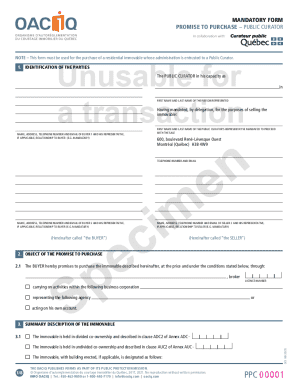

Get the free Form 10qsb

Get, Create, Make and Sign form 10qsb

How to edit form 10qsb online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10qsb

How to fill out form 10qsb

Who needs form 10qsb?

Form 10-QSB: A Comprehensive How-to Guide

What is Form 10-QSB?

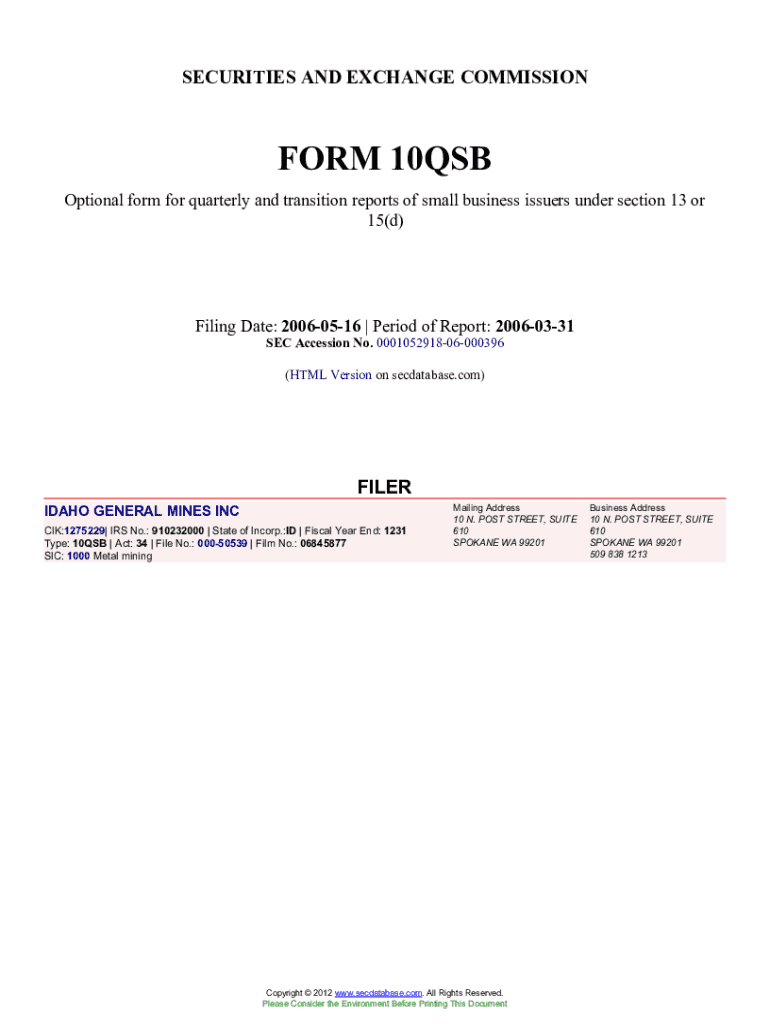

Form 10-QSB is a quarterly report filed with the U.S. Securities and Exchange Commission (SEC) specifically designed for small businesses. It serves as an essential formal document to inform investors and the public on a company's financial health and operating performance over a three-month period. The form encapsulates crucial information, facilitating transparency and timely disclosure, especially for companies designated as small reporting companies under SEC rules.

Unlike the more comprehensive Form 10-Q, which is applicable to larger public companies, Form 10-QSB follows a streamlined format that accommodates the specific needs of smaller firms, making it easier for them to comply with regulatory requirements without overwhelming detail. Understanding the distinctions between these two forms is vital for any business navigating the financial landscape.

Understanding the importance of Form 10-QSB

The significance of Form 10-QSB lies in its role as a crucial mode of financial transparency for small businesses. By mandating regular updates on performance and changes in operations, the form fosters a sense of accountability among management and promotes trust among stakeholders, including investors and shareholders. With timely and accurate filings, businesses can effectively communicate their growth and strategies, positioning themselves favorably in the eyes of potential investors.

