Get the free Direct Debit Request Form

Get, Create, Make and Sign direct debit request form

Editing direct debit request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct debit request form

How to fill out direct debit request form

Who needs direct debit request form?

Direct Debit Request Form: How-to Guide

Understanding the direct debit request form

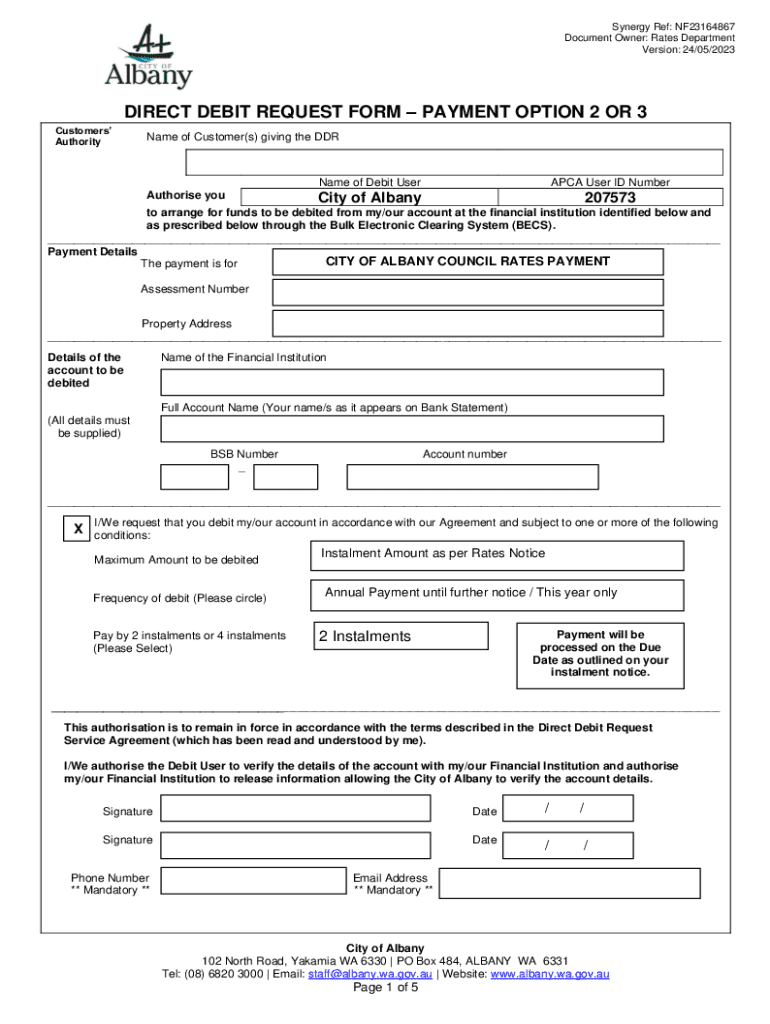

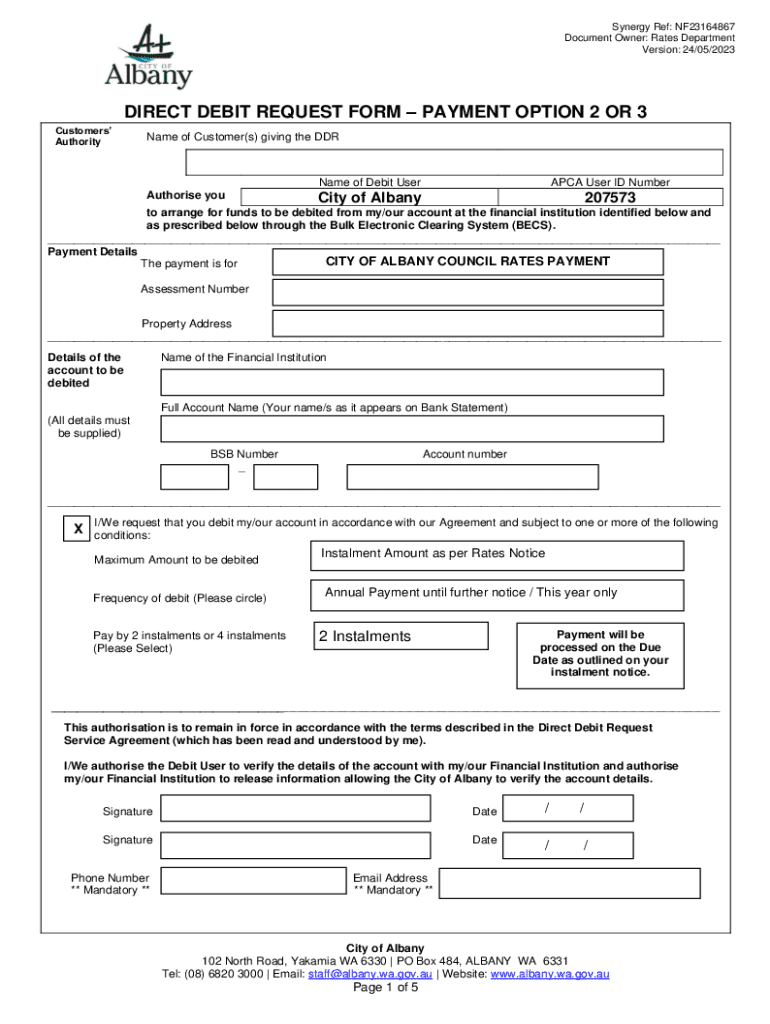

A direct debit request form is a legal document that authorizes a company or organization to withdraw funds directly from your bank account on an agreed schedule. This form is primarily used for regular payments such as utility bills, subscription services, and loan repayments. Its main purpose is to simplify the management of recurring expenses, ensuring that payments are made automatically without manual intervention.

You might encounter a direct debit request form in various scenarios, such as signing up for a gym membership or subscribing to an online service. With this form, individuals can avoid the hassle of remembering due dates, making it a practical tool for effective financial management.

Key benefits of using a direct debit request form

Utilizing a direct debit request form offers multiple benefits. Firstly, it provides the convenience of automatic payments, eliminating the need for manual transactions. You can set it and forget it, significantly reducing your administrative burden each month. This is ideal for individuals with busy schedules who want to ensure bills are paid on time without interruption.

