Get the free Campaign Financial Disclosure Report - sos idaho

Get, Create, Make and Sign campaign financial disclosure report

How to edit campaign financial disclosure report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign financial disclosure report

How to fill out campaign financial disclosure report

Who needs campaign financial disclosure report?

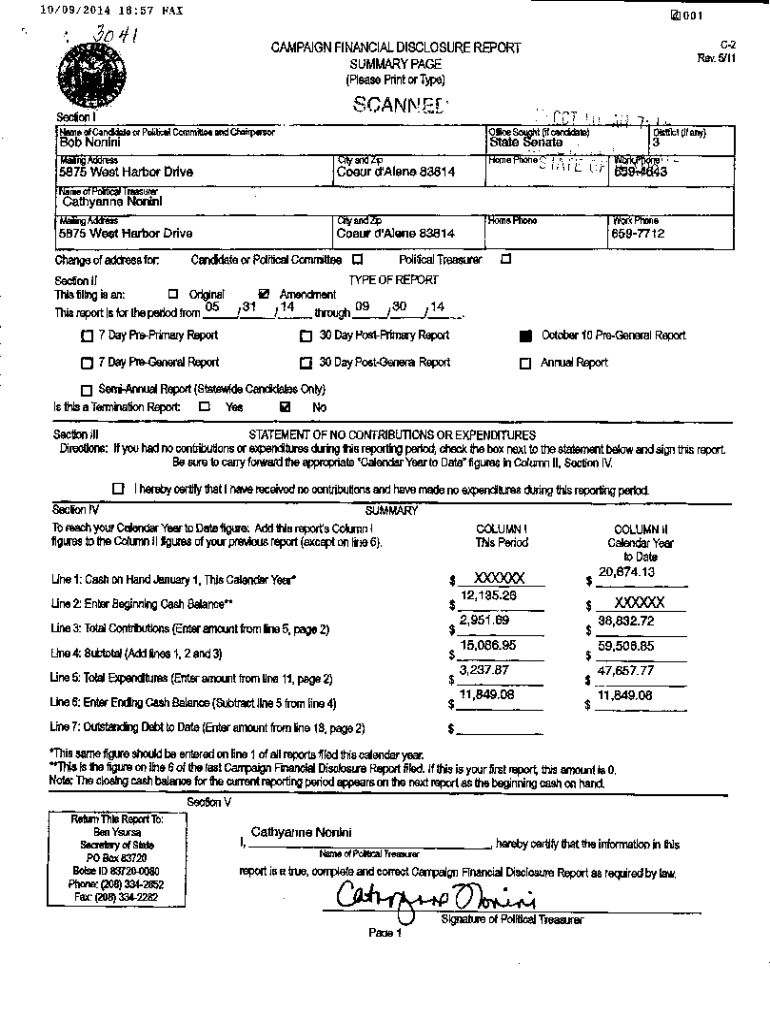

Understanding the Campaign Financial Disclosure Report Form

Understanding the need for campaign financial disclosure

Transparency in campaign financing is crucial for the health of a democratic process. Candidates and political committees must adhere to specific legal obligations that dictate how they report financial contributions and expenditures. These requirements help maintain the integrity of elections, ensuring that voters are informed about who is funding campaigns and how those funds are being used.

Non-compliance with these regulations can lead to severe consequences, including fines, penalties, or even criminal charges. Therefore, understanding the campaign financial disclosure report form is essential for any candidate serious about their electoral aspirations.

Overview of campaign financial disclosure report form

The campaign financial disclosure report form is a structured template that candidates and political committees use to report their financial activities during an election cycle. Its main purpose is to provide a clear and detailed account of the funds received and spent, ensuring maximum transparency to the electorate. Every section of the form is designed to capture vital data that can impact public perception and electoral outcomes.

Key components of the form typically include sections for candidate information, contributions, expenditures, and any outstanding debts. While federal forms have standardized formats across the nation, state-specific forms can vary significantly, reflecting local laws and guidelines. This discrepancy makes it essential for candidates to familiarize themselves with both federal and state requirements.

Step-by-step guide to filling out the form

Filling out the campaign financial disclosure report form might seem daunting, but breaking it down into manageable steps can simplify the process.

Gather necessary information

Start by collecting all required documentation and data, which should include detailed records of contributions and expenditures. This involves maintaining an accurate log of donor information, receipts, and transaction histories throughout the campaign. Using spreadsheets or dedicated financial software can help organize this data effectively.

