Get the free California Form 3551

Get, Create, Make and Sign california form 3551

Editing california form 3551 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california form 3551

How to fill out california form 3551

Who needs california form 3551?

California Form 3551: A Comprehensive Guide

Overview of California Form 3551

California Form 3551, officially known as the Motion Picture Credit form, is crucial for film and television producers in California. This form allows eligible taxpayers to apply for tax credits related to qualified expenditures incurred during the production of motion pictures. By submitting this form, producers can significantly reduce their overall tax liabilities, thereby encouraging more film-related activities within the state.

The importance of California Form 3551 cannot be overstated. For taxpayers engaged in the entertainment industry, it serves as a vital financial tool that facilitates growth, job creation, and investment in local economies. The tax credits offered not only support the production itself but also stimulate jobs in ancillary industries related to production.

Who needs to use Form 3551?

Eligibility criteria for using California Form 3551 are primarily based on the nature of the motion picture production. Generally, any individual or entity producing a feature-length film, television series, or other qualifying media would benefit from this form. Key scenarios in which taxpayers would file include productions that meet budget limits and incorporate California spending requirements.

Key features of Form 3551

Form 3551 applies to a range of tax credits that aim to enhance California's film industry. One of the primary features of the form is the Motion Picture Tax Credit that allows for a credit amount based on qualified expenditures made within the state. This includes costs related to crew salaries, equipment rentals, and other production-related expenses. The benefits extend not just to large productions but also to independent filmmakers who meet the necessary criteria.

By filing California Form 3551, taxpayers can access reduced tax liabilities resulting from eligible expenditures on motion pictures, thereby making it easier for new films to be produced and financially backed within the state.

Recent updates and important information

For the tax year 2023, there are several updates to consider when submitting California Form 3551. Changes in regulations may affect credit limits, which have seen adjustments due to ongoing economic shifts and state decisions aimed at promoting local productions. Producers should remain aware of these amendments to maximize their potential tax benefits.

The deadlines for filing Form 3551 are critical to ensure taxpayers do not miss out on available credits. Late filings can lead to denial of credits, thus impacting the overall profitability of the production. Taxpayers must keep important dates in mind, typically, these are correlated with the overall tax filing season.

Detailed instructions for filling out California Form 3551

Navigating California Form 3551 may seem daunting at first, but by breaking it down into manageable sections, you can streamline the process. The following is a step-by-step guide to assist you in completing the form accurately.

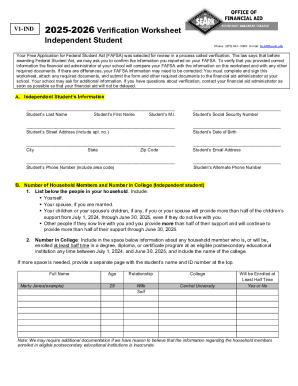

Section 1: Basic information

This section requires personal details such as the taxpayer's name, contact information, and Social Security or Tax Identification Number. Providing correct and complete information is essential for the processing of your application.

Section 2: Claiming your credits

In this segment, you specify the types of credits being claimed, generally linked to qualified expenditures. A thorough understanding of eligible expenses will enhance accuracy and aid in maximizing your benefits.

Section 3: Calculation of tax credits

Calculating the tax credits is one of the most crucial steps. For instance, if your total qualified expenses amount to $10 million, and the credit rate is 20%, you may qualify for a credit of $2 million. Ensure that all calculations align with state guidelines and include any required documentation.

Section 4: Final review and submission

Before submitting Form 3551, conduct a thorough review. Check to ensure all sections are completed, all required signatures are in place, and that you have included any necessary attachments. With pdfFiller, you can file electronically, which substantially reduces processing times and facilitates a more efficient submission.

Common mistakes and how to avoid them

When filling out California Form 3551, several frequent errors could hinder the approval process. The most common mistakes include entering incorrect data or failing to provide the right documentation. Missing signatures and dates are also common pitfalls that can lead to delayed processing or outright rejection of your application.

To avoid these issues, take time to double-check calculations and ensure all information is accurate. Utilizing pdfFiller's editing tools can enhance your submission accuracy by allowing for easy modifications and checks before the final submission.

Interactive tools and resources

One way to simplify the process of working with California Form 3551 is through pdfFiller’s cloud-based document management platform. The suite of editing tools available makes filling out the form straightforward and efficient. From text editing to form fields, pdfFiller helps eliminate common errors and ensures submissions are compliant with guidelines.

Furthermore, the eSignature capabilities expedite the signing process, allowing users to sign documents digitally and securely without needing a physical presence. This feature is particularly advantageous during peak filing periods where time is of the essence.

Collaborative features for team use

For teams working together on productions, pdfFiller provides collaborative features that allow multiple users to access and work on the same document simultaneously. This capability is essential for reviews and revisions and makes managing access and editing rights secure and hassle-free.

After you submit: What to expect

Once California Form 3551 is submitted, understanding what to expect can alleviate stress. Generally, processing times can vary but anticipate a timeframe of 2-6 months for applications to be reviewed by the Franchise Tax Board. During this period, it's crucial to remain vigilant for any communications requesting additional information.

If you receive a notification from the Franchise Tax Board, it will detail any missing information or issues encountered during processing. Responding promptly and providing the requested materials is essential to keep your application on track.

Additional support and FAQs

Many taxpayers have lingering questions regarding California Form 3551, such as what qualifies as eligible expenditures or how to rectify a mistake after submission. Providing clear answers to these queries can enhance understanding and confidence in the process.

For further assistance, you can contact the support team at pdfFiller, who can help guide users through the intricacies of filling out Form 3551. Whether through email, chat, or detailed guides, pdfFiller is dedicated to empowering individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send california form 3551 to be eSigned by others?

How do I edit california form 3551 in Chrome?

How do I fill out the california form 3551 form on my smartphone?

What is california form 3551?

Who is required to file california form 3551?

How to fill out california form 3551?

What is the purpose of california form 3551?

What information must be reported on california form 3551?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.