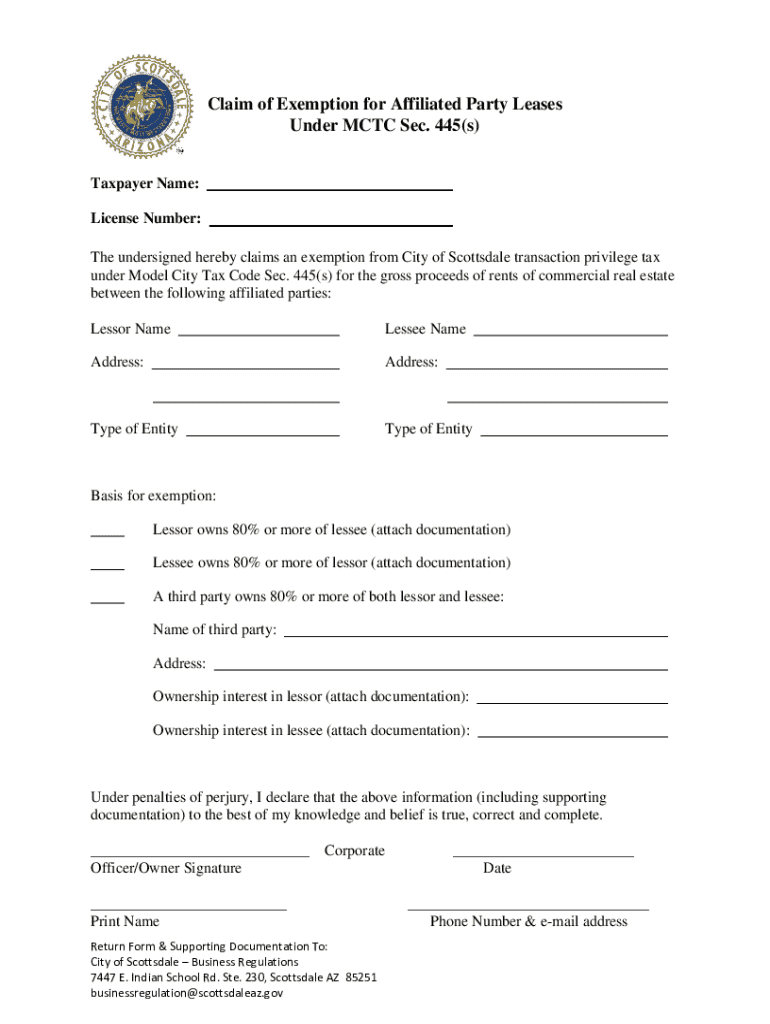

Get the free Claim of Exemption for Affiliated Party Leases

Get, Create, Make and Sign claim of exemption for

Editing claim of exemption for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim of exemption for

How to fill out claim of exemption for

Who needs claim of exemption for?

Claim of Exemption for Form: A Comprehensive Guide

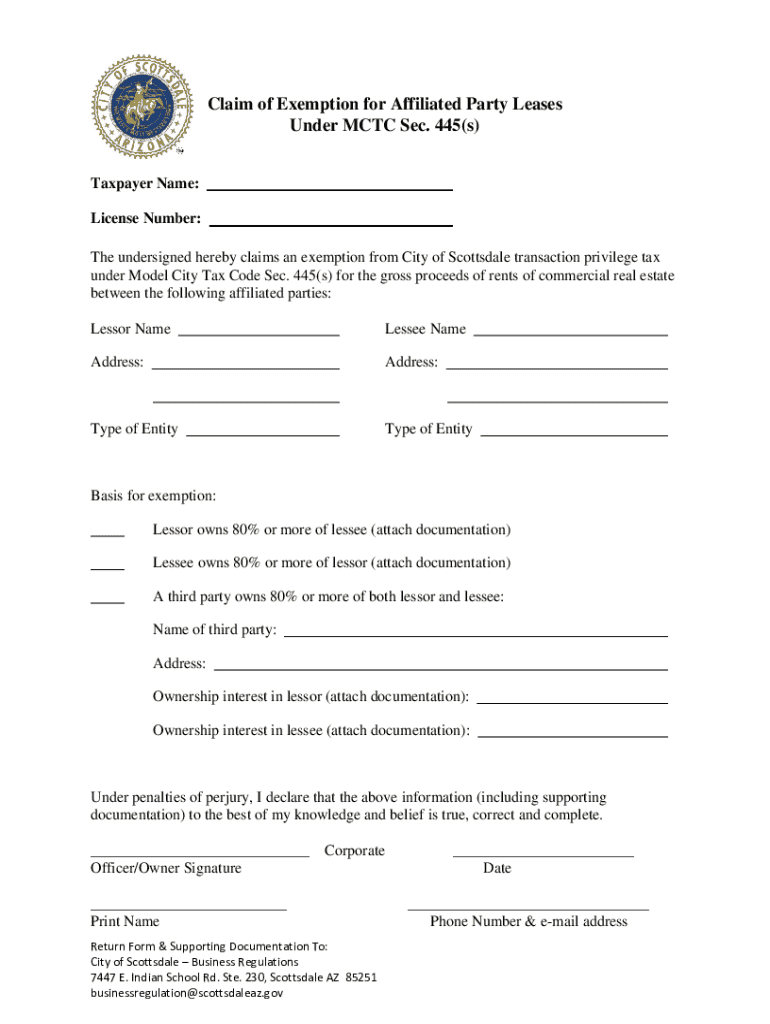

Understanding claim of exemption

A claim of exemption is a formal request made by individuals or entities to protect specific assets from legal processes, such as wage garnishment or creditor claims. This legal maneuver is crucial for safeguarding essentials needed for living and functioning, particularly in financial distress. It serves as a buffer, allowing individuals to retain critical resources while attending to other obligations.

