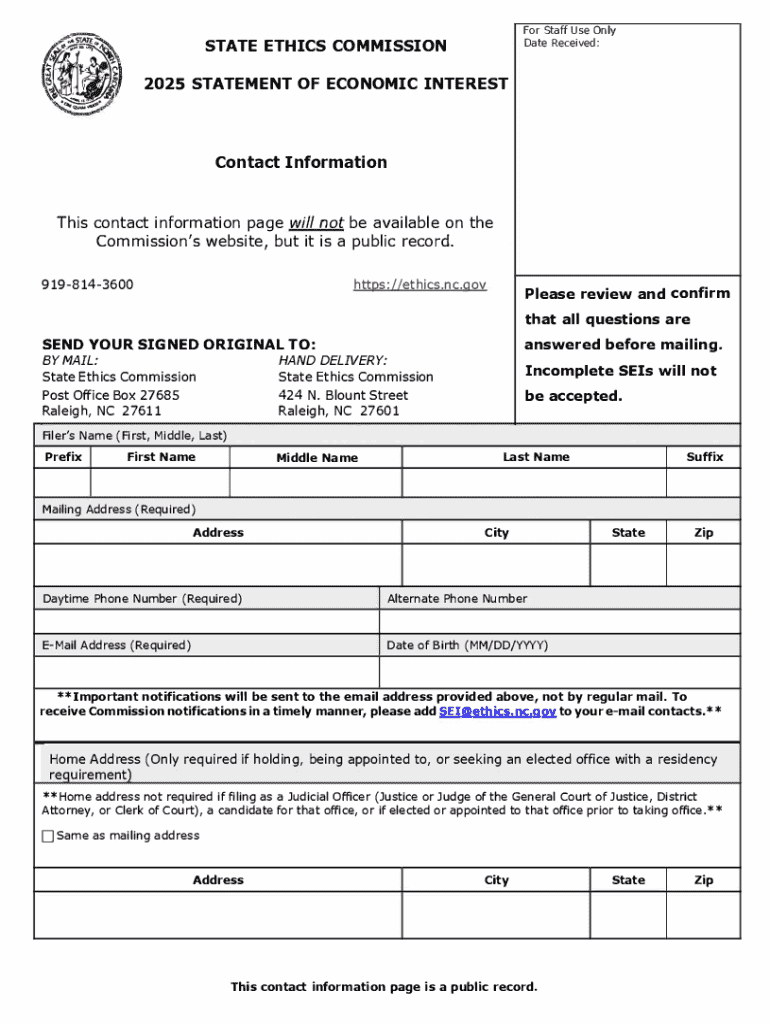

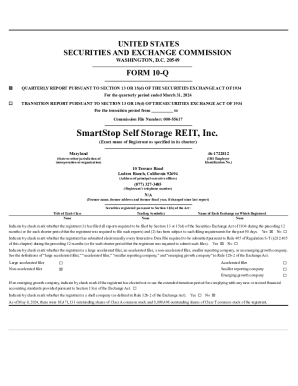

Get the free 2025 Statement of Economic Interest

Get, Create, Make and Sign 2025 statement of economic

How to edit 2025 statement of economic online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 statement of economic

How to fill out 2025 statement of economic

Who needs 2025 statement of economic?

