Get the free Fo-10k

Get, Create, Make and Sign fo-10k

Editing fo-10k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fo-10k

How to fill out fo-10k

Who needs fo-10k?

Comprehensive Guide to Filing the Form 10-K

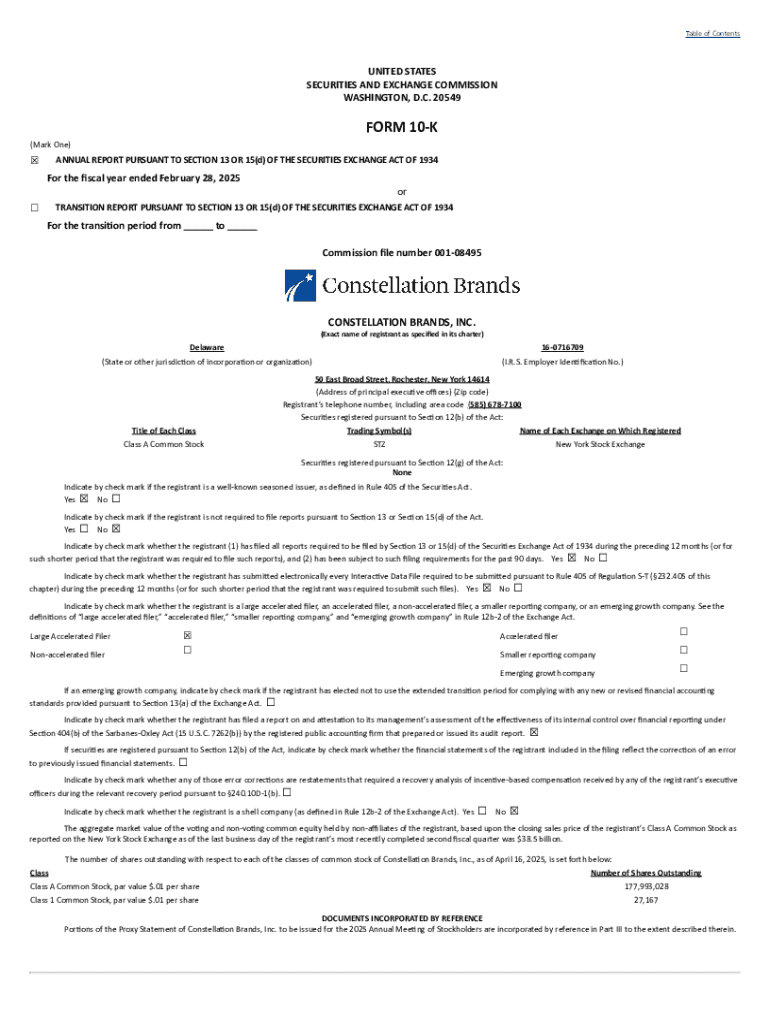

Overview of the Form 10-K

The Form 10-K is a comprehensive annual report filed by publicly traded companies with the Securities and Exchange Commission (SEC) in the United States. This document serves as a critical tool for organizations to present an overview of their financial condition and operational performance over the past year. It is mandatory for all public companies, underscoring its significance for investors and stakeholders seeking detailed insights into corporate health.

Investors heavily rely on the Form 10-K to make informed decisions based on the company’s reported risks, strategies, and financial data. The importance of this filing cannot be overstated as it establishes transparency and builds trust in the company's financial reporting.

Key components of the Form 10-K

Understanding the filing requirements

Public companies in the United States are required to file a Form 10-K annually. The criteria for determining what constitutes a public company include those listed on stock exchanges and entities that have more than a certain number of shareholders or assets. Smaller reporting companies, as defined by the SEC, may have simplified reporting requirements but still must file a Form 10-K.

Understanding the deadlines for filing is critical. Generally, the Form 10-K must be filed within 60 to 90 days after the end of the fiscal year, depending on the size of the company. This filing period is crucial as it aligns with the company’s fiscal year-end, which may vary by organization.

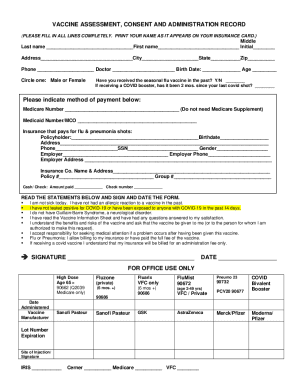

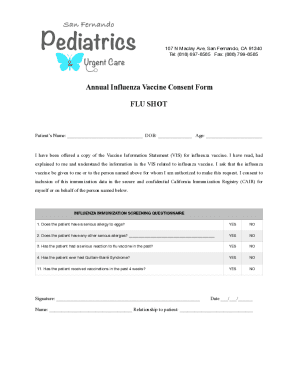

Preparing to file the Form 10-K

Filing the Form 10-K requires careful preparation and a thorough understanding of the necessary information. Gathering required materials starts with compiling accurate financial statements and disclosures. These documents should reflect true and fair views of the company's transactions, commitments, and end-of-year financial position.

