reporting across organizations. On the other hand, Non-UNC forms often provide more flexibility, allowing organizations to tailor their content to better meet their specific audit requirements.

Understanding the non-UNC audit form

A Non-UNC audit form is designed for organizations that require a more bespoke approach to their audit processes. Unlike the standardized UNC forms, the Non-UNC version allows for modifications that reflect the unique needs of the organization or the specific audit type. This flexibility is especially essential in industries where detailed reporting is necessary for regulatory compliance or internal assessments.

Key components of a Non-UNC audit form typically include sections for required information such as the organization’s identification details, specifics on the financial data, and any qualitative metrics necessary for a comprehensive audit. Furthermore, special considerations and annotations may be added to clarify entry requirements, provide context for unusual entries, or document important notes relevant to the audit.

Step-by-step guide to filling out the non-UNC audit form

Filling out a Non-UNC audit form involves several critical steps to ensure accuracy and comprehensiveness. The first step is gathering all necessary information, which should include identification details such as the organization's name, address, and tax identification number, along with financial data relevant to the audit period.

The second step entails completing the form meticulously. Pay careful attention to each section—ensure that all required fields are filled accurately, as common mistakes include missing entries or using incorrect data. It is advisable to follow guidelines specific to the form’s design.

Once the form is completed, take time to review and edit your submission. Proofreading is vital in this phase — mistakes at this stage can lead to delays. Utilizing tools available in platforms like pdfFiller can significantly aid in editing and refining your document, ensuring it meets compliance standards.

The final step is signing the document, which can be done conveniently using eSigning options available on platforms like pdfFiller. Ensure that the signature is affixed securely to lend authenticity to your submission.

Tips for submitting your non-UNC audit form

Submissions of the Non-UNC audit form can be done through various channels, depending on the requirements of the auditing organization or the governing body overseeing compliance. It’s essential to ensure that you are familiar with the recommended submission channels specific to your domain, whether that be electronic submission via email or specific portals, or traditional postal services.

Additionally, it is crucial to be aware of filing deadlines to ensure compliance. Failing to meet these deadlines can result in penalties or complications in the auditing process. After submission, engage in follow-up actions; confirm receipt of the audit form and ensure that any queries raised during the audit are addressed promptly.

Interactive tools for managing your audit forms

pdFFiller offers a range of interactive tools that enhance your experience with managing audit forms. By utilizing cloud-based storage solutions, users can access their documents from anywhere, ensuring that critical forms are within reach whenever needed. Furthermore, collaboration tools facilitate teamwork, making it simpler for various members of a team to input, edit, or review sections of the Non-UNC audit form.

Tracking and managing your forms is vital, and pdfFiller provides features to keep you organized. This includes real-time updates on the status of your submitted forms, helping to maintain transparency throughout the audit process. Users can also leverage reminders to ensure that compliance requirements are consistently met.

Common issues and troubleshooting

Common issues related to Non-UNC audit forms often revolve around mistakes or misunderstandings in the completion process. If you find that a mistake has been made after submission, the best course of action is to reach out to your auditor for guidance on the necessary corrections and resubmission process.

Additionally, handling rejections requires prompt action. Understand the reasons behind any rejection and be prepared to address those in your resubmission. PdfFiller offers customer support options, including email and live chat, which are invaluable during these situations.

Case studies: success stories with non-UNC forms

Success stories regarding the effective use of Non-UNC audit forms highlight the potential these documents hold for streamlining audit processes and enhancing compliance management. For instance, many organizations have reported increased efficiency by leveraging tailored forms that meet their unique auditing requirements, thus allowing for thorough documentation and reporting.

Testimonials from users utilizing pdfFiller for their Non-UNC forms have consistently underscored the platform's effectiveness, claiming that the ease of document management and the top-ranked customer support contribute meaningfully to their success in navigating audits.

Expert advice on audit process best practices

Keeping audit records organized is paramount. Implement systematic record-keeping practices that facilitate easy access to audit history. An organized approach not only saves time during audits but also ensures that all necessary documentation is up-to-date and compliant with regulatory standards.

Additionally, consider recommendations for continuous improvement in auditing practices. Regularly review processes, gather feedback from auditors, and strive to implement changes that enhance overall efficiency. Leveraging technology effectively can also streamline workflows, automating repetitive tasks and freeing up time for more strategic areas of focus.

Additional tools and resources for comprehensive form management

Organizations benefit from having a suite of related forms and templates available on platforms like pdfFiller, facilitating fast access to necessary documents. Integration with other workflow tools can further enhance the overall efficiency of the audit preparation and submission processes.

New users can take advantage of onboarding resources provided that smooth the transition to effective form management. These tutorials and support materials empower users to maximize the potential of audit forms and related functionalities for streamlined workflows.

Contact information for further assistance

For additional support regarding your audit form for Non-UNC Form, pdfFiller offers robust customer support options. Users can reach out via phone, email, or through live chat services for immediate assistance.

Schedule a consultation or demo session to get hands-on guidance on maximizing pdfFiller's offerings in document creation and management. This personal touch can often resolve issues more efficiently and equip you with insights tailored to your specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the audit form for non-unc electronically in Chrome?

How can I edit audit form for non-unc on a smartphone?

Can I edit audit form for non-unc on an iOS device?

What is audit form for non-unc?

Who is required to file audit form for non-unc?

How to fill out audit form for non-unc?

What is the purpose of audit form for non-unc?

What information must be reported on audit form for non-unc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.