Another advantage is the reduction in late payment risks. Since the payments are handled automatically, you can avoid fees and penalties associated with missed deadlines. Furthermore, it enhances your ability to manage recurring expenses, making it easier to monitor your budget and financial commitments.

Preparing to complete the direct debit request form

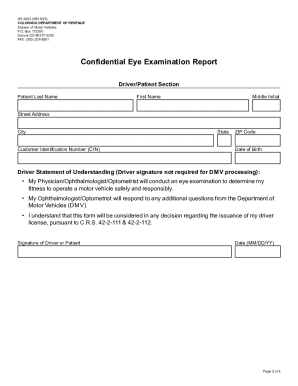

Before filling out a direct debit request form, it's essential to gather all necessary information. This includes your personal identification details such as your name and address. You'll also need your bank account information, including the account number and name of your bank. Lastly, be prepared to provide details about the service provider or organization that will be withdrawing the payment.

It’s important to check your eligibility for submitting a direct debit request. Generally, individuals with a bank account can submit this request, but it’s wise to inquire if the service provider has any specific conditions or requirements that need to be met. Ensure you read all terms and conditions related to the direct debit process.

Step-by-step guide to completing the direct debit request form

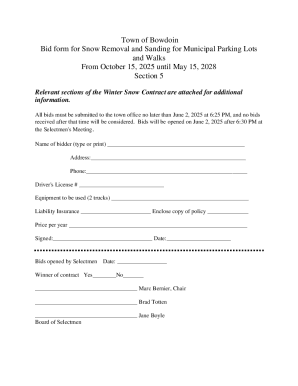

The first step to completing your direct debit request form is to acquire the form itself. You can usually receive it directly from the service provider, or you can download one from platforms like pdfFiller. They offer a user-friendly interface for filling out various types of forms.