On the contrary, failure to file Form 10-QSB accurately or on time can lead to grave consequences for small businesses. Non-compliance may result in penalties from the SEC, damage to a firm's reputation, or potential loss of investor confidence. Furthermore, investors often scrutinize timely filings closely, and discrepancies can raise red flags regarding a company’s operational integrity.

Key components of Form 10-QSB

A well-prepared Form 10-QSB encompasses several key components, each serving a specific function in conveying information. Understanding these components is essential for proper completion and ensuring all necessary information is provided. The primary sections included in the form are:

Step-by-step guide to completing Form 10-QSB

Completing Form 10-QSB may seem daunting, but by breaking it down into manageable steps, you can ensure a thorough and accurate submission. Below is a step-by-step guide to streamline the process:

Where to find Form 10-QSB

Form 10-QSB is readily available through official sources. The SEC’s EDGAR database is a primary resource for downloading the form and reviewing prior filings. Users can easily search for specific companies and their 10-QSB submissions, which can provide insights and benchmarks for understanding typical reporting practices in the industry.

Additionally, pdfFiller streamlines the retrieval and storage of the Form 10-QSB, allowing users to edit and sign the document right from the platform. This simplifies the management process, making it easier to keep critical documents organized and accessible.

Reading and interpreting Form 10-QSB

Understanding how to read and interpret the Form 10-QSB will give stakeholders insights into a company’s financial status and future outlook. When analyzing the key sections, it’s essential to focus on several common metrics. These metrics can reveal trends in growth, operational efficiency, and any potential red flags that may arise.

Investors should be vigilant about changes in revenue, operating expenses, and profit margins, as these metrics will indicate the overall health of the company. Furthermore, comparing multiple 10-QSB filings over time can provide an even clearer picture of a company’s performance trajectory, signaling areas of strength as well as those requiring improvement.

Comparing Form 10-QSB and other financial reports

When evaluating a company’s financial statements, understanding the differences between Form 10-QSB and other SEC filings, such as Form 10-K, is crucial. While Form 10-QSB is a quarterly report focused on providing up-to-date information, Form 10-K is an annual report that offers a comprehensive overview of the company’s year-long performance.

These reports serve different purposes and display unique characteristics. For instance, Form 10-K includes detailed audits and a wealth of information that cannot be as effectively communicated within the limited scope of Form 10-QSB. Depending on stakeholder needs, one report may be prioritized over another for thorough insights into a company’s financial health and operational strategies.

Tips for efficiently managing your Form 10-QSB

Managing your Form 10-QSB efficiently is essential to keeping your business compliant and organized. Leveraging tools like pdfFiller can greatly facilitate editing and signing your documents. With this cloud-based platform, you can track changes, collaborate with team members in real-time, and ensure that all necessary information is included.

Best practices also include storing all financial forms in a central repository to prevent loss and ensure easy access for stakeholders. Utilizing cloud-based solutions will allow businesses to update and access their documents anywhere and at any time, making operational agility more achievable.

Common mistakes to avoid when filing Form 10-QSB

Filing Form 10-QSB accurately requires attention to detail, and there are numerous mistakes that filers commonly make. Some frequent errors include misreporting figures, failing to include required components, or submitting the form past the deadline. It’s essential to double-check the accuracy of the statements and disclosures included in the document before submission.

Another proactive step is seeking legal or financial advice to mitigate risks associated with errors. Engaging with mentors or consultants who specialize in SEC compliance can enhance your understanding and help navigate the complexities of financial reporting effectively.

Navigating post-filing activities

Submitting your Form 10-QSB is just the beginning; there are crucial activities that follow submission. Companies must be prepared to monitor any feedback or inquiries from the SEC to address any discrepancies or concerns that may arise. Additionally, keeping stakeholders informed about the company’s financial health is vital, as timely communications can enhance investor trust and engagement.

Regular updates concerning performance allow stakeholders to feel connected and informed about their investment and its trajectory. Setting a schedule for follow-up communications ensures that your shareholders and investors remain engaged while fostering an environment of transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 10qsb online?

How do I edit form 10qsb in Chrome?

Can I edit form 10qsb on an iOS device?

What is form 10qsb?

Who is required to file form 10qsb?

How to fill out form 10qsb?

What is the purpose of form 10qsb?

What information must be reported on form 10qsb?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.