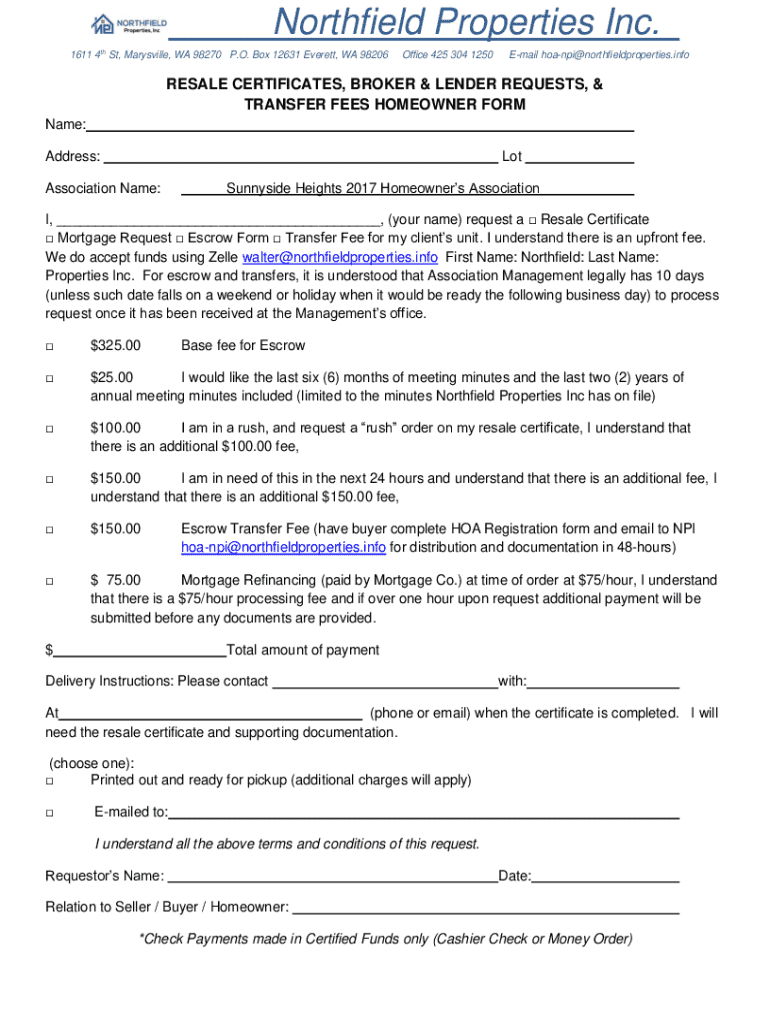

Get the free Resale Certificates, Broker & Lender Requests, & Transfer Fees Homeowner Form

Get, Create, Make and Sign resale certificates broker lender

How to edit resale certificates broker lender online

Uncompromising security for your PDF editing and eSignature needs

How to fill out resale certificates broker lender

How to fill out resale certificates broker lender

Who needs resale certificates broker lender?

Understanding the Resale Certificates Broker Lender Form

Understanding resale certificates

A resale certificate is a crucial document used primarily in sales transactions to allow the buyer to purchase goods without paying sales tax. This exemption is vital for businesses engaged in reselling products, as it reduces their upfront costs. Essentially, the resale certificate verifies that the buyer intends to resell the item and is not the end consumer.

The importance of resale certificates lies in their ability to streamline the purchasing process. By providing a resale certificate, businesses can purchase inventory without incurring immediate tax obligations, thereby improving cash flow. Additionally, the use of this document helps ensure compliance with tax regulations and protects sellers from potential disputes over tax liabilities.

Key components of a resale certificate

A valid resale certificate generally includes several key components that vary by state or region. These components typically consist of the seller’s and buyer’s business names, addresses, and tax identification numbers. The document must also specify the nature of the transaction and state that the purchase is for resale purposes.

Certain states require additional information, such as the seller's license number or a unique identifier for the transaction. It's essential for both buyers and sellers to understand the specific requirements of their state to ensure the validity of their resale certificate and avoid complications during audits.

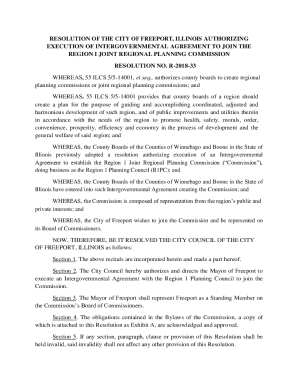

The role of brokers and lenders

Brokers play a significant role in resale transactions by facilitating the use of resale certificates. They act as intermediaries between buyers and sellers, ensuring compliance with legal requirements and assisting in the proper documentation process. Brokers must be knowledgeable about the rules governing resale certificates in their state to guide clients effectively.

Lenders, on the other hand, find resale certificates critical when evaluating loan applications or financing agreements. The inclusion of a resale certificate can indicate the buyer’s intent to generate revenue through resale, which may influence the lender's decision on funding. Understanding how these certificates interact with loan agreements is essential for both brokers and lenders.