Detailed instructions for each section

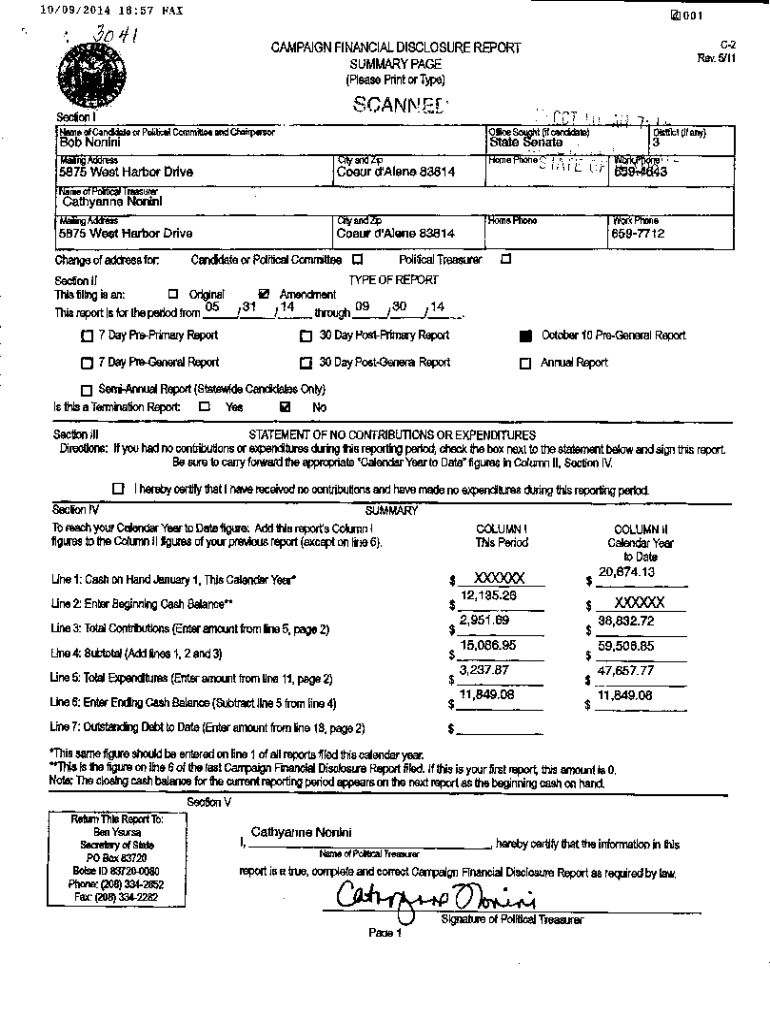

Section 1: Candidate Information

This section requires accurate details about the candidate, including name, address, and office sought. Ensure all information matches with public records to avoid discrepancies.

Section 2: Financial Contributions

List all sources of funding, ensuring to specify the amount contributed, the donor's details, and to remain mindful of contribution limits imposed by state or federal law.

Section 3: Expenditures

Here, you must itemize every expense incurred during the campaign. Include support for each item through relevant receipts and budget forecasts to substantiate your spending.

Section 4: Debt and Obligations

If there are outstanding debts or obligations related to the campaign, this section is where you will report them. Being transparent about any owing balances is essential to maintain trust.

Section 5: Summary and Certification

Accuracy in this final section is paramount as it summarizes your financial standing. Both candidates and treasurers must sign, either manually or using eSigning options via platforms like pdfFiller, to certify the authenticity of the report.

Tools and resources for effective reporting

Utilizing interactive tools

Platforms like pdfFiller offer interactive tools that ease the process of filling and signing the campaign financial disclosure report form. With user-friendly features, users can edit PDFs, collaborate with team members, and digitally archive their documents for future reference.

Common mistakes to avoid

Common pitfalls include failing to report in-kind contributions, miscalculating totals, or not maintaining adequate documentation. To maintain compliance, double-check your entries against your organized records.

Best practices for managing campaign financial reports

To stay on top of your campaign finances, regular tracking is essential. This means not only keeping receipts but also entering expenditures and contributions contemporaneously. Create a system of alerts or reminders for filing deadlines so that you never miss an important date.

Additionally, implementing best practices such as saving all documentation and relying on a secure cloud-based platform, like pdfFiller, can streamline future campaigns and foster better collaboration among team members.

Frequently asked questions (FAQs)

Several questions frequently arise during the process of campaign financial reporting. For instance, what happens if a form is filed late? Typically, this can result in fines or penalties, depending on local laws. Can submissions be amended? Yes, candidates can submit amendments as necessary to correct any errors.

Another important question is about record retention; generally, campaign records should be kept for a minimum of three years post-election. Understanding state-specific regulations also enhances compliance and transparency.

Navigating compliance and audits

Understanding the audit process for campaign finances is vital for candidates who want to avoid unexpected scrutiny. Proper preparation includes setting up a clear system for records, ensuring that all entries are accurately documented and corroborated with receipts.

Best practices recommend routine checks against submitted forms to verify balance and compliance, decreasing the likelihood of deficiencies when facing an audit.

Case studies and real-world examples

Analyzing successful campaign financial disclosures reveals critical lessons learned in compliance and reporting. For instance, high-profile cases where candidates were transparent about their funding sources won public trust and support, highlighting the positive impact of ethical fundraising.

Conversely, compliance failures have led to severe repercussions, such as disqualification from future elections, underscoring the importance of meticulous attention to detail in financial disclosure.

Conclusion of the form completion process

In summary, completing the campaign financial disclosure report form involves a structured and thorough approach. Candidates must ensure transparency and compliance at every step, reinforcing their commitment to ethical campaigning.

Ongoing financial oversight is crucial in maintaining the integrity of reporting and ultimately, the election process itself.

Leveraging pdfFiller for future campaigns

Moving forward, leveraging pdfFiller can substantially enhance future document management. Its cloud-based platform allows teams to collaborate seamlessly, share documents, and ensure that all forms, including the campaign financial disclosure report form, are thoroughly completed and stored securely.

Features like digital signatures streamline the process, enabling candidates to focus on what matters most — engaging with voters and building their campaign.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit campaign financial disclosure report online?

How do I edit campaign financial disclosure report in Chrome?

How do I complete campaign financial disclosure report on an iOS device?

What is campaign financial disclosure report?

Who is required to file campaign financial disclosure report?

How to fill out campaign financial disclosure report?

What is the purpose of campaign financial disclosure report?

What information must be reported on campaign financial disclosure report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.