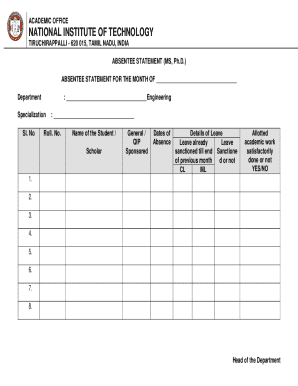

Once you have the form, move on to filling out your personal information accurately. This includes your name, address, and contact number. Pay careful attention to avoid mistakes, as inaccuracies can lead to payment issues down the line.

Next, you’ll provide your bank account details. Ensure all banking information, including the account number and bank name, is double-checked for accuracy. Sharing sensitive information should be done securely, preferably through encrypted channels provided by your service provider.

Step four involves specifying payment details. Decide on the amount to be withdrawn, the frequency of payments (weekly, monthly, etc.), and start, as well as end dates for your direct debits. It’s crucial to set the parameters according to when you expect to have funds available in your account.

Finally, review all the entered information to ensure its accuracy. Use pdfFiller’s eSignature tools to sign the document electronically, which not only speeds up the process but also keeps your document organized and easily accessible.

Submitting your direct debit request form

When it comes to submitting your direct debit request form, you have several options. Electronic submission is often preferred for its speed and convenience. Most service providers allow you to send the form via their platforms, or you may choose to email it directly. Alternatively, you can use postal services if required, but make sure to factor in longer processing times.

Always pay attention to submission deadlines specified by the service provider, as missing these deadlines may delay your direct debit establishment. After submission, it’s important to track your request. Follow up with the service provider to confirm that your request has been processed to avoid any unexpected issues with your payments.

Managing your direct debit setup

Once your direct debit is set up, it’s essential to manage it effectively. If you need to modify or cancel your direct debit request, initiate the process with the service provider. They usually have a specified procedure for altering bank details or changing the amount and frequency of payments. Familiarize yourself with these processes, as they vary among organizations.

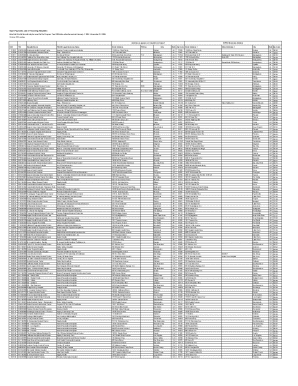

Monitoring your transactions is equally important. Keep track of direct debit withdrawals by reviewing your bank statements regularly. This practice helps in spotting any unauthorized transactions and gives you better insight into your spending habits, enhancing your financial literacy.

Common issues and FAQs

Despite the convenience of direct debits, issues can occasionally arise, such as a payment failing due to insufficient funds. In such cases, liaise with your bank and service provider to resolve the issue promptly. If disputes occur, maintain clear communication with the service provider to find a resolution.

Here are some frequently asked questions about direct debits:

Utilizing pdfFiller for direct debit management

pdfFiller offers an array of tools that simplify the process of filling out, editing, and managing your direct debit request form. Users can easily edit forms online, ensuring that any changes needed can be done quickly without the hassle of printing and rescanning paperwork.

The platform also provides collaborative tools that are perfect for teams needing to manage multiple documents. Team members can work together seamlessly, keeping track of changes and ensuring proper documentation flow. Furthermore, pdfFiller's cloud management system allows you to access your forms from anywhere and any device, which is particularly useful for those on the go.

Best practices for using direct debit

To maximize the benefits of direct debits, establish alerts and notifications. This helps you stay informed about payment schedules and ensures you’re always aware of upcoming deductions from your account. Furthermore, staying updated on any changes to terms and conditions from your service providers is crucial in avoiding any surprises.

Lastly, enhancing your financial literacy while using direct debit is empowering. Understand your obligations related to payments and manage your budget effectively. By doing so, you position yourself to better handle your finances and make informed decisions about future expenditures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find direct debit request form?

Can I create an electronic signature for the direct debit request form in Chrome?

Can I create an eSignature for the direct debit request form in Gmail?

What is direct debit request form?

Who is required to file direct debit request form?

How to fill out direct debit request form?

What is the purpose of direct debit request form?

What information must be reported on direct debit request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.