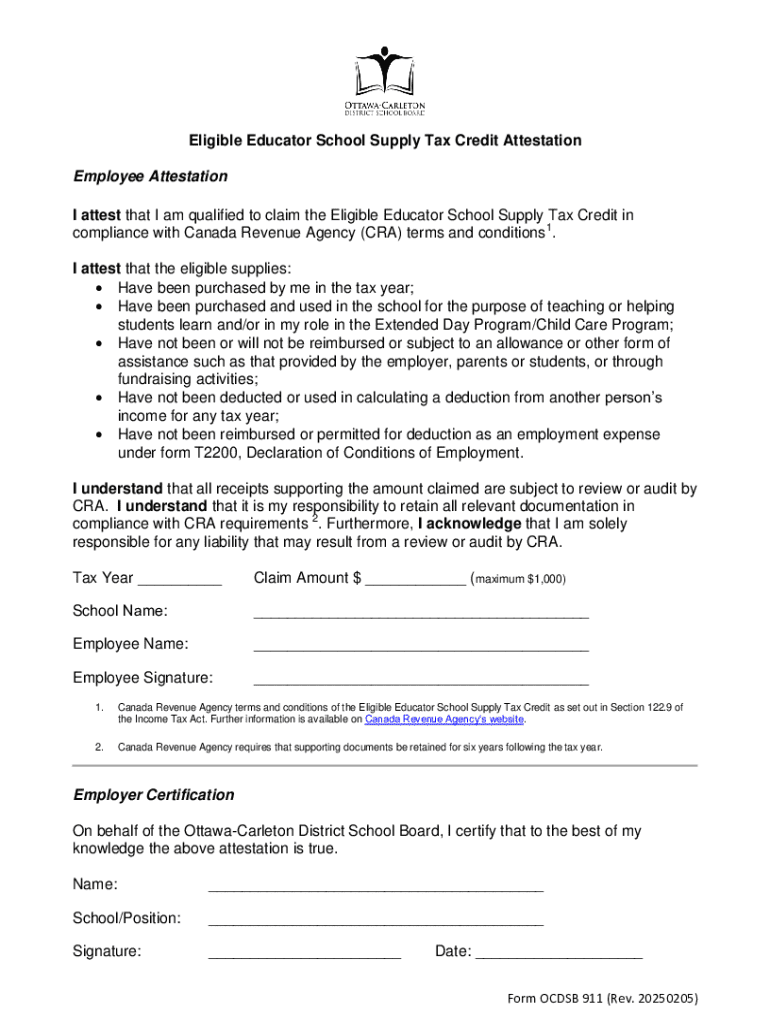

Get the free Eligible Educator School Supply Tax Credit Attestation

Get, Create, Make and Sign eligible educator school supply

How to edit eligible educator school supply online

Uncompromising security for your PDF editing and eSignature needs

How to fill out eligible educator school supply

How to fill out eligible educator school supply

Who needs eligible educator school supply?

A Complete Guide to the Eligible Educator School Supply Form

Understanding the eligible educator school supply form

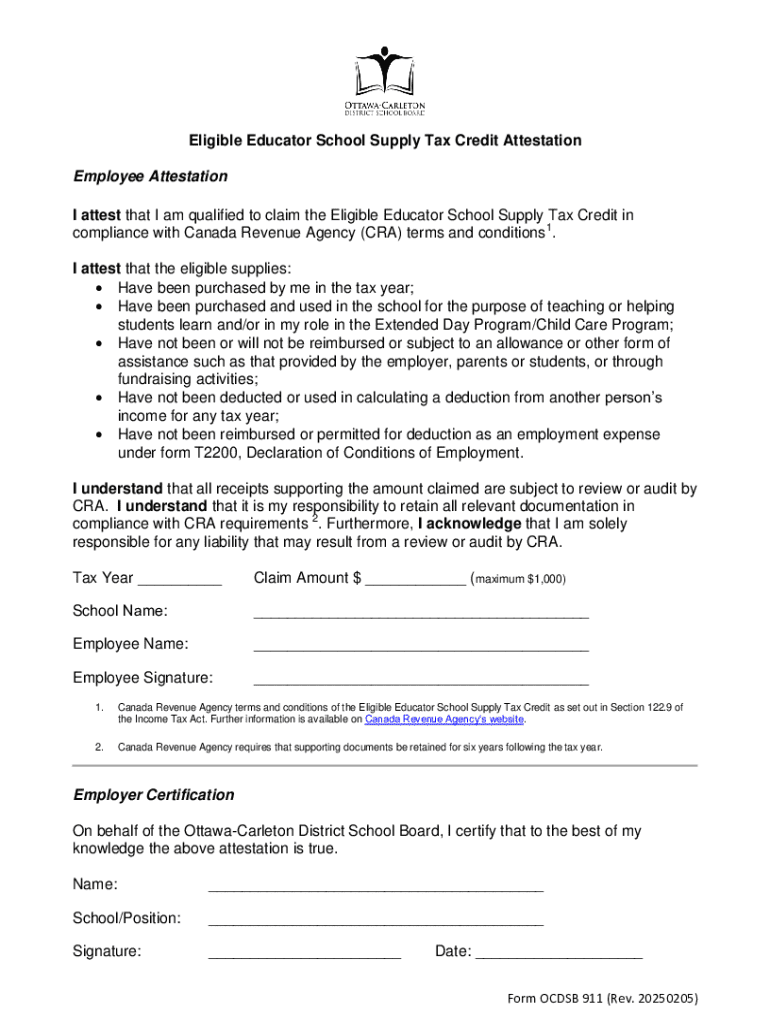

The eligible educator school supply form is designed specifically for educators to claim tax deductions on unreimbursed classroom expenses. This form allows teachers to recoup costs incurred for necessary supplies, which can significantly impact their financial well-being.

