Get the free State Charitable Solicitation Disclosures

Get, Create, Make and Sign state charitable solicitation disclosures

How to edit state charitable solicitation disclosures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state charitable solicitation disclosures

How to fill out state charitable solicitation disclosures

Who needs state charitable solicitation disclosures?

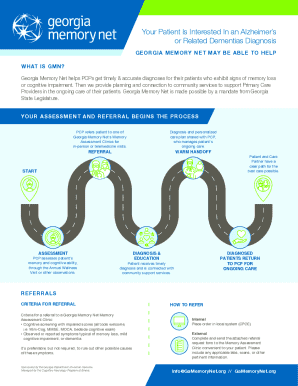

Understanding the State Charitable Solicitation Disclosures Form

Understanding charitable solicitation requirements

Charitable solicitation encompasses the efforts made by nonprofits and other organizations to raise funds for various causes. Transparency in fundraising is paramount, as it builds trust with potential donors and the community. Different states have established regulations that mandate certain disclosures to protect donors against fraudulent activities and misuse of contributions.

State regulations serve multiple roles; they ensure that solicitors provide accurate information about their operations and financial practices. These laws help facilitate informed giving and enhance the accountability of organizations. Understanding these requirements is key to a smooth fundraising process.

Who needs to file a disclosure?

Not all organizations will be subjected to the same regulations. Typically, nonprofits and specific charitable organizations that solicit donations must file a state charitable solicitation disclosures form. Each state sets parameters on who qualifies as a ‘charitable organization’ based on their structure, mission, and the nature of their fundraising activities.

Moreover, some states have specific thresholds that determine whether an organization must file. For example, in New York, any charity that raises over $25,000 must disclose its solicitation activities, while in California, that threshold is set at $50,000. Organizations must review their state's laws to ascertain their obligations.

The state charitable solicitation disclosures form explained

The state charitable solicitation disclosures form is a vital document designed to foster accountability and transparency in the nonprofit sector. By completing this form, organizations affirm their commitment to ethical fundraising practices and help streamline the regulatory process for monitoring solicitations.

The primary purpose of this disclosure form is to protect donor rights. Transparency yields trust; when donors are informed about how their contributions will be utilized, they are more likely to engage and support charitable causes. Also, states use this information to maintain a registry of compliant organizations, which can enhance credibility in the nonprofit landscape.

Key information required on the form

When filling out the form, organizations must provide key details including:

Step-by-step guide to completing the disclosure form

Completing the state charitable solicitation disclosures form can be straightforward if you approach it systematically. Here’s a step-by-step guide to ensure you gather everything you need to file properly.

Gathering necessary information

Start by gathering all necessary documents. This may include articles of incorporation, tax-exempt status documentation, financial reports from the past three years, and your organizational budget. Understanding financial requirements is vital; failure to provide accurate or complete financial statements can lead to delays or rejections.

Filling out the disclosure form

As you fill out the disclosure form, each section will require specific information. For example, in the Organization Information section, you’ll need to confirm your charity’s legal name, tax ID, and address. Next, in the Fundraising Methods section, give a detailed account of how you plan to raise funds, ensuring you highlight compliance with relevant state guidelines.

Finally, the Financial Statements section will require you to upload recent financial documents. Make sure to double-check figures and descriptions here.

Common pitfalls and how to avoid them

Some common pitfalls organizations encounter include submitting incomplete information or misinterpreting financial data. Other mistakes may involve using outdated forms or failing to account for changes in state laws regarding charitable solicitation. To avoid these issues, it’s vital to interact directly with state charity officials when uncertain, consult the latest guidelines, and employ collaborative tools for organization.

The role of pdfFiller in managing charitable solicitations

pdfFiller serves as an invaluable aid for organizations by simplifying the process of creating and managing state charitable solicitation disclosures forms. With its cloud-based platform, users can quickly access forms, edit them as needed, and ensure compliance with state specifications.

Editing and customizing the disclosure form

pdfFiller simplifies form editing by enabling organizations to tailor the disclosure form to their unique branding. Adding logos, changing fonts, and adjusting colors can help create a cohesive identity that resonates with donors and stakeholders.

eSigning for efficiency

The legality of electronic signatures in state filings streamlines the filing process. With pdfFiller, organizations can easily eSign documents, eliminating the need for printing and scanning. The platform provides a step-by-step eSigning process, ensuring that all necessary parties can sign without hassle.

Collaborating with your team

A notable feature of pdfFiller is its real-time editing capabilities, which enhance collaboration among team members. Individuals can work simultaneously on the form, making updates and contributions as necessary. Task assignments within the software can also pinpoint who is responsible for specific sections of the disclosure, improving accountability within the organization.

Submitting the state charitable solicitation disclosure form

Understanding submission deadlines is critical to ensure that charitable organizations comply with state regulations and avoid penalties. Deadlines may vary significantly across states, with some requiring annual updates and others necessitating immediate disclosure following a solicitation campaign.

Understanding submission deadlines

Ignoring these timelines can result in noncompliance. For example, in New York, the annual filing deadline is typically set for the 15th day of the 5th month after the fiscal year ends, whereas California may require filings on a different schedule. Organizations should always check their respective state laws to remain informed.

How to file your form effectively

Organizations can choose between online submission or physical filing when submitting the state charitable solicitation disclosures form. Online submissions are often faster and provide immediate confirmation receipts. Alternatively, organizations filing physically should retain copies of submitted forms for their records and track their submission status through state department resources.

Frequently asked questions (FAQs)

Clarifying misconceptions about solicitation disclosures

Many organizations wrongly assume that exposure to filing such disclosures is limited to larger nonprofits. In reality, small community organizations are also required to comply, depending on the amount of funds they plan to raise. Understanding this is key.

What to do if you receive a rejection notice

If your organization receives a rejection notice, the first step is not to panic. Instead, review the feedback provided and rectify any errors noted. Sometimes, a mere clarification in the financial statements can lead to successful re-filing. Most states have specific re-filing procedures which can be followed easily.

Tools for managing your charitable solicitation activities

Leveraging pdfFiller for ongoing compliance

Using pdfFiller can streamline ongoing compliance efforts. The platform allows organizations to maintain accurate records and provides automated reminders about upcoming filing deadlines.

Integrating with other management tools

Integrating pdfFiller with customer relationship management (CRM) software enhances communication with stakeholders and supports tracking donor engagement. Seamless integration ensures data consistency across platforms and optimizes outreach strategies.

User experiences and testimonials

Success stories of organizations using pdfFiller

Many nonprofits have found success through implementing pdfFiller for their document management needs. For instance, a small educational charity experienced a 40% reduction in the time taken to prepare and submit their disclosures after adopting the platform.

Tips from experienced nonprofits

Experienced nonprofits emphasize the importance of transparency and open communication during solicitation campaigns. They recommend documenting everything meticulously and using tools like pdfFiller to maintain organized records. Best practices lead not only to compliance but also foster stronger relationships with supporters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in state charitable solicitation disclosures?

How do I edit state charitable solicitation disclosures in Chrome?

How do I fill out the state charitable solicitation disclosures form on my smartphone?

What is state charitable solicitation disclosures?

Who is required to file state charitable solicitation disclosures?

How to fill out state charitable solicitation disclosures?

What is the purpose of state charitable solicitation disclosures?

What information must be reported on state charitable solicitation disclosures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.