Navigating the 2025 Statement of Economic Form: A Comprehensive Guide

Overview of the 2025 statement of economic form

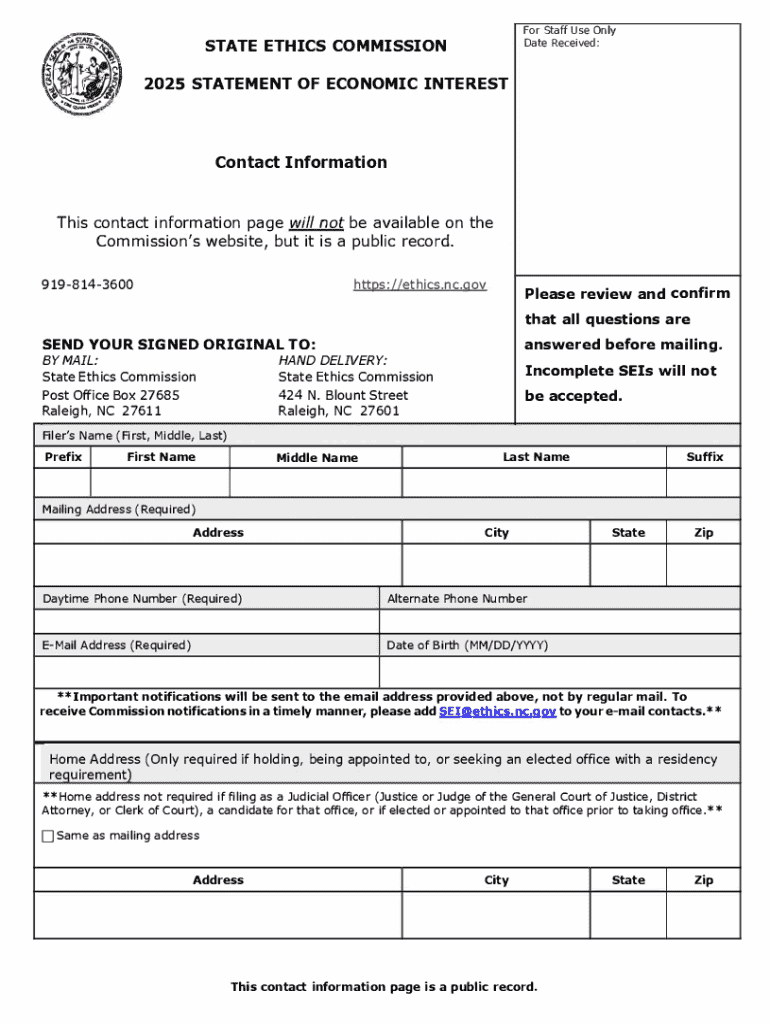

The 2025 Statement of Economic Form serves as a crucial document for individuals and entities to declare their economic conditions in a structured manner. This form includes detailed financial disclosures designed to enhance transparency and accountability. As we step into 2025, the importance of this statement is underscored by increasing regulatory scrutiny and a demand for clear economic reporting.

One significant evolution in the 2025 form is its enhanced digital format, allowing for easier access and completion. Unlike previous years, where paper submissions were the norm, 2025 sees a shift towards digital submissions, reflecting technological advancements and the growing trend toward remote operations.

Key components of the 2025 statement of economic form

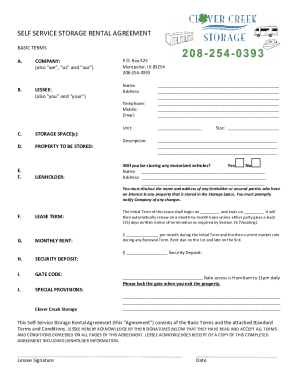

Understanding the key components of the 2025 Statement of Economic Form is essential for accurate completion. At its core, the form includes financial disclosures such as personal income, business revenues, expenditures, and specific assets owned. Each of these components must be meticulously detailed to ensure compliance with regulatory standards.

Filers must provide supporting documentation, including bank statements, tax returns from the previous year, and any documentation related to significant financial transactions. Additionally, timelines for submission have been clarified, with a focus on strict adherence to deadlines to avoid penalties or rejection.

Who needs to file the 2025 statement of economic form?

The 2025 Statement of Economic Form is aimed at a variety of filers. This includes both individuals and entities, each with specific criteria determining their filing obligations. Individuals who earn above a certain income threshold must file, while businesses that exceed a set revenue limit are also required to submit this form.

Entities range from small businesses to large corporations, all subject to different regulations based on their structure and revenue. It's essential for potential filers to identify their obligation status to ensure compliance and avoid penalties.