To be eligible, educators must work full-time in a recognized educational institution and typically be responsible for a classroom. Besides, they need to cover their supplies without reimbursement from their employers. This form provides a structured approach for educators to access the benefits available to them, showcasing their accumulated expenses.

By filling out this form, eligible educators gain access to many benefits, such as minimizing out-of-pocket expenses and facilitating budgeting for classroom needs.

Document overview: What to expect

The eligible educator school supply form is structured to ensure thoroughness when reporting expenses. Key features include sections for personal and school details, itemized supply lists, and total expenditures. A well-completed form can enhance your chances of securing a timely reimbursement.

Completing this form accurately is vital. Each detail, from your personal information to the specific supplies listed, must be correct to avoid processing delays. Additionally, understanding how this form fits within your overall budget for school supplies can help you maximize your benefits while remaining conscientious about your spending.

A complete and correctly filled form emphasizes your commitment as an educator and provides a structured means of financial responsibility.

Step-by-step instructions for completing the form

Completing the eligible educator school supply form involves several crucial steps, which ensure that you provide all necessary data for successful processing.

Step 1: Gathering required information

To start, gather essential personal details including your name, position, and the school district you are associated with. You will also want to collect detailed information regarding your supply purchases, including receipts and records to substantiate your claims.

Step 2: Accessing the eligible educator school supply form

You can find the eligible educator school supply form easily on the IRS website or directly through [pdfFiller](). Search for educational forms, or use their streamlined interface to access and download the document you need.

To make accessing the form even easier, consider using pdfFiller’s online capabilities to download the form in various formats.

Step 3: Filling out the form

When filling out the form, accurately complete each section. Provide your personal information, such as name and contact details, followed by details of your school, including its address and identification number. Then, in the supply details section, list each item you purchased, including quantity and cost.

Avoid common pitfalls like lack of clarity in your itemized list or missing signatures. Double-check your entries to ensure everything aligns with supporting documents.

Step 4: Reviewing your submission

Reviewing your submission is a critical final step before sending your form off. Double-check for typos and ensure all information is accurate. Using pdfFiller, you can edit and revise in real-time, making adjustments as needed.

Step 5: Submitting the form

Once everything is in order, choose your method of submission. You can file the form online or send it by mail. Be mindful of deadlines; keep an eye on reimbursement timelines to ensure you submit promptly to avoid missing out on benefits.

Editing and customizing the form

With pdfFiller, editing and customizing the eligible educator school supply form is user-friendly. Utilize their tools to make modifications, adjust sections, or add notes that clarify your entries.

Using pdfFiller to make adjustments

Begin by uploading your downloaded form to pdfFiller. Use the intuitive editing interface to navigate between sections effortlessly. You can highlight important notes, add comments, or even adjust figures if needed.

Collaborating with others

If you're working on the form as part of a team, utilize pdfFiller's sharing capabilities. Share the document with colleagues for input or collaboration. Clearly establish deadlines and requirements for contributions so that everyone is on the same page.

eSigning the eligible educator school supply form

An eSignature is an essential aspect of the eligible educator school supply form, verifying your identity and confirming your claims. Utilize pdfFiller's eSigning feature, which provides a secure and straightforward method for signing documents electronically.

Modern regulations permit eSignatures to hold the same legal weight as handwritten signatures, provided that the methods used comply with established electronic signature laws. This ensures a seamless process, mitigating potential delays caused by postal services.

Managing your submissions

After submission, staying organized becomes imperative. Use tools available within pdfFiller to track your submissions effectively. The platform allows you to store, categorize, and retrieve forms with ease.

Follow up on your application status to ensure timely processing. Reach out to the designated department to retrieve any needed updates and maintain documentation for your records.

Navigating common challenges

As with any form submission, challenges can arise. It's essential to be prepared for potential form rejections due to minor errors. Always re-evaluate your submission for accuracy before sending it out.

If you encounter issues, seek clarification from your educational institution's administrative office. Their insights can significantly ease the process and help with troubleshooting any setbacks.

Stay informed through FAQs or help resources commonly available alongside the form to address common concerns and questions without added stress.

Utilizing additional resources

To maximize the benefits of the eligible educator school supply form and budgeting, consider utilizing various resources. Online budgeting tools specifically tailored for educators can streamline your planning and spending.

Engage with educator communities both online and locally to grow your network and access shared resources. Collaboration can offer additional insights on managing expenses and capturing potential savings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete eligible educator school supply online?

How do I make changes in eligible educator school supply?

How do I complete eligible educator school supply on an Android device?

What is eligible educator school supply?

Who is required to file eligible educator school supply?

How to fill out eligible educator school supply?

What is the purpose of eligible educator school supply?

What information must be reported on eligible educator school supply?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.