Management is also responsible for articulating insights about their assessments, future projections, and the overall financial landscape. Utilizing templates provided by platforms like pdfFiller can streamline this process significantly, making it easier to adhere to industry standards while ensuring the document is customizable to specific company needs.

Detailed walkthrough: Completing the Form 10-K

1. Business overview

In this section, companies should crisply outline their services, product lines, market dynamics, and corporate strategy. It’s crucial to articulate business objectives and future vision clearly, as this section lays the groundwork for reader understanding.

2. Risk factors

Identifying and categorizing potential risks is paramount. Companies should provide a clear list of risks that could impair their business, ranging from financial uncertainties to shifts in market conditions. This section enhances communication regarding the nature of corporate challenges.

3. Financial data

Properly formatting financial statements is essential for compliance. The financial data section includes detailed balance sheets, income statements, and cash flow statements. A clean audit opinion should accompany this section to validate data integrity.

4. Management discussion and analysis (&A)

The MD&A section provides management with an opportunity to elaborate on financial results and address uncertainties affecting future performance. It is critical to foster transparency by discussing both past results and future expectations.

5. Other required information

This includes disclosures on executive compensation, share ownership by executives, and other significant legal proceedings. It adds layers of transparency and keeps investors informed about potential conflicts or corporate governance issues.

Editing and finalizing your Form 10-K

Effective editing is a crucial stage in preparing the Form 10-K. Platforms like pdfFiller offer tools that can assist in proofreading and formatting drafts. Collaborating with various stakeholders during this phase can provide feedback from diverse perspectives and ensure a well-rounded document.

Before final submission, conduct essential checks to ensure compliance with SEC regulations. Addressing common errors upfront will save time and avoid potential penalties associated with improper filings. A final review will help confirm that statements, risks, and projections reflect the company’s current status accurately.

Electronic filing process

Filing electronically through the SEC’s EDGAR system is the mandated process for submitting the Form 10-K. First, users must create a user account by providing company and personal identification information. This step is crucial for ensuring that the submitted documents are linked to valid corporate entities.

It is important to double-check that all required documents are attached and properly formatted before submission. After filing, companies should track their submission status to ensure it was successful. In event of issues, companies need to be prepared to address any concerns raised by the SEC post-submission.

Post-filing considerations

Once the Form 10-K is filed, it becomes a public document accessible to all investors and stakeholders. This transparency not only reflects the company’s commitment to good governance, but also enhances investor relations. Companies should facilitate discussions around their Form 10-K as part of ongoing communication strategies.

Utilizing the Filed 10-K for stakeholder engagement can be invaluable. Companies can leverage insights from their reports to foster trust and confidence among investors, ensuring that future projections and operational strategies align with shareholder interests.

Common challenges and FAQs

The Form 10-K filing process can be complex, with several frequent complications arising during preparation and submission. Such challenges may include gathering accurate data, ensuring compliance with securities laws, and meeting deadlines. Companies should strategize on maintaining organized documentation throughout the year to alleviate these issues.

Addressing common questions can also minimize stress during this process. For instance, if a company misses a filing deadline, immediate steps should be taken to file late and communicate transparently with stakeholders. Additionally, having a plan for handling amendments and corrections can prevent future filing errors.

Interactive tools and resources available on pdfFiller

pdfFiller offers an array of interactive tools designed to simplify the Form 10-K filing process. Users can access comprehensive templates tailored to meet SEC requirements and customize these documents to replace placeholders with relevant information.

Using pdfFiller not only facilitates document creation but also enhances overall document management. From editing to eSigning and collaborative features, pdfFiller empowers users to streamline their filing process—making it easier for individuals and teams to focus on core business activities without overwhelming administrative burdens.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fo-10k without leaving Google Drive?

How can I send fo-10k to be eSigned by others?

How do I fill out fo-10k using my mobile device?

What is fo-10k?

Who is required to file fo-10k?

How to fill out fo-10k?

What is the purpose of fo-10k?

What information must be reported on fo-10k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.