Step-by-step guide to completing the 2025 statement of economic form

Completing the 2025 Statement of Economic Form requires careful attention to detail. Here’s a step-by-step guide to help you navigate the process efficiently.

Step 1: Gathering necessary information

Start by gathering all required documents. Essential items include last year’s tax returns, proof of income such as pay stubs, and documentation for any assets and liabilities.

To streamline data collection, consider creating a checklist of all necessary documents. This can speed up the process and ensure you don’t miss any key information.

Step 2: Accessing the online form through pdfFiller

Accessing the 2025 Statement of Economic Form is simple with pdfFiller. Navigate to the website and search for the form. pdfFiller's platform offers user-friendly features that facilitate easy filling.

Step 3: Filling out the form

When filling out the form, pay close attention to each section. Ensure you're providing accurate details, as common pitfalls often arise from simple errors in data entry.

Step 4: Reviewing and editing your submission

Before submission, utilize pdfFiller’s editing tools to double-check your entries. The platform's collaboration features also allow team members to provide input for accuracy and completeness.

Step 5: Signing and submitting the form

Once you’re satisfied with the form, proceed to the eSignature process. pdfFiller ensures an effortless signing experience and facilitates submission directly through the platform.

Understanding the review process for the 2025 statement of economic form

After submission, it's crucial to understand what happens next. The reviewing process involves scrutiny by regulatory officials to ensure compliance with all stated requirements.

Officials will evaluate the submission based on accuracy, completeness, and adherence to timelines. It's common for submissions to face delays due to missing documents or non-compliance with the stated guidelines.

FAQs about the 2025 statement of economic form

Navigating new forms can lead to several queries. Below are some frequently asked questions regarding the 2025 Statement of Economic Form.

One of the primary concerns is about confidentiality and non-disclosure. Filers often wonder what information is kept confidential and what is mandatory for disclosure.

Real-life scenarios: Filing the 2025 statement of economic form

Real-life examples can shed light on standard practices for filing the 2025 Statement of Economic Form. For instance, a small business owner might encounter challenges related to revenue reporting.

Learning from case studies can provide valuable insights. For example, a case involving delayed submission due to incomplete documentation highlights the necessity of thorough preparation.

Leveraging pdfFiller tools for effective form management

pdfFiller offers a wealth of features beyond simply filling and signing forms. The platform excels in document storage and management, allowing users to keep important files organized and accessible.

Collaboration tools within pdfFiller facilitate teamwork, making it easier for multiple stakeholders to contribute to document accuracy. Maintaining compliance year-round becomes manageable with ongoing access to necessary documentation and templates.

Future considerations for subsequent statements of economic forms

As we look beyond 2025, anticipating changes to the Statement of Economic Form is vital. Regulatory bodies may introduce new guidelines, requiring filers to stay informed and adapt.

Keeping up with industry trends and shifts in economic reporting can help individuals and businesses stay ahead of the curve. Planning ahead ensures you're prepared for any necessary changes in submission requirements.

Relevant regulations and guidelines

The 2025 Statement of Economic Form is governed by specific regulations outlined by financial authorities. These regulations are designed to ensure clarity and uniformity in financial reporting.

For detailed regulatory insights, filers should refer to official resources and guidelines provided by their local governing bodies. Staying updated on these regulations is vital for compliance.

Key takeaways

The 2025 Statement of Economic Form holds significant importance in economic reporting. Understanding its components, the filing process, and compliance criteria will benefit both individuals and businesses.

By utilizing pdfFiller, users not only streamline the document management process but also enhance collaboration, enabling efficient filing of the 2025 Statement of Economic Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2025 statement of economic directly from Gmail?

Can I edit 2025 statement of economic on an Android device?

How do I complete 2025 statement of economic on an Android device?

What is statement of economic?

Who is required to file statement of economic?

How to fill out statement of economic?

What is the purpose of statement of economic?

What information must be reported on statement of economic?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.