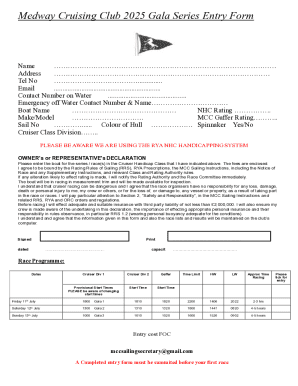

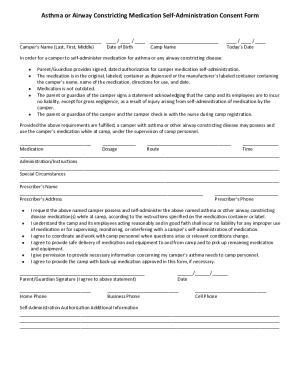

Filling out the resale certificate broker lender form

Completing the resale certificate broker lender form requires attention to detail. Start by gathering all necessary information, including your business name, address, and tax identification number. When filling out the form, ensure clarity and accuracy, as mistakes can lead to invalidity or delays in processing.

Follow these steps for a smooth completion:

Common mistakes to avoid

Many individuals make common errors when filling out resale certificates that can lead to complications. Failing to include complete business information or neglecting to sign the document are frequent issues. Additionally, not being aware of state-specific requirements can render a resale certificate invalid, resulting in potential tax liabilities.

To ensure compliance, take the following precautions:

Required documentation

When submitting your resale certificate broker lender form, certain supporting documents may be required. This can include previous tax returns, business licenses, or proof of tax exemption status. It is important to check with your state’s regulations to determine specific documentation needs.

Make sure you have the following documents ready:

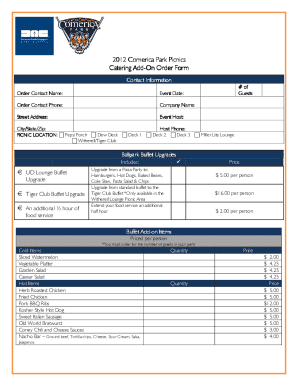

Digital tools for easier completion

Utilizing digital tools can simplify the process of filling out the resale certificates broker lender form. Platforms such as pdfFiller allow users to complete, edit, and sign documents electronically. This streamlines the entire process and reduces the likelihood of errors.

Here are some tips for using digital tools effectively:

Managing and submitting your resale certificate

Managing your resale certificates involves organizing and tracking submission timelines. Successful businesses set reminders for renewal dates and review their documents periodically to ensure they are up to date. Good document management practices can prevent unnecessary delays and ensure continued compliance.

Submission guidelines vary by state but generally involve sending the completed form to the seller or the relevant tax authority. Make sure to follow local rules regarding deadlines for submission to avoid penalties.

Frequently asked questions

Common inquiries about resale certificates often include questions regarding their acceptance in different states. While many states accept resale certificates, differences in regulations exist, which can affect their validity. Additionally, if a resale certificate is challenged, it can lead to audits and potential penalties.

Specific questions for brokers and lenders may revolve around the verification of resale certificates. Brokers must have procedures for validating certificates to protect against tax liability, while lenders need assurance that the certificates are legitimate for financing purposes.

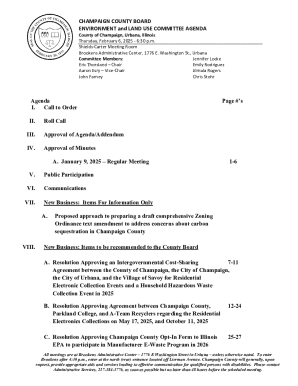

Related forms and documents

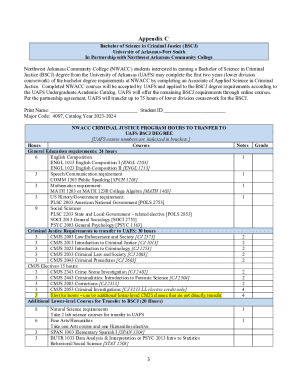

In addition to the resale certificates broker lender form, other relevant forms such as exemption certificates exist that may be applicable in certain contexts. It is essential for individuals in the real estate or sales sectors to understand how these documents interact. Familiarity with a range of forms can enhance compliance and improve transaction efficacy.

Using tools like pdfFiller can help users access customizable templates that resonate with their specific needs, ensuring that all forms are easily accessible and editable.

Real-world applications and case studies

Numerous businesses successfully utilize resale certificates in their operations. For example, a wholesaler might secure inventory by providing a resale certificate, allowing them to pass costs savings onto their customers. Case studies often reveal that businesses that implement robust processes for handling resale certificates tend to experience smoother transaction flows and fewer compliance issues.

However, challenges exist. Brokers and lenders may encounter disputes over the legitimacy of resale certificates, leading to potential legal ramifications. Developing clear strategies for documentation and communication can significantly mitigate these challenges.

Engaging with interactive tools

Adopting interactive tools can greatly enhance the efficiency of managing resale certificate processes. Platforms like pdfFiller provide features that allow teams to collaborate, edit, and manage documents seamlessly in a cloud-based environment. Leveraging such technologies can boost productivity and streamline workflows.

To make the most of these digital resources, consider the following:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my resale certificates broker lender in Gmail?

How can I send resale certificates broker lender to be eSigned by others?

How do I complete resale certificates broker lender online?

What is resale certificates broker lender?

Who is required to file resale certificates broker lender?

How to fill out resale certificates broker lender?

What is the purpose of resale certificates broker lender?

What information must be reported on resale certificates broker lender?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.