The importance of a claim of exemption extends beyond mere financial protection; it encompasses a range of scenarios where safeguarding different types of income or assets is crucial. For example, individuals facing potential court actions, such as collections by marshal, constable or sheriff, often find themselves needing an exemption to keep their necessities intact. There are various scenarios where filing a claim of exemption is necessary, including divorce proceedings, bankruptcy situations, or when facing lawsuits regarding unpaid debts.

Overview of the claim of exemption form

The claim of exemption form serves as the official document utilized to assert one's right to safeguard particular assets or income from garnishment or debt collection procedures. The primary purpose of this form is to inform the court about specific financial situations that justify the claim, ensuring that the court considers the individual's circumstances before making a decision.

Key components of the claim of exemption form generally include personal details, information about the income being safeguarded, and a detailed explanation of why the exemption should be granted. Common types of exemptions available may include exemptions for certain wages, financial assistance, social security benefits, or even property, depending on the jurisdiction.

Eligibility criteria for filing a claim of exemption

Eligibility for filing a claim of exemption largely depends on individual circumstances, including income level and the type of assets in question. Generally, individuals who earn below a certain income threshold or possess minimal financial resources are more likely to qualify for exemptions. Additional qualification criteria might involve specific local laws that dictate what forms of income or assets can be claimed.

Under typical guidelines, documentation such as pay stubs, bank statements, or proof of governmental assistance may be required to support your claim. It’s crucial to gather all pertinent information before initiating the process, as incomplete applications can lead to denied claims, further complicating financial situations.

Step-by-step instructions for completing the claim of exemption form

Completing the claim of exemption form accurately is essential for a successful claim. In this section, we provide a clear, step-by-step guide to assist you in successfully navigating the process.

Step 1: Preparing your information

Start by gathering all necessary personal financial information, including income levels, household size, and details about your financial obligations. It's also important to familiarize yourself with the terms and conditions associated with your claim to avoid any misunderstandings later in the process.

Step 2: Accessing the form

You can find the claim of exemption form on your local court's website. Alternatively, platforms like pdfFiller offer the option to fill out various legal forms, including this claim, online.

Step 3: Filling out the form

When filling out the claim of exemption form, you will encounter sections for personal information, income details, and asset claims. Pay close attention to each area, ensuring all numbers and details are correct. A common mistake is underestimating or overlooking financial obligations, which can lead to complications in the approval of your claim.

Step 4: Reviewing your submission

Reviewing your form before submission is paramount. Utilize editing tools provided by pdfFiller to double-check your form for accuracy. Double-checking ensures that all information is legible and accurate, reducing the likelihood of a denial due to clerical errors.

Step 5: Submitting the form

You have several options for submitting your claim of exemption form, including online submission, mailing it to your local court, or delivering it in person. Be aware of submission deadlines to ensure timely processing. Depending on your jurisdiction, processing times can vary, so review local regulations for insights into expected timelines for response.

Editing and managing your claim of exemption form

One of the significant advantages of using pdfFiller is its robust cloud-based platform, which allows you to edit and save your claim of exemption form easily. Managing multiple versions of your forms ensures that you can track changes over time while collaborating with teammates on submissions if needed.

Collaboration is key, especially when multiple individuals are involved in a case that requires a claim of exemption. The platform allows for seamless sharing and commenting features, enabling all parties to stay informed and aligned throughout the submission process.

Frequently asked questions (FAQs)

It’s not uncommon to have questions about the claims process. Here are some frequently asked queries that can provide further clarity on filing a claim of exemption.

Tips for successful claims

To ensure your claim is successful, adhere to best practices such as providing complete and accurate details on the form, keeping communication open with the court, and following up if necessary. Using features from pdfFiller can enhance your submission process by allowing you to correct mistakes quickly and efficiently.

Make sure to utilize available resources offered through platforms like pdfFiller, including templates and support, to make the process smoother. Understanding state-specific regulations and requirements for filing claims can also play a significant role in achieving a successful outcome.

Additional considerations

Legal compliance regarding claims of exemption often varies by state. It's essential to be informed about your local laws, as failure to follow state-specific regulations can have consequences. Many state laws outline specific exemptions concerning wages, assets in garnishment, and types of properties protected from creditors.

Sudden changes in financial situations may also necessitate reassessing your claim. For instance, if you receive a new job or inheritance, understand how these changes might impact your previously filed claim. Staying informed about the ever-evolving tax laws and exemption claim regulations is key for optimal resource management and ensuring protection when needed.

Interactive tools and resources

By utilizing interactive tools from pdfFiller, you can enhance your document management practices. The platform provides helpful templates and forms related to claims of exemption, making it easier to navigate legal paperwork efficiently. Users can also access video tutorials to gain visual guidance on filling out forms, which can be especially useful for first-time filers.

These resources contribute to a smoother filing experience and empower you to submit claims of exemption confidently. In a complex legal landscape, such tools not only simplify the process but also serve as an informative guideline to equip you with knowledge throughout your legal journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in claim of exemption for?

Can I edit claim of exemption for on an Android device?

How do I complete claim of exemption for on an Android device?

What is claim of exemption for?

Who is required to file claim of exemption for?

How to fill out claim of exemption for?

What is the purpose of claim of exemption for?

What information must be reported on claim of exemption for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.